Text Transcript - Washington Access Fund

advertisement

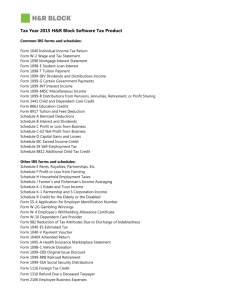

Event Started: 3/4/2013 6:00:00 PM ---------Please stand by for realtime captions. >> [ Participants logging into the presentation. Captioner on stand by. ] . >> To access the presentation, log in to www.ideal-group.or/watf/, c lick on #1, then option #2. >> If you need -- I am Francis and with the Washington access fund which is a statewide nonprofit, dedicated to promoting access to technology and economic opportunity for people with disabilities throughout the state. Today, it is our great pleasure to welcome Jean Ross who is with the IRS. Jean is a Senior tax consultant with the stakeholder partnership education and communication division of the IRS. They are the part of the IRS that does our reach outreach to the community and helps people with organizing free tax preparation programs. They do a whole range of things, Dean Jean has agreed to do this webinar which you did last year. We are glad to have him back. Assisting us today is Kathy Gilman who is our program director at the Washington access fund. Kathy will be helping out in many respects. Let's get started. >> Thank you for the explanation of what SPEC is. For 28 years, beginning in 1985 and in different capacities, SPEC has been about outreach of individuals. We coordinate the volunteer tax preparation sites where you can get returns. I will be talking a little bit about those at the end of the presentation. Also, if you have any questions that are not answered during the presentation, feel free to -we will take questions at the end. Taxes can be really complicated and a lot of the information will be available. I will try to explain what publications it is then, in, where you can find the answer. I will talk about the website as well. >> The topics we will be covering our, the child and dependent care credit, credit for the elderly or disabled, medical expenses, and impairment related work expenses. These topics are of particular interest particularly the impairment related work expenses, but I will also include information regarding per -- free tax preparation at the end as well is a link, which will show you some access to educational materials that you can use to learn more about taxes yourself. >> Let us start with the earned income credit. The earned income credit, the very first thing, it is designed as an incentive to work. It is a very long-standing program. The program began in 1975 and has evolved over the years. It started as a relatively small amount of money available, now it has progressed to what can be very significant in terms of how much credit you can receive. I will talk about how that works. >> The major thing about the earned income credit is that it was designed primarily as an incentive to work and to earn wages. Let's look at what earned income includes. The number one thing is wages. There are tips for anyone in the industry where tipping is c ustomary. Self-employment income is significant, because many people start their own businesses. Many times, that is at the same time they are working regular wage paying jobs. Anyone that is earning income as a household employee is included. Also, this is complicated, certain long-term disability benefits received prior to retirement age. What that means in more understandable terminology is that if you retire before normal retirement age based on the disability, you often will receive the income selling out on a W-2 is wages. You need to talk to your employer if you have questions concerning how the income is reported or whether it was reported properly. There are instances in which the disability income, prior to retirement, can count. That income will normally show up on the W-2 form. >> Earned income does not include a few things. Some common ones are Social Security benefits, workman's comp, Virginia benefits -- VA benefits, all of those are not included in income. They are related to your earned income credit. These incomes for the most part are not taxable on a tax return. Let's look at the amount of earned income credit. That depends on a lot of things the earned income credit can run anywhere from a couple of dollars up to several thousand dollars. It depends on your filing status, your income, there is a phased program. It also depends on your filing status, a single person can get that your earned income, but the amount of the credit is larger if you have dependent children. The credit maxes out for the maximum amount received if you had up to three dependence. >> The publication that explains is the publication 596 which is available on the IRS .gov website. They have the current one. Also, the amount of the earned income credit is calculated normally if you file either electronically yourself or go to a tax preparation sites, or even to a preparer, that is normally calculated when you are filing the tax return. It is a very common thing. The tables are also on paper in the 1040 or 1040 eight income tax tables. >> The most common errors, we will look at these next. It is incorrect filing status, if the person Ms. Marks the return of put down the wrong filing status, also it does not include the qualifying child, for instance if someone leaves off a dependent child or put down and incorrect security number, that is a common error