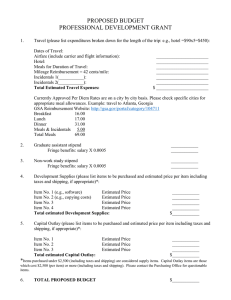

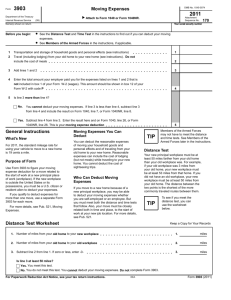

Form 2106:

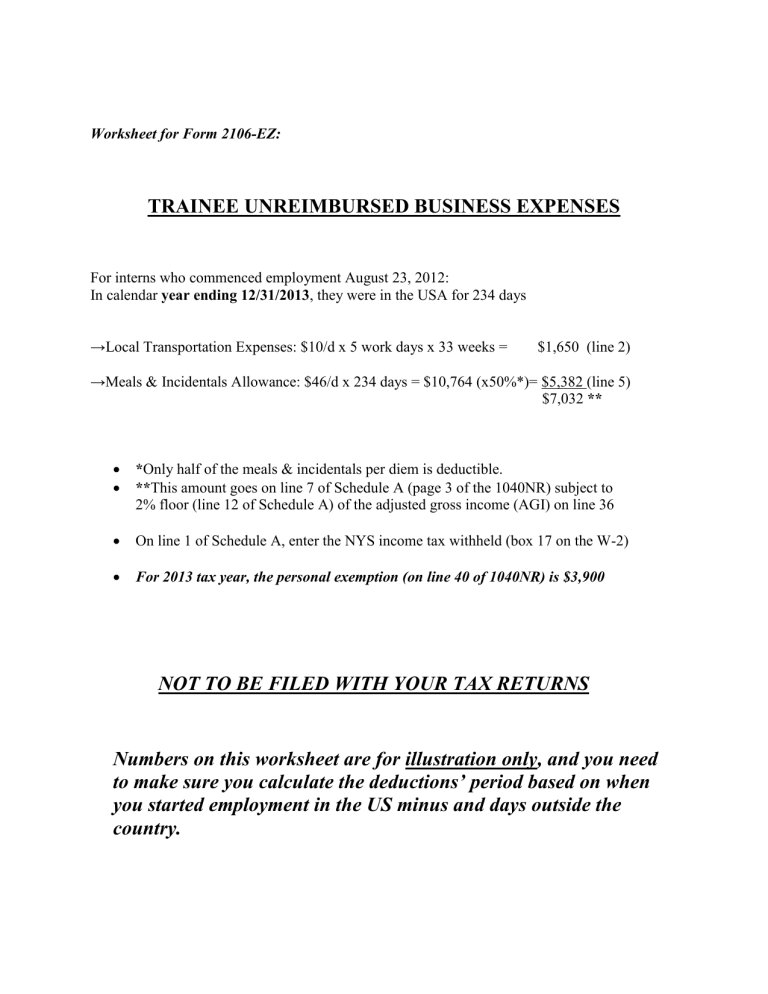

Worksheet for Form 2106-EZ:

TRAINEE UNREIMBURSED BUSINESS EXPENSES

For interns who commenced employment August 23, 2012:

In calendar year ending 12/31/2013 , they were in the USA for 234 days

→Local Transportation Expenses: $10/d x 5 work days x 33 weeks = $1,650 (line 2)

→Meals & Incidentals Allowance: $46/d x 234 days = $10,764 (x50%*)= $5,382 (line 5)

$7,032 **

* Only half of the meals & incidentals per diem is deductible.

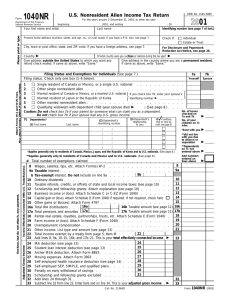

** This amount goes on line 7 of Schedule A (page 3 of the 1040NR) subject to

2% floor (line 12 of Schedule A) of the adjusted gross income (AGI) on line 36

On line 1 of Schedule A, enter the NYS income tax withheld (box 17 on the W-2)

For 2013 tax year, the personal exemption (on line 40 of 1040NR) is $3,900

NOT TO BE FILED WITH YOUR TAX RETURNS

Numbers on this worksheet are for illustration only, and you need to make sure you calculate the deductions’ period based on when you started employment in the US minus and days outside the country.