Table 1: Variable Definitions, Sources, and Means1

advertisement

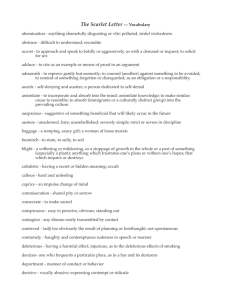

House Prices and Deed Type David M. Brasington Economics Department Louisiana State University Robert F. Sarama Jr. Economics Department Louisiana State University February 3, 2005 Abstract When houses are sold they come with a deed attached that spells out the guarantees the seller makes about the house. Sometimes the deed tells us about the circumstances surrounding the sale. Using a 37,043-observation house price hedonic with a Bayesian spatial error model, we find that the type of deed attached to a housing sale can have a dramatic correlation with the sale price. Warranty deeds are the most common type, but ten deed types command a discount and one commands a premium relative to warranty deeds. Houses with a survivorship deed sell for 1.4% more than houses with warranty deeds, all else constant. Houses with quit claim deeds sell for 51% less than warranty deeds, the largest discount we find. Houses with sheriff’s deeds sell for a 31% discount and houses with foreclosure deeds sell for a 36% discount. The discount for three of our 15 deed types varies significantly across regions. Parameter estimates seem robust to the exclusion of deed type information. Additionally, we ask whether higher mortgage rates are associated with riskier deed types, but find no relationship. Finally, we investigate whether certain deed types are found more often in poor neighborhoods. Contact information: David Brasington Economics Department Louisiana State University Baton Rouge, LA 70803 Phone: 225-578-7822 Email: dbrasin@lsu.edu JEL Classifications: G21, K11, R31 Keywords: mortgage lending, house price hedonic, spatial statistics, real estate law 1 Scores of studies have examined the determinants of house price, yet none has examined whether the type of deed attached to the house affects its sale price. The deed attached to a house sometimes contains guarantees of good title, freedom from encumbrances, and protection from heirs making competing claims against the property; other deeds make no such guarantees. The type of deed attached to a house can also impart information about the seller (Hite and ???) and other circumstances surrounding the sale. For example, a foreclosure deed suggests a lending institution took possession of the property after the borrower defaulted on the mortgage. A look at the relation between deed type and house price may be interesting for several reasons. Real estate agents care about the type of deed attached to the property if the deed type affects the sale price and their commission. Academics care about deed type if the exclusion of deed type biases the parameter estimates of environmental quality or school quality in a house price hedonic. Property tax assessors care about deed type if the use of this information yields a better prediction of the underlying structural value of the house than even the sale price does. Knowing the discount for less secure deed types can help home buyers decide whether it is worth the increased cost to look for a house with a more secure deed. Discounts and premiums for certain deed types suggest interesting stories, such as a principal-agent problem for houses sold by guardians of minors or mentally incapacitated persons. Finally, if traditional lending institutions refuse to lend for mortgages on houses with risky deed types, sub-prime lenders may fill the gap and charge higher interest rates to cover the increased risks (Pennington-Cross, 2003a, 2003b). 2 We construct a data set of 37,043 housing sales that have the deed type listed. We control for outliers, omitted variables, and heteroskedasticity using a Bayesian spatial error model (LeSage, 1997b). We find that the deed attached to a house can have a dramatic link with the sale price. The most expensive deed type in our study, a survivorship deed, commands a 52.4% premium over the price of the typical house sold with a quit claim deed. This 52.4% premium translates to an average house price difference of $76,339. Warranty deeds are the most common in our sample. We find that houses with sheriff’s deeds sell for a 31% discount, and foreclosure deeds a 36% discount, relative to houses sold with warranty deeds. In all, ten deed types command a discount and one commands a premium relative to warranty deeds. The value of most types of deeds is constant across regions, but there are three striking exceptions. We also check for an indicator of sub-prime lending by regressing the mortgage rate of the transactions on the deed types. Although our results show that there is no significant relationship between mortgage rate and deed type, further investigation of this topic with additional data may be warranted. Lastly, we look at the probability of observing certain types of deeds in poor neighborhoods. We find that survivorship deeds are more prevalent in affluent neighborhoods, while we are more likely to observe fiduciary covenants, quitclaim deeds, and sheriff’s deeds in poverty-stricken neighborhoods. Data Housing data with deed type information is fairly widely available from county auditors and real estate companies. We collect a sample of 37,043 houses that were sold 3 in Ohio in 2000 that contain information about the type of deed attached to the house at the time of sale (FARES, 2002). The houses come from five metropolitan areas: Akron, Cincinnati, Cleveland, Columbus, and Youngstown. All houses are single-family detached structures that sold for more than $30,000, to help ensure arms’ length transactions. We have information about 14 structural characteristics of the houses. These characteristics are the number of fireplaces, bedrooms, and full and partial bathrooms in the house; the number of detached structures on the lot; the age of the house; the size of the house and yard; and dummy variables for whether the house is one-story, made of brick, and has a deck, patio, garage, or finished basement. [Insert Table 1 about here] Our Estimation Approach sections will discuss additional strategies, but the traditional identification strategy in cross-sectional house price hedonic studies is to include controls for the characteristics of the neighborhood of the house (e.g., Haurin and Brasington (1996)). To this end, we match our houses to data from seven different sources. A substantial literature investigates the relation between house prices and school quality (Ross and Yinger, 1999). Brasington (1999) and Brasington and Haurin (2004) suggest that proficiency test scores are good measures of homeowners’ valuation of the quality of the public schools. The percent of students in each public school district who failed the Ohio 12th grade proficiency test is used to capture school quality (or the lack of it). The other public services in the hedonics measure police protection and environmental quality, and the tax rate is included