LENOVO: NOT YOUR FATHER’S IBM

Andrew Feldstein & Pradeep Gopalakrishna, Pace University

Case Objectives and Use

This case is best suited at the undergraduate level for introduction to marketing, international

marketing and international management respectively. The case should accompany class

discussions on global “branding” (brand development, country of manufacture vs. brand equity),

In this case, the decision maker Steve Ward has to outline a strategic market plan for the next

five years reflecting upon the choices available to Lenovo. Given, the shift in emphasis of global

marketers from North American and European markets to “emerging” markets, the case

promises a lively and interesting discussion. The instructor can begin the case discussion with

Michael Porter’s 3 critical tests to evaluate acquisitions. First, the attractiveness test (how

attractive is the business, in this case the U.S PC market), the cost of entry (does the cost of entry

take away all the expected profits of the deal?), and the “better off test (at least one, preferably

both, should benefit from the deal, i.e., either IBM or Lenovo should benefit). In this case,

although we mention potential benefits for IBM, we are concentrating on the Lenovo side of the

deal. The first question deals with the “attractiveness” component. The second question deals

with the cost of entry. Both questions deal, to some extent with the “better off” aspect. The third

question deals with the integration of acquisitions and the compatibility issue.

Case Synopsis

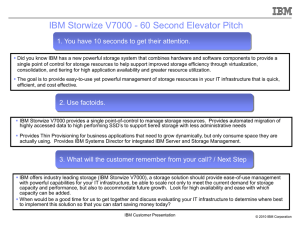

It was not too long ago when IBM and PCs were synonymous terms. With the onslaught of

competition from the likes of Dell and HP in the 1990s, IBM’s PC division resigned to lower

margins and profits, and thus faced the cruel reality of having to divest itself of the PC division.

Lenovo, a Chinese company had acquired IBM’s PC division for $1.75 billion in cash, stock and

assumed liabilities. Lenovo Group Limited (formerly Legend Group Limited) was reported to be

the largest IT firm in China, with a staff of 19,000 with the addition of IBM employees. Lenovo

and IBM were not strangers to working together as Lenovo had been distributing IBM products

in China since 1984 when they first began doing business as Beijing Legend. Lenovo acquired

exclusive access to the IBM logo for 5 years and as well as the ThinkPad brand outright. The

combined companies occupied a number three position in the global PC market behind Dell and

HP. IBM stood to profit considerably from this deal, gaining a stronger relationship with the

Chinese government. With the improved access, IBM could concentrate on extending their

service and software company into China. Steve Ward, senior V.P. & General Manager of the

systems group, knew he was going to face formidable challenges as he was reflecting on the

future of the Lenovo brand.

______________________________

The authors developed the case for class discussion rather than to illustrate either effective or ineffective handling of

the situation. The case, instructor’s manual, and synopsis were anonymously peer reviewed and accepted by the

North American Case Research Association (NACRA) for its annual meeting, October 27-29, 2005, North

Falmouth, MA. All rights are reserved to the authors and NACRA. © 2005 by Andrew Feldstein and Pradeep

Gopalakrishna.. Contact person: Pradeep Gopalakrishna, Lubin School of Business, Pace University, One Pace

Plaza, New York, NY 10038, 212-619-6456, pgopalakrishna@pace.edu