pset2_answers

advertisement

Akos Lada

Summer Program 2014

Harvard Kennedy School

Problem Set #2

(Due Monday, August 1st)

Please do this problem set on a separate sheet of paper.

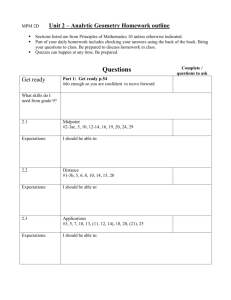

Elasticity and Pricing Decisions (problems 1 and 2)

1. Here’s a short excerpt from an article: “As the chart at the right shows, it was only when the company, in

desperation, lowered the toll to $1 that it has come even close to attracting the expected traffic flows.

Although the Greenway still is losing money, it is clearly better off at this new point on the demand curve

than it was when it first opened. Average daily revenue today is $22,000, compared with $14,875 when

the ‘special introductory’ price was $1.75.”

a) What was the quantity of use of the toll road when the toll was set at $1.75? What about when it was

then set at $1?

ANSWER:

b) Using your answers from part a) and the prices you already knew, use the midpoint method to calculate

the price elasticity of demand over this price range on the demand curve.

ANSWER:

PED = ((Qnew – Qold) / Midpoint) / ((Pnew – Pold) / Midpoint))

PED = ((22,000 – 8,500) / 15,250) / (($1.00 – $1.75) / $1.375) = - 1.62 or 1.62 in absolute terms

c) Based on the answer to part b), is the price elasticity of demand: inelastic, elastic, or unit elastic?

ANSWER: The price elasticity of demand between these two points is 1.62, which is elastic (a bigger %∆ in

QD in response to the initial %∆ in P).

Akos Lada

Summer Program 2014

Harvard Kennedy School

d) Without doing any calculations, how could we have determined whether the price elasticity of demand

was elastic, inelastic, or unit elastic?

ANSWER: We saw that, when the toll operators lowered the toll price, total revenue increased (what we

expected with a PED of 1.62 – i.e., people were responsive so we gained a lot of customers). This means

that the demand curve must be elastic between these points, because the %∆ in QD is larger than the initial

%∆ in P.

(P x Q = TR).

2. Upon graduation from the Kennedy School you take a job with AT&T Wireless Communications (I know

– probably not the job you’re shooting for). Your title is Director of Revenue Management. You are in

charge of setting prices for their standard wireless usage plan (usage plans are based on allotted free

minutes of cell phone use). Currently the standard plan sells for $35 a month. You are trying to decide

whether you should continue with this price point, or increase the plan’s price to $40, or decrease the

plan’s price to $30. Operations have informed you that changes in variable costs (and hence marginal

costs) associated with usage increases or decreases of 10 million customers are negligible.

Note: The setup of the question says that the changes in variable cost will be negligible with an increase or

decrease of usage of 10 million users. Therefore, total costs do not change with the changes in demand

discussed in this problem. Therefore, when total revenue increases so does total profit and when total revenue

decreases total profit does too. I note this because firms are profit maximizers not total revenue maximizers –

but this distinction is inconsequential in this problem.

a) If you increase the price to $40 an independent consulting firm you have contracted with has projected

a decrease in plan holders from 26 million to 20 million (ceteris paribus – i.e., assuming AT&T’s

competitors don’t respond with price changes of their own). What is the price elasticity of demand

coefficient? Over this range of prices, is the price elasticity of demand elastic or inelastic? Would

revenue increase or decrease and by how much? (Use the mid-point formula)

ANSWER:

Qnew = 20 million; Pnew = $40

Qold = 26 million; Pold = $35

PED = ((Qnew – Qold) / Midpoint) / ((Pnew – Pold) / Midpoint))

PED = ((20 – 26) / 23) / ((40 – 35) / 37.5) = - 1.96 or 1.96 in absolute terms

Therefore, demand is elastic over this range of the demand curve. We would expect the TR to go down with a

price increase.