as well. 4 Archer, Gatzlaff and Ling (1996) find that growing areas have higher house price appreciation rates, so fast-growing communities might also have higher sale prices than slower-growing communities. To this end, a variable HOT MARKET is included to capture development activity in the community. Other included community descriptors include the prevalence of single-parent households and racial heterogeneity. The focus variables are the types of deeds associated with the houses at the time of sale. Fully 15 deed types are represented in our data set. The definitions, means, and sources of all our variables are included in Table 1. Estimation Approach: OLS Models The traditional ordinary least squares (OLS) house price hedonic takes the following form: (1) ln Vi = X + , N(0,2) where V is the value of house i, X is the matrix of explanatory variables with parameters to be estimated, and the error term is assumed to have a zero mean and constant variance 2. With the included neighborhood characteristics controlling for the influence of omitted variables, a house price hedonic for the full sample is performed using Equation (1). The results appear in the OLS column of results in Table 2. Adjusted R-squared for the OLS model of Equation (1) is 0.71. Most of the house and neighborhood controls have the expected sign. With WARRANTY DEED as the omitted category, many of the other deed types show up as statistically significantly related to sale price. A more detailed examination of results is delayed until we reach our preferred estimation approach. 5 While OLS is the traditional approach, other research suggests that omitted variables bias the parameter estimates. Ries and Somerville (2004) find that by adding fixed effect dummy variables, their school quality parameter estimate becomes weaker, for example. To this end, a dummy variable for each metropolitan area (MSA) is added to Equation (1), with Akron as the omitted category.1 The MSA dummy variables will capture the influence of variables that vary at the metropolitan area level, such as economic conditions. The results are shown in the Fixed Effects OLS column of results in Table 2. [Insert Table 2 about here] The addition of the MSA fixed effects has increased adjusted R-squared slightly from 0.71 to 0.73. Most of the signs and significance of the parameter estimates remain unchanged, but there are exceptions. SURVIVORSHIP DEED has become positively related to house price. Brick houses, outbuildings, and racial heterogeneity have stronger parameter estimates than before. Market conditions still matter, but the MSA dummies seem to have siphoned off some of the influence of HOT MARKET. Single parent households no longer depress house price. However, the MSA dummy variables are coarse ways of capturing the influence of omitted variables: they fail to capture a wide range of more localized influences on house prices like the presence of parks and abandoned houses. To better capture the influence of omitted variables, we adopt spatial statistics. Estimation Approach: The Spatial Error Model 6 Spatial dependence is the idea that some things are related to each other over space: the closer these things are, the more related they are. For example, two nearby houses have almost equal access to the nearest park; a third house far away from the park has less access. So there is spatial dependence in access to the park. If access to the park is valued, all else equal, there will be spatial dependence in the prices of the houses as well: the two nearby houses will have similar prices, while the third house will have a less similar price. If park services are omitted from a house price hedonic, there will be spatial dependence in the error term, invalidating the OLS assumption of independent, zero-mean errors (LeSage, 1997a). In fact, a likelihood ratio test for spatial dependence in the residuals of the OLS model of Equation (1) reveals its presence: with a critical chisquared test statistic of 6.6 at the 1% level, the calculated test statistic of 6215.7 rejects the null hypothesis of no spatial dependence.2 There are two main approaches to modeling spatial dependence. One approach is the spatial autoregressive (SAR) model, which models spatial dependence by including an autoregressive term to the set of explanatory variables. Another approach is the spatial error model (SEM), which models spatial dependence by including an autoregressive term to the errors of the model. We follow Lacombe (2004) to help decide which model is more appropriate for our sample. We perform both SAR and SEM regressions and find that the SEM model captures more spatial dependence than the SAR model.3 We therefore adopt the SEM model for our hedonic regressions. The SEM model takes the following form (Anselin, 1988, p. 182): (2) Vi = X + = W + , N(0,2) 7 The SEM model introduces an autoregressive term W into the error term of the house value regression. The parameter captures the strength of this autoregressive relation, and the term W is a spatial weight matrix that summarizes the spatial layout of the data.4 There are many equally valid ways to construct a spatial weight matrix W to show who the neighbors are for each house. Some studies like Brasington and Hite (2005) choose an arbitrary number of neighbors. The fewer neighbors one chooses, the more localized the influences picked up. Rather than choosing a number of neighbors to use, we rely on a technique called Delauney triangularization (Pace, 2003). The Delauney triangularization technique chooses the number of neighbors to allow for each house and assigns the weight each neighboring house is given. For example, house number 1052 might be assigned four neighbors with weights 0.10, 0.30, 0.25, and 0.35, while house number 15,382 might be assigned six neighbors with weights 0.50, 0.15, 0.15, 0.05, 0.05 and 0.10.5 The spatial error model of Equation (2) is estimated using maximum likelihood. The concentrated log-likelihood function takes the following form (Anselin, 1988, p. 182; LeSage, 1999, p. 76): (3) L = C – (n/2) ln[(1/n)e(I-W) ( I-W)e] + ln| I-W| In Equation (3), C is a constant not related to the parameters, n is the number of observations, and e is the matrix of residuals from least squares estimates for in the first part of Equation (2). The most difficult part of Equation (3) is evaluating the log-determinant of (IW). Computers today are limited to running the SEM model of Equation (2) with a few 8 thousand observations, which takes hours. However, Pace and Barry (1998) and Barry and Pace (1999) have developed computational tricks that permit larger models to be run. In fact, the 37,826-observation SEM model takes 62 seconds on a laptop computer with a 2.66 GHz Pentium 4 processor. The SEM model captures the influence of omitted variables, providing a more convincing identification strategy than simply including neighborhood characteristics or