Toward a “Balancing Weights” Approach

advertisement

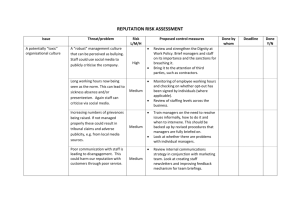

The Competitor May 2001 Toward a “balancing weights” approach to efficiencies analysis? Federal Court of Appeal reverses landmark Tribunal decision in Propane By: D. Jeffrey Brown and Randall J. Hofley The Federal Court of Appeal has overturned the Competition Tribunal’s approval of Superior Propane’s (Superior) merger with ICG Propane (ICG). In a landmark decision last August, the Tribunal concluded that, although the merger would lessen or prevent competition substantially in nearly all local propane-delivery markets across Canada (as well as in the related market for national account co-ordination services), section 96 of the Competition Act (Act) – the so-called “efficiencies defence” – precluded the Tribunal from prohibiting the merger because efficiencies to be gained would offset the merger’s anti-competitive effects. (See Stikeman Elliott, “Propane industry merger approved on basis of efficiency defence”; The Competitor, September 2000). Background The appeal stems from the acquisition of ICG by Superior, which merged Canada’s two largest propane companies with activities in the retailing and wholesaling of propane and related equipment in Canada. Although their market presence varied throughout Canada, the merging parties’ combined share of the propane market on a national basis was approximately seventy percent. In its application of section 96, the Tribunal majority applied a “total surplus standard, ” which restricts the relevant anti-competitive effects of a merger to those effects suffered by the economy as a whole (i.e., the “deadweight loss”). According to the Tribunal, section 96 of the Act required that it allow the merger because the total deadweight loss (qualitative and quantitative) caused by the merger was only $6 million, in contrast to efficiencies of $29.2 million. The Commissioner had advocated the rejection of a total surplus standard in favour of a “balancing weights” approach. Under the Commissioner’s approach, the Tribunal would consider a number of factors in assessing the anti-competitive effects of a merger, including deadweight loss, STIKEMAN ELLIOTT 2 the transfer of wealth from consumers to purchasers caused by an increase in price, loss of product choice and the creation of a monopoly, but none of these factors would be assigned a fixed, a priori weight. This position departed from the Commissioner’s own Merger Enforcement Guidelines (MEGs), which set out a total surplus standard. Issues on Appeal The principal issue in the appeal was the scope of the Act’s efficiency defence; in particular whether, as a matter of law, the Tribunal’s interpretation of “effects” in section 96 was too narrow. The Court also considered the standard of review applicable to the Tribunal’s interpretation of “effects” and whether the Tribunal erred in finding that the Commissioner bears the burden of quantifying the anti-competitive effects of a merger for the purposes of a section 96 analysis. Standard of Review Before considering the Tribunal’s interpretation of “effects” within the meaning of section 96, the Court first addressed the appropriate standard of review for such a determination. The Court noted, and the parties agreed, that in light of the Supreme Court of Canada’s decision in Southam, it should apply a standard of “reasonableness simpliciter” if it found that the Tribunal was entitled to deference in its determination. Otherwise, the Court would hold the Tribunal to a standard of correctness. Notwithstanding the Tribunal’s “considerable expertise” in the areas of “economics and commerce,” the Court concluded that the Tribunal’s interpretation of effects was not entitled to deference. The meaning of “effects” in section 96 was a question of law, as evidenced by the Tribunal’s purporting to provide an interpretation for general application, rather than one restricted to the particular facts before it. Given, among other things, the existence of an unrestricted right of appeal on questions of law, the Court concluded that the Tribunal’s interpretation of “effects” in section 96 was not entitled to deference, with the result that the appropriate standard of review was correctness. This finding constitutes a rather narrow application of the Southam decision and a departure from the Federal Court of Appeal’s tendency in recent years to accord tribunals deference even in matters of law. Toward a “Balancing Weights” Approach The central issue in the appeal was whether the Tribunal was correct in applying a “total surplus standard” to determine the anti-competitive effects of a merger for the purposes of section 96. As noted above, such a standard equates anti-competitive effects with the deadweight loss caused by a merger, ignoring all other effects, such as the elimination of smaller competitors, the creation