Chapter 16 ACCRUED DEPRECIATION Accrued Depreciation 333

advertisement

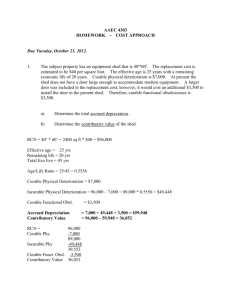

Chapter 16 ACCRUED DEPRECIATION Accrued Depreciation 333 Accrued depreciation is a loss in value from the reproduction or replacement cost of improvements that may emanate from physical, functional or external causes, and any combination thereof. After separate elements of accrued depreciation are identified and measured, the appraiser deducts the dollar amounts of all applicable types of depreciation from the reproduction or replacement cost of the improvements. The result is the estimated depreciated reproduction or replacement cost of the improvements. Theoretically, depreciation can begin to accrue the moment construction is completed, even in a functional building that represents the highest and best use of its site. Although most forms of physical depreciation can be corrected or temporarily halted, physical depreciation tends to persist. As a building ages, functional depreciation may occur. Even new buildings can have various forms of functional depreciation such as obsolescence attributable to poor design. In the cost approach, depreciation from all causes is subtracted from current reproduction or replacement cost. However, depreciation is a penalty only insofar as it is recognized by the market as a loss in value. For older buildings, the value loss may be offset by a temporary scarcity relative to demand or by a building's historical or architectural significance. If an appraiser uses replacement cost rather than reproduction cost to derive the current cost estimate, the estimate of accrued depreciation will be affected. Some forms of functional depreciation are automatically eliminated when replacement cost is used. An appraiser who uses a replacement cost estimate must consider the added costs of removing items of curable functional depreciation and any excess operating costs associated with superadequate construction. DEFINITIONS To analyze accrued depreciation an appraiser should understand these essential terms: depreciation, accrued depreciation, book depreciation, economic life, remaining economic life, effective age, and actual age. Depreciation is a loss in property value from any cause. It may also be defined as the difference between the reproduction cost or replacement cost of the improvement and its market value. Deterioration, or physical depreciation, is evidenced by wear and tear, decay, dry rot, cracks, infestation, or structural defects in a building. Other types of depreciation are caused by obsolescence, which may be either functional or external. Functional depreciation may be caused by the inadequacy or superadequacy of a building's size, style, or mechanical equipment. Physical and functional depreciation can usually be observed in an improvement. External depreciation is caused by factors outside the property such as changes in demand, general property uses in the area, zoning, financing, and government regulations. To measure accrued depreciation, an appraiser identifies and measures the loss in value experienced by the subject structure in its present condition and compares its present value with the value it would have if it were new. Accrued depreciation is sometimes referred to as diminished utility. Book depreciation is an accounting term that refers to the amount of capital recapture written off an owner's books. Generally, it is the amount that a particular owner can provide for the retirement or replacement of an asset under the tax laws. Book depreciation is not market-derived; traditionally, accountants have based depreciation on book value or original cost. In current cost accounting, however, some assets are listed at current value, which is the same as market value measured with accepted valuation methods. 334 The Appraisal of Real Estate Economic life is the period of time over which improuements to real estate contribute to property value. Economic life and physical life can differ widely; physical life is expected to exceed economic life. For example, improvements with varying degrees of physical utility are ordinarily replaced with new structures. However, renewing or remodelling older properties usually extends their economic lives. At any given point in time, a property's economic life cannot exceed its physical life. Rehabilitation can extend the physical life of real estate. Remaining economic life is the estimated period during which improuements continue to contribute to property value. An appraiser determines a property's remaining economic life in part by interpreting the attitudes and reactions of typical buyers of competitive properties. Actual age, sometimes called historical or chronological age, is the number of years that have elapsed since construction was completed. Effectiue age is the age indicated by the condition and utility of a structure. The effective age of a building may be less than its actual age if it has had above-average maintenance or is of superior quality or design, or if there is a scarcity of such buildings in the market. For example, a 40-year-old building may have an effective age of 20 years due to rehabilitation, modernization, or strong market demand. However, if the building has not been adequately maintained, its effective age may be greater than its actual age. METHODS OF ESTIMATING ACCRUED DEPRECIATION An appraiser identifies depreciation due to physical, functional and external causes by analyzing similar improvements and the market's reaction to their observed condition. The amount of depreciation to be deducted from an improvement's current reproduction or replacement cost is typically indicated by the difference between the improvement's contribution to the current market value of the property and the market-value contribution of a similar improvement constructed new on the date of the appraisal. Several methods can be applied to estimate accrued depreciation; each is acceptable if the appraiser applies it consistently and logically and if it reflects an informed, prudent buyer's reaction to the condition of the structure being appraised. To produce an accurate and supportable estimate of accrued depreciation with any method, the appraiser must consider all elements that may diminish value and account for each element only once. The methods for estimating accrued depreciation are the economic age-life method, the modified economic age-life method, the breakdown method, sales comparison techniques, and income capitalization techniques. An additional method, the physical age-life method, can be used to estimate physical deterioration only. Accrued depreciation is applied to improvements only because the site is included in the value estimate at its current market value. External forces can cause the site to lose value, but the effects of externalities on site value are reflected in the current market value of the site. Economic Age-Life Method To estimate accrued depreciation with the economic age-life method, the ratio between the effective age and total economic life of a building is applied to the cost of the improvements as of the effective appraisal date to obtain a lump-sum Accrued Depreciation - 335 Table 16.1 Estimating Accrued Depreciation by the Economic Age-Life Method Reproduction Cost Cost new Total economic life Remaining economic life Effective age Ratio applied to current cost: 18/50 Less total accrued