CORPORATE FORM

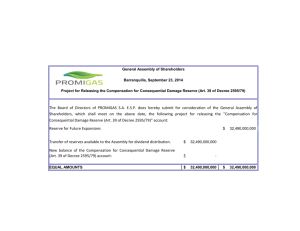

advertisement

CHAPTER 14 Corporations: Organization and Share Capital Transactions CORPORATE FORM A corporation is a legal entity that is separate and distinct from its owners. It has most of the rights of a person, and it has the same duties and responsibilities. It must respect laws and pay taxes. A corporation may be organized for the purpose of making a profit, or it may be nonprofit. Classification by ownership distinguishes between publicly held and privately held corporations. A publicly held corporation may have thousands of shareholders, and its shares are regularly traded on an organized securities market. A privately held corporation, often referred to as a closely held corporation, usually has only a few shareholders, and does not offer its shares for sale to the general public. A crown corporation is similar to a private corporation, but it is owned by the government. CHARACTERISTICS OF A CORPORATION Separate legal existence. As an entity separate and distinct from its owners, the corporation acts under its own name rather than in the name of its shareholders. Limited liability of shareholders. Since a corporation is a separate legal entity, creditors ordinarily have recourse only to corporate assets to satisfy their claims. Transferable ownership rights. Ownership of a corporation is held in capital shares, which are transferable units. Ability to acquire capital. Obtaining capital is relatively easy for a corporation because shareholders have limited liability and shares are readily transferable. Continuous life. Most corporations have an unlimited life. Its continuance as a going concern is not affected by the withdrawal, death, or incapacity of a shareholder, employee, or officer. Corporation management. Although shareholders legally own the corporation, they manage the corporation indirectly through a board of directors they elect. The board, in turn, formulates policies and selects officers to execute policy and to perform daily management functions Government regulations. Canadian companies may be incorporated federally, under the terms of the Canada Business Corporations Act, or provincially under the terms of a provincial act. A corporation is subject to numerous regulations that are designed to protect the owners of the corporation. Income tax. Corporations must pay federal and provincial income taxes as a Entity separate legal entity. These taxes are substantial; they can amount to as much as 50% of taxable income. There are income tax deductions available to some corporations that can reduce the tax rate to 20% to 25%. In some circumstances, an advantage of incorporation is the deferral of personal income tax. Shareholders do not pay tax on corporate earnings until they are distributed in the form of dividends. FORMING A CORPORATION The initial step in the formation of a corporation is to file an application with the provincial or federal authorities. The federal government and the majority of provinces file articles of incorporation to incorporate a company. Costs incurred in the formation of a corporation are called organization costs. Most companies expense these costs in the year they occur, since determining the amount and timing of any future benefits is very difficult. OWNERSHIP RIGHTS Shares of a company are divided into different classes, such as Class A, Class B, and so on. The different classes are often identified by the generic terms common shares and preferred shares. When a corporation has only one class of shares, it has the rights and privileges of common shares. Each common share gives the shareholder the following ownership rights: Each share entitles the owner to one vote in the election of the board of directors and in corporate actions that require shareholder approval. Through the receipt of dividends, a shareholder receives corporate earnings. In many companies and jurisdictions, common shareholders are granted the right (preemptive right) to purchase any additional shares in proportion to their present holdings. Common shareholders have a claim (residual claim) on corporate assets in proportion to their holdings if the corporation is terminated. A share certificate proves that a shareholder owns shares. SHARES ISSUE CONSIDERATIONS Authorized share capital. The amount of shares that a corporation is authorized to sell is indicated in its articles of incorporation. Most companies have an unlimited number of authorized shares. The authorization of share capital does not result in an accounting entry, since it has no immediate effect on any ledger accounts. Issuance of shares. A corporation has the choice of issuing common shares directly to investors or indirectly through an investment dealer (brokerage house). A first-time issue is known as an initial public offering (IPO). The company’s assets and equity increases. Once issued, shares trade on the secondary market. Investors buy and sell from each other, so there is no impact on the company’s ledger accounts. The only change in the company records is the name of the shareholder. In Canada, shares trade using organized securities exchanges, like the Toronto Stock Exchange, or using the “over-the-counter” market, the Canadian Dealing Network. Market value of shares. The market price per share is established by the interaction between buyers and sellers. Generally, the price follows earnings trends, but there are many other factors that can influence share prices. Par, no par, and stated value shares. A par value share is share capital that has been assigned a specific value in the corporate charter. The par value represents the legal capital per share that must be kept in the business for the protection of the creditors. Par value shares are only permitted in some provinces. A no par value share is share capital that has not been assigned a value in the corporate charter. The entire proceeds received