personal selling—part ii

advertisement

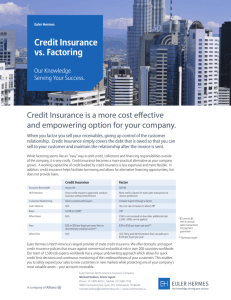

PERSONAL SELLING—PART II Weeks 5 & 6 1. Test 1 review (this material will be used throughout the semester) 2. Intro to the selling process: a. Finding and “qualifying” prospects: secondary information (tax and related government records, professional and trade associations, trade shows and conventions, S&P records, current customers and related networking) b. Qualifying leads: Need, ability to purchase, accessibility, authority to buy, structure of buying center c. Stages in buying: the “AIDA” model: pay particular attention to what prospects need to be aware of to move to interest, and then how interest can move to desire, and how action may have to be tiered or staged (see also hierarchy or solution jumping) d. Traditional steps in sales presentations: pre-approach, approach, opening/entrance (referral, benefit, product, compliment, question), exploration and questioning (problem identification versus appreciative inquiry), “need behind the need” or real benefit/problem solution identification (very important), building interest and desire, handling objections, closing, follow-up. i. Remember the use of social style in choosing opening and meet and greet behaviors. ii. Role of opening is to draw buyer into sales presentation if necessary. iii. Introduction approach: basic introduction that should be tied to some other opening technique iv. Referral: using the name of someone who buyer knows who has referred seller. Referral is effective with amiables and expressives (think of their interests in people and relationships) v. Benefit: widely used, designed to put buyer in position of having to respond. It must be a strong/key benefit, must be understandable and most important is the buyer’s understanding that this is a key benefit. Because benefit openings are used most often, buyers are used to them and benefit openings are relatively easy to counterargue. Therefore, sellers need to have researched buyer issues before using a benefit opening. vi. Product demonstrations: Opening a presentation with a feature and benefit. Nicely dramatic, but again, must match buyer’s needs and perceptions. vii. Compliments: professionally or business-based compliments addressed to the buyer. Can be very risky if buyer feels compliment is insincere. Note that different social styles may respond to different types of compliments: amiables to positive personal comments friends or associates may have made about them, drivers to positive comments about successes and outcomes, expressives to positive comments about how others perceive them and/or ability to see the “big picture” or successful mission/vision planning outcomes and analytics for careful, detailed and balanced analysis. The goal of a successful 3. 4. 5. 6. 7. 8. 9. compliment is to lead into a specific aspect of the sales presentation. A compliment should not leave the interaction hanging with a “what’s next” problem. Setting interaction objectives and the promotional hierarch line. Awareness, knowledge, trial, comparison, structured research, etc. Note the difference between action (seller or buyer actually does something, versus knowledge goals. Action goals are easier to measure and usually lead to more movement along the hierarchy. Handling objections: Identification, agreement, restatement, resolution. a. Types of objections: price, don’t need it, don’t understand it, more information, don’t like you, don’t like your company, can’t afford, like current supplier, want more time b. Handling techniques: direct and indirect denial, compensation, feel-feltfound, boomerang, postpone or ignore Price versus cost: intro to financial concepts Buying cues: ownership and buying questions (delivery, installation issues, time line questions Closing during the interaction and for the sale (good and bad ways)—direct close, illusion of choice, benefit summary, T account close, benefit in reserve, fire sale close, sympathy close, assumptive close Ensuring satisfaction through setting expectancies MORE COMING In-Class Topics (this list will be added to as topics come up in class) 1. Perfect Product Question: Asking customers what would be a perfect solution (solution, not perfect “product”) to problem they are trying to solve. Note that this works best for multi-attribute products where consumers may have several choices and are unsure about the differences between products.” 2. Closing an interaction: At the end of any buyer-seller interaction, briefly summarizing where you are now, and what the buyer can expect in future interactions—when, where, facing what type of decision, what information you may be providing buyer with, what tasks the buyer may undertake. This is particularly important from a relational/relationship standpoint as you are setting up the next interaction. In the real world of selling, you might write or email the buyer with this information to make sure it stays current in the buyer’s mind. “Closing” can also be seen as how the buyer-seller relationship is moving along the promotional hierarchy line. 3. Buyer Counterarguing: When a buyer takes issue with a seller’s product or other claim, this is a counterargument (it also may be an objection). Counterarguing is important to avoid if possible because it can reinforce buyer’s existing negative beliefs. Buyer counterarguing can also be thought but not expressed, in which case it is particularly destructive to a sales presentation. 