and can affect the return. Another error on this is actually not reporting earned income. In the case of the earned income credit, you actually have to have earned income in order to receive those credits. >> How do you get the credit? The first thing that is important is this, in order to get the error and income credit you must file a tax return and meet some of these rules. The most important thing about this credit is that it is called a refundable credit. We will talk about some other credits that are not refundable, they can reduce tax, but that is all they can do. The earned income credit is like withholding, in other words, let us say you do not owe any income tax at all when you do your tax return. When you look at the it earned income credit table it shows $1000. In a situation like that, the earned income credit would be just like having $1000 withheld. So, in the event that you owed no tax, you would get $1000 back, based on your earned income credit. >> The earned income credit can be received, but you must file. Even if you know that you are not going to owe any taxes, it is important to look at this to see if potentially you can qualify for the earned income credit. Again, that is in the publication when you first look at it it is a long publication, but only look at the parts, and I will say this about any of our publications, concentrate on the parts that affect you. It is easy to sort through those. The earned income credit publication is 596. That is available on IRS .gov or you can order AP a paper copy, as well. >> We will now look at the child and dependent care credit. This is not a refundable credit. That means that you can reduce your tax, in fact you can reduce your tax all the way down to zero, which means you might get a larger r efund, but it isn't like the earned income credit. You cannot get it back on its own, it does not not act as withholding. It is a credit in the sense that it only goes against your tax so we can reduce your tax. >> It is based on the expenses paid for the care of the qualifying person. The qualifying person most often issued dependent. -- most often is your dependent. >> Let's look at the qualifications for the credit. On this one, you must have earned income during the year. The expenses have to be paid and this is how this originated, to allow you to work or to look for work. Also, if your spouse is a full-time student, and this is treated as working during any month of full-time school attendance. >> The most common situation is for a dependent to care for a child. The form we will look at is 2441. There is a publication about this. The public -- publication for the childcare credit, the 2441 has complete instructions on how to calculate the credit. Again, that is form 2441. >> Let's look at it qualifying person. It qualifying person is a person for whom the expenses can be paid. The most common one you will see is a child who is under 13 when the care was provided. [ Silence ] >> It also includes a person who is unable to care for themselves. It could also be a spouse. Essentially, this credit is designed to offset the expenses that you have to pay in order to work, so A percent can care for a someone who is a spouse or a dependent. >> To figure and claim the credit, the credit can be claimed either on the 1040 or the 1040A, cannot be claimed on the easy form. You have too complete and attach form 2441 in order to claim that credit. Some of these forms may look complicated. Bear in mind that if there is some information that it is not understood or missing, you will get notification from the IRS. It should tell you, this is what he we are missing. You need to send it back. If you get something back and you are thinking you're not going to get a credit, that is not necessarily the case. In many ends this, I worked in a walk-in office for a number of years, simply asking you to provide information or information they do not understand. Any kind of notice to get back on any of this, be sure to read the notice carefully. If you have a question, there should be a phone number for you to call on the no. >> -- note. >> The next thing we will look at is the child tax credit and the additional child tax credit. The child tax credit is not a refundable credit. It can reduce your tax, the credit can be up to $1000 for each qualifying child. It is a sickness again credit. I should define the difference here between credit and deduction. A credit reduces your tax dollar for dollar of that is why they are so important and why they can be so beneficial. A deduction reduces your income and you can end up paying less tax based on your tax rate, but a credit is an actual olive for dollar reduction of the tax, not just a lowering of the income. They can be very important in the calculation. >> The additional child tax credit can be available, even if you have a zero tax. [ Silence ] that is calculated on form 8812, that is the additional child tax credit. Probably the best information on that is the actual 8812 instructions which give you line by line instructions. It will tell you to make the entry, again, if you're going to be volunteer site or filing electronically, that is the advantage. It does all the calculations for you based on your entries. >> For both credit, the most common qualifying child is your child. Under 17 at