become the legal capital. CORPORATE CAPITAL Owner’s equity in a corporation is identified as shareholders’ equity. The shareholders’ equity section of a corporation’s balance sheet consists of: Contributed capital. Contributed capital is the total amount of cash and other assets paid in to the corporation by shareholders in exchange for share capital. When a corporation has only one class (e.g., Class A) of share capital, it is identified as common shares. Retained earnings. Retained earnings are the cumulative net income (loss) that has been retained (not distributed to shareholders) in a corporation. Retained earnings are distributed to shareholders through dividends. Net income is recorded in Retained Earnings by closing revenue and expense accounts to Retained Earnings. The Dividends account is also closed to Retained Earnings. ACCOUNTING FOR COMMON SHARES ISSUES The primary objectives in accounting for the issue of common shares are to: Identify the specific sources of contributed capital. Maintain the distinction between contributed capital and retained earnings. For par value shares, the par value of the shares is credited to Common Shares and the portion of the proceeds that is above par value is recorded in a separate contributed capital account called Contributed Capital in Excess of Par Value. When no par value common shares are issued, the entire proceeds from the issue become legal capital and are credited to Common Shares. When shares are issued for services (compensation to lawyers, consultants) or for noncash assets (land, buildings, and equipment), the cost is the fair market value of the consideration given up, if it is clearly determinable. Companies may purchase their own shares on the open market. They may be trying to: (a) to increase the level of trading activity, (b) reduce the number of shares issued, (c) have additional shares available to reissue to employees, (d) have additional shares available for use in the acquisition of other companies, (e) comply with percentage share ownership requirements, or (f) eliminate a hostile shareholder. Usually, reacquired shares must be retired and cancelled. In some provinces, however, they can be held in the treasury for later reissue. Usually, outstanding shares (shares held outside the company) equals issued shares. If treasury shares exist, issued shares less treasury shares equals the number of outstanding shares. PREFERRED SHARES A corporation may issue preferred shares in addition to common shares to appeal to a different segment of potential investors. Preferred shares have contractual provisions that give them priority over common shares in certain areas. Typically, they do not have voting rights, but preferred shareholders have a priority as to (1) dividends and (2) assets in the event of liquidation. Journal entries for issuance of preferred shares are the same as for common shares. Dividend Preference. First claim for dividends does not guarantee the payment of dividends. Dividends depend on factors such as adequate retained earnings and available cash. The per share dividend amount is usually given as an annual amount. It will be stated either as a specified dollar amount or as a percentage of the stated (or par) value of the preferred shares. Preferred shares usually contain a cumulative dividend feature. Both current year dividends and any unpaid prior year dividends must be paid to preferred shareholders before common shareholders receive any dividends. Preferred dividends not declared in a given period are called dividends in arrears. Dividends in arrears are not considered a liability but they should be disclosed in the notes to the financial statements. Convertible preferred shares give shareholders the option of exchanging preferred shares for common shares at a specified ratio. Convertible preferred shares have the greater security of preferred shares along with the potential for large gains if the common share price rises dramatically. To record a conversion, the original amount paid for the preferred shares is transferred to the appropriate common share accounts. The conversion does not result in a gain or loss to the corporation. Redeemable (callable) preferred shares give the issuing corporation the right to purchase the shares from shareholders at specified future dates and prices. Retractable preferred shares grants the shareholder the right to sell the shares to the corporation at specified future dates and prices. Redeemable and retractable preferred shares are similar to debt in some ways. As a result, they are often shown in the liabilities section of the balance sheet, rather then in the equity section. Most preferred shares have a preference on corporate assets if the corporation fails. The preference may be for the legal capital of the shares or for a specified liquidating value. SHAREHOLDERS’ EQUITY PRESENTATION AND DISCLOSURE In the shareholders’ equity section, contributed capital and retained earnings are reported. Within contributed capital, two classifications are recognized: 1. Share capital consists of preferred and common shares. Preferred shares are shown before common shares because of their additional rights. The features (e.g., cumulative, etc.), par value, shares authorized, and shares issued are reported for each class of shares. 2. Additional contributed capital includes the excess of amounts paid in over stated (or par) value. If the shares are no par value, this category will not exist, and it is usual to use the caption “share capital” instead of “contributed capital” in this case. TEXTBOOK ILLUSTRATIONS CORPORATION MANAGEMENT p. 650 “Accounting in Action” GOVERNMENT REGULATIONS p. 651 “Accounting in Action” FORMING A CORPORATION p. 652 “International Note” OWNERSHIP RIGHTS p. 653 “Illustration 14-3” p. 654 “International Note” CORPORATE CAPITAL p. 667 “Illustration 14-9” PREFERRED SHARES p. 663 “Accounting in Action” JOURNAL ENTRIES