4. Feature-Benefit-Consequence Analysis: Features, (tangible aspects of product) create benefits (what happens to buyers because of those features), which in turn have broader positive consequences. This is the role of the sell sheet on the web site and is a key concept to selling and marketing in general. Sellers know features, but buyers think in terms of benefits rather than features, and buyers often do not make all the associations between benefits and consequences (e.g., more efficient selling can make for smoother production schedules). 5. Solution Jumping: Moving to solutions before buyer’s situation has been clearly defined and understood. Solution jumping makes fully understanding product benefits much more difficult for buyer because of potential poor fit to buyer’s specific situation. 6. Question Asking/Question Answering. Asking a question and then not giving the buyer ample time to respond to the question by either reframing the question “what I mean is . . . “, or “for example . . .” or providing the buyer with an answer: “what types of pans do you prefer . . . for example “some people like stainless for long life while others like nonstick for cooking ease.” Note that if you want to have the buyer answer a question comparing the two, then you would begin the question asking the buyer to compare the two. Sellers are better off letting the buyer ask for clarification that trying to clarify when the seller may not know what the buyer does or does not understand. 7. Feature/Product Dumping: When sellers lose the customer in the selling interaction and retreat to talking about product features and benefits with no knowledge of where the buyer is in regard to those features and benefits. 8. Failure to help buyers make associations between your product and the benefits/outcomes they seek. We have instances in roleplays where buyers don’t remember much about the product. This, as we have pointed out, is a function of not linking benefits to the specific situation of the buyer. The greater the seller can have the buyer using the buyer’s existing memories and knowledge, the more likely the buyer will remember key seller points. This also relates to the use of stories or metaphors that help buyers make associations between what they all ready know and what your product does. A related problem is the use of canned sales techniques often used by home sales or vertical marketing techniques (Mary Kay, Amway, Vector). These are when benefits are presented first to customers before customers needs have been identified. For example, a product benefit will be presented, followed by a statement to the effect of “now don’t you think you would like that benefit?” True professional selling always relies on first identifying what benefits customers are seeking, and then matching those to product features and benefits. 9. Selling through to the final customer. In business-to-business marketing, your buyers always have a “next” customer. This next customer can be a wholesaler, terminal consumer, manufacturer and so on. While your focus as a seller may be on your immediate buyer, remember than your buyer, particularly if he/she is a good marketer, will be focused on their customers. Therefore, successful use of the feature->consequence->benefit chain should incorporate benefits for your buyer’s customers. Note that this can also be linked to a “pull” strategy where sellers who successfully tap key benefits for buyers can help increase demand. 10. Word economy. The fewer words you use in restating and questioning, the more likely the buyer will understand you. Good salespeople practice questions to get questions down to the smallest number of words. 11. Tying negatives to positives. When buyers object to specific product attributes (e.g., price, how it performs, etc.), the cause for this can also be the cause of positives (e.g., slower cars get better gas mileage, more expensive cars may have higher residual/resale value, a house may be small but in a great neighborhood). If the positive is important to the buyer, or can be made important to the buyer, then the seller can put the buyer in choosing or rating the tradeoff value of the negative and the positive. 12. Avoiding close-ended question traps. Questions that can be answered with a “yes” or “no” can lead to a closed-ended question trap where the buyer can say “no” or “not really” and the interaction is stalled or stopped. This is particularly important when “spinning” with problem questions. While the actual answer can be a “yes” or “no,” these answers can also just be a socially acceptable response (as with an amiable that’s trying to be pleasant, or our “how’s your dinner” or “is everything ok with your dinner” restaurant questions). The “yes” or “no” responses can also be from experienced buyers that just don’t want to be bothered. Traps are set by “Do you have any problems with . . . “ that can be answered with a “not really.” You can change the types of buyer responses by eliminating a “yes” or “no” response. Rather than asking “Do you (xyz)?” or “Are you having any problems with (xyz)?,” you can ask “What . . “ or “Of all the . . ., what are . . .?” This technique removes the easiness of a “yes” or “no” response. Note however that if a “yes” or “no” is the buyer’s true position, he/she can still give that response. 13. Price versus cost versus value. We have discussed this at length in class, and it ties to points #4 and #8 above. 14. Buying cues. These are cues buyers give sellers to indicate that the buyer may be ready to move closer to purchase. Buying cues can be price questions, ownership questions, benefit endorsements (both verbal and non-verbal), direct comparisons to competitive or currently-used products and related areas. Buying cues always call for restatements when possible, or questions when the seller has nothing directly to restate. 