UNIVERSITAS INDONESIA FACULTY OF ECONOMICS AND

advertisement

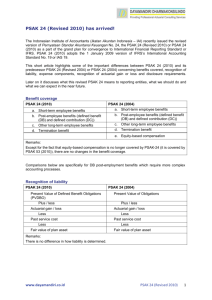

UNIVERSITAS INDONESIA FACULTY OF ECONOMICS AND BUSINESS DEPARTEMENT OF ACCOUNTING UNDERGRADUATE PROGRAM SYLLABUS AKUNTANSI KEUANGAN 2 (FINANCIAL ACCOUNTING 2) ECAU601203 SEMESTER II 2015/2016 No. 1 2 Lokasi Depok Depok Depok Depok Alamat E-mail farah_mj@yahoo.com 3 Nama Pengajar Aria Farah Mita Dwi Martani / Kurnia Irwansyah Rais Taufik Hidayat 1 2 3 Nurul Husnah Ralliyati Viska Anggraita Salemba Salemba Salemba Nurulhusna78@gmail.com Rally222@gmail.com Viska257@gmail.com Subject Code ECAU601203 Subject Title Credit Value Pre-requisite/ Co-requisite/ Exclusion Role and Purposes Financial Accounting 2 3 Financial Accounting 1 taufikwalhidayat@gmail.com This course is part of the financial accounting class which consists of the Financial Accounting 1 and Financial Accounting 2. This course is a continuation of the Financial Accounting 1, which aims to provide understanding of the concept and application of the accounting treatments of the elements of the financial statements based on Statement of Financial Accounting Standards (SFAS) in Indonesia (PSAK) and the International Financial Reporting Standards (IFRS). The knowledge and skills acquired from this subject will be an important basis for developing accounting competence. This course discusses accounting treatment (recognition, measurement, presentation and disclosure) in the financial statements for long-term liabilities, equity, compound financial instruments, investment, revenues, accounting for income tax, and lease based on Indonesia financial accounting standards (PSAK) and the IFRS. This course also discusses the preparation of a cash flow statement, the accounting treatment for errors and changes in accounting, the accounting treatment of events after the reporting period and the application of financial accounting standards for entities without public accountability (SAK ETAP). Subject Learning Outcomes Subject Synopsis/ Indicative Syllabus Upon completion of the subject, student will be able to: 1. Apply International Financial Reporting Standards (IFRSs) or other relevant standards to transactions and other events a) Apply the accounting treatment for transactions involving long-term liabilities, equity, investment, corporate income taxes, leases, revenue recognition, changes in estimates, accounting policies and correction of errors, in accordance with Indonesia Financial Accounting Standards (PSAK) and the IFRS. (T2) b) Explain the accounting treatment for entities without public accountability (T2) 2. Evaluate the appropriateness of accounting policies used to prepare financial statements c) Compare several methods to record the assets and liabilities and is able to choose the methods that can be applied in accordance with Indonesian Financial Accounting Standards (PSAK) and IFRS-related (T3) d) Explain the difference between SAK ETAP and PSAK (T3) 3. Prepare financial statements, including consolidated financial statements, in accordance with IFRSs or other relevant standards e) Apply techniques of the preparation of Statement of Cash Flows (T4) Week# 1 Topic and Sub Topic Long Term Liabilities Bonds Payable: o Issuing Bonds o Types and Ratings of Bonds o Valuation of Bonds o Effective interest method Long Term Notes Payable: o Zero interest bearing notes o Special notes payable situation Special issues: o Extinguishment of noncurrent liabilities o Fair value option Presentation and Disclosure LO a,c Reading Materials KW ch 14 PSAK 50 (2013), 55 (2013) MHO Ch 25, 26, 40. 2 Stockholder Equity 3 Dilutive Securities ISAK 11 PSAK 61 UU PT No. 40/2007 a a 5 Earning Per Share-Simple Capital Structure Earning Per Share-Complex Capital Structure Presentation and Disclosure Investment – Debt Securities 6 Equity Investment at Fair Value Equity Method Consolidation Impairment of Value Transfer between Categories Presentation and Disclosure KW ch 16 PSAK 56 (2010) a, c KW ch 17 PSAK 50 (2013), 55 (2013), PSAK 60 (2013) Accounting for Financial Asset Debt investment: Amortised Cost Debt investment: Fair Value Investment – Equity Securities KW ch 16 PSAK 50 (2013), 55 (2013), PSAK 53 Debt & Equity Convertible Debt Convertible Preference Shares Share Warrant Accounting for Share Compensation Presentation and Disclosure Earning Per Share KW ch 15 PSAK 50 (2013) Corporate Form of Organization Equity Preference Shares Treasury Shares Dividend Policy Government Grants Presentation and Disclosure 4 a a,c KW ch 17 PSAK 15 (2013), PSAK 50 (2013), PSAK 55 (2013), PSAK 60 (2013) 7 Statement of Cash Flow e 8 Preparation