Cardholder User Guide - E-Pay electronic expense reporting

advertisement

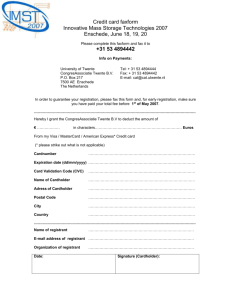

Xerox Corporation Cardholder User Guide (9/25/2006) Version 1.0 Cardholder Guide | 1 Table of Contents Section 1.0 Cardholder User Guide Introduction 1.1 Purpose of the Guide .......................................................................................................... 4 1.2 Program Vision .................................................................................................................... 4 1.3 General Information ............................................................................................................ 4 1.4 Key Contacts and Responsibilities ...................................................................................... 5 Section 2.0 Purchasing Card Overview 2.1 Program Overview .............................................................................................................. 6 2.2 Purchasing Card Benefits ................................................................................................... 7 2.3 How a Purchasing Card differs from Corporate or Consumer Cards ................................................................................................................. 7 Section 3.0 Program Management 3.1 Obtaining a Card ................................................................................................................. 8 3.2 Card Activation .................................................................................................................... 8 3.3 Cardholder Terms and Conditions ...................................................................................... 8 3.4 When and When Not to Use the Purchasing Card ........................................................... 10 3.5 Restrictions on Types of Purchases ................................................................................. 10 3.6 Suppliers ........................................................................................................................... 11 3.7 Authorizations Procedures ................................................................................................ 11 3.8 Transaction Dollar Limits/Monthly Spending Limits .......................................................... 13 3.9 Purchasing Card Expense Accounting ............................................................................. 13 3.10 Sales and Use Tax ............................................................................................................ 13 3.11 Receipts/Documentation ................................................................................................... 14 3.12 Bill Payment ...................................................................................................................... 14 3.13 Settlement ......................................................................................................................... 14 3.14 Memo statements.............................................................................................................. 14 3.15 Reconciliation Procedures ................................................................................................ 14 3.16 Receipts/Documentation Filing Procedures ...................................................................... 15 3.17 Supplier Dispute Procedures ............................................................................................ 15 3.18 Return and Exchange Procedures for Purchases ............................................................ 15 Cardholder Guide | 2 Table of Contents Section 4.0 Cardholder User Guide Account Maintenance 4.1 Address, Name or Account Coding Changes ................................................................... 17 4.2 Lost or Stolen Cards ......................................................................................................... 17 4.3 Card Renewal ................................................................................................................... 17 4.4 Employee Termination and Card Cancellation ................................................................. 17 4.5 Exceptions ......................................................................................................................... 18 4.6 Duplicate Statement Requests ......................................................................................... 18 4.7 We Welcome Your Input ................................................................................................... 18 Appendices A. Cardholder Application ...................................................................................................... 19 B. Employee Acknowledgement of Responsibilities ............................................................. 