including fixed effect dummy variables. The proximity to parks illustration at the beginning of the section is characteristic of the types of omitted influences that the SEM model addresses. In fact, proximity to anything is subsumed by the spatial error model. If proximity to a nuclear power plant, a shopping mall, an interstate highway, and a lake affect house prices, these omitted influences will be subsumed in the error term, and normally might adversely influence parameter estimates. But the second part of Equation (2) recognizes the correlation between the error terms of neighboring houses: if the error term for house 1 is affected by being near a nuclear power plant, the error term for nearby house 2 is affected to a similar degree. The error term could also include omitted variables for income levels, racial composition levels, and other demographic information. If demographic composition for one house is similar to that of its neighbors, the spatial error model will capture these influences. In this manner the SEM model addresses the influence of omitted variables in the house price hedonic. A more complete intuitive explanation of how spatial statistics addresses omitted variables is found in Brasington and Hite (2005). A mathematical proof is available in Griffith (1988, p. 94107). 9 The results of the SEM estimation appear in the Spatial Error Model column of Table 2. Model fit has improved from an adjusted R-squared of 0.71 in the OLS model to 0.73 in the Fixed Effects model to 0.78 in the SEM model. The spatial error parameter estimate is 0.56, and it is highly statistically significant. This implies that the average correlation between the residuals of an observation and that of its neighbors is 0.56. Relative to the Fixed Effects OLS model, the SEM model has made PATIO lose statistical significance, while BEDROOMS and SINGLE PARENTS become statistically significant. The strength of the relation between house prices and HOT MARKET has strengthened, while it has weakened for ONE STORY, BRICK, OUTBUILDINGS, DECK, and RACIAL HETEROGENEITY. The SEM model also appreciably alters the relation between house prices and the age of a house. We are almost ready to interpret the focus variables at length, but to be more certain of our results we make one final modification to our estimation technique by adopting a Bayesian approach. Estimation Approach: The Bayesian Spatial Error Model Because we wish to make the most correct inferences possible, we must be wary of heteroskedasticity and outliers. Heteroskedasticity will cause inefficient parameter estimates and invalidate hypothesis testing, and outliers can dramatically alter parameter estimates. The preceding OLS, Fixed Effects, and SEM models ignore these problems, while in fact White’s test rejects the null of homoskedasticity at the 1% level.6 Anselin (1988) suggests a heteroskedasticity correction for maximum likelihood spatial routines like that of Equation (3), but there are many reasons to favor a spatial Bayesian SEM model instead (LeSage, 1999, p. 141). A Bayesian model does not 10 require a restrictive specification for the heteroskedastic disturbance term. Bayesian models are more robust to outliers than maximum likelihood. Maximum likelihood methods require normally distributed errors, which may be an erroneous assumption. And although the Bayesian approach uses conditional distributions in its sampling methodology, with a large sample of draws it converges in the limit to the true joint posterior distributions of the parameters. The Bayesian spatial error model is that of LeSage (1997b). It takes the same form as Equation (2) except for the more complex specification of the disturbance term: (4) Vi = X + = W + , N(0,2V) V = diag(v1, v2,…, vn) r/vi 2(r) / r 1/2 (,) A big difference between Bayesian and non-Bayesian estimation is the use of prior information. We allow diffuse priors for , , and 2. Ordinarily, the term r in Equation (4) would be distributed gamma with two parameters. Instead, following LeSage (1999, p. 121), we set r = 4 as our informative prior on vi. This particular prior yields relatively constant estimates of vi in the presence of homoskedasticity, while at the same time accommodating non-constant error variances in the presence of heteroskedasticity and outliers.7 Again, the computational tricks of Barry and Pace (1999) and Pace and Barry (1998) must be used to allow the large sample to run in a reasonable amount of time.8 The Bayesian spatial error model in Equation (4) depends on having a large number of draws to converge to the true joint posterior distribution of the parameters. If 11 you don’t have enough draws, you can’t trust your parameter estimates. Although convergence diagnostics are available, the true test of convergence is when the estimates don’t change with added draws. We run a model with 300 draws (with 30 additional burn-in draws) and a model with 1000 draws (with 100 additional burn-in draws) and achieve similar results, suggesting that 300 draws is sufficient. One way to see if the Bayesian technique improves on the non-Bayesian spatial error model is to compare the 2 estimates. The estimate of 2 has fallen from 0.0682 to 0.0486, suggesting some benefit to using the Bayesian approach (LeSage, 1999, p. 121).9 Adjusted R-squared is 0.78 in the non-Bayesian model and 0.77 in the Bayesian model, suggesting that the non-Bayesian model tried to fit outliers to a minor extent. Going from the non-Bayesian to the Bayesian model made ADMINISTRATOR’S DEED become statistically significant for the first time, CORPORATION DEED increase its statistical significance from the 10% to the 1% level, and SINGLE PARENTS have a somewhat stronger negative relation with house price. The remaining parameter estimates change little. Having settled on our theoretically preferred econometric model, we are ready to interpret the key parameter estimates. Deed type estimation results: Our omitted deed category, WARRANTY DEED, is among the most valued by the housing market. Only survivorship deeds command a premium relative to warranty deeds. All else constant, houses with survivorship deeds sell for 1.4% more than warranty deeds. With a mean house price of 145,685, the 1.4% premium for survivorship deeds translates to almost $2040. The survivorship deed is one in which a joint tenant 12 maintains ownership rights following the death of another joint tenant. Because the survivorship deed prevents the heirs of the deceased from making claims against the property, the property becomes less risky for the final owner. Three deed types have insignificant parameter estimates, implying that we cannot reject the null hypothesis that houses with these types of deeds sell for anything different than houses with warranty deeds. These three types are execution deeds, trustee’s deeds, and final distribution deeds. Although statistically significant results are found for three