This form should not be used for Teaching work

advertisement

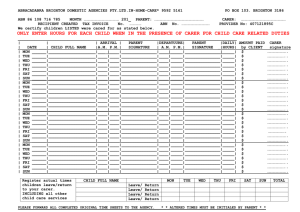

Payroll Reference Number Directorate CASUAL EMPLOYMENT CLAIM FORM School (please tick as appropriate) Directorate / School Name / Service Area / Team Name PLEASE COMPLETE IN BLOCK CAPITALS Title e.g. Surname First Name Mr/Mrs Claim for the month of: Day Date Year Hours Worked From To Break From To Total Hours (deduct break) MON TUES Home Address and Postcode WED THU FRI SAT Is this a change of address since your last claim ? Yes/No SUN MON This form should not be used for Teaching work TUES Please supply this information on every claim WED Date of Birth THU …….……./…….……./……..…… FRI National Insurance No | | | | | | | | | | SAT If Social Work please state Social Work registration number. SUN No: MON TUES 1. Is this a FIRST Casual Claim Yes/No WED If yes please answer the following questions, failure to do so will cause a delay in processing the payment THU 2. SAT If you are presently employed by Oxfordshire County Council please state where and in what capacity. ................................................................................................ FRI SUN MON ................................................................................................ TUES 3. WED Have you previously been engaged/employed by Oxfordshire County Council? Please state where, and dates of service. ................................................................................................ ................................................................................................ 4. If you have a form P45, please staple it to the claim. If not, see notes overleaf. THU FRI SAT SUN MON TUES You have the option to join the Local Government Pension Scheme. Please see paragraph overleaf. WED Reason for engagement/employment e.g. sickness cover: THU FRI SAT SUN Nature of engagement/employment e.g. Admin, Teaching Asst TOTAL NO. OF HOURS Hours/Sessions/Days Pay Grade & Point of post being covered * Office Use Only - Total (£) * Employee Signature Date: * Certified signature: * Where this claim relates to cover for an established post the grade and point must be in line with the evaluated grade of the post. In exceptional circumstances where the work is not cover for an existing post and lasts for no longer than 12 weeks please enter rate of pay (£) instead. Work lasting more than 12 weeks must be evaluated. Print name: Job Title Date COST CENTRE CODE [Must be completed before sending to Pay and Employment Information team] % INTERNAL ORDER (if applicable): % * Authorised signature: Print name: Job Title Date * Before signing you must read notes on the next page SUBMISSION OF CLAIM AND PAYMENT Claims will be paid only on a monthly basis, in arrears, (i.e. one payment per calendar month). If you are already in receipt of a regular salary or wage from Oxfordshire County Council payment for this claim will be added to the next appropriate payment. Payments include an element for holiday pay unless otherwise notified. Signatures Employees must always sign the form. In some parts of Oxfordshire County Council it may be necessary for both a certified and authorised signatory; in other parts one signature if both the line and cost centre manager may suffice (e.g. Headteacher). Directorate managers should refer to the appropriate Scheme of Delegation and Headteachers to the Schools Financial Manual of Guidance if they are unsure of the appropriate signatory. National Insurance Contributions Failure to provide your National Insurance number may result in contributions not being credited to your record by HMRC, which could affect your entitlement to benefits and pension. If you do not know your NI number this can be obtained by contacting the National Insurance contributions Office on 0845 915 8582. If you are a married woman in receipt of a current certificate of Reduced Liability, please staple certificate to this claim. At present women aged 60 need not pay NI contributions, however between 2010 and 2020 this will rise to age 65 to be the same as the current male exemption age (65). Any NI exemption certificate must be attached to your first claim. Local Government Pension Scheme You have a right to join the Local Government Pension Scheme (LGPS). Your first contribution will be deducted from the first pay period following your opt in [there will be no option to backdate]. If you would like to consider joining the scheme please see LGPS Membership pack on the intranet at Home>Staff>Pay and Pensions>A basic guide to your LGPS or ask your Line Manager or Payroll Officer. If you decide to elect to join the scheme you must complete the membership form, together with a nomination of beneficiary form, and return to your Payroll Officer with your completed casual claim form. If you have not already opted to join the LGPS in respect of your casual work then our policy for autoenrolment, as allowed by law, is to postpone for a period of 3 months from the commencement of each period of work you undertake for us in this capacity. Each casual claim is classed as a separate period of work. Income Tax If you do not have a form P45 and you are not already employed by the Council, you must complete a P46, which can be obtained from Pay and Employment Information. Either the P45 or P46 must be submitted with your first claim otherwise you will be taxed at Basic Rate. If you are undertaking your last claim for the Council please attach a note confirming this and your P45 will be sent to the address on this form unless you state otherwise. The address and contact details for the Council’s tax office are: HM Revenue & Customs, South Wales Area (Oxford), Ty Glas, Llanishen, Cardiff, CF14 5YF. Quote PAYE Reference 075 A9000. Telephone number: 0845 300 3948. The Working Time Directive limits the amount of time a worker can work unless they have opted out. If the amount of work you are undertaking exceeds 48 hours per week you are opting out of the regulations by submitting this form for payment. When to use this form and when to use an overtime claim form Complete Overtime Claim Form Yes Extra Work at same place and for same job No Complete Casual Claim Form Contact us - Please return this form to: Pay and Employment Information, Oxfordshire Customer Services, Unipart House, Garsington Road, Oxford, OX4 2GQ or contact us via e-mail at payandempdirectorates@oxfordshire.gov.uk (Directorates) or or payandempschools@oxfordshire.gov.uk (Schools) or telephone 0845 6054175. We are always pleased to receive your comments and suggestions to improve our service. Revised August 2014