20 Cardholder Guide | 3 Section 1.0 Introduction Section 1.1 Cardholder User Guide Purpose of the Guide The user guide is designed to provide the information you need to participate in the Xerox Corporation Purchasing Card Program. The guide provides the policies and procedures under which the cardholders may utilize their purchasing cards. Section 1.2 Program Vision The Xerox Corporation Purchasing Card Program is designed to offer a low cost and more efficient alternative for the purchase of low value goods and services. The purchasing card focuses on purchases $3,000 or less. The card is designed to eliminate the purchase order and invoice processing associated with these transactions. Section 1.3 General Information The Xerox Purchasing Card Program is not intended to avoid or bypass appropriate procurement procedures, but is to be used in accordance with the guidelines established within Xerox to complement existing procurement and payment procedures. Please treat this program with the same sense of responsibility and security you would use with your own personal credit cards. By signing the Citibank Cardholder Application (Appendix A – Xerox Version) and Employee Acknowledgment of Responsibilities Form (Appendix B – Xerox Version) the employee indicates that he/she understands the intent of the program and agrees to adhere to the guidelines established for the program. Cardholders will receive their Xerox Corporation Purchasing Card approximately 10 business days after signing and submitting the Cardholder Application and Employee Acknowledgment of Responsibilities. The cardholder may begin using the card immediately after receipt and activation. Participation in Xerox Corporation’s purchasing program does not affect personal credit ratings. Accurate record keeping is essential to ensure the success of this program. This is not an extraordinary requirement--standard reimbursement policies require retention of receipts, etc. As with any credit/charge card, common sense suggests the retention of receipts for your protection. As with any new process, it is difficult to anticipate every question or issue regarding the program. Therefore, your suggestions for any improvements or changes to the program are welcome. Please keep the Purchasing Card Program Administrator informed. Finally, remember you are committing company funds each time you use the Xerox Procurement Card. This is a responsibility that must be taken seriously. Cardholder Guide | 4 Section 1.0 Introduction Section 1.4 Cardholder User Guide Key Contacts and Responsibilities Xerox Corporation has established a relationship with Citibank to provide and support the Xerox Corporation Purchasing Card Program. Along with Citibank, the program relies on key contacts within the Xerox Corporation organization to ensure its success. These include: Xerox Corporation Cardholder: Uses the purchasing card in accordance with the policies and procedures defined for the program Verifies transactions made using the purchasing card are properly posted on their monthly memo statement Maintains the security of the purchasing card Contacts Citibank Customer Service if their card is lost or stolen Cardholder Manager: Identifies who is authorized to receive and use the purchasing card Ensures that cardholders are using the purchasing card in accordance with corporate policy and within the program guidelines Reviews and approves cardholder statement of monthly purchases Business Unit Coordinator: Responsible for business unit coordination of the Purchasing Card Program Serves as the local resource to clarify program policies and guidelines Serves as local contact to Citibank and Program Administrator Accounts Payable: Responsible for payment of monthly consolidated invoice Posts expenses to the appropriate General Ledger account Ensures that each cardholder group submits support documentation (receipts) for monthly purchases. Conducts post-payment audits on supporting documentation submitted by cardholders to monitor card usage within the program guidelines. Global Purchasing Reviews supplier lists and monitors supplier acceptance Manages MCC code list, and reviews any requests to unblock codes, whether permanently or on a one time basis. Purchasing Card Program Administrator: Responsible for the overall management and coordination of the program Serves as the centralized contact for Citibank and Xerox Corporation functional areas involved with the administration of the program Citibank Customer Service: (800) 248- 4553 U.S. (888) 834 - 2484 Canada (Bi-Lingual) Provides 24-hour service for cardholder inquiries Cardholder Guide | 5 Section 2.0 Purchasing Card Overview Section 2.1 Cardholder User Guide Program Overview The Xerox Corporation Purchasing Card is primarily designed for the purchase of goods and services $3,000 or less. Below is an overview of the general process and procedures for the use of the Xerox Corporation Purchasing Card: 1. Xerox Corporation is responsible for payment of authorized purchases made under the Purchasing Card Program. However, each cardholder is accountable for purchases made and proper use of the card in accordance with outlined procedures. 2. Purchasing cards are issued by Citibank. Citibank will issue cards, send memo statements to cardholders and reports to managers and other levels within the organizational structure and deliver billing statements to accounts payable. 3. A number of flexible card controls are available under the program. These controls ensure that the card cannot be used for certain types of purchases. ATM/cash advances and travel and entertainment related expenses are blocked. Other card controls such as monthly credit limits and single transaction dollar limits have been established for each account. If a cardholder needs to make purchases outside the established controls, please see your Program Administrator for an exception request. 