even less numerous deed types, the relatively small number of execution deeds (12) and final distribution deeds (21) may contribute to their statistical insignificance. The remaining ten deed types are associated with lower house prices, all else constant. In most cases the lower house prices are associated with the level of risk involved with holding a particular deed. The largest discount (51%) is attached to houses with quit claim deeds. Quit claim deeds do not state the nature of the rights conveyed in a transaction and provide no warranties of ownership. These deeds merely convey the grantor’s rights or interests in the real estate. For these reasons, a property selling with a quit claim deed has a higher chance of previous owners surfacing and claiming title to the property than a deed that provides more warranties of ownership. Other discounts may be attributed to a level of urgency associated with selling a particular real asset. The second-largest discount is for houses with foreclosure deeds (36%), followed closely by sheriff’s deeds (31%). A foreclosure occurs when a mortgage goes into default and the lender acquires ownership rights to the property. The lender then sells the asset quickly, usually by auction. As a result, the property sells for a discount compared to what it would have sold for had it been left on the market longer. 13 A sheriff’s deed is issued when a court orders the conveyance of a property to satisfy judgment. As in the foreclosure case, the receiving party of a sheriff’s deed may have an interest in extracting the monetary value from the property as quickly as possible. Such an action would cause the asset to sell for discount. Guardian deeds command a 27% discount. This means that the typical house would sell for nearly $39,335 more if it had a warranty deed rather than a guardian deed. The “urgency factor” may also play a role in the discount associated with guardian deeds. A guardian deed is used to convey the property of an infant or incompetent. As an example, a minor may reach the predetermined age of conveyance of the property and need the monetary value of the asset rather than the physical value. Such a situation can occur when a minor reaches the age of eighteen and needs the money invested in a house to pay for college. This situation would merit the quick sale of the house in order to extract the monetary value in a timely fashion. In some cases of guardian deed sales there may also be a principal-agent problem: guardians don’t get paid any more for selling the house for a high price, and therefore may wish to sell as quickly as possible to lessen the amount of time they have to spend selling the property. The next highest discounts belong to houses with limited warranty deeds (19%), administrator’s deeds (16%), and special warranty deeds (14%). The limited warranty provides a warranty for only the period during which the seller held the title, leaving the buyer open to claims from previous periods. This deed is less risky than the quit claim deed, but more risky than the warranty deed. The special warranty deed requires the grantor to defend title against claims of only those related to the grantor in the some way. This means that only claims brought by the grantee and those claiming under him are 14 guaranteed to be defended by the grantor. In both the limited and special warranty deeds, the buyer of the house must rely on title insurance for protection. An administrator’s deed is used to convey the property of a person who dies without a will. The discount for this deed type may be associated with the “urgency factor.” Two cases in which a person would die without a will occur when the death is unexpected or when the person has no close heirs to leave the asset. In both cases, the property might be sold quickly. For example, if a wife’s husband dies in a car accident, the wife may downsize to a smaller residence that doesn’t constantly remind her of her husband’s tragic death. Another example may include the possibility of a distant relative passing away, and the asset being passed down to someone who hardly knew the deceased. In this case, the heir might be anxious to sell the property and realize the unexpected profit quickly, before someone surfaces to contest the administrator’s judgment. Houses sold with corporation deeds sell for an 11% discount relative to warranty deeds. If a corporation relocates an employee, it may buy the employee’s house at market price to speed the employee’s relocation. But having no interest in holding real estate, the corporation sells the property quickly at a discount, possibly to another employee new to the area. The weakest discounts belong to houses with fiduciary (9%) and executor’s deeds (8%). A fiduciary covenant is not as safe as a warranty deed because it does not specifically and absolutely provide warranty against all claims against the title, which would explain the 9% discount. An executor’s deed conveys the property of one who has died with a will. This is similar to the administrator’s deed in that the grantor is now dead. However, unlike an administrator’s deed, an executor’s deed is issued when the 15 deceased grantor has a will. The presence of a will would decrease the “urgency factor,” and the remaining discount could be attributed to the fact that the executor’s deed simply provides less protection against claims to the title than does a warranty deed. Implications of omitting deed types House price hedonic studies are published fairly often by economists and real estate researchers. The preceding analysis suggests that the type of deed associated with a house can have a dramatic effect on the price it sells for, either because of the type of deed itself or because the type of deed signals something about the quality of the house or the motivation level of the seller. A failure to include deed type in house price hedonics may cause biased parameter estimates and incorrect inference about parameters of public policy interest, like that of school quality, environmental quality, or police services. The Bayesian spatial error model is performed again, this time omitting information on deed type. The Bayesian SEM w/o Deeds column of Table 2 suggests that excluding deed types does not appreciably alter any parameter estimates. Many parameter estimates are completely unchanged, in fact. So the exclusion of deed type information seems not to hurt inferences made from house price hedonics. It is only necessary to include deed type information if one is researching deed types themselves. Individual MSA regressions Performing house price hedonics for the full sample provides a concise way of examining the relation between deed type and house price across the state of Ohio. And 16 the use of spatial statistics helps control for the influence of omitted variables that affect cities. But a pooled regression may mask differences in discounts