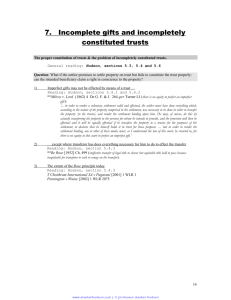

ARTICLE - Sorensen & Edwards, PS

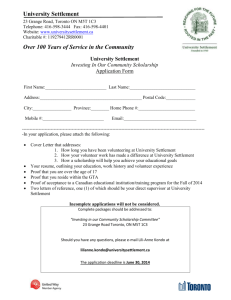

advertisement