4. In the U.S. each cardholder will be required to fax receipts (over $100) to verify sales taxes paid for sales tax audit purposes. In Canada, each cardholder will be required to fax all receipts, regardless of dollar amount for tax audit purposes. 5. Monthly Statements will be mailed directly to each cardholder by Citibank. It will be the responsibility of each cardholder to verify the accuracy of charges made and to ensure any exception accounting entries are processed in the Pcard Expense Reporting System located in the EPay website.. 6. Store all relevant documentation in a secure area. Company retention policy is 10 years. Cardholder Guide | 6 Section 2.0 Purchasing Card Overview Section 2.2 Cardholder User Guide Purchasing Card Benefits By taking full advantage of Xerox Corporation’s Purchasing Card Program, significant benefits will be shared by you, Xerox Corporation, and Xerox Corporation’s suppliers. Some of these benefits include the following: For the cardholder: Simplifies the purchasing process Fosters trust and empowers employees Shortens the cycle time for delivery of goods and services Eliminates the need for personal funds outlay For Xerox Corporation: Reduces the volume of manual and automated purchase order transactions Simplifies the authorization process Reduces the need for small dollar checks Reduces excess paper and storage Reduces supplier file set-ups and maintenance volumes For Purchasing: Enables procurement personnel to focus more on strategic sourcing, vendor relationships and process management. Significantly reduces the number of low-dollar purchase requisitions, purchase orders, and the associated supplier database administration For the supplier: Ensures payment within 48 hours Reduces the need for accounts receivable management Reduces cost of generating invoices Fosters supplier and client alliances Section 2.3 How a Purchasing Card Differs From Corporate or Consumer Cards The Xerox Corporation Purchasing Card differs from both corporate or consumer credit cards in a number of ways. Specifically, the purchasing card allows Xerox Corporation to set usage parameters, obtain enhanced control and receive management information reports for all purchase activity on behalf of the company. These include: $3,000 single transaction dollar limits $15,000 U.S. and $6650 Canadian billing cycle limits for total monthly spending (These limits will be reset at the beginning of each cycle) Supplier category restrictions. All merchants are assigned a Merchant Category Code (MCC) classification based on their type of business. The Xerox P-Card is encoded to block certain merchants based on this MCC Classification. Cardholder Guide | 7 Section 3.0 Program Management Section 3.1 Cardholder User Guide Obtaining a Card To request a Xerox Corporation Purchasing Card, a Citibank Cardholder Application and Employee Acknowledgement of Responsibilities Form (Appendix B – Xerox Form) must be completed by the Xerox employee (no contractors will be eligible for a card). Important items to consider when completing the cardholder application are: The employee and cardholder manager should sign and date the Citibank Cardholder Application. The cardholder manager signature authorizes the account to be established. All completed and signed cardholder applications should be forwarded to the Purchasing Card Program Administrator for processing. Citibank will not set up accounts without the proper authorizations. Employees should notify the Purchasing Card Program Administrator if the new card is not received within 10 business days. For Canadian Employees only – your data will be stored and processed in whole or in part in the United States. If you proceed to fill out the Citibank Purchasing Card application, your data will be transferred out of Canada to the United States. Your information will be treated as confidential information and with the understanding that it may be used for any purposes necessary to process this application. Information provided on this application may be available to the United States Government or its agencies under U.S. law. Section 3.2 Card Activation The Xerox Corporation Purchasing Card is intended for use by Xerox Corporation employees who have business procurement authority. The purchasing card is issued in the name of the authorized employee who must sign the back of the card as soon as it is received. The purchasing card may only be used by the employee identified on the card. For security reasons the purchasing card is issued inactive. Affixed on the card will be a label with card activation procedures. Only the employee whose name appears on the card is authorized to activate it. In order to activate the card, the employee will need to provide their Employee Number and Date of Hire (Month/Year). Section 3.3 Cardholder Terms and Conditions By activating and signing the purchasing card, the employee agrees to participate in the Xerox Corporation Purchasing Card Program and assumes responsibility in accordance with program guidelines. Failure to abide by these terms may be viewed as grounds for disciplinary action to and including dismissal. These responsibilities include but are not limited to the following: Cardholder Guide | 8 Section 3.0 Program Management Cardholder User Guide Xerox Corporation’s Purchasing Card is to be used for business expenditures only. The purchasing card may only be used within the policies and procedures outlined in the Purchasing Card User Guide. Xerox Corporation’s Purchasing Card