the end of the year is key. There are a few other qualifications. Normally, you will see that these are your dependent children that can qualify you for the child tax credit. It is important that them must have lived with you for more than the half of year and claimed as the dependent on your tax return. [ Silence ] >> You will see some of the instances where it does not have to be your child if you are providing support to a brother, sister, grandchild, etc.. Claiming the credit is pretty simple. You enter the amount of the tax credit on either the 1040 or 1040A. For the additional child tax c redit, again, that is a refundable credit, that is claimed by filing an attaching form 8812. On that additional tax credit you do have to have earned income to qualify. That is covered on the 8812 instructions. >> The next credit we will look at is another credit, this again is not refundable. This is called the credit for the elderly or disabled. You will see the qualifications for this credit. [ Silence ] main qualifiers here is that you can take this credit if you are 65 or older at the end of the year or retired on permanent and total disability and have taxable disability income. If you do not owe any tax, you would be able to claim this credit, because it would not benefit you. This credit was designed for to give people that had taxability -- taxable disability income and relatively low Social Security benefits a tax benefit. It is actually a credit that fewer and fewer people can take over the years as more people have been covered under Social Security. It does still exist. >> In terms of taking the credit, or in terms of the credit itself, it has income limitations that are explained on schedule R that I will talk about animate. It is also affected by Social Security benefits. You use schedule R to determine whether you are qualify for the credit. That would be attached to the tax return. To take the credit, you complete schedule R and that determines the qualifications and amount of the credit. This credit can be taken either on the form 1040A or on form 1040. It is provided for both on the tax return. Schedule R will give you complete instructions on where to put the entries on the tax return. >> [ Silence ] >> Let's look at some medical expenses. Medical expenses, everyone is somebody with medical expenses. They are basically the cost of diagnosis, Doctor appointment, treatment, prevention, anything affecting you medically. The publication that gives that definition of medical expenses is publication 502. 502 is a comprehensive good publication. It probably addresses 99% of questions about medical expenses. In any case, if you are looking at an expense and are not quite sure, you can call the Internal Revenue Service and ask a question. For the most part, our publications to address the questions, but there is going to be the occasional question that does not quite fit. Publications are written for a broad cross-section of questions, but there may be one that might present a problem. >> Some of the most common medical expenses our health insurance premiums. Anytime you make a payment to a physician, medical supplies or equipment, prescription medicines, these are included. Those are the most common of medical expenses. We get a question occasionally regarding service animals. You can include, this is in the publication 502, the cost of b uying, training, and maintaining a service animal. The service animal I am is from the air with our guide dogs. I do not have one, but I am familiar with the blind person having a guide .-dot. There are service animals for various disabilities as well. They can be included as medical expenses. >> Let's look at reporting and deducting medical expenses. For medical expenses, you have to itemize. You have to be able to use schedule . Medical expenses are lines one through four on schedule A. They are the first thing to jump out at two in the first thing you see. The key for medical expenses is to save anything you think might qualify and then sort through it at the end of the year. Medical expenses are reduced by 7.5% of your adjusted gross income. Back calculation is right on the schedule , so you cannot miss it. If you come out with a deduction of $5000 and your adjusted gross income you must reduce debt that reduction by 7.5%. That may turn out to be $3000, you would do a subtraction right on schedule A and that would leave you with a deduction of $2000 that you could make the entry online for. It is a little, Kitty, but it is a way of limiting -- it is a bit complicated, but it is a way to limit the deduction. If you are not certain, look in the publication or call the IRS. If you have something that you are not sure of or is not addressed in our publications, you can call the IRS. >> We will next look at impairment related work costs. Impairment related work costs can cover a lot of different things. They are addressed in publication 529. This is what is important, they are taken online 28 of schedule A as a miscellaneous expense. The big advantage to this over other miscellaneous expenses is this, most miscellaneous expenses are reduced by 2% of your adjusted gross income. That would be business expenses that an employee takes or a number of other things. But, work related impairment expenses are not reduced by 2%, they go online 