depreciation Depreciated value of improvements Plus land value Indicated value by the cost approach Rounded $222,725 50 yrs. 32 yrs. 18 yrs. 36% $ 80,181 $142,544 60,000 $202,544 $202,500 deduction for accrued depreciation. (See Table 16.1.) The formula is as follows: Effective age Total economic life x reproduction or replacement cost = accrued depreciation This method appears simple, but many items of accrued depreciation are obscured because they are grouped together. One major weakness of the economic age-life method is that curable items of depreciation are not treated separately. Furthermore, the method does not recognize that some building components may have shorter remaining physical lives than the total economic life of the structure. The economic age-life method should not be applied to derive a separate estimate of the incurable physical depreciation of short-lived or long-lived items in the breakdown method of estimating accrued depreciation. The economic age-life concept pertains only to overall depreciation. A distorted estimate will result if the economic age-life method is used to measure the incurable physical depreciation of short- or long-lived items separately. This method does consider functional, external and physical depreciation, but it does not differentiate between the separate causes of accrued depreciation. Modified Economic Age-Life Method The effect of curable items of accrued depreciation is recognized in the modified economic age-life method. To apply the method, the appraiser first estimates the cost to cure all curable items of physical depreciation due to deferred maintenance, and functional depreciation. This sum is deducted from the cost of the improvements as of the effective appraisal date. The appraiser then arrives at a percentage, lump-sum deduction that covers all incurable items by applying the ratio of effective age to total economic life to the cost of improvements minus all curable physical and functional depreciation estimated as of the effective appraisal date. (See Table 16.2.) In applying the modified economic age-life method, the appraiser 336 - The Appraisal of Real Estate Table 16.2 Estimating Accrued Depreciation by the Modified Economic Age-Life Method Reproduction Cost Cost new Less physical and functional curable items Depreciated cost $220,475 Total economic life Remaining economic life* Effective age* Ratio applied to cost less physical and functional curable items: 17/50 Less incurable items from all causes Depreciated value of improvements Site value Indicated value by the cost approach Rounded $222,725 2 , 250 50 yrs. 33 yrs. 17 yrs. 34% $220,475 x 0.34 $74,962 $145,513 60,000 $205,513 $205,500 After curable physical deterioration and curable functional obsolescence have been accounted for, the remaining economic life of the structure may increase and/or its effective age may decrease depending on the magnitude of the changes. must recognize that when curable items are cured, the structure's remaining economic life may increase and/or the effective age may decrease. Although immediately curable items of depreciation are recognized in the modified economic age-life method, the method does not allow for differences in the remaining economic lives of individual structural components, particularly shortlived items. The method is predicated on the assumption that a single age-life ratio can be applied to the entire structure. The modified economic age-life method presumes that utility is reduced on a straight-line basis, which makes the method simple, but perhaps unrealistic. Careful estimation of effective age based on thorough investigation of the property can often overcome this weakness. The modified economic age-life method provides a convenient means for relating properties to one another and for making comparisons within a set of properties. Breakdown Method To apply the breakdown method of estimating accrued depreciation, an appraiser analyzes each cause of depreciation separately, measures the amount of each, and then totals the estimates to derive a lump-sum figure that is deducted from the estimated reproduction or replacement cost. If the appraiser is using replacement Accrued Depreciation 337 Table 16.3 Breakdown Method of Estimating Accrued Depreciation Item Reproduction Cost Replacement Cost Physical deterioration Curable Incurable Functional obsolescence Curable Deficiency requiring Addition Substitution or modernization Superadequacy Incurable Deficiency Item not included in cost new but should be Item in cost new but should not be Superadequacy External obsolescence Cost to cure Physical age-life or economic age-life (with effective age adjusted) Same Same Cost to add less cost if included in new building today Cost of existing item in cost new less physical deterioration previously charged plus cost to remove less salvage value Current cost new less physical deterioration charged plus cost to remove less salvage value Same Same Cost to remove less salvage value Capitalized (PV) net rent loss @ R, less cost if included in cost new Same Current cost new less physical deterioration charged less value added Current cost new less physical deterioration charged plus PV of added cost of ownership less value added Capitalization of property's net income loss due to external obsolescence; proportionate allocation to improvement Same PV of added cost of ownership less value added Some 338 - The Appraisal of Real Estate cost, some forms of functional depreciation are automatically eliminated. The five basic types of accrued depreciation that affect structures are as follows: 1. Curable physical depreciation 2. Incurable physical depreciation 3. Curable functional depreciation 4. Incurable functional depreciation 5. External depreciation (which may be temporary if caused by depressed market conditions) The various types of accrued depreciation are discussed in this chapter in the order in which they are traditionally treated in appraisal reports. However, an appraiser may find it more convenient to measure all curable physical and functional items first and then analyze physical, functional, and external incurable items. Generally, incurable items cannot be measured properly until all curable items have been measured due to the nature of curable and incurable depreciation. The valuation of single-family properties generally does not require the amount of detail used in the breakdown method. To estimate accrued depreciation for a single-family property, an appraiser may sometimes use a simple cost per square metre derived from a national cost service or a lump-sum accrued depreciation estimate derived with an age-life method. These procedures are distillations of the method illustrated in the following pages. Although certain appraisal problems can be resolved with simple cost-per-square-metre estimates, many appraisals require the use of the breakdown method. Appraisers should be familiar with the more exacting, detailed method to apply the simple procedures accurately. SAMPLE APPLICATION The tables that follow illustrate applications of the breakdown method. The site value indicated in the tables is presumed to be supported by market analysis. The tables are based on a hypothetical two-storey office building that has 433.5 square metres of gross building area and 350.0 square metres of net rentable area. The building is located on a 220-sq.