associated with deed types across different markets. To this end, separate regressions are run for houses in the Akron, Cincinnati, Cleveland, Columbus, and Youngstown metropolitan areas. The results are summarized in Table 3 below. [Insert Table 3 about here] Although all deed types are defined in the Ohio Revised Code, and are therefore recognized across the state, our sample does not have all deed types represented in every metropolitan area. In fact, our Akron sample has only four deed types represented. The other areas have all but two deed types represented. And because each metropolitan area necessarily has fewer observations than the full sample, fewer deed types attain statistical significance. Still, a few observations can be made. The discount for having an executor’s deed is 10% in Cincinnati but only 5% in Cleveland. The discount for having a quit claim deed varies from 35% in Akron to 61% in Cleveland, a difference in mean sale price of nearly $38,000 between the two regions. And fiduciary deeds command a discount of only 7.6% in Cincinnati but a 17% discount in Columbus. The discount for sheriff’s deeds, survivorship deeds, guardian deeds, limited warranty deeds and foreclosure deeds is fairly constant across regions. Still, the discount varies widely between regions for certain deed types. What kind of houses have these deeds? Having found that deed type is related to the sale price of a house, and that the discount of having certain deed types is more pronounced in some regions than others, 17 we now ask a new question: are houses in poor neighborhoods more likely to have certain deed types? We estimate probit models with each of the fourteen unusual deed types as dependent variables. The explanatory variables used to characterize a neighborhood include census block group measures of per capita income, percentage of the population with graduate degrees, poverty level, unemployment rate, total residential value, and the level of urbanization. The results are summarized in Table 4 below, and several observations can be made from the output. [Insert Table 4 about here] The negative signs on the coefficients of the unemployment, urbanization, and poverty parameters indicate that survivorship deeds are less prevalent in poor urban neighborhoods. Also, there is a greater probability of observing a foreclosure deed in an urbanized neighborhood with lower per capita income. The neighborhoods with a higher probability of having sheriff’s deeds are located in more rural areas, have a higher poverty rate, and less people with graduate level educations. The probability of observing fiduciary covenants or quit claim deeds is higher in poverty stricken neighborhoods than in affluent ones, all else constant. Another interesting observation is that there is a lower probability of observing a corporation deed in a neighborhood inundated with inhabitants with graduate degrees. This may indicate that corporations supply houses primarily for their blue collar workers, while the executives are left to find their own homes. Alternatively, executives who were transferred to another city lived in central city neighborhoods close to corporate headquarters, where education levels were lower. 18 The influence of deed types on mortgage interest rates One could hypothesize that individuals who buy houses with riskier deed types would pay higher mortgage interest rates than individuals who take out mortgages on houses with warranty deeds. In fact, traditional lending institutions may refuse to issue mortgages on houses with shaky collateral. Buyers of houses with riskier deed types may need to turn to sub-prime lending institutions and pay higher interest rates. We regress mortgage interest rates as a function of deed types and control for the mortgage amount, frequency of mortgage payments, racial heterogeneity of the neighborhood, the size of the house, and the quality of public schooling. The results can be seen in Table 5. [Insert Table 5 about here] Of the 37,043 houses with deed types, only ??? have the necessary mortage data. While our data limit us from doing an exhaustive study of this issue, we conclude that there appears to be no significant relationship between more risky deed types and mortgage rates. Although four of the deed types are statistically significant, the signs of the coefficients do not tell a consistent story. As expected, special warranty deeds have higher interest rates and survivorship deeds have lower interest rates. However, sheriff’s and foreclosure deeds have lower interest rates than warranty deeds. This leads us to reject the hypothesis that houses with riskier deed types have higher mortgage rates than safer deed types. Conclusion The type of deed attached to a house often has a marked influence on sale price. All else constant, the difference between the sale price of a house with the most valued 19 deed type and the least valued is 52.4%. The most common type of deed is a warranty deed. The premium or discount for the average house of each deed type is summarized in Table 6 below: [Insert Table 6 about here] Some of the discounts reflect the added risk that a buyer incurs when buying a house with a quit claim deed, for instance, which does not guarantee that the seller has a clear title to the house. Other discounts reflect motivated sellers who are willing to get rid of the house without waiting for a higher bidder, like a guardian deed. Some discounts indicate motivated sellers and possibly the condition of the house, like a foreclosure deed or a sheriff’s deed. The current study provides estimates of the trade-off between higher sale price and higher seller risk for a number of deeds. A quit claim deed sells for about $54,000 less, or 37% of the price of the average house, than a special warranty deed but also entails additional risk. It also provides guidance for real estate agents: all else equal, commissions are 19% larger for houses with warranty deeds than for houses with limited warranty deeds. Property tax assessors may obtain a more reliable estimate of the underlying value of a house by factoring in the type of deed. For example, the discount for a corporation deed may stem from unique seller motives and not from the structural condition of the house. So houses with corporation deeds may be worth about 11% more than the sale price of the house, which affects property tax collections from the buyer. States like California assess taxes based on the sale price of a home. If assessment were based on sale price, Ohio would have under-collected $60,680,570 in property taxes in 2000 for 20 houses whose deed types command a discount. On the other hand, it would have overcollected $23,789,312 in property taxes for houses whose deed types command a premium over warranty deeds.10 And states like Ohio that use comparable house sales for assessment also mis-estimate house value by not accounting for the non-traditional