They Might Be Giants

It's been nearly two years since Arthur Andersen went under and

Sarbanes-Oxley was passed. Have the Big Four audit firms changed

since then?

John Goff, CFO Magazine

January 01, 2004

Prologue: Back in the early 1970s, the accounting profession was a

gentlemanly affair. Work hard, make a decent salary, and play golf on

Saturday with your clients. Auditors were like bankers: conservative,

straightforward, and ethical to a fault. Indeed, accountants routinely topped

the lists of most-admired professionals.

"I was CFO at two companies in the '70s," recalls Robert Howell, now

distinguished visiting professor of business administration at the Tuck School

of Business at Dartmouth College. "When my accountant said, 'You ought not

do that,' that was it. Things have gone 180 degrees out of phase since then."

The shift can be traced to 1978, when the American Institute of Certified

Public Accountants (AICPA) lifted the ban on advertising and solicitation. The

end of that prohibition triggered a land grab in the accounting industry, and a

big push into consulting services.

The ensuing conflicts of interest culminated in a string of now-infamous

accounting scandals and the dismantling of Arthur Andersen. Many observers

believed the downfall of Andersen, the passage of the Sarbanes-Oxley Act of

2002 (Sarbox), and the establishment of the Public Company Accounting

Oversight Board (PCAOB) would curb the excesses of the previous decade.

The tough talk of the PCAOB's chairman, William McDonough, only reinforced

that notion. In a press conference in October, he noted that the Big Four

accountancies "have a high interest in restoring confidence [in publiccompany accounting]. If they don't do it themselves, we will do it for them.

And it will be painful."

But recent events suggest McDonough will have his work cut out for him. In

June, public-interest groups, including Common Cause and Consumers Union,

charged that Ernst&Young was advising audit clients to "rubber stamp" the

purchase of nonaudit services, a seeming violation of the spirit of Sarbox, if

not the law. Soon after, news broke that three of the Big Four (excluding

Deloitte Touche Tohmatsu) were being sued by a single client for allegedly

padding travel expenses. Then, in September, a former senior partner at

E&Y's San Francisco office was charged with destroying documents related to

a government investigation of a failed dot-com called NextCard. To some

industry watchers, the three incidents suggest that the Big Four are still

finding their way in a post-Sarbox world. Barbara Roper, director of investor

protection at the Consumer Federation of America, is harsher: "I don't see a

lot of evidence that the Big Four firms have seen the light."

Rope-a-Dope

You can't really blame the Big Four for not owning up to any past mistakes.

Any admission that previous audits were not as rigorous as they might have

been could expose the firms to shareholder lawsuits. Publicly, the four firms

have expressed general concern over the tarnishing of the audit profession.

PricewaterhouseCoopers vice chairman John O'Connor concedes that he was

embarrassed by the accounting scandals of the past few years: "We asked

ourselves, 'Have we lost our nobility?'" Even before the scandals hit, the

accountancy had instituted PwC University, a five-day seminar to help

employees deal with the kinds of stresses auditors experience.

Nevertheless, O'Connor asserts that PwC's biggest mistake during the past

few years was that it simply lost sight of the value of its core audit service:

"We had underinvested in some of our services, including audit."

Sarbox was intended, in part, to refocus audit firms on auditing. To some

extent, it has, by prohibiting auditors from offering certain consulting

services altogether and allowing them to offer others only to nonaudit clients.

In addition, auditors are meeting more often with corporate audit

committees, which are now empowered to hire and fire the firms. That's a

definite power shift. "Audit committees are our clients now," notes Susan

Frieden, Americas vice chair of quality and risk management at E&Y.

CFOs say engagement partners have become more conservative in the wake

of Sarbox as well. At a recent conference at MIT's Sloan School of

Management, Howard Smith, CFO of insurer AIG, noted that the amount of

time spent getting feedback from the company's auditors has "grown

tremendously" for complicated accounting issues. At the same conference,

John Millerick, CFO of Analogic, said bluntly: "There are no quick answers

[from our auditors] anymore."

Others argue that Sarbox could have gone further. "Sarbox was just triage,"

asserts Cynthia Smith, a lecturer at Ohio State University and co-author of

Inside Arthur Andersen. "It addressed a number of obvious things." Under

Section 203 of the act, for example, firms are required to rotate lead audit

partners every five years. But critics say legislators should have required

companies to change firms every five years (a stipulation E&Y vice chairman

Beth Brooke labels "a horrible idea").