TRold = Pold * Qold = $35 * 26 = $910

TRold = Pnew * Qnew = $40 * 20 = $800

TR would decrease by $110 mil

Akos Lada

Summer Program 2014

Harvard Kennedy School

b) If you decrease the price to $30 your consulting firm projected an increase in plan holders from 26

million to 36 million (ceteris paribus – i.e., assuming AT&T’s competitors don’t respond with price

changes of their own). What is the price elasticity of demand coefficient? Over this range of prices, is

the price elasticity of demand elastic or inelastic? Would revenue increase or decrease and by how

much? (Use the mid-point formula)

ANSWER:

Qnew = 36 million; Pnew = $30

Qold = 26 million; Pold = $35

PED = ((Qnew – Qold) / Midpoint) / ((Pnew – Pold) / Midpoint))

PED = ((36 – 26) / 31) / ((30 – 35) / 32.5) = - 2.097 or 2.097 in absolute terms

Therefore, demand is elastic over this range of the demand curve. We would expect the TR to go up with a

price decrease.

TRold = Pold * Qold = $35 * 26 = $910

TRold = Pnew * Qnew = $30 * 36 = $1080

TR would increase by $170 mil

c) Before making your decision you decide to consult with your industry analyst to see if they anticipate

responses from AT&T’s competitors to any price changes. They inform you that if you raise your

plan’s price your competitors will probably not follow with similar price changes. However, if you

decrease your plan’s price, your competitors probably will follow since AT&T is the price leader (due

to their dominant firm status) in the market. They project that if AT&T decreases its price by $5 on its

standard package, the competitors will follow by decreasing their prices by $5 (to $29) – their current

standard plan price is $34. Further, they predict a co-efficient cross-elasticity of demand of 1.1 for

AT&T’s pricing plans (meaning when your competitors change there price 1.1 is the relative

responsiveness of AT&T’s customers) in relation to your competitor’s pricing plans (if your

competitors were to decrease their prices after AT&T decreased its prices). Based on this information,

how would this impact your revenue forecasts in #2? How much would this impact the total number

of plan holders of AT&T’s standard usage plan? (For this problem, when dealing with % changes,

feel free to use the formula { (Qnew – Qold ) / Qold })

Note: The industry analyst also inform you that your competitors are not planning on making a

pricing change if AT&T does not make a pricing change.

ANSWER:

QnewAT&T = ? million; Pnewcompetitors = $29

QoldAT&T = 36 million; Poldcompetitors = $34

Note: The problem states that your competitors will change their price point after you change yours. These

are sequential activities, not concurrent. Therefore, Qold is 36 million customers (not 26 million – i.e.,

Qold_old – the amount AT&T received after they make their pricing decision (before the competitors). What

we don’t know is how many of the 36 million customers AT&T is going to lose. I admit this is a bit stylized

Akos Lada

Summer Program 2014

Harvard Kennedy School

because it is doubtful AT&T will gain all 10 million customers prior to their competitors changing their plan,

but based on the information given, this is the best way to go about solving the question. As a side point, the

pricing plan of $35 corresponds with a monthly charge. So, the time horizon of problems (a) and (b) could be

assumed to be 1 month – making sequential movements a bit more plausible.

XPED = ((QnewAT&T – QoldAT&T) / Midpoint) / ((Pnewcompetitors – Poldcompetitors) / Midpoint)) = 1.1

XPED = ((QnewAT&T – 36) / 36) / ((29 – 34) / 31.5) = 1.1

Note: A positive XPED number means that the two goods are substitutes, which is what we would expect.

So, QnewAT&T = 29.7 million

So, TR will not be $1,080 million once AT&T’s competitors make the change. Instead, AT&T’s TR on their

standard plan will be 29.7 million times $30 (not 36 million times $30). Thus, the new TR will be $837

million once their competitors lowered their prices.

d) However, you’re still not ready to make your pricing decision. You realize that you need to determine

the impact on AT&T’s own alternative usage plans. In other words, how much is your pricing

decision going to cannibalize AT&T’s other usage plans? You call a meeting with some of your

associates and ask them to run some numbers based on your potential pricing changes in regards to

other AT&T plans. They inform you that only one of AT&T’s other usage plans will be impacted by

your pricing decision. For this package, they estimate the coefficient cross-price elasticity of demand

on this other plan to be 0.9 (meaning we are looking at the other plan’s quantity change) whether you

increase your price by $5 or decrease your price by $5. Currently, AT&T sells 15 million packages of

this particular alternative plan at a price of $25. Based on this information, determine the impact of

increasing and decreasing the price of AT&T’s standard usage plan on AT&T’s total revenue. What

would be the total change to the number of alternative plan holders if AT&T increased their price on

their standard plan? Conversely what be the total change to the number of alternative plan holders if