of the Statement of Cash flows: Direct & Indirect Method Special Problems in Statement Preparation Interest and dividend Gross or net amount Accounting for Leases (part 1) KW ch 23 PSAK 2 (2009) a,c KW ch 21 PSAK 30 (2011) The Leasing Environment Accounting by Lessee Accounting by Lessor ISAK 8, ISAK 23, 24 9 Accounting for Leases (part 2) a,c 1011 (CL) 12 Special Accounting Problems Residual Values Bargain Purchase Options (lessee) Initial Direct Cost (Lessor) Sales-type Lease (lessor) App B: Sale and Lease-back Presentation and Disclosure Revenue Recognition PSAK 30 (2011) a,c Current Environment Revenue Recognition at Point of Sale Long Term Contract (construction) Other Revenue Recognition Issues Services Interest, Dividend, and Royalty Customer Loyalty Program Accounting for Income Tax Fundamental of Accounting for Income Taxes Accounting for Net Operating Losses Review of the Asset Liability Method Presentation and Disclosure KW ch 21 KW ch 18 PSAK 23 (2010), PSAK 34 (2010), ISAK 10 a,c KW ch 19 PSAK 46 (2013) 13 Accounting Changes & Error Analysis a KW ch 22 14 PSAK 25 (2009) Changes in Accounting Policy Changes in Accounting Estimates Correction of Errors Motivation of Change of Accounting Policy Errors analysis: o Statement of Financial Position Errors o Income Statement Errors o Preparation of Financial Statement with Error Correction Special Topics in Financial Reporting PSAK 8 (2009) a,b,d Subsequent Events Reporting for Entities without Public Accountability SAK ETAP (2009) Teaching/Learning Teaching method uses active lecturing and class discussions, in which students Methodology achieve the study objectives by discussing and completing related problems or cases under the guidance of lecturer. The problems and cases are taken from the text book and other sources. There are several sessions that use small group discussion and collaborative learning with simple jigsaw approach. Students are also required to attend the tutorial sessions and practicum to improve their technical skill related to all topics in this subject. The students will be required by tutor to complete the problems, quizzes, and home works. Assessment Method in Alignment with Intended Learning Outcomes Specific Assessment Methods/Tasks % Weighting Continuous Assessment GROUP Collaborative Learning (5%) INDIVIDUAL Mid Term Exam (35%) Final Exam (35%) Collaborative Learning, participation & discussion (5%) Quizzes (10%) Tutorial/Home work (10%) 100% 5% Intended Learning Outcomes to be Assessed a b c d e √ √ √ √ √ 80% 40% √ 10% √ 20% 20% √ 5% √ 25% √ √ √ √ √ √ √ √ √ √ √ 95% Details of learning methods Student Study Effort Expected Reading List and References The specific learning methods used in this subject are: 1. Lecturing 2. Small Group Discussion Almost in all sessions, the students will participate in small group discussion. The discussion is designed to raise their curiosity as well as to solve some assignments. 3. Collaborative Learning At session 9 and 10 uses collaborative learning with simple jigsaw approaches, in which students are divided into groups and discuss the specific cases in Home Group Discussion (HGD) and Focus Group Discussion (FGD). The cases are divided into several topics for FGD and then all of FGD’s topics will be discussed in HDG. In each discussion (FGD and HGD) students will assess their peer in a peer review form. Finally, each group will present the results of discussions with the lecturer as facilitator. Results of the discussion and presentations are expected to improve students understanding about the concept and the implementation based on cases. This presentation sessions are also expected to benefit the students to learn from other focus group discussion. Class Contacts: Lectures Tutor Collaborative Learning Presentation Other student study effort: Preparation for project/assignment/tests 28 Hours 20 Hours 4 Hours 2 Hours 20 Hours Required Readings: 1. Kieso, Donald E., dan Jerry Weygandt, Warfield, Terry., Intermediate Accounting, IFRS Edition, 2nd edition, John Wiley and Sons, 2014 (KW) 2. Lau, Peter and Lam, Nelson, Intermediate Financial Reporting: An IFRS Perspective 2nd ed, McGraw-Hill, 2011 (LL) 3. Martani, Dwi, et al., Akuntansi Keuangan Menengah 2, Penerbit Salemba Empat, 2014 (AKM2) 4. Relevant PSAK 5. Mirza, Abbas Ali, Graham J. Holt, dan Magnus Orrell, International Financial Reporting Standards (IFRS), Workbook and Guide, 2nd edition, John Wiley, 2010 (MHO) Supplementary Readings: 6. Epstein, Barry J., Abbas Ali Mirza, IFRS 2010: Interpretation and Application of International Accounting and Financial Reporting Standards, John Wiley, 2009.