What's more, Andersen's downfall has actually proven to be a windfall for the

remaining top-tier firms, which picked up the disgraced firms' clients. E&Y,

for one, reported revenues of $13.1 billion for its fiscal year 2003, a 30

percent rise from the previous year. And PwC's aggregated net revenue for

its fiscal year 2003 was $14.7 billion, a jump of nearly $1 billion.

In fact, it appears the Big Four have managed to neatly ride out the storm of

investor and congressional criticism triggered by the Andersen scandal. "The

Big Four firms are very good at taking blows, doing the rope-a-dope," says

Stephen Giusto, CFO at Costa Mesa, California-based consulting firm

Resources Connection Inc. and a former partner at a marquee firm. "But

there's been very little change to how they do business."

Auditors disagree, pointing to the creation of the PCAOB as just one example

of an industry in flux. "It's a big change from self-regulation to regulation,"

asserts O'Connor.

Indeed, the end of the peer-to-peer review system has been hailed by both

audit firms and their critics. The PCAOB has also garnered praise for its

decision, taken early on, to limit the role of the AICPA in the making of auditindustry standards. But the reality is, the Big Four audit the financial

statements of the public companies that generate 99 percent of all revenues

in the public sector. That's not likely to change anytime soon. Officials of the

Big Four think there's plenty of competition in the sector. "It's not unusual to

have three or four major players in an industry [that's gone through

consolidation]," says O'Connor. "It's still very competitive for clients." Adds

E&Y's Brooke: "Four firms is a workable number."

Charles Mulford has a different view. Mulford, a professor of accounting at

the Georgia Institute of Technology, recounts the story of one large

corporation that recently decided to dump its auditor of record (a Big Four

firm). Of the remaining three top-tier firms, one already provided the

company with consulting services, knocking that firm out of contention. In

addition, Mulford says the chairman of the company didn't like a key partner

at one of the two remaining Big Four audit houses. "The company ended up

sending out an RFP to one firm," he says.

McDonough acknowledges the scarcity of audit choices for large corporations.

"The lack of competition is a problem...," he says. "But what can be done

about it?" Very little (see "Return of the Big Eight?" at the end of this article).

"Four firms is close to a big problem already," says Giusto. "Anything less

would be a complete disaster."

Given that prospect, it's doubtful the PCAOB would put any of the top-tier

firms out of commission. "If there's a shortcoming to oversight," says

Mulford, "it's that the PCAOB can't let another [big firm] fail. If firms get to a

situation where they know this, it could be a problem." Roper thinks it's

already a problem. "At this point," she says, "the PCAOB is boxed in."

Oh, Calcutta!

This is not to say the accounting oversight board won't flex its regulatory

muscle. Rather than going after firms, however, the board will likely punish

individual partners.

There are plenty of those. On average, the Big Four firms (which are set up

as limited liability partnerships) employ about 6,600 partners. The LLP

structure, which merits full partnership tax treatment, shields the firms'

partners from vicarious liability. Unlike a corporation, which is hierarchical,

an LLP is by nature decentralized. In some cases, the setup can create a Wild

West mentality, in which partners at headquarters-level have relatively little

control over conduct at local offices.

While the national offices of the Big Four firms have undoubtedly become

more influential in the past few years, the power of local partners remains

strong ("they rule with an iron fist," is how one former auditor put it). That

power, some worry, could lead to future abuses. "Many of these partners

believe they're their own bosses," argues Dartmouth's Howell. "It's pretty

hard to keep the screws down."

It's even harder if auditors feel a greater loyalty to the executives who hire

them than to the shareholders served by those executives. Congress's

demand that corporate audit committees take over responsibility for the

auditor relationship may change that dynamic. Moreover, national officers at

the top audit firms say they've been extremely forceful in advising partners

to back away from potentially risky situations. Such exhortations could be

having an effect, too. "Culturally, people are more willing to [drop a client]

now," says PwC's O'Connor.

Getting the message across to all of a firm's worldwide partners will be a

feat, however. Asks Howell: "You might be able to get a change at the top,

but how do you reach Calcutta?"

You'll Never Get Rich

Ohio State's Smith argues that there is still concern that audit firms will

remain more focused on revenues than shareholders. A recent academic

study would seem to support that view. In a theoretical model devised by

professors at Vanderbilt University's Owen Graduate School of Management,

researchers found that audit firms are still likely to produce inaccurate audit

opinions to benefit a big client—if auditors think they can get away with it.

