Econometrics(計量經濟學)

advertisement

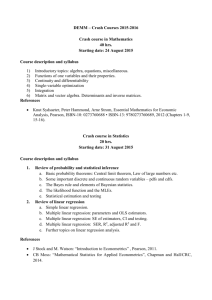

Econometrics(計量經濟學) Institute of Business Administration and International Business By Professor Hsin Hong Kang Sep, 2012 Lectures: Prerequisite: Introductory Level of Statistics Textbooks: 1. Damodar Gujarati, Essentials of Econometrics, McGraw-HILL International Editions, 4th edition, 2010 新月圖書公司, TEL:02-2331-7856, 0933709103 2. G.S. Maddala, Introduction to Econometrics, John Wiley & sons, Ltd, 4th edition, 2009 華泰文化事業股份有限公司, TEL:02-2377-3877 中文參考書目: 1. 計量經濟學 黃台心著 雙葉書廊有限公司(02)2368-4198 2. 財金計量 鍾惠民、吳壽山、周賓凰、范懷文合著 雙葉書廊有限公司 (02)2368-4198 Course Requirements: 1. Problem sets and class attendance: 60% 2. Research project: 40% Note: I will not accept “late” problem sets and research projects Course Objectives: 1. The main purpose of this course is to learn how to use econometrics methods to conduct an empirical research in the areas of business, finance, economics, marketing and social science. 2. We will emphasize the applications rather than the theories of econometrics. 3. We will emphasize the “intuition” behind the procedures involved in econometrics analysis and concentrate upon achievement of proficiency in the implementation and interpretation of econometrics models. Lecture Outlines: The brief lecture outlines will be introduced in the first lecture. However, these brief lecture outlines will be modified as the course progresses. The Contents: 1. The Nature and Scope of Econometrics 1.1 What is Econometrics? 1.2 Why Study Econometrics? 1.3 The Methodology of Econometrics 1.4 The Road Ahead Key Terms and Concepts Basic Ideas of Liner Regression: The Two-Variable Model 2.1 The Meaning of Regression 2.2 The Population Regression Function(PPF) 2.3 Statistical or Stochastic Specification of the Population Regression 2. Function 2.4 The Nature of the Stochastic Error Term 2.5 The Sample Regression Function(SRF) 2.6 The Special Meaning of the Term “Linear Regression” 2.7 Two-Variable Versus Multiple Linear Regression 2.8 Estimation of Parameters 2.9 Putting it All Together 2.10 Summary The Two-Variable Model: Hypothesis Testing 3.1 The Classical Linear Regression Model 3. 3.2 Variance and Standard Errors of Ordinary Least Squares Estimators 3.3 The Properties of OLS Estimators 3.4 The Sampling, or Probability, distributions of OLS Estimators 3.5 Hypothesis Testing 3.6 How Good is the Fitted Regression Line 3.7 Reporting the Results of Regression Analysis 3.8 Computer Output of the Math S.A.T Score Example 3.9 Normality Tests Multiple Regression : Estimation and Hypothesis Testing 4.1 The Three-Variable Linear Regression Model 4. 4.2 Assumption of the Multiple Linear Regression 4.3 Estimation of the Parameters of Multiple Regression 4.4 Goodness of Fit of Estimated Multiple Regression 4.5 Antique Clock Auction Prices Revisited 4.6 Hypothesis Testing in a Multiples Regression 4.7 Testing Hypothesis About Individual Partial Regression Coefficients 4.8 Testing the Joint Hypothesis 4.9 Two-Variable Regression in the Context of Multiple Regression 4.10 Comparing Two R2 Values ◎ Maddala: Chow Test ◎ Maddala: Nested Hypothesis 5. Functional Forms of Regression Models 5.1 How To Measure Elasticity 5.2 Comparing Linear and Log-Linear Regression Models 5.3 Multiples Log-Linear and Regression Models 5.4 How to Measure the Growth Rate 5.5 The Lin-Log Model 5.6 Reciprocal Models 5.7 Polynomial Regression Models 5.8 Regression Through the Origin 5.9 A Note on Scaling and Units of Measurement 5.10 Regression on Standardized Variables 6. Dummy Variable Regression Models 6.1 The Nature of Dummy Variables 6.2 ANCOVA Models 6.3 Regression on One Quantitative Variable and One Qualitative Variable With More Then Two Classes or Categories 6.4 Regression on One Quantitative Explanatory Variable and More Than One Qualitative Variable 6.5 Comparing Two Regression 6.6 The Use of Dummy Variables in Seasonal Analysis 6.7 What Happens if The Dependent Variables is Also a Dummy Variables? 7. Model Selection: Criteria and Tests 7.1 The Attributes of a Good Model 7.2 Types of Specification Errors 7.3 Omission of Relevant Variable Bias 7.4 Inclusion of Irrelevant Variables 7.5 Incorrect Functional Form 7.6 Errors of Measurement 7.7 Detecting Specification Errors 8. Multicollinerity: What Happens If Explanatory Variables are Correlated? 8.1 The Nature of Multicollinearity 8.2 The Case of Near, or Imperfect, Multicollinearity 8.3 Theortical consequences of Multicollinearity 8.4 Practical consequences of Multicollinearity 8.5 Detection of Multicollinearity 8.6 Is Multicollinearity Necessarily Bad? 8.7 An Extended Example 8.8 What to Do With Multicollinearity 9. Heteroscedasticity: What Happens If the Error Variance Is Nonconstant? 9.1 The Nature of Heteroscedasticity 9.2 Consequences of Heteroscedasticity 9.3 Detection of Heteroscedasticity 9.4 What to Do If Heteroscedasticity is Observed 9.5 White’s Heteroscedasticity-Corrected Standard Errors and t Statistic 9.6 Some Concrete Examples of Heteroscedasticity Autocorrelations: What Happens If Error Terms Are Correlated? 10.1 The Nature of Autocorrelation 10.2 Consequences of Autocorrelation 10. 10.3 Detecting Autocorrelation 10.4 Remedial Measures 10.5 How to Estimate 10.6 A Large Sample Method of Correcting OLS Standard Errors Simultaneous Equation Models 11.1The Nature of Simultaneous Equation Models 11.2 The Simultaneous Equation Bias 11.3 The Method of Indirect Least Squares(ILS) 11. 11.4 Indirect Least Squares 11.5 The Identification Problems 11.6 Rules For Identification 11.7 Estimation of an Overidentified Equation 11.8 2SLS: A Numerical Example Selected Topics in Single Equations Regression Models 12.1 Dynamic Economic Models 12.2 The Phenomenon of Spurious Regression 12. 12.3 Tests of Stationary 12.4 Cointegrated Time Series 12.5 The Random Walk Model 12.6 The Logit Model