deed types of comparable house sales. In our sample, 30% of houses are sold with nonwarranty deeds. In some cases, the mortgage rates attached to real estate transactions can provide evidence of sub-prime lending. We investigated whether or not there is a relationship between the more risky deeds and the mortgage rates. The analysis performed with our limited data set suggests that there is no relationship between the more risky deed types and the mortgage rates. Our investigation into the probability of observing certain deed types in poor neighborhoods yields some interesting results. We find that some deeds, such as quitclaim and sheriff’s, are more common in poverty-stricken neighborhoods than in affluent ones; while others like survivorship deeds are more common in more affluent neighborhoods. Our results show that there is a relationship between neighborhood types and deed types, and those relationships may be further investigated in future studies. Additional work could investigate the discount or premium for sale of houses by banks or between family members (Hite & ???). However, our investigation suggests that neither the relation between house price and structural characteristics nor the relation between house price and neighborhood characteristics or public services is affected by the omission of the type of deed attached to the sale of a house. 21 Table 1: Variable Definitions, Sources, and Means Variable Name LN HOUSE PRICE Definition (Source) ONESTORY Sale price of house in 2000 in U.S. dollars (1); natural log is used in hedonic regressions, but unlogged means are shown Dummy variable = 1 if house is one story (1) BRICK Dummy variable = 1 if house is constructed of brick (1) FINISHED BASEMENT GARAGE Dummy variable = 1 if house has a finished basement (1) FIREPLACES Number of fireplaces the house has (1) OUTBUILDINGS Number of exterior buildings on the lot (1) BEDROOMS Number of bedrooms the house has (1) FULLBATHS Number of full bathrooms the house has (1) PARTBATHS Number of partial bathrooms the house has (1) AGE Age of house in hundreds of years (1) HOUSE SIZE Thousands of square feet of building size (1) YARD SIZE PATIO Size of yard of house in acres, where 1 acre = 43,560 square feet (1) Dummy variable = 1 if house has a patio (1) DECK Dummy variable = 1 if house has a deck (1) BAD SCHOOL Percent of students in school district who are below proficient on Ohio 12th grade math proficiency test in 2000-2001 school year (6) Single-parent returns as a percentage of total returns in school district, for 1999 income tax returns (7) value of new agricultural and residential (class 1) buildings constructed between 1999 and 2000 per pupil in school district in tens of thousands of U.S. dollars (8) Tax year 2000 class 1 (agricultural and residential) tax rate in school district in effective mills (2) Air releases in Census tract of the house in hundreds of SINGLE PARENTS HOT MARKET TAX RATE AIR POLLUTION Dummy variable = 1 if house has a garage (1) Full Sample Means () 145,685 (116,841) 0.46 (0.50) 0.41 (0.49) 0.08 (0.27) 0.57 (0.49) 0.52 (0.59) 0.01 (0.09) 3.12 (0.75) 1.49 (0.63) 0.47 (0.54) 0.41 (0.31) 1.68 (0.73) 0.53 (1.93) 0.10 (0.30) 0.12 (0.33) 36.7 (12.9) 10.9 (5.2) 0.24 (0.38) 32.0 (5.6) 0.30 22 RACIAL HETEROGENEITY POLICE PROTECTION WARRANTY DEED EXECUTION DEED ADMINISTRATOR’S DEED CORPORATION DEED EXECUTOR’S DEED QUIT CLAIM DEED SHERIFF’S DEED TRUSTEE’S DEED FINAL DIST DEED SURVIVORSHIP DEED FIDUCIARY DEED GUARDIAN DEED SPECIAL WARRANTY DEED LIMITED WARRANTY DEED FORECLOSURE DEED MORTGAGE AMOUNT MORTGAGE FREQUENCY MORTGAGE RATE PER CAP INCOME GRADUATE DEGREE thousands of pounds (3) Leik index of racial heterogeneity of Census block group of the house, where 0 is racially homogeneous, 1 is racially heterogeneous (4) Number of police officers per 1000 residents in police district in 1997 (5) Dummy variable = 1 if house is sold with a warranty deed (1) Dummy variable = 1 if house is sold with an execution deed (1) Dummy variable = 1 if house is sold with an administrator’s deed (1) Dummy variable = 1 if house is sold with a corporation deed (1) Dummy variable = 1 if house is sold with an executor’s deed (1) Dummy variable = 1 if house is sold with a quit claim deed (1) Dummy variable = 1 if house is sold with a sheriff’s deed (1) Dummy variable = 1 if house is sold with a trustee’s deed (1) Dummy variable = 1 if house is sold with a final distribution deed (1) Dummy variable = 1 if house is sold with a survivorship deed (1) Dummy variable = 1 if house is sold with a fiduciary deed (1) Dummy variable = 1 if house is sold with a guardian deed (1) Dummy variable = 1 if house is sold with a special warranty deed (1) Dummy variable = 1 if house is sold with a limited warranty deed (1) Dummy variable = 1 if house is sold with a foreclosure deed (1) Amount of mortgage in dollars (1) Frequency, in years, with which the mortgage rate can change (1) Interest rate of mortgage in percentage points (1) Per-capita income of households in census block group in dollars (4) Percentage of census block group residents who have a graduate school degree (4) (3.56) 0.10 (0.10) 15.3 (14.2) 0.70 (0.46) 0.00032 (0.018) 0.00024 (0.015) 0.0023 (0.048) 0.011 (0.10) 0.0090 (0.095) 0.0052 (0.072) 0.0012 (0.034) 0.00056 (0.024) 0.24 (0.43) 0.015 (0.12) 0.00029 (0.017) 0.00048 (0.022) 0.0037 (0.061) 0.0022 (0.047) 104,833.28 (77,000.58) 0.35 (1.26) 1.16 (3.17) 24,973.49 (10,267.62) 9.66 (8.58) 23 TOT RESIDENTIAL VALUE UNEMPLOYMENT Total residential property value in school district (2) 953,365,362 (965,749,967) Percentage of adults in census block group that is 3.85 unemployed (4) (3.62) URBAN Percentage of population in census block group that is 91.26 living in an urbanized area or urban cluster (4) (24.19) POVERTY Percentage of persons in census block group living below 6.83 the appropriate threshold poverty income level (4) (8.14) Sources: (1) First American Real Estate Solutions (2002); (2) Ohio Department of Taxation (2003); (3) U.S. Environmental Protection Agency (2002); (4) GeoLytics CensusCD 2000 (2002); (5) GeoLytics Crime Reports CD (2000); (6) Ohio Department of Education (2002); (7) Ohio Department of Taxation (2002); (8) Ohio Department of Taxation (2000) 24 Table 2: Full Sample Regression Results Dependent Variable is LN HOUSE PRICE Explanatory Variable EXECUTION DEED ADMINISTRATOR’S DEED CORPORATION DEED EXECUTOR’S DEED QUIT CLAIM DEED SHERIFF’S DEED TRUSTEE’S DEED FINAL DIST DEED SURVIVORSHIP DEED FIDUCIARY DEED GUARDIAN DEED SPECIAL WARRANTY DEED LIMITED WARRANTY DEED FORECLOSURE DEED ONESTORY BRICK FINISHED BASEMENT GARAGE FIREPLACES OUTBUILDINGS OLS Fixed Effects OLS Spatial Error Model -0.030 (0.35) -0.13 (1.30) -0.11** (3.45) -0.085** (5.68) -0.48** (29.80) -0.34** (15.77) -0.001 (0.023) -0.0089 (0.14) 0.0052* (1.38) -0.098** (7.77) -0.21* (2.35) -0.17* (2.39) -0.17** (6.78) -0.32** (9.49) 0.058** (14.42) 0.025** (7.08) 