may not be used for personal or business travel and entertainment purposes. The purchasing card will be issued in the name of the employee. By accepting the card, the employee assumes responsibility for the card and will be accountable for review and approval for all charges made with the card. The card is not transferable and may not be used by anyone other than the cardholder. Xerox Corporation’s Purchasing Card must be maintained with the highest level of security. If the card is lost or stolen, or if the cardholder suspects the card or account number has been compromised, the cardholder agree to immediately notify Citibank Customer Service and his/her manager and the Program Administrator. Under no circumstances is a cardholder to give their card or their card number to another employee for them to make a purchase. All charges will be billed and paid directly by Xerox Corporation. Therefore, the cardholder’s credit rating is not affected by participating in the Xerox Corporation Purchasing Card Program. On a monthly basis, the cardholder will receive a statement listing all activity associated with the card. This activity will include purchases and credits made during the reporting period. While the cardholder will not be responsible for making payments, the cardholder will be responsible for the verification and reconciliation of all account activity. Cardholder accounts may be subject to periodic internal control reviews and audits designed to protect the interests of Xerox Corporation. By accepting the card, the cardholder agrees to comply with these reviews and audits. The cardholder may be asked to produce the card to validate its existence and produce statements and receipts to verify appropriate use. Policies and procedures related to the Purchasing Card Program may be updated or changed at any time. Xerox Corporation will promptly notify all cardholders of these changes. The cardholder agrees to and will be responsible for the execution of any program changes. The cardholder agrees to surrender and cease use of his/her card upon termination of employment whether for retirement, voluntary separation, resignation or dismissal. In addition, the cardholder must surrender and cease use of card in the event of transfer or relocation. The cardholder may also be asked to surrender the card at any time deemed necessary by Xerox Corporation management. Misuse or fraudulent use of the card may result in disciplinary action and may be grounds for dismissal. In a case where an employee misuses a card, the employee will be responsible to repay the company for the amount of unapproved charges. These funds will be recovered by the company through a deduction from the cardholder’s paycheck. Suppliers are paid within 48 hours of the business transaction. Cardholder Guide | 9 Section 3.0 Program Management Section 3.4 Cardholder User Guide When and When Not to Use the Purchasing Card The purchasing card will be used to buy business related goods and services that typically cost $3,000 or less that are within the guidelines of Xerox Corporation’s Purchasing Card Program. The purchasing card may be used for (list not all inclusive): Transactions within allowable limits Miscellaneous goods and services not available through defined Global Purchasing solutions or online catalogs Miscellaneous repair, replacement and spare parts (production excluded) Laboratory equipment and research supplies Miscellaneous operating and/or specialty supplies Equipment rental and maintenance External business services Seminars and conference registration fees Educational subscriptions, books, CD/DVD’s, tapes, etc. Training course fees and subscriptions Postage The purchasing card may not be used for (list not all inclusive): PERSONAL USE Business travel and entertainment (airfare, hotels, etc.) — use AMEX Cash Advances Any item exceeding $3,000 in value — use iProcurement Capital items charged to CLAR capital projects Production materials (cost of goods) Any items available through designated Global Purchasing programs — e.g., Contract Labor solutions, iProcurement on-line catalogs Educational reimbursement & relocation expenses Employee reward and recognition gifts of any value Cellular personal expense —use T&E expense reporting process Computer software and licenses (Internal use) Daytime planners — Covey, Day Runner, etc. Handheld computers — Palm, Handsprings, etc Unincorporated service providers (1099 suppliers) Any merchant, product, or service normally considered to be inappropriate use of company funds Misuse of the purchasing card may be grounds for disciplinary action up to and including dismissal. If you have questions regarding the appropriate use of the purchasing card, contact Purchasing Card Program Administrator. Section 3.5 Restrictions on Types of Purchases Certain types of suppliers (e.g. traditional T&E categories) are excluded from the Purchasing Card Program. These categories of suppliers have been “blocked” based on merchant category codes (MCC). Any attempt to use the card at these suppliers will be declined. Restricted supplier types include, but are not limited to airline transportation, cash advanced, hotels, restaurants and car rental companies. Cardholder Guide | 10 Section 3.0 Program Management Section 3.5 Cardholder User Guide Restrictions on Types of Purchases (cont.) These restrictions have been implemented to support the guidelines of the Purchasing