Syllabus - Angelina College

advertisement

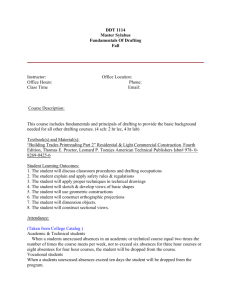

Date approved or revised 8-23-13 Angelina College Business Division ACCT 2301 – Principles of Financial Accounting Instructional Syllabus I. BASIC COURSE INFORMATION A. Course Description: ACCT 2301 is a three-hour credit course. This course is an introduction to the fundamental concepts of financial accounting as prescribed by U.S. Generally Accepted Accounting Principles (GAAP) as applied to transactions and events that affect business organizations. Students will use recorded financial information to prepare a balance sheet, income statement, statement of cash flows, and statement of shareholders’ equity to communicate the business entity’s results of operations and financial position to users of financial information who are external to the company. Students will study the nature of assets, liabilities, and owners’ equity while learning to use reported financial information for purposes of making decisions about the company. Students will be exposed to International Financial Reporting Standards (IFRS). B. Intended Audience: This course is structured for students pursuing a two-year or four-year Business degree. Material presented will expose the student to accounting practices followed in a variety of companies. Emphasis will be on familiarizing the student with the Balance Sheet and Income Statement for a proprietorship, and steps required for their preparation. C. Instructor: Name: Jin Ulmer, CPA, MBA Office Location: Business Building B102K Phone: 936-633-5302 Office Hours: Monday & Wednesday: 11:00 am – 12:00 pm 2:30 pm – 4:00 pm Tuesday & Thursday: 1:00 pm – 4:00 pm Friday: 8 am – 11:30 am E-mail Address: julmer@angelina.edu II. INTENDED STUDENT OUTCOMES: A. Core Objectives Required for this Course 1. Critical Thinking: to include creative thinking, innovation, inquiry, and analysis, evaluation and syntheses of information 2. Empirical and Quantitative Skills - to include the manipulation and analysis of numerical data or observable facts resulting in informed conclusions 3. Personal Responsibility: to include the ability to connect choices, actions, and consequences to ethical decision-making B. Course Learning Outcomes upon successful completion of this course, students will: 1. Use basic accounting terminology and the assumptions, principles, and constraints of the accounting environment. 2. Identify the difference between accrual and cash basis accounting. 3. Analyze and record business events in accordance with U.S. generally accepted accounting principles (GAAP) 4. Prepare adjusting entries and close the general ledger. 5. Prepare financial statements in an appropriate U.S. GAAP format, including the following: income statement, balance sheet, statement of cash flows, and statement of shareholders’ equity. ACCT 2301 –Principles of Financial Accounting 1 6. Analyze and interpret financial statements using financial analysis techniques. 7. Describe the conceptual difference between International Financial Reporting Standards and U.S. Generally Accepted Accounting Principles. III. ASSESSMENT MEASURES A. Assessments for the Core Objectives 1. Critical Thinking: While critical thinking will be used in many aspects of the course, the key assignment will be assign debits and credits to transactions and prepare various financial statements in all homework assignments and exams. The student’s performance of this specific learning activity, will be assessed through utilization of the AC Critical Thinking Skills value rubric. 2. Empirical and Quantitative Skills: Students will ensure total debits equal to total credits for each transaction, and also ensure total assets equal to the sum of total liabilities and total stockholders’ equity. A practice set designed to simulate a real-world environment will be used for students to utilize their empirical and quantitative skills. The student’s performance of this specific learning activity, will be assessed through utilization of the AC Empirical and Quantitative Skills value rubric. 3. Personal Responsibility: As students are instructed on the ethical considerations associated with excellent business communication, they will be asked to analyze and determine the ethical issues that are involved and make proper recording in each homework assignment. The student’s performance of this specific learning activity will be assessed through utilization of the AC Personal Responsibility value rubric. B. Assessments for Core Learning Outcomes 1. Students will demonstrate their knowledge of the accounting theory and techniques required for proper recording of business transactions. 2. Students will demonstrate their knowledge of the human skills necessary for successful development of communication skills through successful completion of pertinent tests of assigned topics. 3. Students will demonstrate their knowledge of the basic tools for gaining employment through successful completion of appropriate testing over the related material. IV. INSTRUCTIONAL PROCEDURES: The course is taught using a combination of lectures and hands-on practice in the class that complement and supplement lecture material. Audio-visual materials, marker board illustrations, and supervised in-class activities will be employed to enhance lecture presentations. V. COURSE REQUIREMENTS AND POLICIES: A.. Required Textbooks, Materials, and Equipment Financial Accounting - 9th Edition by Weygandt, Kimmel, & Kieso A Business Practice set by Larry Falcetto "Campus Cycle Shop" Calculator – 4-function, pencils and Staedtler-type eraser. WileyPlus – a publisher’s online tool for reading, studying, practicing, and homework assignments submission. You will need an access code to WileyPlus, the access code is included with bundled textbook package at the AC bookstore. ACCT 2301 –Principles of Financial Accounting 2 B. Course Policies – (This course conforms to the policies of Angelina College as stated in the Angelina College Handbook.) 