28 of schedule A and those are a deduction where there is no requirement to reduce it. You do not have to lower it by a percentage over your income. >> If you are a self-employed person and you have the same kind of expenses, they aren't adaptable, also, but they would go on either schedule C or CEZ for self-employed person. You're not missing out, it is just that you use different schedules. >> Here is an example of a work related impairment expense. I took something for my own experience which is a reader. This is an expense -- I'm sorry, can we go back to slide 24. This is the definition of the work related impairment expense. We will then look at the example. I have here a reader. In this example, you are using a reader, because you needed to do your work. >> If you have a reader for both work and personal use, the work related portion is deductible on all of it. The portion that you are using of the readers time and the portion you are paying the reader require you to do your work. This is an example that was pulled from a publication, the 529. It is usually pretty easy to determine. If you are incurring an expense, and this is true for anybody whether they are self-employed or an employee, if you are incurring an expense that is both business and personal, it is important to keep track of what part is business and what part is personal. The deductible part is going to be the part that relates to your work. Again, that is true of a self employed person or an employee, either way. >> Let's look at some filing options that we have. We will then take questions. >> The IRS has several programs for filing tax returns, for this particular program, the program has no cost. There are sites run by AARP, a number in Seattle, where you can get your returns prepared at no cost. >> You can also choose to do the return yourself with facilitated health assistance where there is a volunteer that help you. This is one that is becoming more and more popular and that is looking at pre- files on IRS .gov. That takes you through, if your income is under $57,000, there is a series of questions that ask you what type of income you have and return you're going to be filing. It will take you through options to file your tax return for free. These are private companies that have entered into an alliance to allow the free filing of tax return select on equity. The nice thing about this is you can do it from your home. The VITA site you must the men and bring records. If you want to do it yourself, here is an option for you. >> Another possibility would be to start the free file link and maybe they sure you want to have someone help you with it, then the sites are certainly an option for you. At -- assuming you are getting a refund, you have several options for the reason. You can purchase U.S. saving bonds. You can also direct deposit to a bank. A lot of people split a tax refund and send part party checking, part two savings. That is now another option. Direct deposit is much easier, there is no check issues. It alleviates the cost or the possibility of losing that check are having the check stolen or somewhat compromise. The direct deposit is something that is very much encouraged. It helps everyone out including the IRS. >> The last thing I want to show you is a link called understanding taxes. Understanding taxes was designed as a curriculum for teachers. It is something that can be used for teachers and students and can also be used by anyone who wants to look at the material. This was designed to get people looking at taxes. It takes you to whatever links you are asking about or whatever your inquiry is about. A lot of people have begun to use it in classroom situations, where they are trying to teach people who are doing their own taxes or just getting into the workforce about how taxes work. It covers the kind of work words -- records you need to keep. You can always take a look at the understanding taxes link and see if it meets your needs. >> I have a few questions that came in previously and I will address those now. If you have any questions, you are more than welcome to ask. I will answer them or if I am not able, I will give you the proper referral to look up the i nformation. >> This is a question related to an adult child who did not have any income other than Social Security. In that instant, the child has no filing requirements, because the only income they had was SSI. The parent provides well over half the support and the child lives with the parent. The question was, (inaudible) and the answer is yes. The household filing status would be appropriate in that situation and the child would normally be your dependent on it even though they are over the age of 19 or 24 if they are student. That information regarding dependence and filing status both is included in the publication 501. That is on the website. That has charts in it that take you through and say if you answer this question continue. If you answered no, stop. It takes you to the answer of whether you have on what your filing status would be or if you have someone who qualifies as your dependent. >> [ Silence ] we covered service animal which can be taken as a medical expense. I have some questions regarding the educational expenses. Educational expenses are pretty complicated, but they can be very beneficial. The