Q&A – Glo-Bus - Bellevue College

advertisement

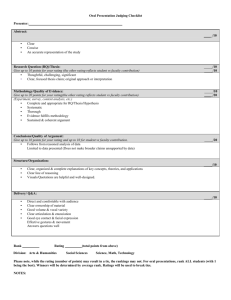

Source: Chris Aquino, Bellevue College Instructor, used with permission Glo-Bus Questions and Answers Q: How can you print a screen you are working in the Decision/Reports module? Use the Print button in the upper right corner of the screen. It will print a single page report summarizing all 45 of your decisions and does NOT require that you Save the decisions before printing. Q: If money is invested into R&D will the company reap the benefits through improved features such as more megapixel, more zoom options, or lower costs? In the real world, a company that spent more on R&D would receive technological improvement to their product verses just improved image ratings. R&D expenditures do not directly affect the cost of camera components. However, R&D does allow one to achieve a desired P/Q rating using lower cost components than would otherwise be necessary. Q: Does the program include any regional price sensitivity adjustments to reflect real-world circumstances? In other words, would it be advantageous to try to "corner" the North American high end market over the Asian-Pacific market because the population of North-America tends to be more affluent and less sensitive to higher prices meaning a higher per camera profit could be achieved? No. Because all companies start out on equal footing from a financial perspective but their regional market share percentage are different, the program was written to keep the demand elasticities the same in all regions. This means any regional strategy has as good a chance as any other of being successful; independent of real-world economic conditions. Q: How is the image rating score determined? The image rating calculation is based on a company’s (1) P/Q rating for both entry-level and multifeatured cameras, (2) market share for both entry-level and multi-featured cameras in each of the four geographic regions, and (3) actions that display corporate citizenship and socially responsibility over the past 4-5 years. The impact each factor has on the image rating score is as follows: P/Q rating = 40%, market share = 40%, and corporate citizenship and social responsibility = 20%. Q: Is the “Match Assembly to Orders” function most efficient or just easy? Use of the “Match Assembly to Orders” button is a quick and dirty way of resetting assembly after changes have been made in product design and marketing. However, you should understand that there may be a more efficient and thus more profitable way to assemble the cameras. Q: How are the Game-to-Date scores determined? Game-to-Date scores are NOT simply an average of the company’s annual I.E. and B.I.I. scores. EPS and ROE are short-term measures, stock price and credit rating are long-term measures, and image rating is a medium-term measure. Game-to-Date scores for all years completed to date are based on a company’s: (1) weighted-average EPS as compared to an average of the EPS targets for all years completed, (2) weighted-average ROE as compared to an every-year ROE target of 15%, (3) average image rating for the 3 most recent years as compared to an every-year image-rating target of 70 (A 3-year average image rating is used to measure game-to-date performance, as opposed to an all-year average, so as not to burden a company’s performance by image ratings that are not representative of the image and reputation it has recently achieved with its strategy.), (4) most recent stock price as compared to the most recent year’s stock price target (The latest stock prices of companies are used here because a company’s latest stock price is a function of EPS growth, ROE, credit rating, dividend per share growth, and management’s ability to consistently deliver good results (as measured by the percentage of these 5 performance targets) and thus includes a heavy long-term element.), and (5) most recent credit rating as compared to the ongoing credit rating target of B+ (The latest year’s credit rating is used here, as opposed to an all-year average credit rating, because a company’s latest credit rating is largely reflective of management’s entire multi-year record of finance-related actions/decisions and the overall financial condition and balance sheet strength that management has engineered to date. The game-to-date scores for credit rating are always the same as for the current-year scores because both are based on the most recent year’s credit rating.). One very important point about the GLO-BUS scoring methodology warrants emphasis: a company’s overall score is what matters (how close company scores are to 100-120 in the case of the I.E. standard and how close they are to 100 in the case of the B.I.I standard), not whether a company is in first or third or fifth or tenth place. There will always be a last place company, but what is truly telling is whether it is in last place with a score of 85 or in last place with a score of 60. Q: How will individual grades be determined for the Glo-Bus group project? (note: revised for Judith’s class) The Glo-Bus group project is worth 30% of the final grade in the class. An individual’s group project grade will be determined by summing the following five four figures: (1) Quiz 1 score times 2.5%, (2) Quiz 2 score times 7.5%, (3) Overall Company Game-to-Date (following SDR7) score times 80%, (4) Peer evaluation scores (including self-evaluation) times 10%, and (5) Group Presentation score times 5%. Q: How are the number of available retail dealers determined and should all that are available each year be utilized? On the Marketing Decision screen, you will see the number of retail chains, online retailers, and local camera shops in each geographic area that are willing to stock and display your brand of digital cameras in the upcoming year—this number is based on the prior-year’s appeal of your company’s camera models and there’s nothing you can do in the upcoming year to attract additional retailers. The company’s four regional sales offices (Milan, Singapore, Sao Paulo, and Toronto) incur costs of $10,000 annually in recruiting and supporting the digital camera sales efforts of the chain-store retailers handling the company’s brands. Support costs for each online retailer stocking the company’s cameras are $4,000 annually, and support costs for each local camera shop that carries the company’s cameras is $200 annually. Worldwide retailer support costs to support the 8,288 dealers stocking the company’s cameras in Year 5 were about $3.3 million. However, if, for any reason (perhaps to cut back on retailer support costs), you do not want to ship cameras to all of the retailers currently willing to merchandise your cameras, then you have the flexibility to drop retailers and restrict deliveries to a smaller number of retailers. Q: What drives competition for cameras? In other words, what factors determine consumer’s choice of whether or not to buy our products? Competition in each of the two product market segments (entry-level and multi-featured digital cameras) is based on 10 factors: price, camera performance and quality (as measured by P/Q), number of quarterly sales promotions, length of promotions in weeks, the size of the promotional discounts offered, advertising, the number of camera models, size of retail dealer network, warranty period, and the amount/caliber of technical support provided to camera buyers. Q: Is there one “best” strategy or will any reasonable strategy be effective? Each company typically seeks to enhance its performance and build competitive advantage via more attractive pricing, greater advertising, a wider selection of camera models, more appealing camera performance/quality, longer warranties and/or more aggressive sales promotion campaigns. Any and all competitive strategy options—low-cost leadership, differentiation, best-cost provider, focused low-cost, and focused differentiation—are viable options. A company can have a strategy aimed at being the clear market leader in either entry-level cameras or multi-featured cameras or both. It can focus on one or two geographic regions or strive for geographic balance. It can pursue essentially the same strategy worldwide or craft slightly or very different strategies for each of the four geographic regions. There’s no built-in bias favoring any one strategy and no “secret” to being an industry leader. Which strategies end up delivering the best performance in any given group of 4 to 12 companies that are competing head-to-head always depends on the competitive interplay among the specific decisions and strategies of rival companies—there absolutely is no “magic bullet” strategy or competitive approach that co-managers are challenged to discover in trying to out-compete rivals. Most any well-conceived, well-executed strategy is capable of succeeding, provided it is not overpowered by the strategies of competitors or defeated by the presence of too many copycat