-M. site and contains most forms of accrued depreciation. Table 16.4 is a summary of the reproduction cost estimate of the office building. In the subsequent tables, estimates of each category of depreciation are calculated on a reproduction cost basis. Curable Physical Depreciation Curable physical depreciation refers to items of deferred maintenance; the estimate of curable physical depreciation applies only to items in need of repair on the effective appraisal date. This element of accrued depreciation is measured as the cost of restoring the item to new or reasonably new condition, i.e., the cost to cure. Table 16.5 shows the calculations for estimating curable physical items of depreciation. The cost to cure the painting exceeds its current cost because additional labour and preparation are required that are not involved in new construction. An Accrued Depreciation - 339 Table 16.4 Reproduction Cost by the Quantity Survey Method Reproduction Cost Direct costs (including labor, materials, equipment, and contractor's overhead and profit) Excavation and site preparation Foundation Exterior walls Roof structure Roof cover Frame Floor structure Floor cover (carpeting) Ceiling Interior partitions Painting (exterior and interior) Plumbing system Plumbing fixtures Electrical system Electrical fixtures H VAC Total direct costs Indirect costs (including architect's fees, survey, legal fees, permits and licenses, insurance, taxes, financ ing charges, selling expenses, leasing expenses, and holding expenses) Entrepreneurial profit Total reproduction cost Cost per sq. ft. of gross building area Table 16.5 $ 395 4,685 53,275 9,720 2,505 19,590 12,925 5,995 5,505 33,300 1,250 5,675 2,135 6,560 3,415 13,580 $180,510 $ 15,215 $ 27,000 $222,725 $ 47.72 Reproduction Cost: Curable Physical Deterioration (Deferred Maintenance) Roof cover (repair) Painting Total curable physical deterioration Reproduction Cost Cost to Cure $2,505 1,250 $ 250* 1,350t Remainder $2,255 0 $1,600 *The roof was damaged in a storm; the cost to cure the roof is $250. t The cost to cure the painting exceeds its current cost because additional labor and preparation are required that are not involved in new construction. 340 The Appraisal of Real Estate observed condition in the improvements being appraised is considered curable if the cost of correcting the condition, including any reasonable profit, would be offset by an equal or greater increase in value. Most structural defects, deficiencies, and superadequacies can be corrected with new construction technology, but the crucial consideration is economic. Will curing the condition restore the structure's function and is it prudent to cure it at this time? Appraisers differ in how they categorize a curable building component that is only partly worn. For example, a five-year-old roof that is expected to have a total physical life of 25 years obviously contributes less value than it would if it were new, Some appraisers argue that the 20% loss in value cannot economically be cured as of the date of the appraisal; others believe that deteriorated roofs are indeed curable. The prorata loss in value due to such an item may be deducted as incurable or curable depreciation; the appraiser's choice of either category will not affect the market value opinion. Incurable Physical Depreciation Incurable physical depreciation identifies items of deterioration that cannot be practically or economically corrected at present. This type of depreciation is calculated for all structural components that are not included in the curable physical category. Because the cost to cure curable physical items of depreciation has already been deducted from the total reproduction or replacement cost estimate, incurable physical depreciation does not apply to the total cost estimate. Incurable physical depreciation must be based on the reproduction or replacement cost of the entire structure that remains after the cost to cure the components treated as physically curable has been deducted. Otherwise, the cost of incurable physical depreciation would also be charged to curable items, and excess depreciation would result. For purposes of analysis, items that have incurable physical depreciation are classified as long-lived and short-lived. A long-lived item is a building component that is expected to have a remaining economic life that is the same as the remaining economic life of the entire structure. A short-lived item is a component that is expected to have a remaining economic life that is shorter than the remaining economic life of the structure. Whether items of physical depreciation that are not due to deferred maintenance are classified as curable or incurable, the depreciation in short-lived items must be measured consistently and each element of the structure must be measured only once. Tables 16.6 and 16.7 show the calculations for estimating the physical depreciation evident in short- and long-lived items. In the tables, incurable physical depreciation for both short- and long-lived components is estimated with the physical age-life method. To estimate the amount of incurable physical depreciation in short-lived components, the appraiser applies the ratio of actual age to estimated total physical life to the reproduction or replacement cost of each incurable physical shortlived component that remains after the cost to correct curable physical depreciation has been deducted from the total cost estimate. The depreciation evident in all the items is added to obtain an estimate of the total incurable physical depreciation in short-lived building components. To calculate the amount of depreciation to be charged to incurable physical long-lived components, the total reproduction or replacement cost of the curable physical items (or cost to cure in some instances) and incurable physical short Accrued Depreciation . 341 Table 16.6 Reproduction Cost: Incurable Physical Deterioration, Short-Lived Components Roof cover Floor cover Ceiling Painting Plumbing fixtures Electrical fixtures H VAC Reproduction Cost Remaining Actual Age Total Physical Life Ratio Applied to Cost Incurable Physical Depreciation $ 2,255* 5,995 5,505 0 10 yrs. 7 yrs. 5 yrs. New 15 yrs. 10/15 10 yrs. 7/10 15 yrs. 5/15 5 yrs. 0 (67%) (70%) (33%) $ 1,511 4,197 1,817 0 2,135 10 yrs. 20 yrs. 10120 (50%) 1,068 3,415 4,750t 8 yrs. 10 yrs. 10 yrs. 8/10 15 yrs. 10/15 (80%) (67%) 2,732 3,183 $24,055 Total incurable physical deterioration, short-lived components Rounded $14,508 $14,510 *Of the current reproduction cost of $2,505, $250 was cured in the treatment of physical curable deterioration, leaving a remainder of $2,255. The appraiser may choose to use the entire $2,505 if repairing the damaged item will not increase the remaining life of the building component. t Of the current reproduction cost of $13,580 for the entire HVAC system, $4,750 is attributable to short-lived items such as fans, controls, and other mechanical components that will need to be repaired or replaced before the end of the structure's estimated economic life. The $8,830 remainder is included in the long-lived category. Table 16.7 Reproduction Costs: Incurable Physical Deterioration, Long-Lived Components Reproduction cost less reproduction cost of curable physical items and incurable physical short-lived items $222,725 $ 1,500* $24,055 -25,555 Reproduction cost of long-lived items $197,170 Actual age-5 yrs. Total physical life (new): 75 yrs. Ratio applied