Card Program and to protect the interests of Xerox Corporation and its cardholders. Restricted Supplier types are: Cash Advances Airline transportation, hotels, restaurants and car rental companies Department, electronics, clothing and duty-free stores Antique, jewelry, furriers, pawn shops Certain business services (tax prep, financial and legal services) Community agency or government services Educational institutions (universities, colleges, schools, etc.) Financial and credit institutions Food and beverage merchants Health services (Doctors, dentists, hospitals, medical labs, etc.) Recreational merchant (bowling, golf, movie theaters, video rentals) Transportation services (automotive, limousines, motor freight, etc.) Utilities (electric, gas, water, fuel cable, etc.) Section 3.6 Suppliers These restrictions have been implemented to support the guidelines of the Purchasing Card Program and to protect the interests of Xerox Corporation and its cardholders. There are a wide variety of suppliers that currently accept credit cards. If the cardholder identifies a supplier that meets the purchasing card guidelines and is not a credit card acceptor, the cardholder should contact the Xerox Corporation Program Administrator. The Administrator will work with Global purchasing and Citi, to help get the supplier added. Section 3.7 Authorizations Procedures To make a purchase using the Xerox Corporation Purchasing Card, follow the same general procedures used for any type of credit card purchase. The purchasing card may be used at any supplier that accepts MasterCard® for payment of purchases. If a supplier does not currently accept MasterCard®, please use an alternative approved method for purchasing. The steps of a typical purchasing card transaction include the following. Please indicate to merchants the cardholder should not be invoiced. An invoice could result in a duplicate payment. Phone/Mail Order: 1. Cardholder initiates a purchase by calling the supplier and performing the following: a) Request the supplier to label packages as a purchasing card purchase and include the cardholder’s name, shipping address and mail code. Never include your credit card number on any sales receipts or shipping materials. Cardholder Guide | 11 Section 3.0 Program Management Section 3.7 Cardholder User Guide Authorizations Procedures (cont.) b) Request the supplier to include invoice transaction detail including purchase price, sales tax and packing specifics. 2. The supplier will process the purchase by noting the account number and expiration date of the purchasing card. Some suppliers have the capability of capturing sales tax and a 16-digit customer defined code. 3. Confirm the price, sales tax (if applicable) and any other charges. The supplier will request authorization for all purchases via the Citibank MasterCard® system. An authorization number will be given to the supplier as long as the purchase is within the controls and spending limits established for your card. Otherwise, the authorization request will be declined. 4. MasterCard® regulations require that requested merchandise be shipped before a credit card charge can be processed. Confirm the anticipated delivery date with the supplier. 5. If the purchase is outside the card limits, the charge is declined. If you encounter any problems, please contact your Purchasing Card Program Administrator. At Point of Sale: 1. Cardholder initiates a purchase by visiting the supplier and providing the supplier with card for payment. 2. The supplier will either “swipe” the card through their terminal or make an imprint of the card. Some suppliers have the capability of capturing sales tax information and a 16-digit defined code. 3. Confirm the price, sales tax (if applicable) and any other charges. The supplier will request authorization for all purchases via the Citibank MasterCard® system. An authorization number will be given to the supplier as long as the purchase is within the controls and spending limits established for your card. Otherwise, the authorization request will be declined. 4. The cardholder will sign the credit card receipt and request a receipt that includes the purchase price and sales tax. 5. MasterCard® regulations require that requested merchandise be shipped/provided before a card charge can be processed. 6. If the purchase is outside the card limits, the charge is declined. If you encounter any issues, please contact the Purchasing Card Program Administrator. Cardholder Guide | 12 Section 3.0 Program Management Section 3.8 Cardholder User Guide Transaction Dollar Limits/Monthly Spend Limits Each Xerox Corporation Purchasing Card will be assigned a single dollar transaction limit of $3,000. Any purchase attempted with a total sales price exceeding the limit will be declined by Citibank’s authorization system. In addition, each account will have a total monthly spending limit of $15,000 for U.S. and $6650 for Canada. As purchases are made using the purchasing card, transactions are posted against the monthly spending limit as part of the authorization process. Once the sum of all purchases (net of credit adjustments) exceeds the monthly spending limit, any incremental purchases will be declined. The spending limits are determined by the department and appear on the cardholder application. Please not that the manager who signs the application must have approval authority that meets or exceeds the single