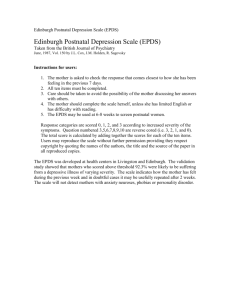

for FY 2014-15 projected by EPDS

advertisement