to cost: 5/75 Total incurable physical deterioration, long-lived components x 0.06667 $13,145 This figure consists of the cost to cure the roof ($250) and the reproduction cost of the painting ($1,250). The reproduction cost of the painting is used because the cost to cure exceeds reproduction cost. 342 The Appraisal of Real Estate lived components must be deducted from the estimated reproduction or replacement cost. If this step is not completed, the charges for curable and incurable physical depreciation in short-lived components will be duplicated. After subtracting these figures, an appraiser may use one of two methods to estimate incurable physical deterioration in the long-lived components. The first method involves use of a ratio of actual age to estimate total physical life. This ratio is applied to the remaining replacement or reproduction cost of incurable physical long-lived building components. The use of this ratio ensures that components of functional or external depreciation are not included in the estimate of physical depreciation. The problem with this method is the difficulty of estimating total physical life from the market. Physical life is typically longer than economic life. The second method employs a ratio of effective age to economic life. This ratio is applied to the remaining replacement or reproduction cost of the incurable physical long-lived building components. In applying this method, the effective age has to be adjusted so that the ratio does not include curable physical depreciation, incurable physical depreciation of short-lived components, functional depreciation, or external depreciation. Accordingly, the effective age used in the ratio is shorter than the effective age used in the economic age-life method of estimating total depreciation. The economic age-life method should be applied with great care to derive a separate estimate of the incurable physical depreciation of long-lived items. The economic age-life concept normally applies only to overall depreciation. A distorted estimate may result if the economic age-life method is used to measure the incurable physical depreciation of long-lived items separately without proper adjustment of effective age to reflect deductions for curable physical depreciation, incurable physical depreciation of short-lived items, and functional or external depreciation. Curable Functional Depreciation Functional depreciation is a loss in value resulting from defects in design. It can also be caused by changes that, over time, have made some aspect of a structure, such as its materials or design, obsolete by current standards. The defect may be curable or incurable. To be curable, the cost of replacing the outmoded or unacceptable aspect must be the same as or less than the anticipated increase in value. Curable functional depreciation is measured as the cost to cure the condition. Deficiencies requiring additions are not included in either reproduction or replacement cost, and some items of functional depreciation due to superadequacies are not present when depreciation is estimated on a replacement cost basis. Curable functional depreciation may be divided into three subcategories. 1. Deficiency requiring addition, which is measured by how much the cost of the addition exceeds the cost of the item if it were installed new during construction. 2. Deficiency requiring substitution or modernization, which is measured as the cost of the existing component in the cost estimate, minus physical depreciation already charged against the existing component and salvage value, plus the cost to remove the existing component and the added cost of installation. Salvage value is defined as the value attributed to an item to be removed from the property, usually for use elsewhere. Accrued Depreciation 343 3. Superadequacy, which is measured as the current reproduction cost of the item minus any physical depreciation already charged plus the cost of removal, minus the salvage value, if any. A superadequacy is curable if correcting it on the date of the appraisal is economically feasible; otherwise it is considered incurable. For example, a superadequacy is curable when the added value of curing it is greater than the cost to cure. The measure for a superadequacy when using replacement cost new is the cost to remove minus the salvage value. Tables 16.8, 16.9, and 16.10 show the calculations for measuring curable functional depreciation when reproduction cost is used. The office building being appraised has no lavatory on the second floor, which has made it difficult to rent this space. Adequate space is available for the addition. Although space allocation is included in the reproduction cost estimate, fixtures are not. The calculation is necessary because it would be improper to deduct a component from the reproduction cost that was not included in this cost. Table 16.8 Reproduction Cost: Curable Functional Obsolescence - Deficiency Requiring Addition Cost to install a lavatory in the existing structure $1,200 Less cost to install a lavatory in the existing structure if the structure were being built new on the date of the appraisal 900 Loss in value $300 The light fixtures in the subject office building are outdated. Table 16.9 shows the loss in value attributable to this item. Table 16.9 Reproduction Cost: Curable Functional Obsolescence Deficiency Requiring Substitution or Modernization Cost of existing fixtures already included in cost estimate Less physical deterioration previously charged Less salvage value Plus removal costs Plus cost to install new fixtures Loss in value $1,000 800 0 200 400 $800 The office building includes 15 square metres of lighted and climate-controlled storage area. Demand for office space indicates the storage area should be converted. This superadequacy is considered curable only if it is economically feasible to cure on the effective appraisal date, i.e., if the added value of curing it is greater than the cost to cure. 344 The Appraisal of Real Estate Table 16.10 Reproduction Cost: Curable Functional Obsolescence – Superadequacy Determination of Feasibility Cost to finish storage area Less salvage value Total cost to cure Potential gain in NOI (150 square feet x $6.00)* Less increased operating expenses or plus reduced operating expenses Gain in NOI Change in N0I capitalized at the building capitalization rate of 10.5%t Rounded $750 0 $750 $900 0 $900 $8,571 $8,570 The capitalized gain in NOI to the building that results from curing the superadequacy is greater than the cost to cure, so it is feasible to convert the storage area to office space. Depreciation Estimate Current reproduction cost of the storage areat Less physical deterioration already charged Subtotal Plus net cost to cure Loss in value Rounded $6,400 427 $5,973 750 $6,723 $6,725 *The market rent for office space is $10 per square foot. Current storage space is leased for $4 per square foot. The increase in NOI is $6 per square foot for the 150 square feet. t The appraiser estimates a building capitalization rate of 10.5%. t The appraiser estimates the current reproduction cost of the storage area to be $6,400. Functional Depreciation in Replacement Cost Estimates If the current cost estimate is based on a replacement rather than a reproduction, the cost of excess or superadequate items is not included. Therefore, no expenditure to reproduce them and no charge for physical