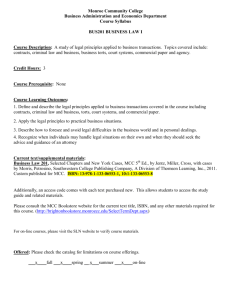

14_Internal Financial Controls_US

advertisement

1

Internal Financial Controls

MCC Resource for Treasurers of Our Local Churches

1

Table of Contents

Internal Financial Controls and Risk Management …………………………………….. 002

Separation of Duties ………………………………………………………………… 002

Physically Safeguarding Cash Receipt s………………………………… 002

Collections……………………………………………………………………………. 003

Counting ……………………………………………………………………………… 003

Recording Cash Receipts………………………………………………………….. 003

Disbursements………………………………………………………………………… 004

About Check Writing…………………………………………………………………… 005

Additional Security Concerns………………………………………………………. 005

Audit…………………………………………………………………………………….. 005

References and Resources …………………………………………………………………. 006

Forms…………………………………………………………………………………………… 007

MCC Resource for Treasurers of Our Local Churches

2

Internal Financial Controls and Risk Management

Unfortunately, churches are not immune to the actions of unscrupulous people, even staff and

volunteers. Indeed, because churches want to operate in an atmosphere of mutual trust, they

can be especially vulnerable if they fail to establish sound internal financial controls. Internal

financial controls are sets of risk management tools, procedures and protocols designed to

safeguard the church’s assets, ensure accurate financial reporting and efficient and effective

use of funds. In addition, internal controls serve to protect staff and volunteers from false

allegations of embezzlement or misuse of funds.

Internal financial controls should be set forth in your church’s Financial Operating Procedures

(FOPs) which describe how you will handle each of these issues. This will provide guidance to

staff, board, and volunteers and is especially important as turnover occurs and new people take

on new roles. Financial Operating Procedures can be as detailed and comprehensive as the

circumstances of your church require. Three examples of FOPs are included at the end of this

Booklet.

Separation of Duties

Separation of duties not only plays a critical role in safeguarding church assets and protecting

staff and volunteers, but also reduces the workload of the church Treasurer. Dividing duties

among a number of people ensures that no one person has the opportunity for or gives the

appearance of improper conduct.

Duties are often separated by receiving and disbursement functions. For example, the individual

who receives and records contributions should not handle disbursements or prepare checks. A

different way to think of separation of duties is to separate recording and reporting functions

from cash handling functions.

Large churches often have paid staff - a financial secretary or administrative assistant, for

example - who posts contributions to individual giving records, posts receipts to the General

Ledger, and performs the monthly bank reconciliation, but does not handle disbursements - this

would typically fall to the Treasurer. Smaller churches often do not have the resources for paid

staff to handle this function and must rely on the Treasurer and volunteers, preferably in the

form of an Assistant Treasurer, who is assigned specific tasks, as set forth in the FOP’s.

Physically Safeguarding Cash Receipts

The primary purpose of internal controls is to protect contributions from members and other

contributors. This begins with appropriate procedures for collecting and counting funds during

church services and other events, as well as any received by mail.

MCC Resource for Treasurers of Our Local Churches

3

Collections…………………………………………………………………………….

003

Collections, during the worship service or other events should always be in the custody of at

least two un-related individuals. This means that the offering should be handed directly over to

counters or placed in a secure, locked location until they can be retrieved by at least two people

responsible for counting. Checks received by mail should likewise be secured until they can be

counted.

Counting ………………………………………………………………………………

003

Counting should occur as soon after collection as possible and should be performed by two unrelated individuals who are, ideally, part of a counting committee that rotates responsibility

frequently. Many churches also take the additional step of requiring the presence of a Board

member during counting. Counting should occur in a secure, locked location, where there is no

“traffic” or interruption.

Deposits should be made immediately following counting whenever possible and should be

made by two people. When it is not possible to deposit receipts immediately, they should be

secured, preferably in a safe or lock box. Cash receipts should NEVER be kept in an

automobile or in someone’s home.

Recording Cash Receipts

Accurate accounting of member contributions and other receipts begins with counters.

Counters should:

Use a ‘count sheet’ to record individual contributions, the purpose of the contribution,

check number (or indicate cash) and to tally totals.

Make sure the amount written on envelopes matches the amount inside the envelope.

Endorse all checks ‘for deposit only’ to the church’s bank account.

Double-check each other’s work.

Ensure that the count sheet totals agree with the deposit slip.

