Complaint - North Carolina Business Litigation Report

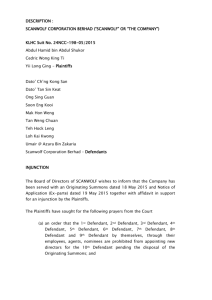

advertisement