depreciation need be deducted. However, the cost to cure the superadequacy is still a valid charge. The $750 shown in Table 16.10 as the cost to cure (convert) the storage area represents the extent of curable functional depreciation due to the superadequacy that must be applied to the replacement cost estimate. Tables 16.11, 16.12, and 16.13 illustrate appropriate procedures for calculating curable functional depreciation when a replacement cost estimate is used. Like the preceding tables, these tables are based on the conditions observed in the subject office building. Accrued Depreciation 345 Table 16.11 Replacement Cost: Curable Functional Obsolescence - Deficiency Requiring Addition Cost to install a lavatory in the existing structure Less cost to install a lavatory in the existing structure if the structure were built new on the date of the appraisal Loss in value $1,200 900 $300 As mentioned earlier, the curable functional depreciation evidenced by the outdated light fixtures is measured by the cost to cure the defect after the contributory value of the deteriorated items, if any, is deducted. If a structure contains an obsolete component that must be removed at a separate cost, the cost of removal would be added to the cost of the repairs. Table 16.12 Replacement Cost: Curable Functional Obsolescence Deficiency Requiring Substitution or Modernization Cost of existing fixtures already included in cost estimate Less physical deterioration previously charged Less salvage value Plus removal costs Plus added cost to install new fixtures Loss in value Replacement Cost: Curable Functional Obsolescence - Superadequacy Cost to finish the storage area into office space less salvage value $1,000 800 0 200 400 $800 Table 16.13 $750* *This is the only charge because the storage area was not included in the replacement cost estimate. Incurable Functional Depreciation Incurable functional depreciation may be caused by a deficiency or a superadequacy. Two types of deficiencies may be involved: an item not included in the cost new that should be, or an item included in the cost new that should not be. Incurable functional depreciation due to a deficiency that is not included in the 346 The Appraisal of Real Estate Table 16.14 Reproduction or Replacement Cost: Incurable Functional Obsolescence – Deficiency Estimated N0I loss due to the deficiency Building capitalization rate applicable to subject property (developed in the income capitalization approach) N0I loss divided by building capitalization rate ($1,274/0.105) Less cost if included in cost new estimate Estimated incurable functional obsolescence due to the deficiency (rounded) $1,274 10.5% $12,133 7,500 $4,635 cost estimate but should be is measured as the net income loss attributed to the deficiency, capitalized at the building capitalization rate (developed in the income approach), less the cost of the item if it was included in the cost estimate. Incurable functional depreciation due to a deficiency that is included in the cost estimate but should not be is measured as the current cost new, less physical depreciation previously charged, less value added. The calculations for measuring incurable functional depreciation due to a deficiency are the same whether a reproduction or replacement cost basis is used (see Table 16.14). The office building being appraised has no fire protection system. Other office buildings in the neighbourhood have fire protection and sprinkler systems in place. Market analysis indicates a differential of $8.00 per square metre of net leasable area between office buildings with adequate fire protection systems and those without adequate systems. The subject property has 350 square metres of net leasable area, which indicates an annual gross income loss of $2,800, minus vacancy losses and expenses of $1,526, to produce a net operating income loss of $1,274 per year. The cost to add a sprinkler system is $15,000. In many cases, the net income loss as a percentage of gross income loss attributable to functional depreciation differs from the general income and expense ratio for the property because certain expenses, such as utilities and insurance, are not affected by the deficiency, while other expenses, such as taxes and management, may be affected. Incurable functional depreciation due to a superadequacy is measured differently depending on whether a reproduction or replacement cost estimate is used. If reproduction cost is the base, the appraiser must consider the cost to construct a building that contains the same superadequacy. The superadequacy is measured as the reproduction cost of the superadequate component, minus any physical depreciation already charged, plus the present value of any added cost of ownership due to the presence of the superadequacy, less any value added such as increased rent. The charge for this burden of ownership is based on items such as additional taxes, insurance, maintenance, and utility charges. The excess depreci Accrued Depreciation 347 Table 16.15 Reproduction or Replacement Cost: Incurable Functional Obsolescence - Superadequacy Current reproduction cost of the superadequacy Less physical deterioration already charged* Subtotal Plus present value of added cost of ownershipt Less value addedt Estimated incurable functional obsolescence due to superadequacy $6,900 460 $6,440 0 0 $6,440 *A 62/3% charge was made for incurable physical deterioration, long-lived. Therefore, 62/3% Of the reproduction cost of the excess component must be deducted to avoid a double charge. t No extra ownership expenses are incurred for this type of superadequacy. t There is no increased rent resulting from the superadequacy. Therefore, no value added is attributable to this component. ated reproduction cost of the item, over and above the cost that may be supported by an increase in market rent as a result of the superadequacy, is added to the capitalized net income loss to derive an indication of the total depreciation caused by incurable functional depreciation due to a superadequacy. To estimate incurable functional depreciation due to a superadequacy when reproduction cost is the base, the appraiser must review the estimates of curable and incurable physical depreciation. If the superadequate component has been included in either of these categories, the reproduction cost of the superadequacy must be reduced by the amount of physical depreciation already charged. Such a charge is often made in estimating the incurable physical depreciation in longlived components, but it could also be made in estimating curable or incurable physical depreciation in short-lived components. All charges made in estimating physical depreciation must be reviewed to ensure that charges for items of accrued depreciation are not made twice. Replacement cost does not include the cost to construct a superadequacy, so no loss in the value of a superadequacy due to physical depreciation is considered when replacement cost is used. However, a charge is required if the superadequacy causes a monetary burden of ownership for items such as additional taxes, insurance, maintenance, and utility charges. The capitalized value of these additional expenses, over and above any increase in market rent resulting from the superadequacy (value added), represents the loss in value caused by incurable functional depreciation due to the superadequacy. Incurable functional depreciation caused by a