transaction spend limit that is being requested. Section 3.9 Purchasing Card Expense Accounting Along with the streamlined processing that the Xerox Corporation Purchasing Card Program offers, the accounting for purchases made with the card may also be simplified as each supplier MCC code will be mapped directly to a GL account code on a one to one basis. Section 3.10 Sales and Use Tax In order for taxes to be tracked properly, U.S. cardholders will be required to submit receipts for any purchases of $100 or more. Canadian cardholders are required to submit all applicable receipts. If a particular business group mandates a lower receipt submission threshold for their cardholders, that threshold will take precedence over the stated limit. However, a business unit may not elect to raise their receipt threshold above $100. Cardholder Guide | 13 Section 3.0 Program Management Section 3.11 Cardholder User Guide Receipts/Documentation In the U.S. all purchases over $100 and in Canada all purchases regardless of dollar value that are made using the purchasing card should be supported by store receipts, MasterCard® charge slips, shipping detail, etc. The documentation MUST be maintained and stored for reconciliation, auditing and tax purposes. In addition, these documents will be necessary to resolve billing and shipping disputes. Typically, a store receipt and MasterCard® charge slip are provided to the cardholder at the point of sale. With phone, mail order, or online purchases, employees should request the supplier to: Clearly mark packages as purchasing card transactions Label packages with the cardholder’s name and shipping address Attach invoice transaction detail including purchase price, sales tax and packing specifics Supply an online purchase slip Section 3.12 Bill Payment On a monthly basis, accounts payable will receive a central invoice from Citibank that consolidates all spending activity for Xerox Corporation cardholders during the billing period. The invoice will provide individual transaction detail segregated by cardholder name and account number. Accounts payable is responsible for making payments to Citibank. Individual cardholders will not be responsible for paying the Citibank bill. However, individual cardholders are responsible for reconciling their accounts. Participation in the Purchasing Card Program does not affect the credit rating of a cardholder. Section 3.13 Settlement Settlement of payment to Citigroup is not a prerequisite for cycle spend limits to be reset. At the beginning of each new cycle, full corporate spend will be available to all cardholders. Any issues regarding credit availability should be directed to the Purchasing Card Program Administrator. Section 3.14 Memo statements Each month, Citibank will deliver to the cardholder a document referred to as the cardholder memo statement. The cardholder memo statement includes a listing of purchases made and credits received during the monthly cycle. The memo statement is a reference document and not a bill. The cardholder is responsible for verifying all activity listed on the memo statement is accurate. Section 3.15 Reconciliation / Approvals Procedures All cardholders are required to log into the Pcard Expense Reporting system using their S3 log on to review and approve their Pcard purchases. Please refer to training documentation in the EPay website for Pcard Expense Reporting. The cardholder is required to reconcile the cardholder memo statement for accuracy and verification of goods and services purchased with transactions reviewed/approved in the Pcard Expense Reporting System located on the EPay website. The cardholder may need to refer to previous orders to reconcile credits that may have been posted on the current memo statement. Cardholder Guide | 14 Section 3.0 Program Management Section 3.15 Cardholder User Guide Reconciliation Procedures (cont). Cardholder reconciliation procedures include: Review all transactions listed on the memo statement using the Pcard Expense Reporting System. Fax appropriate receipts to (703) 554-8376 Attach all sales receipts and other documentation to the memo statement as support for each transaction Identify and highlight all discrepancies on the memo statement Contact supplier directly to resolve discrepancies Section 3.16 Receipts/Documentation Filing Procedures After the transactions have been reviewed and approved by the cardholder and their manager, and the receipts have been faxed to the appropriate number, the documentation package should be stored in a secure area. Section 3.17 Supplier Dispute Procedures While reviewing the memo statement, the cardholder may identify purchases that were billed but were not received or ordered. It is the responsibility of the cardholder to resolve any discrepancies on the memo statement. The cardholder should first contact the supplier directly to notify him/her of the dispute. If the supplier agrees that an error has been made, the supplier will credit the cardholder’s account. This should be noted to ensure the appropriate credit is received on the next memo statement. If the cardholder is unable to resolve the dispute with the supplier, the cardholder should contact Citibank Customer Service at (800) 248-4553 in the U.S. and (888) 834–2484 (Bi-Lingual) in Canada to report the dispute. A dispute form will be provided to the cardholder that must be filled out and returned to Citibank. All