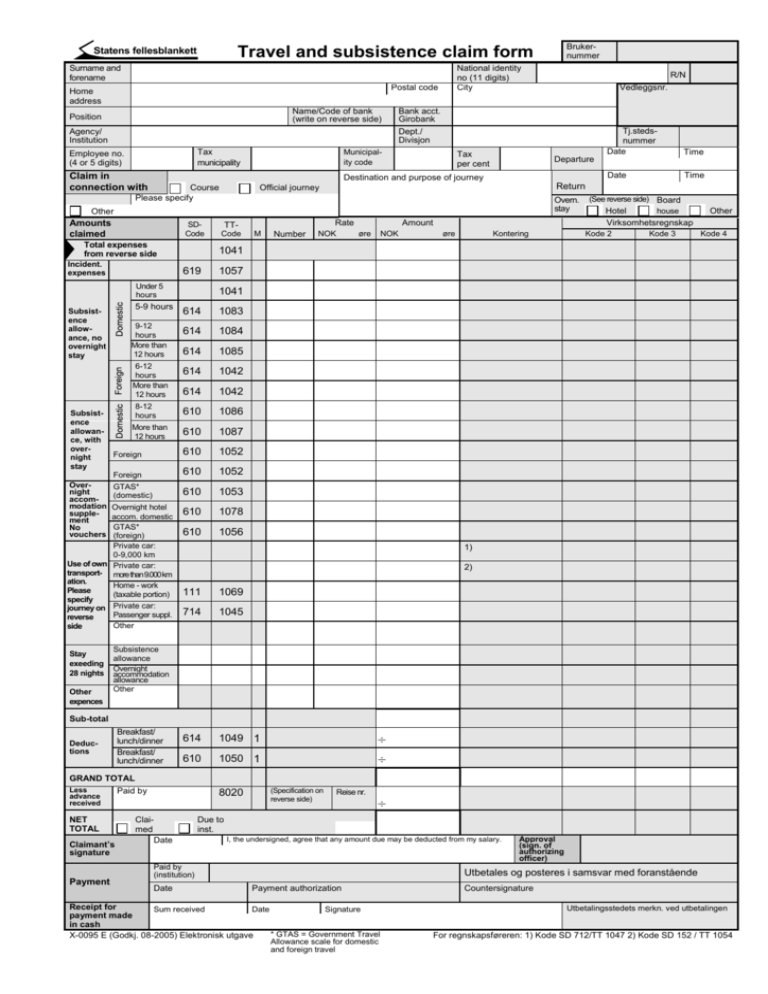

Travel and subsistence claim form

advertisement

. Statens fellesblankett Surname and forename National identity no (11 digits) City Postal code Home address Name/Code of bank (write on reverse side) Position Agency/ Institution Tax municipality Employee no. (4 or 5 digits) Claim in connection with Bank acct. Girobank Dept./ Divisjon Municipality code Tax per cent Amounts claimed SDCode Total expenses from reverse side Overn. stay Incident. expenses 619 614 1084 614 1085 614 1042 614 1042 610 1086 610 1087 Foreign 610 1052 Overnight accommodation supplement No vouchers Foreign 610 1052 GTAS* (domestic) 610 1053 610 1078 610 1056 8-12 hours More than 12 hours Overnight hotel accom. domestic GTAS* (foreign) Private car: 0-9,000 km Use of own Private car: transport- more than 9.000 km ation. Home - work Please (taxable portion) specify journey on Private car: Passenger suppl. reverse Other side Stay exeeding 28 nights Other expences NOK Amount øre NOK (See reverse side) Board house Hotel Other Virksomhetsregnskap øre Kontering Kode 2 Kode 3 Kode 4 1041 1083 6-12 hours More than 12 hours Number Time 1057 614 9-12 hours More than 12 hours Rate M Date 1041 Under 5 hours 5-9 hours Code Time Return Official journey TT- Tj.stedsnummer Date Departure Other Other Subsistence allowance, with overnight stay R/N Vedleggsnr. Destination and purpose of journey Course Please specify Subsistence allowance, no overnight stay Brukernummer Travel and subsistence claim form 1) 2) 111 1069 714 1045 614 1049 1 ÷ 610 1050 1 ÷ Subsistence allowance Overnight accommodation allowance Other Sub-total Deductions Breakfast/ lunch/dinner Breakfast/ lunch/dinner GRAND TOTAL Less advance received NET TOTAL Claimant’s signature Payment Paid by 8020 Claimed Date (Specification on reverse side) Reise nr. ÷ Due to inst. I, the undersigned, agree that any amount due may be deducted from my salary. Paid by (institution) Date Approval (sign. of authorizing officer) Utbetales og posteres i samsvar med foranstående Payment authorization Receipt for Sum received Date Signature payment made in cash * GTAS = Government Travel X-0095 E (Godkj. 08-2005) Elektronisk utgave Allowance scale for domestic and foreign travel Countersignature Utbetalingsstedets merkn. ved utbetalingen For regnskapsføreren: 1) Kode SD 712/TT 1047 2) Kode SD 152 / TT 1054 Name National identity Journey specification Expenses FROM Date Time Mode of transport* To Place Place Time Type Total km priv. transp. Currency Code Amount Total km this jorney. Carry forward to Use of own transportation on front page. Authoriza- Date tion for use of private car Authorizing officer + Total mileage this year (km) Exhange rate Sub-total Mark with X if transferring km. Cumulative mileage this year(km) *For use of private car, please include: Itinerary - distance driven for each journey, listed by destination and speedometer reading -reason for detours - local mileage at destination. Calculating subsistence allowance Travel period in connection with a course ends when the course starts. New travel period is initiated at the time course concludes. Expenses for accommodation, food, etc. Currency Date Specification If subsistence allowance is to be calculated on the basis of days exceeding 6 hours, the number of days should be entered on the reverse side under «Subsistence/allowance with overnight stay», TT code 1086/1087/1052 Subsistence and accommodation by voucher Enter here food and accommodation expenses documented by vouchers. If in addition to recovering these expenses you are entitled to a course allowance, enter the number of days under TT code 1057 on the front. The total course allowance should be entered in the “amount” column. Total (enter on reverse side, TT-kode 1041) Overnight stay Name and address of hotel, boarding house, etc. (not private lodgings) Remarks Code Amount Exhange rate Amount