of a monopoly, and wealth transfers from consumers to producers. STIKEMAN ELLIOTT 3 In adopting a total surplus standard, the Tribunal had put forward a number of factors favouring such an approach. Among other things, the Tribunal stated that: Assessing distributive effects as between consumers and producers is a “political task best performed by elected politicians, not members of the Tribunal”; Efficiency was “Parliament’s paramount objective in passing the merger provisions of the Act”; The specific language of section 96 of the Act should prevail over the more general (and multiple) objectives of the Act expressed in its “purpose” clause; A total welfare standard promotes predictability insofar as it provides for a measurable evaluation of anti-competitive effects; and The Commissioner’s own MEGs adopt a total surplus standard. The Court questioned a number of these justifications, and, more fundamentally, concluded that the Tribunal had erred in law when it adopted a narrow interpretation of “effects.” According to the Court, the Tribunal’s narrow interpretation constituted an error of law, because “it failed to ensure that all of the objectives of the Competition Act, and the particular circumstances of each merger, could be considered in the balancing exercise mandated by section 96.” More particularly, the Court reasoned that: Section 96 refers broadly to the effects of a merger; the correctness of an interpretation that, as a matter of law, excludes income redistribution effects from consideration in all cases is suspect. Section 96 applies to a merger only if its efficiencies are greater than “and offset” its anticompetitive effects, which “suggests a more judgmental assessment than is called for by the largely quantitative calculation of deadweight loss.” Section 96(3) of the Act expressly limits the weight accorded to redistribution of income in assessing efficiencies. If Parliament had intended to impose a similar limitation on the effects side of the section 96 balance, it would have done so, using express language. The legislative history of section 96 evidenced rejection rather than adoption by Parliament of a total surplus standard. Early proposals for the text of section 96 contained language (e.g., “by way of savings of resources for the Canadian economy” and “substantial real net saving for the Canadian economy”) that was more consistent with a legislated total surplus standard. A narrow interpretation of “effects” is inconsistent with section 1.1 of the Act, which defines the purposes of the Act more broadly than merely “efficiencies,” and included the protection of consumers. STIKEMAN ELLIOTT 4 The Court also challenged the Tribunal’s more policy-oriented justifications for adopting a total surplus standard. For example, while the Court conceded that the Tribunal’s “predictability” argument was “not without some attraction,” it concluded there were stronger arguments in the other direction. As the Court put it, “discretionary decision-making in the regulation of economic activity is commonplace” and, in any event, one should be careful not to exaggerate the predictive virtues of a total surplus standard since its application “is far from mechanical.” Furthermore, enforcement authorities have other ways of fostering predictability, including guidelines and speeches, and merging parties are free to approach enforcement authorities early on to investigate their views on a particular transaction. Even as it acknowledged that guidelines play an important role in fostering predictability in the enforcement of the Act, the Court downplayed the significance of the Commissioner’s betraying his own MEGs by adopting an approach to efficiencies analysis different from the total surplus standard. While useful tools, such guidelines cannot usurp the Court’s power to interpret the Act: “[T]he possibility that a reviewing court may not agree with an agency’s view of the law is an inevitable risk associated with the administrative practice of issuing non-binding guidelines and other policy documents to shed light on agency thinking and to assist those subject to the regulatory regime that it administers.” Moreover, the Court, in sanctioning the Commissioner’s deviation from the MEGs, noted that it is far from unanimous that total surplus is the appropriate standard for assessing the anticompetitive effects of a merger. Among other things, the US counterpart to the MEGs rejects such a narrow approach, and the Tribunal itself has exhibited differing views on the issue. Ultimately, therefore, the Court rejected a total surplus standard in favour of an approach that takes into account all the objectives of the Act, as well as the particular circumstances of each merger. While the Court declined to “prescribe the ‘correct’ methodology” for assessing such effects, it did say that the “balancing of weights” approach proposed by