disputes must be submitted to Citibank within 60 days of the memo statement date. Citibank Customer Service will resolve the dispute within the next 90 days. Any item in dispute will be placed in suspense on the cardholder’s memo statement by Citibank Customer Service. Any item in suspense is not subject to any finance charges and is excluded from the total payment due amount until the dispute is resolved. *If a cardholder suspects fraudulent activity on their card, then they should contact Citibank immediately. Section 3.18 Return and Exchange Procedures for Purchases The cardholder must ensure that any debits or credits expected as the result of returned or exchanged goods are accurately reflected on the memo statement. The cardholder should follow the procedures outlined below: Contact supplier to confirm instructions for returned merchandise Record and attach all relevant documentation with the memo statement Cardholder Guide | 15 Section 3.0 Account Maintenance Section 3.18 Cardholder User Guide Return and Exchange Procedures for Purchases (cont.) Review monthly memo statements to ensure that expected adjustments are accurately reflected Note: A cardholder may have to pay restocking charges on returned goods. Cardholder Guide | 16 Section 4.0 Account Maintenance Section 4.1 Cardholder User Guide Address, Name or Account Coding Changes To initiate a change, the cardholder must: Complete a Cardholder Application for the appropriate changes with management approval. Forward the approved changes (with proper signatures) to corporatepurchasingcard@xerox.com Purchasing Card Program Administrator will contact Citibank on behalf of the cardholder to process the change Section 4.2 Lost or Stolen Cards In the event of a lost, stolen or compromised card, the cardholder must immediately contact Citibank Customer Service at (800) 248-4553 in the U.S. and (888) 834 – 2484 (Bi-Lingual) in Canada. The cardholder’s account will immediately be closed and a replacement card will be delivered within 7 business days. In addition to contacting Citibank Customer Service, the cardholder is responsible for notifying his/her cardholder manager and the Purchasing Card Program Administrator. Failure to promptly notify Citibank of lost, stolen or compromised purchasing cards may result in inappropriate charges to the department. Section 4.3 Card Renewal The purchasing card has a usage life of two years. Prior to card expiration, the cardholder will be issued a new card to ensure uninterrupted service. Section 4.4 Employee Termination and Card Cancellation Upon cardholder termination of employment or move to a position that no longer requires a purchasing card, the cardholder’s manager must: Collect the Purchasing Card from the cardholder and destroy it Notify the Purchasing Card Program Administrator of the termination, and they will process the card cancellation with Citigroup. Cardholder Guide | 17 Section 4.0 Account Maintenance Section 4.5 Cardholder User Guide Exceptions If a monthly spending limit or single transaction limit adjustment is needed, the cardholder manager must: Review the spending limit adjustment request with the Purchasing Card Program Administrator Have the cardholder complete a new Citibank Cardholder Application Please not that the manager who signs the application must have approval authority that meets or exceeds the single transaction spend limit that is being requested. If an MCC code needs to be unblocked for a one time either temporarily or permanently, the cardholder manager must: Present the reason for the exception to the Program Administrator in writing. The Purchasing Card Program Administrator will contact Citibank Customer Service on behalf of the individual cardholder. The cardholder or cardholder manager should NOT contact Citibank Customer Service directly for any adjustment requests as this requires signature verification. Section 4.6 Duplicate Statement Request To obtain a duplicate of a statement or a copy of the actual record of charge, the cardholder can call Citibank Customer Service at (800) 248-4553, 24 hours a day, 7 days a week. Section 4.7 We Welcome Your Input Any comments or suggestions regarding the Xerox Corporation Purchasing Card Program are welcomed and should be forwarded to the attention of: James Reitz 1350 Jefferson Rd. Mail stop: 0801-55A Rochester, NY 14623 Ph: (585) 427-3003 E-Mail: James.Reitz@Xerox.com Cardholder Guide | 18 XEROX CORPORATION PURCHASING CARD APPLICATION SECTION I INSTRUCTIONS Pre-Requisite: 1. S3 Logon Access is required to utilize the PCard system. To Add New Account: 1. Select New Account request 2. Complete all fields on form To change information for existing accounts: 1. Complete Section II with the type(s) of request. Complete only the applicable fields on the form that need to be updated. 