Says Debra Jeter, associate professor of management at Owen and a coauthor of the research: "Our study suggests that ethics will translate into

behavior only if regulators ensure it is linked to dollar signs."

Whether they can make a whole lot of dollars by selling audit services...well,

that remains to be seen. With Sarbanes-Oxley Section 404 and SAS 99

(which requires auditors to take a more-skeptical approach in engagements),

billable hours for assurance work have gone up. And the Big Four firms do

seem intent on providing more-robust audit products, including some

forensics. But audits are still not the moneymakers that nonaudit services

are. "Audits are clearly profitable," asserts E&Y's Brooke. "As profitable as

[our] other businesses? Probably not."

No doubt PwC, E&Y, and KPMG have been hurt by the sell-off of their

management-consulting businesses. In 1998, 45 percent of Big Five

revenues (not profits) came from professional management services,

according to the General Accounting Office. In 2002, that slice was closer to

10 percent.

Industry watchers say it's only a matter of time before the top firms begin to

expand their lucrative nonaudit services. Case in point: Bruce Nolop, CFO at

Pitney Bowes Inc., in Stamford, Connecticut, says PwC, the company's

independent auditor for 64 years, recently tried to sell it a Sarbox tool. "We

had concerns about whether we should use them," says Nolop. "We came

down on the side of not using our auditor."

Still, Nolop says Pitney Bowes is relying on PwC more than ever to "help us

navigate the new regulatory environment." While that environment should

raise the profile of audit partners at the top firms, nonaudit partners still

make up a fair share of each firm's total number of partners. Critics worry

that those partners will eventually start to dominate the culture of the top

firms, exploiting fuzzy areas to maximize profits. Says one former Big Five

auditor, "Partners tend to vote with their wallets."

It's appropriate for partners, as owners of for-profit businesses, to focus on

making money. But the partnership structure intensifies pressure for

revenues, as there are more "chiefs" expecting C-suite compensation. Top

partners at the Big Four firms earn about $350,000 a year, says one source,

while national practice directors pull in seven-figure incomes. "I remember

senior partners telling me, 'You're not going to get rich in this business,'"

recalls Giusto of his time at Deloitte. "But some of these top guys [at the big

firms] are getting rich."

And while money may not be the root of all evil, it's usually in the vicinity. No

doubt recognizing this relationship, PwC has changed its compensation

system, essentially eliminating the firm's bonus payouts. But the accounting

profession requires rigorous training and demands long hours. Its

practitioners should be paid well. Even Mulford argues that the for-profit

model "brings the best talent to the firms."

Maybe so. But longtime watchers of the accounting scene say big money has

changed the Big Four, and something has been lost. "In the past, auditing

was really a professional service," says Howell. "Now, the primary objective

of firms is to get bigger—and to make more money for the partners."

Epilogue: A few weeks after the Enron scandal broke, Vanderbilt University

conducted a roundtable on the accounting industry. After the conference, a

former student came over to talk to Owen Graduate School's Jeter, who

chaired the discussion. She recalls with amazement the conversation she had

with the former student. "He told me that he had gone on to become a

lawyer, and his wife was a CPA," remembers Jeter. "He then said, in essence,

that he and his wife both do the same thing. I asked him what that was. He

said: 'Find loopholes.'"

John Goff is technology editor at CFO.

Return of the Big Eight?

How many accountancies do we really need? In a survey of Fortune 1,000

companies conducted by the General Accounting Office, 77 percent of the

respondents said there should be four to eight big audit firms.

Although some pundits claim a merger of two of the top second-tier firms

would create a viable top-tier audit firm, the numbers simply don't add up.

Combining the largest two second-tier firms, Grant Thornton and BDO

Seidman, would create a company with 593 partners—slightly more than

one-third the size of the smallest Big Four firm.

Robert Howell, a visiting professor at Dartmouth College's Tuck School of

Business, suggests that rather than merging second-tier firms, it makes

more sense to bust up the existing Big Four partnerships. 'You could make

eight out of four," he insists. "There's no reason why you couldn't unwind a

[PricewaterhouseCoopers]."

To a lesser extent, such an unwinding of the top firms is already happening.

