Small-Shifts-Handout - Tift Regional Medical Center

advertisement

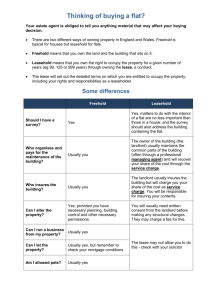

12 Months to Lower Overhead Small shifts that make a big difference Presented by Steven A. Adams, MCS, CPC, CPC- H, CPC-I, PCS, FCS, COA sadams@magmutual.com Licensed Instructor by the American Academy of Professional Coders MAG Mutual Healthcare Solutions, Inc. A Member of MAG Mutual Group Consulting, Publications and Seminars for the Medical Profession 7 Piedmont Center, Suite 601 3525 Piedmont Road Atlanta, GA 30305 888-624-6474 practice-management.org Small Shifts that Make a Big Difference - 12 Months Plan As you know from experience, money can easily leak out of your practice, both through obvious holes that you just haven't gotten around to plugging and through cracks you haven't even noticed yet. In these days of changing and tightening reimbursement for medical care, you simply cannot afford a financially leaky office. Keeping a tight rein on your practice overhead takes time and calls for a disciplined, methodical approach. One such approach is the 12-step, 12-month plan. Month 1: Staffing Needs Staff costs account for the largest single chunk of overhead in any practice, and while that doesn't automatically mean that your staff is likely to be your best source of savings, it certainly makes an examination of your staffing needs a good place to start. Moreover, any savings related to staff costs are likely to result from difficult, emotionally wrenching decisions about staff cutbacks, demotions and other measures that may hurt someone, leave you with an unsettling feeling of disloyalty to your staff and threaten morale. Why not get the hardest part of the task over with first? In MAG Mutual’s work with medical practices, we have found that payroll costs generally run approximately 23 percent of practice revenues. If your payroll runs higher than that or if you have other reason to believe you are paying more than you should in salaries, perform a personnel needs assessment. Essentially, this involves figuring out whether the tasks that occupy your staff are worth doing, whether each responsibility is assigned to the best possible person and whether the whole operation is as efficient as possible. In other words, you need to know that the right things are being done by the right people in the right way. One approach is to list all the tasks carried out by your staff, eliminate or modify any that you consider unnecessary or inefficient, and then imagine the ideal staff for the remaining tasks: How many people, with what kinds of background and training, should you need? Now compare that personnel listing with your actual staff. Do you have two staffers doing the job of one? Are certain jobs being done by staffers who are overqualified for them -- and therefore probably overpaid and under-challenged? Look at your current staff from as many perspectives as possible. Try to think outside your day-to-day acceptance of the way things are done in the office. Are all your employees essential to the practice? Do you have anyone working full time at a job that could be redesigned to be handled by a part-timer? Are there ways of combining tasks that would save time or staff members? Are there places where adding staff might help? For instance, is patient flow so backed up that the practice's lack of productivity is jacking up the overhead percentage? Maybe you need more clinical staff. (Of course, you may just need more efficient procedures, so go carefully before you spend money to save money.) Similarly, if your billing and collections are running sluggishly, you may need to add more collection personnel. As another alternative to leaving work undone or done at a snail's pace, consider outsourcing some billing, collections and administrative work to vendors. In deciding how many staff you should maintain, by all means consult the National Association of HealthCare Consultants’ or MGMA surveys, but remember that what is good for one practice may not be good for another. A high-producing practice, for example, may need more people in its business office than the average practice. Therefore, use surveys as one source of information in your personnel needs assessment. 2 Month 2: Employee Salaries The first question to answer is whether you're paying your staff more than the norm for your area. Examine your payroll position by position. If your salaries are generally in line, you may still be paying a couple of employees excessively -- long-term employees who have been receiving annual pay raises for many years, perhaps. An office manager who started out at $24,000 annually 15 years ago might now be making up to $40,000. Even though you value your long-term employees, you are not obligated to grant sizable salary increases each year -- and you may well not be able to afford to. Instead of awarding annual raises haphazardly or automatically, try to give no more than the prevailing average annual salary increase, which our firm finds to range from 2 percent to 5 percent today. (To provide yourself flexibility, consider giving yourself an overall, staff-wide budget for increases. If that budget is, say, four percent of your current salaries, you can assign more or less of it to individual staffers to reward performance while keeping within your salary maximum.) Have you set salary ranges for your staff positions? By all means do so, using current salary and raise averages data. One approach is to start with the local average for a given position and establish a minimum salary 20 percent below that figure and a maximum or ceiling 20 percent above it. Inform employees that their salary increases will slow down as their salaries approach their respective salary ceilings. Although you may decide that the increases you've been giving are just too big, don't think about doing away with them altogether -- except, perhaps, as a one-time emergency measure taken when the practice is clearly in trouble. The negative effect on morale would more than offset whatever savings you realize. (Of course, withholding an individual staff member's raise because of poor job performance is another story.) You might also find it effective to use incentive bonuses as an alternative to hefty raises. Incentives can range from giving movie passes to giving $500 bonuses for outstanding performance on occasion, and they can make everyone involved feel good without committing you to years of maintaining a higher salary. Although raises and salaries depend on employee performance, length of service and inflation, the bottomline determinant is your generosity. Too much generosity has a price. 