0.034** (5.85) 0.098** (27.5) 0.10** (30.65) 0.049** (2.75) -0.012 (0.14) -0.12 (1.26) -0.089** (2.81) -0.072** (4.94) -0.50** (31.46) -0.30** (14.48) 0.035 (0.80) 0.0098 (0.15) 0.019** (4.96) -0.076** (6.11) -0.23** (2.61) -0.19** (2.72) -0.17** (6.95) -0.37** (11.26) 0.05** (12.59) 0.052** (14.52) 0.024** (4.23) 0.066** (17.94) 0.099** (30.39) 0.085** (4.87) -0.025 (0.34) -0.14 (1.62) -0.077* (2.26) -0.085** (6.65) -0.49** (35.22) -0.31** (16.78) -0.036 (0.94) -0.04 (0.74) 0.017** (5.14) -0.092** (8.48) -0.27** (3.53) -0.14* (2.27) -0.16** (7.40) -0.38** (13.16) 0.029** (8.02) 0.035** (10.39) 0.019** (3.22) 0.059** (14.31) 0.071** (23.43) 0.047** (2.98) Bayesian Spatial Error Model -0.015 (0.23) -0.16* (2.00) -0.11** (3.93) -0.078** (6.35) -0.51** (27.60) -0.31** (17.63) -0.034 (0.85) -0.018 (0.28) 0.014** (4.35) -0.090** (7.89) -0.27** (3.33) -0.14** (2.51) -0.19** (7.45) -0.36** (11.37) 0.037** (9.43) 0.031** (9.00) 0.015** (2.67) 0.066** (16.27) 0.068** (21.71) 0.050** (3.06) Bayesian SEM w/o Deeds 0.035** (8.81) 0.030** (9.84) 0.017** (2.84) 0.067** (16.73) 0.069** (21.57) 0.056** (3.63) 25 BEDROOMS 0.0039* -0.0021 0.0090** 0.0084** 0.008** (1.39) (0.76) (3.58) (3.62) (2.96) FULLBATHS 0.059** 0.064** 0.046** 0.046** 0.048** (16.04) (17.83) (14.06) (13.03) (13.23) PARTBATHS 0.058** 0.054** 0.041** 0.038** 0.039** (15.80) (15.11) (12.64) (12.95) (11.79) AGE -0.36** -0.36** -0.62** -0.61** -0.61** (20.34) (20.18) (32.88) (32.83) (31.94) AGE SQUARED 0.12** 0.11** 0.28** 0.27** 0.27** (8.79) (7.88) (19.41) (18.82) (17.77) HOUSE SIZE 0.45** 0.44** 0.37** 0.39** 0.39** (53.43) (53.65) (49.95) (44.95) (44.59) HOUSE SIZE -0.020** -0.019** -0.017** -0.017** -0.017** SQUARED (14.54) (14.45) (14.01) (11.33) (11.03) YARD SIZE 0.040** 0.040** 0.042** 0.047** 0.045** (29.11) (29.87) (31.51) (24.92) (23.98) YARD SIZE -0.00019** -0.00019** -0.00021** -0.00023** -0.00022** SQUARED (18.54) (19.16) (20.57) (15.97) (16.06) PATIO -0.023** 0.026** -0.00018 -0.0039 -0.0036 (4.22) (4.64) (0.034) (0.75) (0.74) DECK 0.027** 0.068** 0.028** 0.029** 0.032** (5.41) (13.51) (5.99) (7.08) (7.06) BAD SCHOOL -0.0051** -0.0063** -0.0060** -0.0055** -0.0054** (25.50) (29.33) (21.50) (19.04) (19.48) SINGLE PARENTS -0.0044** 0.000019 -0.0035** -0.0050** -0.0050** (8.85) (0.04) (4.30) (6.92) (6.82) HOT MARKET 0.033** 0.020** 0.040** 0.026** 0.027** (6.64) (4.03) (4.95) (4.31) (4.28) TAX RATE 0.0025** 0.0024** 0.0032** 0.0030** 0.0031** (7.80) (7.29) (8.51) (6.61) (6.76) AIR POLLUTION -0.00088* -0.00016 0.00015 -0.000034 -0.00009 (2.00) (0.37) (0.23) (0.06) (0.14) RACIAL -0.26** -0.38** -0.21** -0.22** -0.22** HETEROGENEITY (15.34) (23.13) (8.52) (9.28) (9.45) POLICE PROTECTION 0.0017** 0.0012** 0.0016** 0.0014** 0.0014** (14.46) (10.48) (8.82) (8.47) (9.02) CONSTANT 11.00** 11.10** 11.24** 11.23** 11.22** (604.64) (564.78) (9381.15) (498.15) (497.17) 0.56** 0.49** 0.48** Spatial error parameter (334.29) (99.59) (253.39) Adjusted R-Squared 0.71 0.73 0.78 0.77 0.76 Number of observations = 37,043 housing transactions. Parameter estimates shown with absolute value of (asymptotic) t-ratios in parentheses below. ** = statistically significant at 1% level; * = statistically significant at 10% level. WARRANTY DEED is the omitted deed category. Fixed Effects OLS includes dummy variables for metropolitan area with Akron as the omitted category; dummy parameter estimates suppressed in output but available upon request. 26 Table 3: Metropolitan Area Regressions Summary Dependent Variable is LN HOUSE PRICE Variable EXECUTION DEED Akron Cincinnati Cleveland Columbus Youngstown -0.10 0.10 0.052 0.008 (0.91) (0.81) (0.41) (0.03) ADMINISTRATOR’S -0.09 -0.34 -0.31 DEED (0.84) (1.98) (1.27) CORPORATION DEED -0.10** -0.05 (3.31) (0.20) EXECUTOR’S DEED -0.099** -0.05* 0.05 -0.11 (6.22) (1.99) (1.02) (0.95) QUIT CLAIM DEED -0.35** -0.46** -0.62** -0.57** -0.39** (6.78) (15.40) (21.97) (12.64) (4.98) SHERIFF’S DEED -0.30** -0.35** -0.28** -0.26** (11.28) (9.42) (3.71) (5.21) TRUSTEE’S DEED 0.003 -0.08 0.17 -0.039 (0.06) (0.95) (0.52) (0.32) FINAL DIST DEED -0.023 (0.36) SURVIVORSHIP -0.17 0.012** 0.019** 0.027** 0.045** DEED (0.49) (3.00) (3.28) (2.91) (3.41) FIDUCIARY -0.079** -0.08** -0.18** -0.11* COVANENT (6.54) (3.53) (3.11) (2.97) GUARDIAN DEED -0.29** -0.24* (2.61) (2.30) SPECIAL -0.17 -0.21** -0.015 WARRANTY DEED (1.56) (2.48) (0.14) LIMITED -0.18** -0.26** -0.0039 WARRANTY DEED (4.99) (6.64) (0.07) FORECLOSURE DEED -0.44** -0.36** -0.30** (5.64) (9.29) (4.54) 0.30** 0.48** 0.35** 0.49** 0.30** Spatial error parameter (9.27) (77.94) (22.83) (36.76) (8.53) Adjusted R-Squared 0.74 0.75 0.77 0.83 0.71 Number of observations 1767 18,589 9163 5776 1748 Parameter estimates shown with absolute value of (asymptotic) t-ratios in parentheses below. ** = statistically significant at 1% level; * = statistically significant at 10% level. WARRANTY DEED is the omitted deed category. Other controls from Table 2 also included but suppressed in output; full set of results available from authors. Model used is Bayesian spatial error model. 27 Table 4: Neighborhood Characteristics and Deed Type Probit Analysis. Dependent Variable is Deed Type DEED Per Cap Income Graduate degree Tot Residential Value Unemployment Urban Poverty FORECLOSURE -0.00004** 0.0139* -1.43E-11 0.0117 0.0040* -0.009 SURVIVORSHIP 1.97E-6* -0.0022 -1.96E-10** -0.0126** -0.0035** -0.0064** FIDUCIARY -1.95E-8 -0.0034 -7.51E-11** -0.0016 0.0003 0.0050* QUIT CLAIM -9.02E-6* -0.0041 2.06E-11* -0.0024 0.0015 0.00756* SHERIFFS -1.02E-6 -0.0099* -1.43E-10** -0.0013 -0.0022* 0.0094* CORPORATION 8.18E-6 -0.04** -8.35E-11 -0.0107 0.0015 0.0048 FINAL DIST 9.05E-6 -0.0104 2.2E-10** 0.0164 0.0014 -0.0192 SWARRANTY 5.27E-6 -0.0134 -2.73E-10* 0.0071 -0.0029 0.0115 TRUSTEES 7.46E-6* 0.0064 7.87E-12 0.0151 -0.00003 -0.0036 LWARRANTY 8.95E-6** -0.0052 2.85E-11 0.0029 -0.0007 0.0073* GUARDIAN 0.00002 -0.0403* -2.45E-11 -0.0390 0.8520 0.0159 ADMINISTRATORS -0.00004 -0.0167 1.05E-12 -0.0021 0.0086 -0.0149 EXECUTORS 2.17E-6 -0.00653* 1.39E-11 -0.0060 -0.0002 -0.0010 EXECUTION -1.6E-6 -0.0033 3.32E-11 -0.0540 -0.0027 0.0032 Parameter estimates shown. ** = statistically significant at 1% level; * = statistically significant at 10% level. Number of observations = 34,219 28 Table 5: Interest Rates and Deed Types Dependent Variable is MORTGAGE RATE Explanatory Variable Variable Means OLS Results (Standard Deviation) CONSTANT 1.0 8.74 (0.0) (79.11) RACIAL HETEROGENEITY 0.09 1.88 (0.09) (7.48) MORTGAGE AMOUNT 150,052.07 -0.000002 (108,623.33) (4.78) MORTGAGE FREQUENCY 2.55 -0.124 (2.49) (7.79) BAD SCHOOL 34.155 0.024 (12.48) (11.58) HOUSE SIZE 1.95 -0.222 (0.91) (5.11) CORPORATION DEED 0.001 -0.731 (0.032) (1.43) EXECUTION DEED 0.0004 0.398 (0.02) (0.54) EXECUTORS DEED 0.009 -0.069 (0.0965) (0.22) FIDUCIARY COVANENT 0.016 0.068 (0.124) (0.42) FINAL DIST DEED 0.00061 0.089 (0.025) (0.15) FORECLOSURE 0.0002 -1.345** (0.014) (20.47) GUARDIAN DEED 0.00061 0.482 (0.025) (1.07) LIMITED WARRANTY DEED 0.004 0.063 (0.065) (0.26) QUITCLAIM DEED 0.006 0.323 (0.078) (1.26) SHERIFF’S DEED 0.003 -0.579* (0.059) (2.35) SURVIVORSHIP DEED 0.289 -0.230** (0.45) (4.54) SPECIAL WARRANTY DEED 0.0002 1.221** (0.014) (33.61) TRUSTEE’S DEED 0.0014 0.560 (0.038) (1.01) Parameter estimates shown with absolute value of t-ratios in parentheses below. ** = statistically significant at 1% level, * = 10% level. WARRANTY DEED is the omitted deed category. Number of observations = 4893 Adjusted R-squared = 0.20. 