publication that covers educational expenses is publication 970. Educational expenses can be taken as credit, there are credits available and deductions, the 970 take you through different sonority owes and cover someone who is starting in college and cover someone who is incurring educational costs in their work etc. Yes, educational expenses can benefit you on your taxes, but there our a whole myriad of possibilities as too where you take those expenses. Anyone that is dealing with that or tuition should take a look at the publication 970 to see how they would claim and expense. >> Where the question about adaptive vehicles. The answer is in publication 502. The cost of the vehicle itself is not medical expense, but the difference between the regular cost of vehicle and the cost for an adapted vehicle can be taken as a medical expense. That would include the cost of special adaptive equipment that is required to make the vehicle accessible. That information is found in publication 502 on medical e xpenses. If there are any other questions, I would be happy to take them at this point. . >> I was wondering in the b eginning, you said that the earned income credit is (inaudible). Does that mean Social Security or disability? >> The earned income credit is based on our name come. earned income. A slide that shows what earned income is and then it shows what earned income is not. For instant, Social Security and SSI did not qualify as earned income. For instance, if the only income you have was Social Security or SSI income come a you would not receive that particular credit. >> This is DIN that is not mentioned. >> As SDI is another type of Social Security benefit but it is not considered earned income for that credit. >> Also, does anyone have questions about Social Security d ocumentation? There is a publication on that and it is publication 915. That covers all the different rules regarding Social Security issues on tax returns. >> Is that on the IRS website? The Mac yes, that is at the IRS website. >> Is rental income considered earned income? >> Rental income is not considered earned income. It is income but it is not considered compensation for services. It is shown on a different s chedule, it is on schedule E, and that is publication 527. That talks about the different types of rental income and the different expenses that go along with that. >> What about when you file if you work from home, can you file a portion or deductive portion of your expenses? Can you include electricity, rent, etc. X for Mac yes, that is a possibility. If you are using a part of your home exclusively for your business, that is a possibility. The publication that covers that is 587. The form that is used for self-employed person is form 829. >> Can you repeat that? >> It is 88 29. The publication is the critical thing and that is the 587. >> I have a question, all of this can be complicated and gets down to individual circumstances. Does the free tax prep software available through the IRS website take you through all of those steps and/or if you go to the VITA site can they address these on individual basis? >> They will ask you what type of income you have. Some of the more complicated t hings, they will not address. For instance, medical expenses are common and they can do some schedule Cs that there will be things that crop up that they cannot address address. There is such a variety of things from an expense side regarding this that I cannot say that they would or would not do it. A lot of the software is the same way. It will say you can file this for free, but if it gets beyond this point, no, you cannot use the free program. >> That would put you into a situation where you would have to pay to electronically file or go to a tax preparer. They can do the same thing at a V ITA site and say this return is beyond what we can do. You may then have to go to a paying tax preparer. >> I know that some of the commercial ones guide you through these things come I do not know how good they are. I have personally used TurboTax and of that was helpful. I am guessing that someone could also call the IRS or visit their office to get one-on-one help? >> True, in Seattle, the office is on the Jackson Federal Jackson's federal building on the thirty-second floor. You will be guided to the questions out of scope to someone that can prepare the return. The tax preparation sites do a great job. It is worth checking one of the three options if you want to try to do it yourself. If you want to go to a preparer, that is okay. But it does not cost anything to give it a try on your own. >> Expenses for home in the 587, the 80 ADA 29, I am not sure if that is used any longer. The entry may be to directly enter to this schedule, but that will be covered in the 587. There was a change on that made. That was in the last year or so. >> I have a quick question verifying my understanding. It sounds like to detect both impairment work-related expenses and medical expenses you have to be itemizing. Is that correct? >> Remember for the impairment related work schedules, if you are a selfemployed person that would go directly on your schedule C or C EZ. If you are self employed it is part of your business expenses and it would be different for someone who is an employee. >> That is great to know. >> If you are