1. Academic Assistance – If you have a disability (as cited in Section 504 of the Rehabilitation Act of 1973 or Title II of the Americans with Disabilities Act of 1990) that may affect your participation in this class, you should see Karen Bowser, Room 208 of the Student Center. At a post-secondary institution, you must self-identify as a person with a disability; Ms. Bowser will assist you with the necessary information to do so. To report any complaints of discrimination related to disability, you should contact Dr. Patricia McKenzie, Administration Building, Room 105 or 936-633-5201. 2. Discrimination – Angelina College admits students without regard for race, color, creed, sex, national origin, age, religion, or disability. Inquiries concerning sex equality, disability, or age should be directed to Dr. Patricia McKenzie (936) 633-5201, Angelina College Administration Building, Room A105. 3. Attendance –Students have the responsibility of attending all classes and a record of attendance will be kept by the instructor. Two or more consecutive absences or three or more cumulative absences have been defined by AC as excessive and the student can be dropped by the instructor for excessive absences. Students are encouraged to attend every class, as to do otherwise may adversely impact the student’s grade. The instructor will take on the responsibility to drop a student from this class for excessive absences. If a student decides not to complete this course, they must initiate the proper drop form from the registration office or they will receive an F in this course. Excused absences will be decided by the instructor. For further information regarding attendance please refer to the Student Handbook. 4. There is no excuse for tardiness as being tardy is inconsiderate to the instructor as well as to the fellow classmates. Two late entries to classroom or two leaving early from classroom equals one absence. 5. The last day to drop this course with a “W” is Nov 9, 2015. Incompletes (I) are not given unless approved by the instructor. They are subject to approval by the Dean of Instruction. Failure to appropriately withdraw/drop to complete a course (except as stated above) may result in a final grade of “F”. 6. Assignments – Completion of assignments are strongly encouraged before each regular exam for the chapters covered. All homework assignments post online at WileyPlus.com. 7. Food, drinks, and tobacco products are not permitted in the classroom. 8. All cell phones must be turned off during the class and put away from the desk. Unless the student has made previous arrangements with the instructor and receive the permission, they may set the phone to vibrate once, leave room, and not disturb class by talking on phone. The consequence of disrespecting the cell phone rule will result in dismissal from class. 9. If you need a tutor, contact the Student Tutoring and Access Center at 633-4504, 2nd floor of library. Also, if you as a student have special learning needs which should be accommodated by Angelina College, please contact the Student Services Office. ACCT 2301 –Principles of Financial Accounting 3 VI. COURSE OUTLINE: – Description of the Course Activities, including due dates, schedules, and deadlines. DATE DISCUSSIONS/ACTIVITIES Aug. 26 Introduce the course and review syllabus Chap 1 – Accounting in Action Assignment - online Sept. 02 Chap 2 – The recording process Assignment - online 09 Review Exam 1 – Chap 1 & 2 16 Chap 3 – Adjusting the accounts Assignment - online 23 Chap 4 – Completing the accounting cycle Assignment - online 30 Review Exam 2 – Chap 3 & 4 Oct. 07 Chap 5 – Accounting for merchandise operations Assignment - online 14 Chap 6 - Inventories Assignment - online 21 Review and bring practice set and stay after the exam Exam 3 – Chap 5 & 6 28 Practice Set Workshop Chap 7 – Fraud, Internal Control, and Cash Assignment - online Nov. 04 Chap 8 – Accounting for Receivables Assignment - online 11 Review Exam 4 – Chap 7 & 8 18 Chap 9 – Plant assets, Natural resources, and Intangible assets Assignment – online 25 Thanksgiving Holiday Dec. 02 Chap 10 – Liabilities Assignment – online Practice Set Due Review 09 Final exam THIS COURSE OUTLINE IS SUBJECT TO MODIFICATION AT THE DISCRETION OF THE INSTRUCTOR. ACCT 2301 –Principles of Financial Accounting 4 VII. EVALUATION AND GRADING: A. Grading Criteria Homework - 10 % for homework grade over 70% on WileyPlus. Practice set -10%, it is a group work, due on April 30, Grade by effort. 4 regular exams - 15% each for the regular exam, quizzes will be the bonus points for each regular exam. Final exam is comprehensive – 20% Make-up exam is only allowed with legitimate reason in regular exams and no make-up for Final exam. B. Determination of Grade (assignment of letter grades) A = 90-100 B = 80-89 C = 70-79 D = 60-69 F = below 60 The instructor may modify the provisions of the syllabus to meet individual class needs by informing the class in advance as to the changes being made. ACCT 2301 –Principles of Financial Accounting 5