29 Table 6: Premium or Discount for Each Deed Type Relative to Warranty Deed Survivorship Deed Warranty Deed Execution Deed Trustee’s Deed Final Distribution Deed Executor’s Deed Fiduciary Deed Corporation Deed + 1% 0% 0% 0% 0% - 8% - 9% - 11% Special Warranty Deed Administrator’s Deed Limited Warranty Deed Guardian Deed Sheriff’s Deed Foreclosure Deed Quit Claim Deed - 14% - 16% - 19% - 27% - 31% - 36% - 51% 30 References Anselin, Luc. 1988. Spatial Econometrics: Methods and Models. London and Dodrecht: Kluwer Academic Publishing. Archer, Wayne R., Dean H. Gatzlaff and David C. Ling. “Measuring the Importance of Location in House Price Appreciation.” Journal of Urban Economics 40(3), November 1996, p. 334-353. Barry, Ronald and R. Kelley Pace. "A Monte Carlo Estimator of the Log Determinant of Large Sparse Matrices." Linear Algebra and its Applications 289(1-3), 1999, p. 41-54. Brasington, David M. “Which Measures of School Quality Does the Housing Market Value?” Journal of Real Estate Research 18(3), 1999, p. 395-413. Brasington, David M. and Donald R. Haurin. “Educational Outcomes and House Values: A Test of the Value-Added Approach.” Ohio State University working paper, November 2004. Brasington, David M. and Diane Hite. “Demand for Environmental Quality: A Spatial Hedonic Analysis,” Regional Science and Urban Economics 35(1), January 2005, p. 57-82. FARES: First American Real Estate Solutions. 2002. “CRG 03172.” Cincinnati, OH. GeoLytics. 2002. GeoLytics CensusCD 2000 Long Form Release 2.0. East Brunswick, New Jersey. GeoLytics. 2000. GeoLytics Crime Reports CD 1.0. East Brunswick, New Jersey. 31 Griffith, Daniel A. 1988. Advanced Spatial Statistics: Special Topics in the Exploration of Quantitative Spatial Data Series. Kluwer Academic Publishers, Dordrecht. Haurin, Donald R. and David Brasington. “School Quality and Real House Prices: Intra-and Interjurisdictional Effects,” Journal of Housing Economics 5(4), December 1996, p. 351-368. Hite, Diane and ??? paper on seller type and house price Lacombe, Donald. 2004. “Does Econometric Methodology Matter? An Analysis of Public Policy Using Spatial Econometric Techniques.” Geographical Analysis (forthcoming). LeSage, James P. Econometrics Toolbox. February, 2004. www.spatialeconometrics.com. LeSage, James P. “The Theory and Practice of Spatial Econometrics.” February, 1999. www.spatial-econometrics.com. LeSage, James P.. “Regression Analysis of Spatial Data.” Journal of Regional Analysis and Policy 27(2), 1997, p. 83-94. LeSage, James P. “Bayesian Estimation of Spatial Autoregressive Models.” International Regional Science Review 20(1-2), 1997b, p. 113-129. Ohio Department of Education. 2002. “EMIS Interactive Local Report Card School Year 2000-2001 District Level Data.” Columbus, Ohio. Ohio Department of Taxation. 2003. “2000 Millage Rates by School District.” Columbus, Ohio. Ohio Department of Taxation. 2002. “Demographic Characteristics of 1999 Income Tax Returns Filed by School District.” Columbus, Ohio. 32 Ohio Department of Taxation. 2002. “2000 Real Property Abstract by School District.” Columbus, Ohio. Pace, R. Kelley. “Spatial Statistics Toolbox 2.0.” FDELW2.m. February 15, 2003. Pace, R. Kelley and Ronald P. Barry. "Simulating Mixed Regressive Spatially autoregressive Estimators." Computational Statistics 13, 1998, p. 397-418. Pennington-Cross, Anthony. “Credit History and the Performance of Prime and Nonprime Mortgages.” Journal of Real Estate Finance and Economics 27(3), November 2003a, p. 279-301. Pennington-Cross, Anthony. “Subprime Lending in the Primary and Secondary Markets.” Journal of Housing Research 13(1), 2003b, p. 31-50. Ries, John and Tsur Somerville. “School Quality and Residential Property Values: Evidence from Vancouver Rezoning.” University of British Columbia working paper 2004. Ross, Stephen and John Yinger. “Sorting and Voting: A Review of the Literature on Urban Public Finance,” In: Cheshire, Paul and Mills, Edwin S. (Eds.), Handbook of Regional and Urban Economics. North-Holland, Amsterdam, Netherlands: 1999, p. 2001-2060. U.S. Environmental Protection Agency. 2002. “TRI On-site and Off-site Reported Releases (in pounds), for Facilities in All Industries, for All Chemicals, Ohio, 2000.” The MSA dummy parameter estimates for Cincinnati and Youngstown are negative, Cleveland’s is positive, and Columbus’ is statistically insignificant. 2 The test is the lratios test of LeSage (2004), described in LeSage (1999, p. 73). 3 The spatial parameter from the SAR model is 0.16 with an asymptotic t-ratio of 89.7, while the spatial parameter from the SEM model is 0.56 with an asymptotic t-ratio of 334.29. In addition, the explanatory 1 33 power of the SEM model exceeds that of the SAR model: adjusted R-squared is 0.71 for SAR and 0.78 for SEM. 4 An excellent, intuitive discussion of the spatial weight matrix W is given in LeSage (1997a). 5 This is just an illustration. The actual weights come from the product of wmat*wmat*A, where wmat has elements i = 1/ (square root of the sum of the elements of the i-th row), and A is the adjacency matrix from Voronoi tessellation. 6 The calculated chi-square test statistic is 1525.9 for the full sample. The null is rejected at the 1% level for each of the individual MSA samples as well, with test statistics of 90.8 for Akron, 1039.0 for Cincinnati, 393.8 for Cleveland, 230.2 for Columbus, and 143.9 for Youngstown. 7 An alternative is to set the two parameters of the gamma distribution for r to the informative priors of 8 and 2. Nearly identical estimates are achieved either way. 8 The full sample Bayesian SEM with 300 draws took 543 seconds, and the one with 1000 draws took 1738 seconds. 9 By contrast it is 0.0888 for the OLS model. 10 Assessment in Ohio is based on sale prices of comparable houses. Ohio faces similar problems as states that only use the sale price of the house itself, but only to the extent that these comparable houses sell with atypical deed types (30% of the time, according to our sample means). These calculations assume the discounts and premiums are unrelated to the quality of the house and reflect only seller motivation and uncertainty of title. It also assumes the distribution of deed types in our sample is representative of the state. The dollar figures are based on the average effective millage rate in 2000 of 49.81 and the $119,281,000,000 of assessed residential property value in 2000.