Red Book - School District of Osceola County

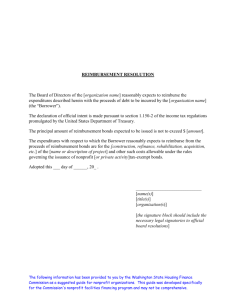

advertisement