10. “SPAIN” (formally known as “SPIN”) as questioning method to uncover possible buyer needs a. SITUATION Questions: what is current situation of buyer. Gathering background information to set up next set of questions. “Do you ever . . . “ “How many . . . “, “What kind?“ b. PROBLEM Questions: difficulties, problems, dissatisfaction with current products. Note that this can also be tapped with a “perfect product” question. Important to note that what are in fact problems may be seen as facts where buyer doesn’t know that other products. For example, Windows crash often and buyers may see this as an evitable problem with computers rather than realizing that other operating systems may not crash as often. c. APPRECIATIVE INQUIRY (see #11 below): What are the strengths of the business? What do the members of the buying group, particularly the decider see as their business’ fundamental value propositions? What do they like most about their jobs and what they do? (this last question can be a great insight into identifying social styles). d. IMPLICATION Questions: very important. These are about consequences of problems identified by buyer. May tie into costs, problems for customers, other workers, time. Very important to tie to ultimate consequences for business: lowered profits, angry shareholders, competitors gain business, the list is endless. e. NEED PAYOFF Questions: solution-based questions designed to get buyer to acknowledge potential benefits. “So, if system crashes were reduced to 1% of operating time, would worker effectiveness and morale be increased?” or “if, then” questions that set up benefit and feature discussion. 11. Appreciative Inquiry as a method to also uncover buyer needs. SPIN has an implicit “what’s wrong” or a problem-to-be-solved orientation. Some consequences of this are potential defensiveness of buyers, especially when relationships haven’t been formed with sellers. SPIN questions can also be seen as somewhat of a “canned” sales approach where a seller is working from a rehearsed script rather than uncovering actual benefits the buyer may be seeking. Canned sales presentations can cause buyers to question the intentions of the seller, particularly with experienced buyers who can recognize when they are being put through a series of steps leading to a benefit close. Appreciative inquiry involves sellers finding out a specific buyer’s strengths and successes rather than weaknesses. This often makes it easier for a buyer to talk about their businesses, and in turn enabling sellers to get a good idea of buyer style and what specific types of benefits the buyer values. Sellers have two possible opportunities: first by listening carefully the seller can figure out what the buyer isn’t mentioning as a strength, and see if there are any opportunities to move those areas more into the strength area, and second, areas that while already viewed as strengths may have opportunity to either be improved or using successful areas of the business as a model for other areas of the business. For example, a buyer may tell a seller “we have no real debt, and it’s really helped us through some hard times.” An astute seller could ask “in order to maintain your low debt, how do you go about handling capital 12. Pay particular attention to different quantifying techniques (cost benefit analysis etc.). You will be responsible for understanding and applying these. These are key concepts in b2b selling, particularly for larger installations and comparing different products. Buyers may be sophisticated, which means you as a salesperson must be able to talk knowledgably, and more importantly buyers may not be knowledgeable, which means you will have to explain it to them. Financial analysis is always included for competitive products, and you may have to make financial comparisons between your product and competitive choices. 1. Payback period: amount of time it will take for savings or net revenues will “pay back” the initial outlay for an investment. Payback is measured in time (e.g., 2.5 years). 2. Return on investment (ROI). Note that text explanation of this is unclear and not totally accurate. ROI is the total savings or net revenues divided by the cost of the investment. ROI is given as a percent along with the expected life of the investment. ROI is analogous to putting money in the bank and drawing interest: the interest rate is the return on the investment. However, a main difference is that you will still have the money, but the value of the product will diminish over time and this is included in computing ROI. 3. Net Present Value (NPV). NPV is method to compare different investments by measuring what each is worth in today’s dollars. NPV takes into account what an investment costs versus what it returns, the life of the investment, and the alternative uses of the total mount of money an investment returns after all costs. The basic idea of NPV is that many purchases can be seen as an investment rather than costs, and as such they should be evaluated against other uses of the money. NPV is measured in dollars. 4. Opportunity Cost: Opportunity is an extremely important concept from both a literal and a conceptual basis. Literally opportunity cost is the “benefit foregone” by a course of action. Literally, this is the amount of money taken up by a purchase, and all the other potential purchases that now can’t be made because the money is gone. Conceptually, all courses of action have opportunity costs and this is a powerful selling tool. Many times the cost of inaction for a buyer is greater than the cost of buying when a full financial analysis is done on the true cost of the investment versus another investment or doing nothing. Any purchase or action has opportunity costs, and buyers are often unaware of all the potential opportunity costs.