3 Month 3: Health Insurance In Mag Mutual’s experience, we have found that health insurance and retirement combined typically can range anywhere from 3 percent to 8 percent of practice revenues. Your real challenge will be containing health insurance costs. Some practices have experienced annual premium increases of as much as 50 percent. As a first step in containing health insurance costs is to find out if everyone needs it then review your current coverage. Is it too generous for what you can afford? A policy with a $500 deductible generally costs more than one with a $2,000 deductible. A policy that has dental coverage costs more than one that does not. In an era of skyrocketing premium rates, it may not make economic sense to provide expansive health insurance coverage to employees. To offset the effect of a high deductible, your office could offer your staffers some medical care for free or other medical care at substantially reduced rates. That way your employees would get a price break on outpatient service just as they would if they were covered by insurance with a smaller deductible. Naturally, there are some supervisor-employee boundary and privacy issues to consider if you choose this option. Have you solicited competitive bids for your health insurance coverage over the Internet? It may be time to do so, especially if your practice has used the same health care insurer for a number of years. For assistance with bids, enlist the help of an independent insurance agent. If you switch plans, lock in the premium rate for as long as possible. Generally, this can be done for at least one year after the new policy is purchased. Each year, though, monitor health insurance premium costs and increases. Be prepared to evaluate the issues of coverage and to switch plans. Don't neglect the possibility of negotiating your way out of premium increases demanded by your current insurer. Were your staff members' health care expenses lower this year than last year? If so, you might have some bargaining chips. Talk with your agent. If your rates continue to increase over time despite all cost-cutting efforts, you may be faced with the need to take more extreme measures. Your employees may need to pay part of their premiums -- perhaps up to 50 percent. Check your state's employment laws first, though, to make sure there are no limitations on employee-subsidized premiums. If your back is to the wall, you may have to impose coverage limitations or eliminate the benefit altogether. Explore all possible alternatives to outright cancellation of employee health insurance. Without offering it, you may have trouble attracting and keeping good employees. One new option that offers insurance and retirement money is to take another look at Healthcare Savings Accounts or Healthcare Retirement Accounts. Be aware, however, that since the premium is lower the agent makes less money and as a result will often not recommend these products. You’ll have to do the legwork on this one, but it is worth the time and effort. You can save money on health insurance you just need to find the right agent. Don’t forget this is a benefit and often the purchase making this decision has a stake in the plan. 4 Month 4: Retirement Plan Is your retirement plan as cost-efficient as possible? Is it the right one for you? For example, you may not realize your 401K needs to be reallocated unless you have it reviewed. You may not know that the 150,000 salary cap to convert an IRAs to a Roth IRA is eliminated in 2010. You may need to talk to someone about obtaining a guaranteed 7% IRA investment right now. If you have one, are you putting as much as you can in your IRA? If you don’t have an IRA are you nuts? Do you know MAG Mutual does free estate planning? For your practice retirement plan pay particular attention to the length of the plan's vesting schedule. If your practice has a high turnover, structure the plan to reallocate any unvested accounts to remaining participants based on the ratio of their own account balances. And remember that retirement combined with health insurance for most practices typically runs from 3 percent to 8 percent of revenues, so you may want to use this range as a measurement in determining how much you want to pay for both. Month 5: Sick Leave and Overtime Payment Another employee issue to examine is your leave policy, which certainly affects your practice's costs. The major point to remember about leave policy is that anything you put into writing for your employees has the force of law behind it, so obviously you will want to think carefully about what your written leave policies say. You will also want to check with your attorney about any state laws that might govern sick and vacation leave before you set up your own policies. The industry standard for sick leave is five days a year for each employee. Do you pay employees for unused sick leave at the end of the year or upon termination? Do you treat sick leave as a compensated benefit? You may not have to. After all, sick leave is a contingency benefit for the employee in case of illness. That's what a fringe benefit is all about. If you remove the cash payment, though, your healthier employees might balk at the idea because they would feel penalized for never using sick leave. As a compromise, carry over unused sick leave to future years. This allows the employee to bank the unused sick leave and use it in the case of an illness, especially a serious one, but frees you from the costly position of paying your resigning employees for unused sick leave. For vacation, two weeks a year for each employee is the industry standard. You may want to set a limit on the number of days you will allow your staff to carry forward each year. Also, it's important for everyone to take vacations, and limiting the carryover of vacation days can encourage the workaholics on your staff to take some time off. Another