Document

advertisement

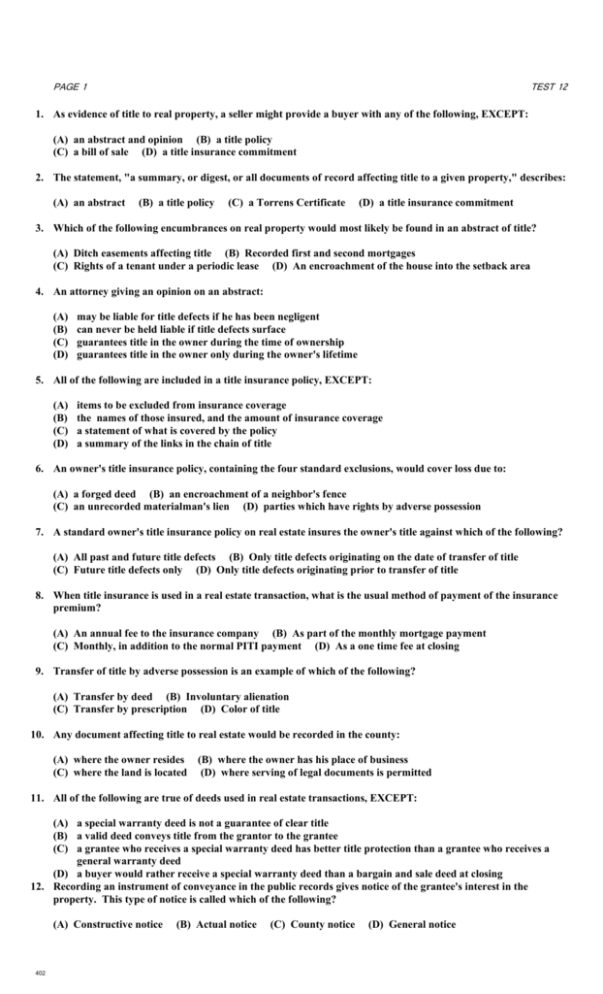

PAGE 1 TEST 12 1. As evidence of title to real property, a seller might provide a buyer with any of the following, EXCEPT: (A) an abstract and opinion (B) a title policy (C) a bill of sale (D) a title insurance commitment 2. The statement, "a summary, or digest, or all documents of record affecting title to a given property," describes: (A) an abstract (B) a title policy (C) a Torrens Certificate (D) a title insurance commitment 3. Which of the following encumbrances on real property would most likely be found in an abstract of title? (A) Ditch easements affecting title (B) Recorded first and second mortgages (C) Rights of a tenant under a periodic lease (D) An encroachment of the house into the setback area 4. An attorney giving an opinion on an abstract: (A) (B) (C) (D) may be liable for title defects if he has been negligent can never be held liable if title defects surface guarantees title in the owner during the time of ownership guarantees title in the owner only during the owner's lifetime 5. All of the following are included in a title insurance policy, EXCEPT: (A) (B) (C) (D) items to be excluded from insurance coverage the names of those insured, and the amount of insurance coverage a statement of what is covered by the policy a summary of the links in the chain of title 6. An owner's title insurance policy, containing the four standard exclusions, would cover loss due to: (A) a forged deed (B) an encroachment of a neighbor's fence (C) an unrecorded materialman's lien (D) parties which have rights by adverse possession 7. A standard owner's title insurance policy on real estate insures the owner's title against which of the following? (A) All past and future title defects (B) Only title defects originating on the date of transfer of title (C) Future title defects only (D) Only title defects originating prior to transfer of title 8. When title insurance is used in a real estate transaction, what is the usual method of payment of the insurance premium? (A) An annual fee to the insurance company (B) As part of the monthly mortgage payment (C) Monthly, in addition to the normal PITI payment (D) As a one time fee at closing 9. Transfer of title by adverse possession is an example of which of the following? (A) Transfer by deed (B) Involuntary alienation (C) Transfer by prescription (D) Color of title 10. Any document affecting title to real estate would be recorded in the county: (A) where the owner resides (C) where the land is located (B) where the owner has his place of business (D) where serving of legal documents is permitted 11. All of the following are true of deeds used in real estate transactions, EXCEPT: (A) a special warranty deed is not a guarantee of clear title (B) a valid deed conveys title from the grantor to the grantee (C) a grantee who receives a special warranty deed has better title protection than a grantee who receives a general warranty deed (D) a buyer would rather receive a special warranty deed than a bargain and sale deed at closing 12. Recording an instrument of conveyance in the public records gives notice of the grantee's interest in the property. This type of notice is called which of the following? (A) Constructive notice 402 (B) Actual notice (C) County notice (D) General notice PAGE 2 TEST 12 13. Hudson conveys Lot 15 to Dewitt who does not record his deed. Hudson later sells the same lot to Thompson, who records his deed and begins to build a cabin on the lot. Upon discovering this, Dewitt's recourse would be which of the following? (A) Sue Hudson for damages (B) Evict Thompson (C) Foreclose on the property (D) Get a quit claim deed from Hudson and record it 14. The law generally provides that no document affecting rights in real property shall be valid against anyone who does not have actual knowledge of such rights unless the document is: (A) acknowledged (B) recorded (C) delivered (D) posted 15. Which of the following transfers a greater interest than the others? (A) General warranty deed (B) Special warranty deed (C) Quit claim deed (D) None of the above 16. The difference between a general warranty deed and a special warranty deed is: (A) the type of warranties (B) the scope of the warranties (C) the quantity of the interest transferred (D) the quality of the interest transferred 17. When a deed is used to convey title to real property, title actually passes when the deed is: (A) recorded (B) signed (C) delivered (D) acknowledged 18. Which of the following would be most beneficial for a seller to use in conveying title to his property? (A) General warranty (B) Quitclaim (C) Bargain and sale (D) Special warranty 19. For delivery of a deed to be effective, it must be: (A) (B) (C) (D) handed directly from the grantee to the grantor an intended delivery on the part of the grantor recorded in the county where the property is located acknowledged before a notary public 20. Rancor signs a deed to his property and gives it, irrevocably in escrow, to a title company to deliver when Brooke deposits $25,000 with the title company. If Rancor dies and Brooke subsequently deposits the money and demands the deed: (A) (B) (C) (D) the deed