2. Fill in the last six digits of the individual Purchasing Card number. __________________________________________________________ 3. Fill in card member’s name as it appears on their Purchasing Card. ________________________________________________________ Please send completed form to Program Administrator via: corporatepurchasingcard@xerox.com *For all new requests, please attach a signed copy of the P-Card Employee Agreement. Note: The address entered onto the form will be where the card and statements are to be mailed. TYPE OF REQUEST (“X” all applicable) SECTION II ___ a. New Account _____ Card_____ No Card ___ e. Transaction Limit Adjustment ___ b. Address/Telephone Change ___ c. Name Change ___ d. Re-Open Account SECTION III CARDHOLDER INFORMATION _____________________________________________________________________________________ (______)______________________ First Name of Cardholder Middle Initial Last Name (max. 25 char) Business Phone Xerox Corporation _________________________________________________________________________________________________________________ 4th Line Embossing (max. 24 char) Date of Hire (mm/yyyy) Employee Number ___________________________________________________________________________________________________________________ Mailing Address (max. 36 char) Mail Stop ___________________________________________________________________________________________________________________ City State Zip Code SECTION VI TRANSACTION LIMITS Monthly Limit $ _15,000.00____________ Single Dollar Transaction Limit $ _3,000.00_____________ Monthly Limit $ _____________ Single Dollar Transaction Limit $ ______________ EXCEPTION LIMITS *Any adjustments or exceptions to these limits should be provided to the program administrator by the manager of the cardholder. *Signing manager’s approval authority must meet or exceed the single transaction limit being requested. SECTION VII I, the cardholder, acknowledge that upon use of my card, I agree to abide by the procedures established in the Xerox Purchasing Card Employee Agreement. I understand that it is my responsibility to notify Citibank at 1-800-248-4553 immediately if my card is lost or stolen. Cardholder Signature ______________________________________________________________________________ Date: ____________ Manager Signature ________________________________________________________________________________ Date: ____________ Comments: _________________________________________________________________________________________________________ SECTION IV ADMIN USE ONLY Organization: _______________________________________________________________________________________________________ MCC Template: _____________________________________________________________________________________________________ Reporting Hierarchy: _________________________________________________________________________________________________ Cardholder Guide | 19 Xerox Purchasing Card Employee Agreement The Xerox Purchasing Card Program is intended to allow authorized employees to make business related purchases utilizing the Citibank MasterCard Purchasing Card. Your acknowledgement and signature below is verification that you have read the purchasing card training documents and that you understand, agree with and will adhere to the policies and procedures that govern the Purchasing Card Program and the statements outlined below. 1. I understand that the purchasing card is for Xerox approved purchases only, and I agree not to make personal purchases. 2. Improper use of this purchasing card will be considered misappropriation of Xerox funds. This will result in disciplinary action, up to and including termination. 3. If the purchasing card is lost or stolen, I will immediately notify Citibank by telephone. I will confirm the telephone call by e-mail or fax along with a copy of the notification to the Xerox Purchasing Card Administrator. 4. I agree to surrender the purchasing card immediately upon termination of employment, whether for retirement, voluntary or involuntary reasons. 5. All charges will be billed to and paid directly by Xerox. The bank cannot accept any monies from me directly; therefore, any personal charges billed to the Company will be considered misappropriation of Xerox funds and could result in disciplinary action, up to and including termination. 6. Any charges for personal use or other use by me in contravention of this Employee Agreement or the policies and procedures that govern the Purchasing Card Program will be recovered by Xerox through an automatic deduction from my paycheck. 7. As the purchasing card is Xerox property, I understand that I will be required to comply with internal control procedures designed to protect Company assets. This includes producing the purchasing card to validate its existence and account number. I am also responsible to review/approve all transactions and will be asked to provide receipts and statements for audit purposes. 8. I will receive a Monthly Reconciliation Statement, which will report all purchasing card activity during the statement period. Because I am responsible for verifying all charges on the purchasing card, I will resolve any discrepancies by contacting the supplier first with elevation to the bank. 9. I understand the purchasing card is assigned to me as a Xerox employee based on a need to purchase materials for the business. My purchasing card may be revoked based on change of assignment or location. I understand that the purchasing card is not an entitlement nor reflective of title or position. ______________________________________ Employee Signature ___________________________________ Approving Manager Signature _____________________________________ Employee Printed Name ___________________________________ Approving Manager Printed Name Employee Number:_____________________ Employee Number:____________________ _____________________________________ Date ___________________________________ Date Cardholder Guide | 20 Sample Cardholder Guide | 21