March 2010 Meeting Overview

advertisement

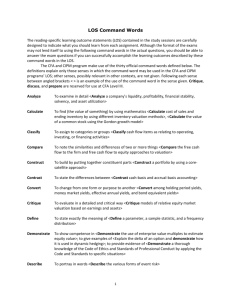

NATIONAL ASSOCIATION OF STOCK PLAN PROFESSIONALS Accounting 201 for Stock Plans Presented by: Elizabeth Dodge Stock & Option Solutions, Inc. Terry Adamson Radford Valuation Services This session will review the following: Valuation inputs Applying forfeiture rates & true ups Tranche-by-tranche accrual Retirement eligibility WHEN: Thursday, March 4, 2010 TIME: 12:00 – 1:00 p.m. PLACE: Webcast Phone: 866-982-8346 (ID: 2297691) WebEx: https://ecm.webex.com/ecm/j.php?ED=133886207&UID=0&PW=d060575a5e58404459 1. Go to WebEx link 2. Enter your name and email address 3. Enter the meeting password: ohnaspp 4. Click "Join Now" RSVP: http://www.surveymonkey.com/s/RSND3W6 CEP CREDIT: 1 hour SPEAKER BIOGRAPHIES: Elizabeth Dodge Elizabeth is the Vice President of Product Management for Stock & Option Solutions, Inc. (SOS). Her responsibilities include monitoring new developments in the equity compensation arena, performing market research, speaking at industry events and helping to define the product roadmap for SOS. 09901-0001/LEGAL14987000.1 Elizabeth has been designing and product managing financial software for the past 14 years, eleven of those for equity compensation applications. She joined ShareData in 1998 where she designed functionality for the Equity Edge application from 1998 to 2007. ShareData was acquired by ETRADE in 1998. She was the sole and/or Senior Product Manager for Equity Edge for ETRADE from 2001 to 2007. With input and assistance from several major audit firms, Elizabeth designed and rolled out the initial functionality for RSUs, variable accounting under APB 25 (FIN 44), non-employee accounting under EITF 96-18, FAS 123(R), FAS 109, diluted EPS for restricted stock, vest schedule adjustments, retirement eligibility, and mobility tracking. She also revamped valuation for ESPP, designed corrections to the diluted EPS calculations for options, updated the leave of absence function to allow multiple LOAs, expanded the participant tax functionality to allow unlimited taxes, reworked the expected term and forfeiture reporting, and added many other key functions and reports. After leaving ETRADE, Elizabeth joined BNY Mellon Shareowner Services Employee Stock Plan Services as VP of Product Management. Her mandate at Shareowner Services was to develop the product management skills and industry expertise of the product group. She designed and managed substantial advances to the performance awards functionality, the participant website, and the FAS reporting at Shareowner Services. Elizabeth joined SOS in July of 2008. Prior to product management, her software experience was in designing, testing, and supporting financial software applications. Elizabeth regularly speaks on industry trends and product development at client and industry events including NASPP and NCEO webcasts, GEO and NASPP Chapter meetings, User Groups, and the NASPP Annual Conference. She was also selected to speak at the West Coast FASB Roundtable on FAS 123(R) and has recently co-authored the chapter on accounting for equity compensation in The Stock Options Book, 11th edition, by Alisa Baker. She became a Certified Equity Professional in 1999 and continues to volunteer for the Certified Equity Professional Institute. She is also volunteers for the Silicon Valley Chapter of the NASPP and the NCEO. Terry Adamson Terry Adamson is senior vice president of Radford Valuation Services, the equity valuation group of Aon Consulting, and has nearly fifteen years of benefit and compensation consulting experience. Terry is involved with all phases of equity compensation valuations including design of executive packages; valuation of compensatory arrangements for purposes of a change in control under IRC 280G; sabbatical valuations under FAS 43/EITF 06-2; and Employee Stock Option (ESO) valuations and Employee Stock Purchase Plans under FAS 123(R). Additionally, Terry consults with clients on issues involving all aspects of a company’s benefit and equity programs in mergers, acquisitions and divestitures. As National Practice Leader for Radford’s ESO valuation practice and the lead project manager, Terry manages a team of valuation experts and is responsible for the completion of quarterly FAS 123(R) accounting valuations in addition to being the primary client contact. Some of his current clients are 3M, Altera Corp, AMD, Applied Materials, Bank of New York, McDonald’s, Prudential Financial, Symantec, UnitedHealth Group, US Bank, and Wells Fargo Bank. Terry recently co-authored articles in: Tax Management Compensation Planning Journal, “Golden Parachutes – New Planning Opportunities” and “Executive Compensation Audits – Planning Now to Avoid Trouble Later;” Benefits Quarterly, “Employee Stock Options – New Valuation Responsibilities and Planning Opportunities;” WorldatWork Journal, “Performance Equity Plans: The Design and Valuation Under FAS123(R);” The Journal of Employee Ownership Law and Finance, “A Technical Roadmap to Expense Allocation Under FAS123(R);” and Compensation and Benefits Review, “No Vacation on Sabbatical Plan Accounting.” 09901-0001/LEGAL14987000.1 Terry earned a Bachelor of Science in Mathematics from Georgetown University. He was on the FASB Round Table on Employee Share Options and is the Chairperson of the Society of Actuaries Taskforce on stock option valuation. Terry is a Certified Equity Professional (CEP) and serves on the Curriculum Committee of the CEP. He is based in Philadelphia. 09901-0001/LEGAL14987000.1