Show&TellOct12

advertisement

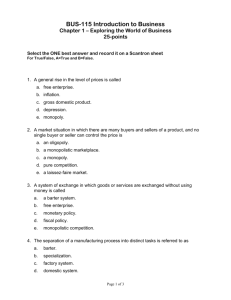

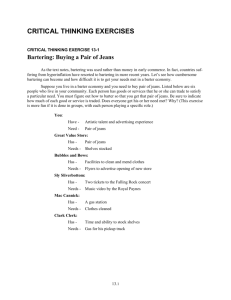

Lee-Sean Huang Show and Tell Studio October 13, 2009 Detailed Character Profiles of your users.Do an in-depth Competitor Analysis for your project. A matrix: other services, what they offer, what yours will. A list of target investors and why they are targets! Competitor Analysis First a little context on barter in general. New England Trade (http://www.newenglandtrade.com/overview/barter-industry.aspx) reports: According to the International Reciprocal Trade Association (IRTA) estimates just in the U.S., over 470,000 companies actively participate in barter for a total of over $12 billion in annual sales. Over 65% of the corporations listed in the New York Stock Exchange are presently using Barter to reduce surplus inventory and bolster sales and to ensure that production facilities run at near capacity. The U.S. Department of Commerce estimates that 20 to 25% of world trade is now barter, and corporate barter is now a 20 billion dollar industry. Barter continues to carve out an important place in the U.S. and world economy. Most traditional barter exchanges target the B2B sectors, while Sokomundi, along with some of the newer internet-based barter exchanges, are services for individuals and very small businesses. One example of a “traditional” B2B barter service is Merchants Barter Exchange (http://merchantsbarter.com/), they only admit businesses, requires a fee to join, and hides their member listings behind a pay wall. The IRS has specific definitions of “Barter Exchanges” and “Internet-based Barter” (http://www.irs.gov/businesses/small/article/0,,id=113437,00.html): Bartering is the trading of one product or service for another. Usually there is no exchange of cash. Barter may take place on an informal one-on-one basis between individuals and businesses, or it can take place on a third party basis through a barter exchange company. A barter exchange is any person or organization with members or clients that contract with each other (or with the barter exchange) to jointly trade or barter property or services. The term does not include arrangements that provide solely for the informal exchange of similar services on a noncommercial basis. Unlike one-on-one bartering, members of exchanges are not obligated to barter or purchase directly from a seller. Instead, when a barter exchange member sells a product or a service to another member, their barter account is credited for the fair market value of the sale. When a barter exchange member buys, the account is debited for the fair market value of the purchase. Internet-based Barter The Internet provides a new medium for the barter exchange industry. Pure Internetbased barter companies differ from traditional, organized trade exchanges in that they do not have a physical office. In modern Internet barter exchanges, there is an agreement or process in place to value goods and services exchanged, which is facilitated by the barter exchange for a fee. A barter exchange functions primarily as the organizer of a marketplace where members buy and sell products and services among themselves. Trade Dollars Barter exchanges have their own unit of exchange, usually known as barter or trade dollars. Trade dollars or barter dollars are valued in U.S. currency for the purposes of information returns. Trade dollars allow barter to take place between parties when one party may not have a simultaneous need or desire for the goods or services of the other members. Barter exchanges act as the bookkeeper for keeping track of trade dollars that participants accumulate. Earning trade or barter dollars through a barter exchange is considered taxable income, just as if your product or service was sold for cash. While Sokomundi will require more individualized tax and legal advice, we currently think that we do not fall under the IRS definition for a barter exchange. We deal information that allows people to make their own educated choices about swapping goods and services. Our system helps connect users based on their trade preferences, but this is a peer to peer system that does not make use of trade dollars. There are certain limitations to this system, but also social advantages. While trade dollars allow users to store value and exchange them later, it is essentially a monetary system that makes online barter exchanges not pure barter. Monetary systems have their place, but Sokomundi’s mission is to be a disruptive technology that provides an alternative to currency-based economies and to restore a kind of personal one-to-one connection in determining value and making exchanges. (This needs to be fleshed out more.) We are more like Craigslist (http://newyork.craigslist.org/bar/) or a dating site than an existing internet barter service, in that we are providing users with the service of contextualized information. How they choose to use that information, and the tax liabilities that arise on account of those actions is for them to deal with individually. Wired Magazine estimates Craigslist’s 2009 revenue to around 100 million dollars (http://www.wired.com/entertainment/theweb/magazine/1709/ff_craigslist?currentPage=all). Craigslist makes its money from a “freemium” service model. Craig Newmark considers the service a community site, so most kinds of posts to Craigslist are free, but certain types of listings cost money. At Sokomundi, we are looking into applying this kind of fremium service model (along with targeted advertising) to make money. Craigslist’s barter listings for the NYC area alone number more than 100 posts a day, but I found the experience a little overwhelming and time consuming to browse through the listings. Even if I use the search function, there is little standardization in the posts and I found it hard to browse through the listings to find what I wanted. Even if I found something on offer, it wasn’t always immediately clear as to what the person offering the good or service wanted to trade for in exchange. While Sokomundi is very different from existing online barter exchanges, we still looked at a number of services for the sake of comparison. Some services, like SwapThing.com only allow users to trade physical items. Others, like Dibspace, based in the Seattle and Portland areas allows users to trade goods or services. Dibspace uses a system of trade currency called “dibs.” They also feature user profiles to add a level of trust to the community. The user profiles could probably be better integrated with existing social networking platforms to make user profiles easier to setup and more transparent. Aside from Dibspace’s use of trade currency, it was the online barter exchange that was closest to Sokomundi in terms of features and functionality. It also had one of the better UI designs (many barter services had very confusing and overwhelming user interfaces). User Profiles This part has been the most challenging so far. We have not yet been able to find demographic or other market data about bartering in general. We do know that we are targeting young professionals in urban areas who skew towards creative and tech fields. Aside from Dibspace, Craigslist and online barter exchanges do not offer user profiles with real offline identities, so it is hard to do online research to see who is doing the bartering. Since Dibspace is the most transparent service I have found so far, I have studied it in more detail to create a user profile for Sokomundi. Dibspace has barter listings for a wide variety of industries, from arts and entertainment to food, to real estate, to restaurants. The goods and services are offered by both individuals and companies. Perhaps Dibspace has been able to attract a variety of different industries by focusing on geographic proximity (only focusing on Seattle and Portland). In that case, it would make sense for Sokomundi to start out in one geographic area (NYC makes sense). Similarly, Craigslist encourages users to deal locally by providing different sites for different metropolitan areas. A glance through Dibspace profiles shows that the user base skews slightly more female than male, and generally young. Users with photos tend to look like they are in the 20-40 range, with a couple older outliers. This is hard to do scientifically because user profiles are not standardized (some do not have photos or detailed user information, and some profiles are of companies, not individuals). (This part needs more research) Target Investors In addition to participating in the NYU Stern Business Plan Competition, Sokomundi is also researching venture capitalist firms specializing in technology as potential sources of funding. DFJ Gotham Ventures http://www.dfjgotham.com/ DFJ Gotham Ventures is an early-stage venture capital firm based in New York City focused primarily on investments in information technology startups based in the Northeast U.S. and Israel. DFJ Gotham is part of the Draper Fisher Jurvetson Global Network, the largest venture capital network in the world. DFJ Gotham’s portfolio includes Drop.io. Earlier projects have been acquired by giants like AT&T, Microsoft, and Adobe. Garage Technology Ventures http://www.garage.com/about/index.shtml Garage Technology Ventures is a seed-stage and early-stage venture capital fund. We’re looking to invest in extraordinary entrepreneurs who have the ability to build great teams and great companies. Garage focuses mainly on tech companies in California and the Western US, but a bicoastal Sokomundi may be a possibility since half of our team have roots and connections on the West Coast. Mobius Venture Capital http://www.mobiusvc.com/ Mobius Venture Capital is an early-stage venture capital fund comprised of seasoned veterans and entrepreneurs from leading technology companies, who bring not only deep domain expertise, but also hands-on operating experience to the companies in our portfolio. Mobius is based in Boulder, Colorado and has invested in companies like FeedBurner, GeoCities, and ELoan. Neoteny http://blog.neoteny.com/neoteny/ Neoteny is an Internet investment firm founded in 2000. It has since completed investing and functions as a holding company for the portfolio of investments Neoteny is one of Japanese venture capitalist Joi Ito’s companies. I met Ito this summer during my internship at Creative Commons, where he serves as CEO. He has been involved with tech companies like SixApart and Twitter. Ito also runs Digital Garage (http://garage.co.jp/en/group/incubation.html), which offers Union Square Ventures http://unionsquareventures.com/ Union Square Ventures is an early stage venture capital fund located in New York City. We focus on IT-enabled services in the media & marketing, financial services, healthcare and telecom verticals. Union Square Ventures is a major player in the NYC tech scene. Their portfolio includes Boxee, Four Square, MeetUp, Twitter, Tumblr, Etsy, and BugLabs.s Other Organizations These organizations are not VCs but they are potential sources for advising and business guidance. Floor Four Ventures http://www.floorfourventures.com/ Floor Four Ventures is a student run platform for students at the Interactive Telecommunications Program at NYU to extend their class projects into viable products, services, and businesses. This project is not formally associated with ITP. Floor Four Ventures is not a VC, but provides support for ITP students and alumni to bring their projects off the floor and into commercial viability. F4V began as Jonathan Swerdloff’s (ITP 2009) thesis project. References http://www.ourgoods.org/ http://thinkingaboutart.blogs.com/art/2006/04/a_new_project_b.html http://www.artofbarter.com/home.htm http://thebulletin.us/articles/2009/01/30/arts_culture/doc49827c1d6a3cc781648499.txt http://www.tradeaway.com/ http://www.huffingtonpost.com/tag/craigslist-bartering http://en.wikipedia.org/wiki/Barter http://faircompanies.com/videos/view/barcelonas-barter-markets-an-antidote-tooverconsumption/ http://www.angkor.com/2bangkok/2bangkok/forum/archive/index.php/t-2224.html http://www.irs.gov/taxtopics/tc420.html http://newyork.craigslist.org/bar/ http://www.irs.gov/businesses/small/article/0,,id=113437,00.html http://www.sindinero.org/ http://www.techcrunch.com/2009/01/24/qxl-founder-tim-jackson-to-launch-dvdswapping-site-lendaround/ http://www.techcrunch.com/2006/12/19/peerflix-swaps-one-problem-for-another/ http://www.switchplanet.com/ http://www.swapthing.com/home/index.jsp http://www.crowdrent.com/ http://neighborrow.com/ http://www.angieslist.com/angieslist/ http://www.merchantsbarter.com/faq.htm http://www.seattlepi.com/business/404903_dibspace8.html https://dibspace.com/ http://www.bartertrainer.com/concept.asp http://www.bigzeit.com/home/what More links: http://delicious.com/hepnova/sokomundi