superadequacy is calculated in Table 16.15. The office building was designed and built to accommodate three stories, but only two stories were constructed. It is not economically feasible to add the additional floor. The framing cost new of a three-storey building would be $19,590, 348 The Appraisal of Real Estate while the framing cost new of a two-storey building would be $12,690. Therefore, the cost of the superadequacy is $19,590 $12,690, or $6,900. Because replacement cost does not include the cost of the superadequacy, no loss in value for incurable functional depreciati on caused by a superadequacy is considered except a charge for any burden of ownership created by the superadequacy. This particular superadequacy does not cause additional expenses for the subject property, so there is no loss in value due to the superadequacy in this case. External Depreciation External depreciation, the diminished utility of a structure due to negative influences emanating from outside the building, is usually incurable on the part of the owner, landlord, or tenant. External depreciation can be caused by a variety of factors, e.g., neighbourhood decline; the property's location in a community, region or province; or local market conditions. Any estimate of external depreciation must be based on a thorough neighbourhood analysis and justified in the neighbourhood analysis section of the appraisal report. External influences can cause any property to lose value. In the cost approach, the total loss in value due to external depreciation is allocated to the improvements. Therefore, an appraiser must first estimate the income attributable to the improvements. Th en the income imputable to the improvements is capitalized at the building capitalization rate to estimate external depreciation. Two methods can be used to measure external depreciation. The appraiser should select the procedure that is supported by the best market evidence. The appraiser can either 1) capitalize the income or rent loss attributable to the negative influence, or 2) compare sales of similar properties that are subject to the negative influence with others that are not. If pertinent sales data are abundant, the second procedure is preferred. However, an appraiser may encounter significant practical problems in attempting to account for other differences between the subject property and the comparable properties. Care should be exercised when this method is used. To estimate external depreciation by capitalizing the resulting loss in property income, the appraiser first estimates the loss to the entire property that is attributable to external forces. Then the loss in income attributable to the improvements is capitalized at the building capitalization rate. Appraisers can often find market data to help break down an overall capitalization rate (R0) into a building capitalization rate (R B ) and land (or site) capitalization rate (R,,). It is much more difficult to find an income or rent multiplier that reflects the proportions of building and site. When net operating income and appropriate capitalization rates are used, the net income loss imputable to the building can be capitalized at the building capitalization rate. The resulting figure is an estimate of external depreciation. Appraisers should recognize that conditions in temporarily depressed markets may dictate measuring external depreciation by discounting the net income loss for the time frame over which the negative externality is expected to exist rather than by capitalizing the loss, which would assume the condition is permanent. The appraiser may capitalize the remaining income at the market-derived land or site capitalization rate to derive an indication of the loss in value attributable to Accrued Depreciation - 349 Table 16.16 Reproduction or Replacement Cost: External Depreciation Estimated annual N0I not subject to external obsolescence after physical deterioration and functional obsolescence are cured Less subject's current N0I after physical deterioration and functional obsolescence are cured Estimated annual N0I loss due to external influences N01 imputable to the land (land value of $60,000 at R, of 8.5%) NOI imputable to the building (total property N0I of $21,490 minus N01 imputable to the land) Income loss attributable to the building (building proportion* of 76.3% x $2,450) Building capitalization rate Capitalized net income loss to building ($1,869/0.105) Amount of external obsolescence applicable to building $23,940 -21,490 $ 2,450 $ 5,100 $16,390 $ 1,869 0.105 $17,800 $17,800 *To derive the proportion of N0I to the building, N0I to the land is divided by N0I to the overall property: $5,100/$21,490 = 23.7%. The resulting percentage was then subtracted from 1; I - 23.7% = 76.3%. the site. If this percentage of the loss in site value is close to the adjustment that was made for location in the direct comparison analysis of site value,' the appraiser can have greater confidence in both the location adjustment and the estimate of external depreciation attributed to the building in the cost approach. Table 16.16 illustrates one procedure for estimating external depreciation. The procedure can be used with either a reproduction or replacement cost estimate. The subject building is adjacent to an operating landfill. On windy days, the neighbourhood and property experience an annoying stench. Office buildings a few blocks away are not affected by this nuisance and have a greater annual net operating income of approximately $7.00 per square metre. The subject suffers an annual net operating income loss of $2,450 (350 square metres x $7.00). TOTAL ESTIMATES OF ACCRUED DEPRECIATION After each element of depreciation is accurately estimated, the results of the analysis are summarized. (See Table 16.17.) FINAL VALUE INDICATION When accrued depreciation is measured with the breakdown method, the appraiser derives a final value indication in the cost approach by deducting the estimate of accrued depreciation from the reproduction or replacement cost of the improvements on the effective appraisal date and then adding the market value of the site on the same date. When appropriate, this total represents a fee simple value indication, which is adjusted to reflect the specific property rights being appraised. An adjustment to reflect rents above or below market levels is made to obtain the 350 The Appraisal of Real Estate Table 16.17 Reproduction Cost: Total Estimate of Accrued Depreciation, Breakdown Method Physical deterioration Curable, deferred maintenance Incurable, short-lived items Incurable, long-lived items Total Functional obsolescence Curable ($300 + $800 + $6,725) Incurable ($4,635+$6,440) Total External obsolescence Total accrued depreciation $ 1,600 14,510 13,145 $29,255 $ 7,825 11,075 $18,900 17,800 $65,955 value of the leased fee. An example appears below. The final calculations are shown in Table 16.18. It is assumed that the office building being appraised is rented to a single tenant for six more years at an annual net rent of $38,000. Market rent is $44,000 per year net. The present value of the tenant's leasehold interest is $24,668, which was obtained by discounting the $6,000 difference between market rent and contract rent for the six-year term at the 12% discount rate currently sought by equity investors, i.e., $6,000 x 4.111407 (present value of $1 per period) = $24,667. ESTIMATING ACCRUED