will pass title to Brooke the deed cannot pass title since the grantor died before delivery the title company must return the money and destroy the deed title will pass only if the grantee signed the deed before Rancor's death 21. Which of the following is essential for the validity of a deed? (A) Words of conveyance (B) Recording (C) Date of the deed (D) Signature of the grantee 22. Which of the following is necessary in order to convey title to joint tenants using a general warranty deed? (A) Both purchasers must sign the deed (B) The grantor must receive valuable consideration (C) The grantor and grantees must be identified in the deed (D) The grantor's signature must be notarized 23. The one who may place a restriction on the use of real estate that is being conveyed by a deed is the: (A) assignor (B) grantee (C) grantor (D) lessor 24. Which of the following is NOT essential in a valid deed? (A) A granting clause (B) A legal description (C) Acknowledged signatures (D) The grantee's name 25. Which of the following statements is true regarding restrictive covenants? 402 PAGE 3 TEST 12 (A) After Woods has sold out his subdivision, he may obtain an injunction against any lot owner who violates the restrictions (B) Deed restrictions are almost always for the benefit of the grantor (C) Restrictions contained in a Declaration of Protective Covenants usually have the effect of reducing property values (D) Restrictions are said to "run with the land" and remain as encumbrances upon use of the property by future owners 26. Homeowner M is home with the flu one day when he notices that Skaeringsson Landscaping is preparing to dig a hole in his front yard in order to plant a 25' spruce tree. M did not order the tree, but is delighted with his good fortune and, several weeks after the tree planting is completed, calls Skaeringsson and tells him that he intends to keep the tree but will not pay for it. In this situation: (A) M may keep the tree without liability to Skaeringsson (B) M must pay for the labor to plant the tree, but does not have to pay for the tree (C) Skaeringsson may recover the cost of the tree and planting from M based on the equitable doctrine of laches (D) Skaeringsson may recover the cost of the tree and planting from M based on the statute of limitations, a legal doctrine 27. When a seller has signed an agreement to sell his house to a buyer, in order for the deed to convey the seller's entire property to the buyer, the deed must contain which of the following? (A) A legal description of the improvements on the property (B) A legal description of the land (C) A description of the land, improvements and appurtenant easements (D) A description of both the land and the improvements 28. If a deed is made out to "Fred Wilson and Donna Wilson," but does not specify what type of concurrent ownership they will have, their ownership will be in: (A) severalty (B) joint tenancy (C) tenancy by the entireties (D) tenancy in common 29. If John and Fran White are married but take title to their new house in joint tenancy as "John White and Fran Osgood, what will be the disposition of the house if John dies a year later willing his property to his son Mike by a previous marriage? (A) (B) (C) (D) Fran will own the house because of right of survivorship Mike will own the house since John and Fran did not own in the same last name The house must be sold and the proceeds divided between Fran and Mike Fran and Mike will each own an undivided one half interest in the house 30. If Mills owns a ski resort condominium which he leases to Edwards for the third week in March, which of the following types of estates is NOT created? (A) An estate for years (B) A freehold estate (C) An estate less than freehold (D) A leasehold estate 31. When various individuals each own a portion of a dwelling and also have a joint ownership interest in the common areas within the property, including the land, this indicates which of the following forms of ownership? (A) An apartment house (B) A cooperative (C) A condominium (D) A townhouse 32. Condominium unit owners hold title to the common elements and the limited common elements of the condominium as which of the following? (A) Tenants in common (B) Tenants in severalty (C) Joint tenants (D) Tenants by the entireties 33. In a partition action resulting from a dispute between two owners of land as tenants in common, the court awarded a portion of the land to each of the owners. Title to the parcels is now held as which of the following? (A) Tenants in common (B) Joint tenants (C) Tenants by the entireties (D) Tenants in severalty 402 PAGE 4 TEST 12 34. Real estate may be transferred by all of the following, EXCEPT by: (A) bill of sale (B) foreclosure (C) will (D) descent 35. An example of an encroachment would be which of the following? (A) (B) (C) (D) A gas line right-of-way across privately owned property Removal of a neighbor's fence from your property A garage that has been constructed over a property line A road between two public highways that crosses private land 36. All of the following unrecorded liens have priority over a purchaser's interest in real estate, EXCEPT: (A) a vendor's lien (B) a special assessment