option may be to switch to a Cumulative Acquired Leave (CAL) system. In essence, employees accumulate leave time based on the number of hours they work. For example, for every 17 hours worked you accumulate 1 hour of CAL time. And don't forget an overtime policy. Do you hold a tight rein on overtime? Are employees made accountable for their overtime hours? How is this time documented? Is overtime approved beforehand? Is overtime being paid to exempt employees when in fact it should not be? Establish a reasonable, practicewide policy and stick to it. 5 Month 6: Lease Agreements Does your office lease account for about 8 percent of net revenues? That's typical for a medical practice. Study your lease, looking particularly at incidental costs where you might find hidden overhead. Review the operating stop provisions and insurance requirements in the lease document. Under the typical operating stop provision, the landlord allocates excess costs of operating the building to all tenants. Excess costs are those that surpass the base operating stop amount the landlord provided each tenant at the outset of the current lease. Even though you agreed to pay a specific rental rate per square foot of space, the actual amount you pay the landlord may increase each year because of the operating stop provision. Therefore, it's important to review the specific costs the landlord includes in the operating stop calculation, which should be included in the lease. Look for costs that have nothing to do with the building's operation. For example, unrelated payroll costs and management fees sometimes make it into the allocation. Ask your accountant to audit the landlord's operating stop calculation each year, and challenge your landlord about any irregularities. Even if the lease contains no hidden expenses, it may still represent a waste of money if you're paying for more space than you need. Is your office space designed as efficiently as possible? Are you renting space that you might someday grow into but don't see a prospect of using in the immediate future? If your office suite has more space than you can use, consider renting part of the space, if that's feasible. And are you paying for more of the building than just your office? There is a difference between net rentable space and net usable space in each office lease agreement. Net rentable space allocates to you your share of common space in the building. So if you are in a building that has a beautiful atrium, you pay for part of this unusable space. Ask yourself how important that space is to you. Also check the lease for insurance the landlord may require your practice to purchase. Is it necessary? Are there alternatives? Although you may be unable to renegotiate these issues in the middle of a lease, you can certainly address them before you sign a new office lease or renew an old one. And you might as well ask yourself the big question: Would it be cheaper in the long run to own a building than to rent office space? Look into some available buildings and ask your accountant to help you compare your lease payments to how much it would cost monthly to own a building, taking mortgage, down payment and upkeep expenses into consideration. Also, you might want to consider practice consolidations as a possibility. Experience has shown that rental fees on clinical and business space can be saved this way, and you may achieve a variety of other economies of scale. While you're talking with your accountant, ask him or her to review all other lease agreements in addition to the office lease document, especially equipment leases. After reviewing the internal interest rate and end-oflease purchase requirements in equipment agreements, might it be cheaper to purchase certain items outright? Also examine all related maintenance contracts on office equipment. Can you acquire the same maintenance contract more cheaply elsewhere? Are the maintenance contracts necessary in the first place? Many practices pay for maintenance contracts for equipment that long ago lost its value or is seldom used. Finally, analyze related repair costs on the practice's equipment, furniture, fixtures and leasehold. Were these expenses necessary? And are they likely to occur again on the same asset? Should you allocate resources to purchase new assets rather than continuing to repair them? 6 Month 7: Costs of Medical. Lab and Office Supplies For a typical practice, our firm finds that supply costs average anywhere from 8 percent to 10 percent of revenues. To assess your own supply costs, start with some comparison shopping. If you have locked yourself into doing business with one vendor, especially for medical supplies, you may be surprised to find that you're not getting the best price available. You'll generally do better if you develop a list of the supplies you use and send the list to a number of vendors for bids. Do you seek membership in a group purchasing plan? For example, a group of practices can purchase some supplies collectively (often through an IPA) at volume-discount prices. Does your computer system have the ability to generate a superbill or patient charge ticket that's just as good as the ones you now purchase? Would you save money without impairing the process of capturing physicians' services by doing your own? No medical office can afford to over purchase and waste supplies. Review your inventory at the end of this month and monthly thereafter. If it remains high or increases, limit the amount of supplies your office purchases each month. Does your office have a clear purchasing policy? If not, develop one that does the following: Specifies how staff will determine what supplies to order each month, Identifies one staff member who will be in charge of purchasing and accountable for responsible purchasing and management of supplies, Gives that staff member authority to collect requests for supplies, shop for the best prices, place orders, check items received against original orders placed and inspect all related vendor invoices. If yours is a group practice with multiple offices, by all means consider centralizing authority for purchasing medical supplies in one location and standardizing the supplies used as much as possible. Then arrange for delivery of supplies to each office