DEPRECIATION BY THE SALES COMPARISON APPROACH When accrued depreciation is measured with sales comparison techniques, the reproduction or replacement cost of the property on the valuation date minus the value contribution of the improvements on the same date should equal the total accrued depreciation. Table 16.19 illustrates the procedure for estimating accrued depreciation through analysis of comparable sales. The accuracy of this method depends on the availability of truly comparable sales of both improved properties and vacant sites. The real property interests conveyed in the improved properties used for comparison should be the same as the real property interests being valued in the subject property. Sales of partial interests should be used with caution because vast differences can exist among leased fee or leasehold interests. Any adjustment for differences in real property interests must be well supported with market data. The sales used in Table 16.19 are current and similar to the subject property in terms of physical, functional, and external elements of accrued depreciation. Adjustments should be made for any dissimilarities. The sales indicate a narrow range for accrued depreciation of between 33% and 37% of total replacement cost. Accrued Depreciation 351 Table 16.18 Cost Approach Value Indication Using Reproduction Cost Reproduction Cost Direct Indirect Entrepreneurial profit* Total Accrued depreciation Curable physical Incurable physical, short-lived Incurable physical, long-lived Subtotalt Curable functional, deficiency Curable functional, deficiency Curable, functional superadequacy Subtotal Incurable functional, deficiency Incurable functional, superadequacy Subtotal External obsolescence Total accrued depreciation Depreciated value of improvements Site value Fee simple value indication Adjustment for tenant's leasehold interestt Leased fee value indicated by cost approach Rounded $180,510 15,215 27,000 $222,725 $1,600 14,510 13,145 $29,255 $300 800 6,725 $7,825 $4,635 6,440 $11,075 $17,800 $65,955 $156,770 60,000 $216,770 -24,668 $192,102 $192,100 *This estimate is derived from market evidence of the profits accruing to investors in properties similar to the subject property. t At this intermediate stage, some appraisers employ physical value, which is the value that would be calculated if the property had no functional or external obsolescence. Physical value is obtained by deducting all physical deterioration from the reproduction or replacement cost estimate. t There are times when the contract rent may be higher than the market rent, necessitating a positive adjustment rather than a negative adjustment as shown above. (29.6%) 352 The Appraisal of Real Estate Table 16.19 Estimating Accrued Depreciation with Sales Comparison Techniques (All sales are of fee simple interests) Sale price Estimated site value Present value of improvements Estimated replacement cost on date of sale Less present value of improvements Indicated total accrued depreciation in dollars Indicated total accrued depreciation as percentage of current replacement cost (rounded) Sale 1 $215,000 -60,000 $155,000 Sale 2 $165,000 -40,000 $125,000 Sale 3 $365,000 -127,750 $237,250 $230,000 -155,000 $195,000 -125,000 $375,000 -237,250 $ 75,000 $ 70,000 $137,750 33% 36% 37% The total percentage of depreciation estimated by the other methods are shown below. Economic age-life Modified economic age-life Breakdown Reproduction Cost 36% 34% 28% When sales comparison techniques are used to estimate depreciation, various types of depreciation, i.e., physical, functional, and external, are not distinguished. If the sale is an open-market transaction involving a fee simple interest, site value is market supported, and the estimate of current replacement or reproduction cost is accurate, the percentage derived from comparative analysis will represent all types of accrued depreciation. However, this method for measuring accrued depreciation has certain limitations. An adequate quantity of reliable comparable sales data is needed. Truly comparable sales are not always available and certain special-purpose properties are not frequently exchanged in the open market. When data are not available, the method is of little use. Furthermore, the allocation of comparable sale prices between site value and improvement value may be difficult to justify, particularly when the ratio of site value to building value varies. SUMMARY Depreciation is a loss in property value from any cause as of the effective appraisal date. In other words, it is the difference between reproduction or replacement cost of an improvement and its market value as of the effective date of appraisal. Depreciation can emanate from three sources: physical depreciation due to deterio- Accrued Depreciation 353 ration of the improvements, functional depreciation attributable to a deficiency or a superadequacy, and external depreciation caused by changes in the overall economy, demand patterns, or general property use in the neighbourhood. Physical depreciation and functional depreciation can usually be observed in an improvement. Depreciation represents a penalty because the market recognizes it as a value loss. A temporary undersupply of properties relative to demand may offset the value loss older buildings generally experience. Historic or architectural significance may also compensate for the value penalty that time imposes. Several important terms are associated with depreciation. To measure accrued depreciation, an appraiser estimates the amount of value loss incurred by the subject structure in its present condition, as compared with the value of the property if it were new. Book depreciation, the amount of capital recapture written off an owner's books, is based on original cost; it is not derived from the market. Economic life is the period over which improvements to real estate contribute to property value. Generally, the economic life of a property is shorter than its physical life if the property is not rehabilitated. Remaining economic life is an estimate of how long improvements will continue to contribute to property value. Actual age (i.e., historical or chronological age) is the number of years that have elapsed since construction was completed. Effective age is the age indicated by the condition and utility of the structure. If a building has been well maintained, has an especially good design, or happens to be in an undersupplied market, its effective age may be less than its actual age. To measure accrued depreciation, an appraiser considers all elements that may cause a loss in value and treats each element only once. Accrued depreciation can be estimated with the economic age-life method, the modified economic age-life method, the breakdown method, or sales comparison and income capitalization techniques. To estimate physical depreciation only, the physical age-life method may be used. To apply the economic age-life method, the ratio of effective age to total economic life is applied to the current reproduction or replacement cost of the improvements. Although this is the simplest method of estimating accrued depreciation, it does not distinguish between curable and incurable items of depreciation, or between short- and long-lived building components. The economic age-life method should not be used to derive separate estimates of the incurable physical depreciation of short- or