Sign or initial the count sheet and the deposit slip

Deposit the collection intact; that is, without “making change” or disbursing cash to cover

expenditures.

Provide a copy of the count sheet and deposit slip to the person responsible for posting

contributions to individual giving records and to the general ledger.

Checks received via mail should be endorsed “for deposit only” to the church’s account and

held in a secure location until they can be counted and recorded.

Recording of receipts should be handled by a financial secretary, assistant treasurer or

volunteer not involved in handling cash or making disbursements.

MCC Resource for Treasurers of Our Local Churches

4

The Assistant Treasurer should:

Receive a copy of the count sheet and deposit slip from counters.

Post totals to General Ledger.

Ensure that totals on the count sheet and deposit slip match totals posted to General

Ledger.

Post contributions to individual giving records.

Retain count sheets and deposit slips in a secure file.

Perform bank reconciliation each month.

Disbursements

Church FOP’s should designate who has authority to authorize and approve disbursements, the

process for obtaining approval, and how and by whom they are recorded. Approval of

expenditures is often delegated according to the level of expenditure. For example, larger

expenditures may require approval by the Board of Directors, while expenditures below a

certain level might be approved by the Pastor or another staff member. A blanket approval is

often in effect for budgeted operational expenses such as mortgage/rent, utilities and the like.

The task of scrutinizing disbursements for proper documentation and approvals and preparing

checks for signature, and recording transactions often falls to the Treasurer or another

designated individual who does not handle receipt of funds.

Disbursements should:

Be documented via disbursement or check request form accompanied by original

invoices and any other necessary documentation or justification, as well as the signature

of the approving official.

Be paid by serially numbered checks rather than cash;

Always be signed by two authorized signers who carefully inspect the request and

documentation.

Be promptly posted to the General Ledger and should depict date, payee, amount,

purpose, and check number.

Include notation of the check number on the documentation.

Documentation should be retained in secure file.

MCC Resource for Treasurers of Our Local Churches

5

About Check Writing…………………………………………………………………… 005

Church Financial Operating Procedures should include specific protocol regarding signature

authority, check writing, and safeguarding checks. Specifically, these protocols should:

Require two signatures on every check.

Identify who is authorized to sign checks.

Prohibit the person who prepares the checks from signing checks.

Ensure that bank signature cards are updated as signature authority changes.

Prohibit signing blank checks.

Prohibit checks made to “cash.”

Provide for physically securing blank, unused checks.

Additional Security Concerns

Is the location where financial records are stored locked when not in use?

Is access to this location restricted to authorized individuals?

Is access to individual giving records restricted to authorized individuals?

Are credit card receipts or other documents containing sensitive financial information

secured properly?

Audit…………………………………………………………………………………….. 005

An important part of ensuring that your internal financial controls are followed and

provide effective protection is an annual audit by an external auditor and/or internal

audit committee. See Audits Resource for more information on audits.

MCC Resource for Treasurers of Our Local Churches

6

REFERENCES AND RESOURCES

Free Church Accounting http://www.freechurchaccounting.com/internalcontrols.html

“Does your church have appropriate internal control for cash receipts?” The National Public

Accountant, Dale L. Flesher,February 1, 2002. http://www.allbusiness.com/accounting/1304371.html

“Fifty Internal Control Practices for Every Church” The Church Guide to Internal Controls,

Church Law and Tax Report, Richard J. Vargo, 1995

http://dowoca.org/files/treasurer/Internal_Control_Practices_.pdf

AccountingCoach.com www.accountingcoach.com

COGpension.org www.COGpension.org

Brethren of Christ in North America http://www.bic-church.org/

Board Source www.boardsource.org.

MCC Policy Manual http://issuu.com/mccchurch/docs/sample_policy_manual_-us_edition

MCC Resource for Treasurers of Our Local Churches

7

FORMS

MCC Resource for Treasurers of Our Local Churches

8

Sample Financial Operating Procedures ……………………………………………. 009

Count Sheet Sample …………………………………………………………………………. 011

Check Request Form ………………………………………………………………………… 013

MCC Resource for Treasurers of Our Local Churches

9

Forms…………………………………………………………………………………………… 007

SAMPLE 1: FINANCIAL OPERATING PROCEDURES

Church finances shall be under the ultimate direction of the congregation. The Finance

Committee shall make monthly reports to the church.

This Church shall be wholly supported by the voluntary tithes and offerings of members and

friends of the church.

This Church shall operate with a unified budget with one treasury. All funds received for any and

all purposes must be accounted for by the Finance Committee. Financial statements will be

made available to members each month.