self-employed, this is where you need to go. A self-employed person is not going to be using that. >> Very good, I had one other question and we are on the website can a person find a free tax prep location? >> A locator on the IRS website should take you to file for free. There should be an indicator on their foray lookup feature. >> Okay, great. >> You can also call the toll-free number. If you cannot find the lookup feature, occasionally things go down on the website, which is something we are all familiar with. You can always call the toll-free number and they can tell can't tell you how to locate a site near you. Also, that should give you both the location and the hours of the site. Some sites are only open one day of week. There are a variety of sites that are open in the afternoons and some are open earlier in the day. One very large site in Seattle is up the library on fourth Avenue, the main library. They do a tremendous number of returns every year. >> There are sites all of the state and plenty in this Seattle/Tacoma areas as well. >> Do we have any other questions from the audience? >> Yes, I have a question. I wanted to find out if your coming even though you have a disability, but you are not claiming a disability processes security purposes, do any of these benefits work for you? >> That is a very good question. >> I am not claiming -- I have a disability, but I am not claiming it, because I feel that I can work around it at this point in my life. I can continue to work. >> I am not limited in what kind of income I can make because of the disability. >> Look at work-related impairment expenses we talked about. You do not have to be on Social Security to be claiming those expenses. You must look at what you are doing and determine that in order to do this, because of the disability, you have to be incurring this expense. I use the obvious example which was a blind person using a reader. I use that myself. Is not an expense for me, but I certainly have used readers in the past to work in different areas. Sometimes it is not as obvious as that. You must sit down and look at the expense, look at the publication, and see if you are meeting this requirement. Am I incurring this expense in order to allow me too do this job. >> Right. >> You look at the publications and you may think you are not sure. That is where he felt call can h elp. They might be able to find an example or something that has come out more recently that says, yes, this is something that has been taken in the past and looks like something you could take or we have never seen this before which can happen also. Yes, it is worth taking a closer look cap -- at. Put together the best record and see if you can take the expense or maybe it does not look like it will work for you. It is not always clear-cut. >> Okay. >> Are you also saying that the definition of disability my very from what you are trying to do next if you're trying to take dependent care tax credit, the definition of disability for that might be different? >> We are talking about essentially in that situation come and that is where someone cannot take care of themselves. They must have care in order for you - and that is the point of that credit. That is different then you say I am working, but I need a reader to read these records for me to allow me too do my job. I hope that make sense. They can be a little bit different. >> Great. Are there any other questions? . >> Thank you so much Eugene, this has been great. I want to point out a couple of things. For those of you who live in Seattle, on March 9, there will be a prefinancial fitness day at Ray near community Center from 10:00 a.m. to 3:00 p.m. At that center, or at the financial fitness day, you will be able to get help with preparing your tax returns, with having someone pull your credit report for you, for financial planning or if you have issues relating to debt, you can get some help with that. Plus, there will be some brief discussion on benefits. If you're interested in that, I encourage you to attend. I will be happy to send you an email to give you more i nformation. >> There are similar financial fitness days in other counties. If you live in a different county county and went to know if there is one there, you can e-mail INFO@w ashingtonaccessfunc. I also wanted to add that if you are a participant in our match savings account program, you can always use your tax return and any dollars you get back to make an extra funding into your match savings account. That is also good to know. Lastly, on March 21, we will be having a webinar in collaboration with the Washington assisted technology asked program on buying hearing aids and hearing related devices. If you're interested in that, just contact us at info @-at-sign Washington access fund .-dot or can we will get you some of that information. >> Following the webinar, probably tomorrow, we will send out a recording of the webinar and also the PowerPoint. You can share with anyone and that would be great. I think that is it. >> Kathy, do you have anything to add? Eugene, do you have anything to a dd? >> I appreciate the opportunity. There is a lot we have not covered, but the website and publications are a huge help. >> Thank you so much and we look forward to working with you again. >> Goodbye. >> [ Event Concluded ]