site. While you may find it useful to allow the individual offices to share supplies to cover shortfalls in certain offices, don't allow any office to order more supplies on its own. 7 Month 8: Outside Services Outside services typically account for one to two percent of practice revenue. Do you inspect those expenses related to professional fees from time to time? Are these expenses really necessary? Do you need additional services? Separate the one-time costs from the ongoing costs. With ongoing professional fees, search for less expensive alternatives. For example, a practice may hire an outside firm to administer its retirement plan, not realizing that its accountant might be able to perform the service for less. Your IPA might do credentialing work that your staff doesn’t have to do on their own. A vocational college might offer free interns to assist with billing and nursing. If you contract with an outside billing agency, do they guarantee their net collection rate and overhead ratios – you get what you pay for. Compare the net amount collected by the billing agency (total collections less the agency's fee) to an estimate of what you would net handling collections internally (total anticipated collections less the cost of personnel, equipment, paper, postage and decreased office efficiency). Other costly services include insurance for your building and its contents. Bid out building-and-contents insurance coverage periodically to make sure you are getting the best insurance for the best rate. Do you do pass-through billing for lab services? If so, are you making sure to reconcile your account monthly and determine if you are making a profit. Typically you should not be paying a lab more than MCD reimburses for lab services. Month 9: Postage and Telephone Costs Postage and telephone costs in a medical office rarely are controlled and should be around two percent. Do your employees use office postage for personal correspondence? To plug this leak, assign one person in your office the responsibility for coordinating mail services, someone who will enforce an office-only mailing policy. How much of the correspondence from your office to the outside world is unnecessary? For example, do your patients receive redundant communications from you? Perhaps your practice would benefit from some type of metered system or a service like stamps.com. And can you double up on mailings? You may be able to save money by including other necessary communication with bills so that you send one envelope instead of two. A small amount of investigation might reduce your telephone costs, too. Does your office pay for telephone lines or other options that it does not use? Have you bid out your answering and paging services lately in search of the same services for less? Can your telecommunications system detect whether employees are making personal long-distance telephone calls? These things add up. Contact your carrier and find out what you can do to reduce these costs. Don’t forget to look at options that would reduce the amount of mailings. Several companies offer lab and appointment confirmation systems that are worth looking into. 8 Month 10: Advertising Critique the cost and related benefits of advertising your office's services. Many offices spend money on advertising and similar marketing ventures that yield them little benefit. Look first at any costs related to display advertising, especially in the Yellow Pages. Many offices pay for display advertising in not one but several telephone directories, an action that can cost thousands of dollars per year needlessly. And do you need to advertise in the Yellow Pages at all, other than merely listing your name, address and phone number? Many MCOs and hospitals now have directories that patients find more useful than the phone book. And what about specialty advertising, such as on calendars or pens? Ask yourself whether it does anything for your practice. Can you tell whether it pays for itself? If your new-patient questionnaire doesn't already include a question like, "How did you hear about us?" consider adding one, giving check-off options that include the media where you advertise as well as referrals from patients and other health care professionals; at least you'll get an indication of how well the money you are spending on the Yellow Pages and other advertising is working for you. If you find that a given advertisement doesn't generate twice its cost in revenue, it's probably not worth keeping. Month 11: Refunds to Patients Refunds to patients are usually listed in the collected revenue portion of the income statement and are thus netted against the practice's actual collections. This may be an overhead expense your practice overlooks. By reducing refunds to patients, you can increase your practice's net income. Together with your business office, examine factors that cause refunds and eliminate them. Do your refunds occur because of posting errors or prepayments by patients before services are rendered? Select a few patients' accounts and trace the related billing and collection transactions through the system. By doing this, you will see whether the refunds happened because of human error (such as incorrect posting of accounts) or an internal systems error (such as guessing patient co-payment amounts). Month 12: Petty Cash and Bank Charges Track your nickel-and-dime expenses. For example, do you know where your petty cash disbursements go? When the pizza man shows up, do you pay him from petty cash and never record where that money went? If you don't record disbursements like that, you'll reach in the money drawer one day and find the petty cash gone. And are your petty cash disbursements really necessary? Petty cash may be another responsibility to assign to one trusted employee for close monitoring. Bank charges and penalties are other hidden overhead expenses, ones no medical office should ever incur. For example, you may be penalized for a late payroll tax deposit or tax form mailing. Or you may receive a bank charge because your account does not maintain a minimum balance each month. Take whatever steps necessary to stop these avoidable expenses. Never be afraid or embarrassed to ask for a less expensive option for a service you already receive. 9