long-lived items in the breakdown method. The modified economic age-life method recognizes the effect of curable items of physical depreciation due to deferred maintenance and functional depreciation. An appraiser estimates the curable depreciation in physical and functional items, and deducts this amount from the current reproduction or replacement cost of the improvements. To estimate incurable depreciation, the appraiser determines the ratio of effective age to total economic life and applies it to the cost of the improvements as of the effective appraisal date, minus the estimated curable depreciation. The appraiser must recognize that correcting curable items may increase the remaining economic life and/or decrease the effective age of the improvements. The modified economic age-life method does not distinguish between short- and longlived items of depreciation. The breakdown method analyzes each cause of depreciation separately and measures its effect. The separate estimates are totalled to arrive at a lump-sum amount, which is deducted from the reproduction or replacement cost of the improvements as of the effective appraisal date. When this method is applied to a 354 - The Appraisal of Real Estate replacement cost estimate, deductions for certain forms of functional depreciation (i.e., superadequacies) in the improvements are not included. The five types of accrued depreciation that this method considers are 1) curable physical depreciation, 2) incurable physical depreciation, 3) curable functional depreciation, 4) incurable functional depreciation, and 5) external depreciation. An appraiser may choose to consider all curable physical and functional items before measuring incurable items, because the depreciation in incurable items cannot be properly measured until the depreciation in curable items has been calculated. The cost to correct curable items is offset by a resulting increase in value; the cost to cure incurable items exceeds the resulting increase in value. Curable physical depreciation applies to items of deferred maintenance that are in need of repair on the effective appraisal date. An item is curable if the cost of curing it is less than or equal to the increase in property value. Appraisers differ on how a partly worn item should be categorized. Some argue that the value loss cannot be cured as of the date of the appraisal, so the item is incurable; others contend that deterioration is curable. In any case, the prorata loss must be deducted as either curable or incurable physical depreciation. Incurable physical depreciation refers to deterioration that cannot be practically or economically cured. The estimate of incurable physical depreciation is based on the reproduction or replacement cost of the entire structure after the cost to cure physically curable components has been deducted. Items of incurable physical depreciation are classified as long-lived and short-lived. A long-lived item is expected to have a remaining economic life equal to the life of the entire structure; a short-lived item is expected to have a remaining economic life that is shorter than the life of the structure. The physical age-life method should be used with short-lived items and may be used with long-lived items. The ratio of actual age to estimated total physical age is applied to the reproduction or replacement cost of the short- and long-lived items to derive an estimate of incurable physical depreciation. An alternative method for estimating the physical depreciation in long-lived items is an economic age-life method in which the effective age is adjusted for all other components of depreciation found in the property. This ratio of effective age to estimated economic life is applied to the replacement or reproduction cost of long-lived items to derive an estimate of incurable physical depreciation. Great care should be taken in applying this method to avoid including other components of depreciation in the ratio. Curable functional depreciation is caused by defects in design or changes in structural standards and building materials. To be curable the cost of replacing the outmoded or unacceptable aspect must be less than or equal to the anticipated increase in value. Curable functional depreciation can result from a deficiency requiring additions, a deficiency requiring substitution or modernization, or a superadequacy. If the cost is based on replacement rather than reproduction of the improvements, the cost of superadequate items is not included. Incurable functional depreciation may be caused by a deficiency or a superadequacy. When it is caused by a deficiency that is not included in the cost estimate but should be, incurable functional depreciation is estimated by capitalizing the net income loss attributable to the deficiency, i.e. by dividing the net income loss by the building capitalization rate minus the cost of the item if included in the estimate of cost new. Incurable functional depreciation due to a deficiency that is included in the cost estimate but should not be is measured as the current cost new, less physical depreciation previously charged, less value Accrued Depreciation 355 added. When caused by a superadequacy, incurable functional depreciation may be measured two different ways, depending on whether reproduction or replacement cost is used. If reproduction cost is the base, the superadequacy is measured as the reproduction cost of the superadequate component, minus any physical depreciation already charged, plus the present value of the added costs of ownership (e.g., for taxes, insurance, maintenance, and utilities) minus value added, if any. If replacement cost is the base, the superadequacy is represented only by a charge for the extra monetary burden of ownership minus value added. External depreciation is caused by negative influences outside the site; it is usually incurable on the part of the owner. The total income loss due to external depreciation must be allocated between the site and the improvements. In one method, the loss in income allocated to the improvement is capitalized at the building capitalization rate to determine the extent of external depreciation as of the effective appraisal date. The effect of external depreciation on site value is considered separately in site value analysis by the adjustment for location. The proportionate share of external depreciation allocated to the site is not applied to the site value, but it may be used to test the reasonableness of the value loss charged to the property's location in the site valuation section of the appraisal report. An appraiser may also apply direct comparison techniques, analyzing sales of similar properties that are subject to the negative influence and others that are not. With this method, practical problems may arise in isolating and quantifying other differences between the subject and the comparable properties. To derive a final value indication, the appraiser totals the estimates of each form of accrued depreciation, subtracts the total from the reproduction or replacement cost of the improvements, and adjusts this figure, if appropriate, to reflect the specific property rights being appraised. Endnotes 1. This procedure assumes that an adjustment for location has been made in the direct comparison approach. If a comparable property in proximity to the subject has recently been sold, there is no need for a location adjustment.