lien (C) an ad valorem tax lien (D) a Federal tax lien 37. When Wally Courshon died intestate, the court appointed administrator had to sell his home to pay his debts. Since the record is unclear as to whether or not the previous owner of the home still had an interest in the property, the administrator would most likely seek to obtain which of the following from the previous owner? (A) A quitclaim deed (B) An administrator's deed (C) A special warranty deed (D) A general warranty deed 38. When a grantor gives a general warranty deed, his warranties differ from the warranties in other types of deeds in that he is warranting against: (A) (B) (C) (D) all encumbrances except those that are disclosed only title defects which occurred during his ownership only title defects which were created by him all encumbrances except those which have not been recorded 39. Marge Holworth gives a life estate in her home to her mother. If her mother then sells her interest to her friend, Margaret, which of the following is true? (A) (B) (C) (D) When Margaret dies, title will revert to Marge When Marge's mother dies, Margaret's ownership will terminate When Marge dies, her mother's interest will terminate It is illegal for Marge's mother to sell her life estate 40. A grantor giving a special warranty deed warrants title against which of the following? (A) (B) (C) (D) Liens disclosed in the deed only All defects which occurred before the deed was delivered All title claims of which the buyer had actual knowledge Only title claims which occurred through, by or under the grantor 41. In joint tenancy ownership of real estate, all of the following are true of each joint tenant, EXCEPT: (A) (B) (C) (D) each owns an undivided interest in the whole property each owns an interest equal to every other owner's interest each may will his interest to his heirs each acquired his interest simultaneously with every other owner 42. Which of the following does NOT have an estate in real property? (A) A lender with a mortgage on real property (B) A tenant in a shopping center (C) A person who owns a house for life (D) A person staying in a hotel overnight 43. A buyer's best protection against title claims when buying real estate is to obtain which of the following? (A) An attorney's opinion of title (B) A general warranty deed (C) An abstract of title (D) A title policy 44. A buyer closes on the purchase of a parcel of land and the broker advises him to record his deed as soon as possible. If the buyer decides to record the deed when he returns from a quick trip to Mexico, he may: 402 PAGE 5 (A) (B) (C) (D) TEST 12 find that another buyer has received a valid deed from the seller during his absence save carrying costs on the property until he records not be liable for real estate taxes or special assessments covering the period of time he is gone be able to reverse the sale up until the time that he records his deed 45. Phil Weir leases space for a retail shop in Frank Woods' commercial center. If the lease is silent regarding trade fixtures, the show cases and equipment Phil installs will become Frank's property: (A) when the lease begins (B) at any time Phil is late in his rent payments (C) if Phil fails to remove these items before the lease terminates (D) when these items are installed in the premises by Phil 46. When a seller agrees to sell his property under a contract for deed, his legal title will be conveyed in all of the following situations, EXCEPT when he: (A) (B) (C) (D) signs a deed and gives it to his broker with instructions to deliver it to the buyer upon his death puts a signed deed into escrow and it is delivered to the buyer after six payments have been received puts a signed deed into escrow with instructions that it be delivered to the buyer upon his death signs a deed and gives it to a title company, as trustee, to be delivered when all payments have been made on the land contract 47. All of the following are true of ownership interests in real estate, EXCEPT: (A) fee simple title is considered to be a perpetual interest in real property and is sometimes referred to as "an estate of inheritance" (B) an owner of a life estate may do anything with his property that a fee simple owner may do (C) a conditional fee owner may transfer his property by will, deed or gift (D) a life estate property owner owns a freehold interest in real estate 48. The grantor in a deed must be: (A) (B) (C) (D) the person identified as seller in the listing the person identified as seller in the contract of sale the holder of the possessory rights in the property the owner of record 49. A condominium owner has an ownership interest in all of the following, EXCEPT: (A) the space between the walls of the units (B) each of the units in the condominium complex (C) the land on which the complex is built (D) the entire condominium complex 50. A condominium owner's association is typically empowered to do all of the following, EXCEPT: (A) (B) (C) (D) 402 file a lien against an owner's unit if he fails to pay his assessments maintain and regulate the common and limited common elements pay real estate taxes on the condominium complex budget for expenses and charge unit owners assessments