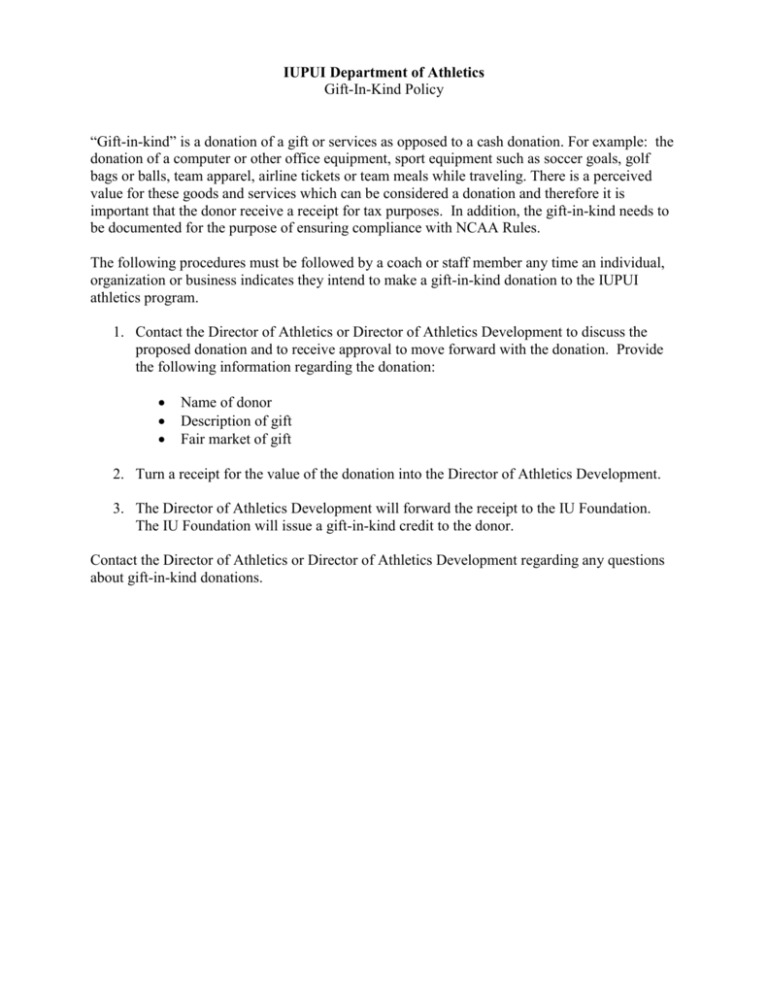

Gift-in-Kind Policy

advertisement

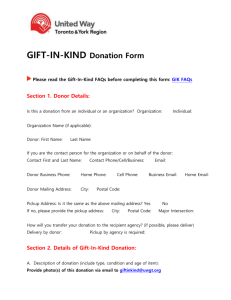

IUPUI Department of Athletics Gift-In-Kind Policy “Gift-in-kind” is a donation of a gift or services as opposed to a cash donation. For example: the donation of a computer or other office equipment, sport equipment such as soccer goals, golf bags or balls, team apparel, airline tickets or team meals while traveling. There is a perceived value for these goods and services which can be considered a donation and therefore it is important that the donor receive a receipt for tax purposes. In addition, the gift-in-kind needs to be documented for the purpose of ensuring compliance with NCAA Rules. The following procedures must be followed by a coach or staff member any time an individual, organization or business indicates they intend to make a gift-in-kind donation to the IUPUI athletics program. 1. Contact the Director of Athletics or Director of Athletics Development to discuss the proposed donation and to receive approval to move forward with the donation. Provide the following information regarding the donation: Name of donor Description of gift Fair market of gift 2. Turn a receipt for the value of the donation into the Director of Athletics Development. 3. The Director of Athletics Development will forward the receipt to the IU Foundation. The IU Foundation will issue a gift-in-kind credit to the donor. Contact the Director of Athletics or Director of Athletics Development regarding any questions about gift-in-kind donations.