AT&T decreased their price on their standard plan? (For this problem, when dealing with % changes,

feel free to use the formula { (Qnew – Qold ) / Qold })

ANSWER:

First, let’s see what happens when AT&T decreases their price.

QnewAT&Talternative = ? million; PnewAT&Tstandard = $30

QoldAT&Talternative = 15 million; PoldAT&Tstandard = $35

XPED = ((QnewAT&Talternative – QoldAT&Talternative) / Midpoint) / ((PnewAT&Tstandard – PoldAT&Tstandard) /

Midpoint)) = 0.9

XPED = ((QnewAT&Talternative – 15) / 15) / ((30 – 35) / 32.5) = 0.9

Note: A positive XPED number means that the two goods are substitutes, which is what we would expect.

So, QnewAT&Talternative = 12.92 million

Akos Lada

Summer Program 2014

Harvard Kennedy School

TRold from alternative plan = 15 million * $25 = $375 million

TRnew from alternative plan = 12.92 million * $25 = $323 million (rounded)

Delta in TR = - $52 million

So, this would also have to be subtracted from the $1080 million TR in the ceteris paribus world.

_________________

Now let’s see how many customers AT&T’s alternative plan would gain when they increase the price on their

standard plan.

First, let’s see what happens when AT&T lowers their price.

QnewAT&Talternative = ? million; PnewAT&Tstandard = $40

QoldAT&Talternative = 15 million; PoldAT&Tstandard = $35

XPED = ((QnewAT&Talternative – QoldAT&Talternative) / Midpoint) / ((PnewAT&Tstandard – PoldAT&Tstandard) /

Midpoint)) = 0.9

XPED = ((QnewAT&Talternative – 15) / 15) / ((40 – 35) / 37.5) = 0.9

So, QnewAT&Talternative = 16.8 million

TRold from alternative plan = 15 million * $25 = $375 million

TRnew from alternative plan = 16.8 million * $25 = $420 million (rounded)

Delta in TR = + $45 million

e) Based on all of the analysis that you have performed, what is your pricing decision (assuming you

want to maximize profits – remember, cost are not varying based on the number of plan holders so if

revenue goes up, profits go up)?

ANSWER:

If you make no changes, TR is $910 million on the standard plan ($35 * 26) and $375 million on the

alternative plan. Therefore TR for AT&T corporate is $1,285 million.

When you lower the price on the standard plan the TR goes to $1,080 million on the standard plan (ceteris

paribus). But, when you factor in your competitors lowering their prices your TR will go to $837 million on

the standard plan. So, you already know you don’t want to do this. However, if you do factor in part (d)

things get worse. You will cannibalize $52 million in TR from your alternative plan (the $52 million is in the

$837 million). Therefore, AT&T corporate TR will be $837 million on the standard plan and $323 million on

AT&Ts alternative plan. Therefore, TR for AT&T corporate would now be $1,160 million. It would be a bad

idea for AT&T to lower their price on their standard plan to $30 per month.

Akos Lada

Summer Program 2014

Harvard Kennedy School

When you raise the price on the standard plan the TR goes to $800 million on the standard plan (ceteris

paribus). Not so good, since before you were making $910 on the standard plan. So, if you didn’t do (d) you

have your decision, don’t do the price increase (because remember, the competitors aren’t going to follow

suit). However, if you do factor in part (d) things get a little better. Some of your customers will go to your

alternative plan. The TR on you alternative plan will increase $45 million to $420 million. Therefore, AT&T

corporate TR will be $800 million on the standard plan and $420 million on AT&Ts alternative plan.