The fiscal year shall begin on January 1 and end on December 31.

The Finance Committee shall begin the budget making process, drawing on the input of all the

ministries and teams of the church. The Personnel Committee shall make recommendations

concerning paid employees of the church. The Finance Committee shall present the budget to

the Board of Directors and then to the church. Copies of the proposed budget shall be

distributed to the church members at least one week prior to its adoption during the December

business meeting.

Once an expenditure is approved by inclusion into the church budget, no other approval is

needed – unless due to the church being in a tight economy, the Finance Committee shall

announce a need for prior approval of expenses.

Designated funds must be approved by the church. No one may establish a "designated fund"

simply by the giving. Requests for creating a new fund must first be submitted to the Finance

Committee. If the proffered gift is outside the scope of the current budget or ministry of the

church, they shall bring recommendations concerning the offer to the congregation for approval.

No tangible property may be received by the church without first being accepted by the Finance

Committee.

Separate persons shall be responsible for having custody of church offerings. These persons

will consist of money counters and a depositor. A minimum of three church members is required

to count church offerings at any time.

There will be a requirement of two signatories on all checks.

There will be no staff members participating in the collecting, counting or depositing of church

offerings.

All requests for reimbursements will be submitted on a "Request for Sundry Disbursement" form

which will be submitted to the treasurer with the proper signature approvals.

MCC Resource for Treasurers of Our Local Churches

10

SAMPLE 2: FINANCIAL OPERATING PROCEDURES

A. All financial accounts of _________ MCC will have all members of the Board of Directors as

signatories. In the event the Treasurer performs the accounting functions of the church, the

Treasurer shall not be a signatory on the account.

B. The counting of all offerings will be done by two persons, as directed by the Board of

Directors, and the offerings shall be deposited into the appropriate church bank account.

C. Cash offerings shall not be used to cash personal checks.

D. All requests for funding outside of the budget with the exception of designated gifts shall be

in writing and shall include a written detailed estimate. The funding is subject to Board approval

and the Board shall determine the source account for the funding.

E. An audit of the church’s finances shall be accomplished annually. Such an audit shall be

conducted by an independent third party selected by the Board of Directors.

F. A budget shall be prepared by the Finance Committee and presented to the Board of

Directors at a regular Congregational Meeting annually and shall be approved by a simple

majority. The budget may be changed as required at any Congregational Meeting.

SAMPLE 3: FINANCIAL OPERATING PROCEDURES

1. Authorization for signatures necessary on contracts, checks, and orders for payment,

receipt or deposit or withdrawal of money, and access to securities of ___ MCC shall be

provided by resolution of the Board.

2. Any individual authorized to purchase goods and/or services for the ___ MCC shall

follow the procedures set forth in these policies and the Internal Control Procedures

Manual.

3. The Finance Committee shall be responsible for reviewing and recommending an annual

operating and a capital budget to the Board for review and sending to the

Congregational Meeting.

4. The Congregation shall be responsible for approving the annual operating and capital

budgets.

5. No expense shall be incurred in excess of the total budgetary appropriations without

prior approval of the Board.

MCC Resource for Treasurers of Our Local Churches

11

COUNT SHEET SAMPLE

MCC Resource for Treasurers of Our Local Churches

12

CHECK REQUEST FORM (SAMPLE)

Payable to: [Name of the Person or Vendor to be paid]

Address: [Street or P.O. Box to which the check will be mailed ]

Address 2: [if needed to complete the address]

City/State/Zip: [City, State, Zip code of reciepent]

Telephone Number: [Vendor Phone Number]

Fax Number: [Vendor Fax Number]

Account Number: [The account number given to the church as a corporate identifier]

Amount: [Amount due to the vendor]

Due Date: {Date payment is due to the recipient}

Requested by:

[Name of the person making the request] Date: [Today’s date]

Contact Number: [ Phone number where requstor can be reached to answer questions]

Reason for Request:[State why this purchase made]

Accounting/Budget Line Item Number: [The church’s Accounting or Budget number]

Approved by: [ Name of Person Approving Payment]

Declined due to: [If payment is declined, reason for the decline]

Vendor Number: [ If your church assigns vendor number, record it here for the person inputting

the check informaiton into the Accounting system]

Signature: [Signature of the person approving the issuance of a check]

Check Number: [Record the check number here]

Check Date: [Record the date the check is issued]

Invoice(s) must accompany a completed check request form.

MCC Resource for Treasurers of Our Local Churches