For one thing, new restrictions on the kinds of tax services auditors can

provide to audit clients has triggered a minor exodus of Big Four tax partners

to law firms. PwC vice chairman John O'Connor claims that most of the firm's

lost tax business has gone to other Big Four firms. But he does grant that

about 3 percent of PwC's tax business has been lost to law firms. "There's a

bit of a market-share grab for the tax business of clients," he notes.

At the same time, a number of boutique accounting firms have opened in the

past few years. In some cases, the start-ups have been launched by

nonpartners of top-tier firms. Erik Linn, an ex-auditor at Arthur Andersen

who started CapAdvisory in 1999, explains that "the intense work schedule

and long hours at the Big Four firms, combined with the increased risk, have

made partnerships at these firms much less attractive."

More small firms will likely pop up in the coming months. Such new

accounting standards as SAS 99 and process refinements wrought by the

Sarbanes-Oxley Act of 2002 will provide yawning business opportunities for

niche players. Stephen Giusto, CFO of Resources Connection Inc. and a Big

Five employee in the early 1990s, sees another reason for the migration from

Big Four firms. "It's getting harder to become partner," he asserts. —J.G.

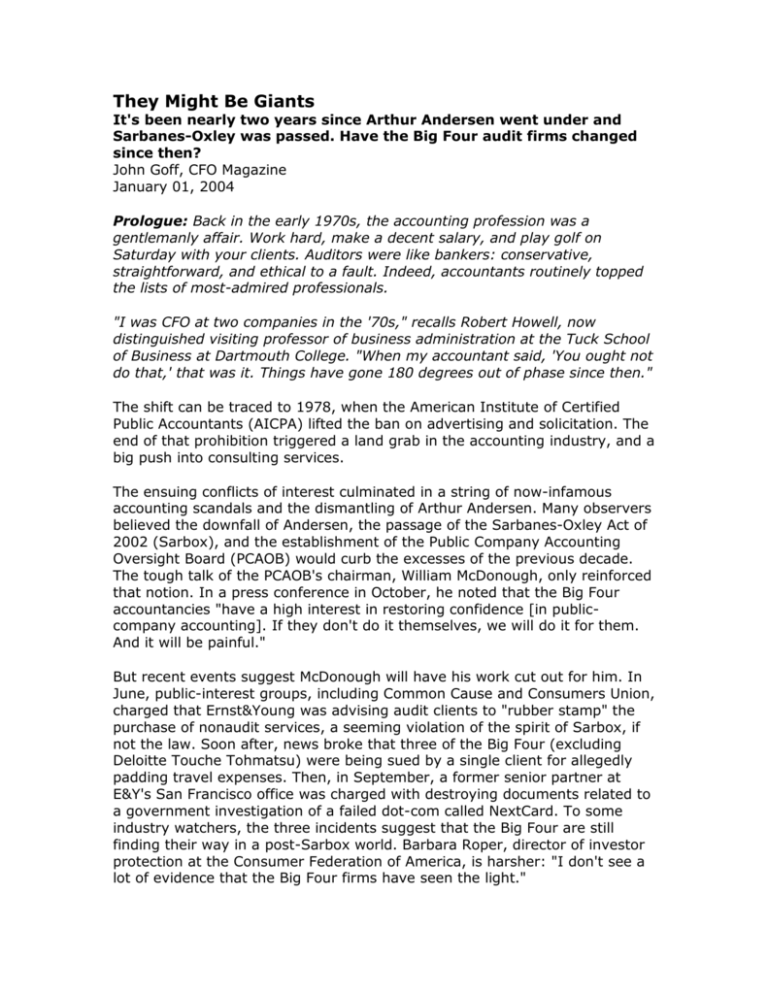

Mind the Gap

First-tier firms still tower over their second-tier cousins.

Accounting Firm

Revenue

($

thousands)

Partners

Professional

Staff

(nonpartner)

$13,782

7,020

97,109

Deloitte & Touche

12,500

6,714

73,810

KPMG

10,720

6,600

69,100

Ernst & Young

10,124

6,131

60,713

BDO Seidman

2,395

2,182

16,078

Grant Thornton

1,840

2,256

14,019

McGladrey & Pullen

1,829

2,245

12,775

Big Four

PricewaterhouseCoopers

Second-tier

Note: This table is limited to U.S.-based firms with global operations. Some foreign firms may

have operations comparable to smaller U.S. firms.

Source: Public Accounting Report, 2003

© CFO Publishing Corporation 2004. All rights reserved