the Commissioner would appear to meet these broad requirements. The Court, therefore, remitted the matter back to the Tribunal, with the result that it will fall upon the Tribunal to flesh out the precise manner in which the Commissioner’s balancing weights approach should apply to the facts of the case before it. Burden of Proof Section 96 of the Act provides that the Tribunal may not prohibit a merger if its efficiencies outweigh its anti-competitive effects. With respect to the two sides of this effects/efficiencies balance, section 96 is clear that the onus is on the merging parties to prove the efficiencies that will result from their merger. Less clear, however, is whether the merging parties must also quantify its anti-competitive effects, or whether it is up to the Commissioner to do so. STIKEMAN ELLIOTT 5 The Commissioner had contended before the Tribunal that, since section 96 established a defence to an otherwise anti-competitive merger, the merging parties are responsible for substantiating each element of the defence. The Tribunal disagreed. In its view, the Commissioner, having borne the initial burden of proving that a merger would have anti-competitive effects, should be the one who quantifies those effects. On appeal, the Commissioner succeeded in persuading a dissenting member of the Court to agree with his position, but a majority of the Court upheld the Tribunal’s decision on the basis that he is “peculiarly situated” to quantify the anti-competitive effects of a merger. As with the meaning of “effects” in section 96, the Court held that the burden of proof was a question of law and therefore should be determined on a standard of correctness. Conclusion As a result of the Commissioner’s successful appeal, a total surplus approach to efficiencies analysis of the Act has been replaced with the more flexible but amorphous balancing weights approach. In rejecting a total surplus standard, the Court served a reminder that there is a distinction between competition policy and competition law in that, even if one accepts that a total surplus standard is the preferred standard among economics and law scholars, the standard set out in section 96 of the Act must be determined as a matter of law using legal rules of statutory interpretation. Applying these rules to the meaning of “effects” in section 96, the Court concluded that effects, viewed in the context of section 96 as a whole and the broader context of the Act and its legislative history, could not be construed so narrowly as to include only the deadweight loss caused by a merger. Instead, “since the efficiency defence requires the Tribunal to balance competing objectives, its operation should remain flexible and not stilted by an overarching and restrictive interpretation.” Viewed from a legal perspective, the Court’s approach is not without merit. However, it also increases the already substantial amount of discretion enjoyed by the Commissioner with respect to enforcement of the Act, as well as the latitude enjoyed by the Tribunal in its application of section 96. Even if, as the court noted, application of a total surplus standard is “far from mechanical,” the manner in which the Tribunal will apply the balancing weights approach to a specific transaction will be impossible to predict. Indeed, the Commissioner’s own expert in the case conceded before the Tribunal that he could not advise the Tribunal as to what weights to assign to the various factors to be considered in his balancing weights approach, nor could he say whether the Superior/ICG merger would pass muster under such a test. Such a loss of predictability could make reliance on section 96 of the Act to support transactions far less appealing. Finally, the Court’s treatment of the Commissioner’s overt departure from the MEGs raises concerns about the extent to which persons can rely on guidelines and other policy statements of the STIKEMAN ELLIOTT 6 Commissioner. While the Court is correct that the Commissioner cannot usurp its role in interpreting the Act, the inevitable risk that a court will disagree with the Commissioner’s views on a particular question sidesteps the real issue, namely that the Commissioner himself initiated the judicial attack on the MEGs. Rather than criticize the Commissioner, for example by suggesting that he should have re-issued modified MEGs rather than enforce the Act in a manner inconsistent with them, the Court endorsed the departure and closed its eyes to the harm so caused by observing that there was no evidence that the parties “had relied to their detriment on the MEG when they agreed to merge.” Merging parties, therefore, would do well to establish a record of reliance on Commissioner guidelines in the future, so as to preserve their administrative law rights under the doctrine of legitimate expectations in the face of a similar departure by the Commissioner.