Therefore, TR for AT&T corporate would now be $1,220 million – close but still less than if you didn’t make

the change at all. It would be a bad idea for AT&T to raise their price on their standard plan to $40 per month.

f) A month later…your Chief Financial Officer informs you that they believe, based on economic

forecasts, the real disposable income of AT&T’s plan holders will go up an average of 3%. Further, it

is estimated that the coefficient of income elasticity of demand is 0.5 for all price points listed in the

problem. For the pricing decision you made in (e), determine the impact of 3% gain in average real

disposable income on both the quantity of standard usage plans sold and the revenue generated by the

standard usage plan. Is the standard usage plan a normal or inferior good/service? How much will

this change your revenue forecasts for next year? (For this problem, when dealing with % changes,

feel free to use the formula { (Qnew – Qold ) / Qold })

ANSWER:

Qnew = 26 million

Qold = ? million

%∆Income = 3%

Income Elasticity of Demand (IED) = 0.5 (it looks like AT&T’s standard plan is not only a normal good but a

necessity)

IED = ((Qnew – Qold) / Midpoint) / ((Inew – Iold) / Midpoint))

PED = ((? – 26) / 26) / (0.03) = 0.5

Qnew = 26.39 million

TRold = P * Qold = $35 * 26 = $910 million (this year)

TRold = P * Qnew = $35 * 26.39 = $923.65 million (next year)

Therefore, your revenues are not projected to keep up with the rate of income growth (which you knew when

you were told that the IED for your product was less than 1). Your revenue will only go up by 1.5%.

Price Controls and Taxes

3. The market for digestive biscuits is described by the following equations:

QD = 150-P

QS = 2P.

Akos Lada

Summer Program 2014

Harvard Kennedy School

The Digestives Minister has decided that he wants to reduce the consumption of digestive biscuits as

much as possible. The minister is considering either imposing a $40 per unit price ceiling or a per unit tax

of $15 on consumers of digestives.

a) What is the equilibrium price and quantity before any policy is imposed?

ANSWER:

Set supply equal to demand and solve for P or Q.

QD = Qs

150 – P = 2P

3P = 150

P = $50

Therefore in equilibrium P = $50 and Q = 100.

b) Which of the two policies better achieves the minister’s objective and why?

ANSWER:

Since the price ceiling is lower than the equilibrium price, we know it is binding. If the price ceiling is

imposed, then QS = 2*40 = 80 and QD = 110. QS will be the quantity transacted, and there will be excess

demand in the market.

If the tax is imposed, then the consumer demand curve will shift left by the amount of the tax, so that the

after-tax demand curve is QD = 150 – P – tax = 135 – P. Set the after-tax demand equal to the supply and you

get

135 – P = 2P

3P = 135

P = $45

This implies that Q = 90 under the tax.

Since the goal is to reduce consumption as much as possible, the minister should impose the price ceiling.

c) Suppose the minister implements the $15 per unit sales tax on consumers. What is the government’s

revenue?

Akos Lada

Summer Program 2014

Harvard Kennedy School

ANSWER:

Revenue will equal quantity sold times the tax, or 90* $15 = $1350.

d) Suppose the minister imposes a $15 per unit sales tax on producers instead of consumers. Compared

to the tax on consumers, does the market price and quantity change? Explain.

ANSWER:

If the tax is imposed on producers the supply curve will shift left, and QS = 2 (P- tax) or QS = 2 (P – 15). Next,

set supply equal to demand—

150 – P = 2 (P-15)

3P = 180

P = $60 Q = 90

This price is different than the price when the tax is on consumers, as in part b. However, we know that

shifting this tax from consumers to producers has no effect on the effective prices paid by consumers and

received by producers. When the tax is on the consumer, the effective or total price paid is the market price

plus the tax that the consumer must pay to the government. In part b, then, the price paid by the consumer is

the market price of $45 plus the $15 tax for a total price of $60, just as it is here.

e) Suppose the government measured the supply curve incorrectly, and although the market equilibrium

is still the same as you calculated in part a, the actual supply curve is steeper than the government first

thought. Could your answer to part b change? Explain with reference to a graph (you need not use

exact numbers on the graph).

ANSWER: See below

Akos Lada

Summer Program 2014

Harvard Kennedy School