ECON 4000 TEST #1 SPRING 2011

advertisement

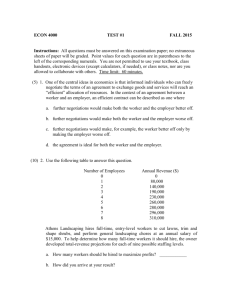

ECON 4000 TEST #1 ANSWER KEY FALL 2015 Instructions: All questions must be answered on this examination paper; no extraneous sheets of paper will be graded. Point values for each question are in parentheses to the left of the corresponding numerals. You are not permitted to use your textbook, class handouts, electronic devices (except calculators, if needed), or class notes, nor are you allowed to collaborate with others. Time limit: 60 minutes. (5) 1. One of the central ideas in economics is that informed individuals who can freely negotiate the terms of an agreement to exchange goods and services will reach an “efficient” allocation of resources. In the context of an agreement between a worker and an employer, an efficient contract can be described as one where a. further negotiations would make both the worker and the employer better off. b. further negotiations would make both the worker and the employer worse off. c. further negotiations would make, for example, the worker better off only by making the employer worse off. d. the agreement is ideal for both the worker and the employer. (10) 2. Use the following table to answer this question. Number of Employees 0 1 2 3 4 5 6 7 8 Annual Revenue ($) 0 80,000 140,000 190,000 230,000 260,000 280,000 296,000 310,000 Athens Landscaping hires full-time, entry-level workers to cut lawns, trim and shape shrubs, and perform general landscaping chores at an annual salary of $15,000. To help determine how many full-time workers it should hire, the owner developed total-revenue projections for each of nine possible staffing levels. a. How many workers should be hired to maximize profits? ______7______ Page 2 b. How did you arrive at your result? By hiring the 7th worker, MR = $16,000 > MC = $15,000. However, if an 8th worker was hired MR = $14,000 < MC = $15,000. (15) 3. Your company is considering hiring one of two applicants, Marianne or Ginger, for a senior management position that pays $100,000 per year. If Marianne is hired, she will reliably add $200,000 in (gross) value to your company each year. However, there is a 50% probability that Ginger, if hired, will produce $500,000 in added value per year and a 50% chance that she will annually destroy $100,000 of company value. Ginger’s true value to the firm (whether she is a “star” or a “lemon”) will be known at the end of the one-year probationary period, after which the position is considered to be “permanent.” a. What are the expected values during the first year of hiring Marianne and Ginger? E(M) = $200,000 ̶ $100,000 = $100,000. E(G) = (0.5)($500,000) + (0.5)(-$100,000) ̶ $100,000 = $100,000 b. Whom would you hire? Why? Ginger. Even though hiring Marianne is associated with the same expected value, there is greater upside potential with Ginger. If Ginger turns out to be a “lemon” and destroys $100,000 of company value, she can be terminated after the one-year probationary period. (10) 4. Many consulting and law firms use lengthy probationary periods to determine which associates will be offered partnerships, which typically come with a permanent equity or ownership interest in the firm. a. Why do these companies use such a costly screening process to evaluate new hires rather than rely on more easily observable educational credentials like college/university reputation, grade point average, or class rank? Workers initially know more than their employers about certain aspects of their qualifications and suitability for the job. That is, there is asymmetric information. A lengthy probationary period enables the employer to acquire additional information with which to evaluate the Page 3 employee’s value added. The “up-or-out” nature of the competition for partnerships gives the employer an opportunity to terminate those associates whose cost exceeds their value to the company. c. Does self-selection by applicants increase or decrease the effectiveness of using a lengthy probationary period as a screening device? Briefly explain. Increase. Individuals who are relatively confident of their prospects for performing well during the probationary period and ultimately succeeding in the up-or-out tournament will be more likely to apply for such jobs. (10) 5. An increasing number of persons with high-school diplomas obtained them by passing the General Educational Development (GED) test rather than completing twelve years of formal schooling. Several studies have shown that GED recipients earn between 6% and 9% more than high-school dropouts who do not obtain the GED diploma. However, when these same studies control for innate ability (using scores on standardized tests), the return to obtaining a GED is approximately zero. Do these results suggest that the process of acquiring the GED is primarily a human-capital investment that increases worker productivity or primarily a signaling device? Explain your answer. The evidence indicates that the GED is primarily a signaling device. Relatively high-ability high-school dropouts, for whom obtaining a GED is less costly than for low-ability dropouts, are trying to signal their quality to prospective employers. If the GED reflected additional knowledge and skills gained through the program that is independently valuable on the job, then the “economic return,” the positive wage differential for GED recipients, would not fall to zero once innate ability was controlled for. Page 4 (10) 6. In companies where worker turnover is especially costly (for example, because the skills learned through on-the-job training and work experience are highly firm-specific), job tasks and the flow of work are often designed around teams to minimize such costs. List two methods of task or work-flow design that serve the purpose of minimizing turnover costs. Collaboration on teams: organize tasks so that they are performed by a group of workers that is not dependent on any one member for success. Cross-training: train each employee to perform more than one task Job rotation: regularly require each employee to work a variety of units and jobs within the organization. Knowledge management: require key employees to write down in detail the responsibilities, skills, processes, and assessments required for successful completion of major tasks. (10) 7. Other things equal, the optimal level of turnover will be [insert “higher” or “lower” in the appropriate blank] if a. the number of positions in the company declines dramatically as one moves up the organizational hierarchy. __ higher__ b. the training undertaken in the company is largely firm-specific. lower__ (10) 8. Describe two types of workers currently employed at other companies (”targets”) who are least likely to cause a raiding firm to suffer the “winner’s curse” by hiring them. A worker who 1. has recently completed a degree (e.g., a part-time MBA) or a general training program. 2. is employed by a firm in a rapidly changing (especially a declining) industry. 3. is employed in an industry experiencing rapid but non-uniform technological change. Skilled employees who work for firms that are lagging behind the market leader are especially ripe for raiding. Page 5 (10) 9. Asset-management firms and real estate companies often require their employees to agree, in the event they quit, not to contact former clients for a period of at least one year. a. What type of “capital” (general or firm-specific) does a client list represents in such a non-compete agreements? general human capital b. Describe one other policy, besides a non-compete agreement, which a business could use to deter its employees from quitting and taking a client list or other form of intellectual property to another company. 1. Pay for performance: the firm can tie compensation to the value to the firm that is generated by clients developed by the employee. 2. Deferred compensation: the firm can make the additional compensation associated with the value of the client list contingent on staying with the firm a certain period of time. (10) 10. In 2012, Federal Express (FedEx) offered a voluntary buyout plan to salaried employees in its corporate, express, services, and IT divisions who had accumulated at least 5 years of continuous service with the company. Which two of the following commonly adopted terms and conditions were not included in the FedEx buyout offer? (Circle the letters corresponding to your two choices.) a. b. c. d. e. short window for acceptance of the buyout credible threat of future layoffs rapid implementation bridge to retirement job-search assistance