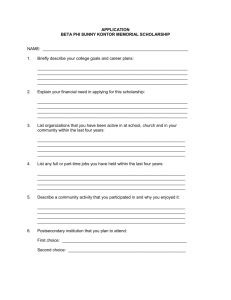

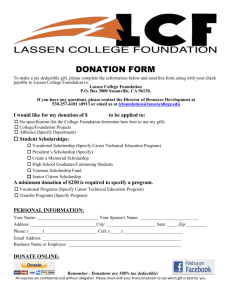

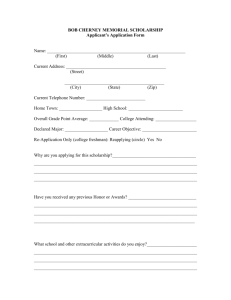

Scholarhip Information Packet, click HERE.

advertisement

Flagstaff Community Christian School Parent Tax Credit/Scholarship Handbook Contents 2 Introduction 4 Information for Current Year 4 Individual Tax Credit Scholarship 5 PLUS (or Switcher) Tax Credit 5 Helpful Strategies 8 Corporate Tax Credit Scholarship 8 Disabled/Displaced Tax Credit Scholarship 9 How to Apply for a Scholarship 9 Empowerment Scholarship Accounts Appendix Examples of Parent Donor Request Letters Narrative Examples AZ140-Form for AZ State Income Tax 1 Introduction The idea of a private Christian school education is appealing to parents for many reasons: small class size, quality academics, and a Biblical worldview taught in the classroom. Often the only major hurdle is the financial challenge of paying tuition. To encourage school choice, the state of Arizona has created a powerful tool: the tuition tax credit program. It allows for the creation of scholarships for private school students. Simply summarized, you can either pay your income tax liability to the state of Arizona or instead have that money go toward a scholarship fund for private school tuition. There are some specific parameters, but that is the essence of the program. This handbook is designed to help you understand the details of how this program works and how you can use tax credits to help you make a private school education for your child a reality. In 1997, the Arizona state legislature passed the individual tax credit program. In this program, taxpayers in the state of Arizona can give to a scholarship organization and receive a dollar-for-dollar tax credit on their AZ income tax. These organizations, referred to generically as Scholarship Tuition Organizations (STOs), will award scholarships to students in private schools. In 2006, the legislature passed a similar program designed for corporate donors. In this program, corporations can give to an STO and receive a dollar-for-dollar tax credit. There is no limit as to what a single corporation can give, but there is a state aggregate limit. Once the statewide limit is reached, no other tax credit donations are received. Again, the STO will issue the tax credit receipts to the participating corporation and award the funds to students of private schools. It is important to note that there are more than 55 different STOs operating in the state of Arizona. This can get confusing! At FCCS, we only have a professional relationship with some of them. We have included a list of the STOs that we work with as well as their contact information. Each one of them has different requirements and application processes. What does all this mean to us? Scholarships play a significant role at FCCS. Many families participate themselves and actively encourage others in order to keep these funds available for students. It is no small thing to help pay the tuition of a Christian school student! This manual was designed to help parents (and anyone else interested) learn how the program works and how to properly use the program to help students and families realize the dream of a Christian education. My sincere hope is that you understand what this program is able to do to help you afford FCCS. Please know that if you have any questions, you may contact me at the school office. If I do not know the answer to your question, I can find the person who does! Thank you for your effort and prayers to help FCCS become all that God desires! Eric Garland FCCS Administrator 2 Information for 2014-15 School Year Please remember that this information is to help you understand how the tax credit scholarship program functions. Flagstaff Community Christian School is not a professional tax or financial institution, and the information contained in this handbook should not be considered financial advice or counsel. Make sure that you consult your CPA or other tax/financial professional for any specific tax/financial advice or counsel. 2014 Tax Year 2015 Tax Year Maximum Donation for AZ Taxpayers Individual PLUS Individual Program Program $528 $525 Single Filers Married Filing $1056 $1050 Jointly $535 $532 Single Filers Married Filing $1070 $1064 Jointly Total Maximum Donation $1053 $2106 $1067 $2134 FCCS Partner Student Tuition Organizations (STOs) Institute for Better Education AZ Private Education Scholarship Fund AZ Tuition Organization AZ Leadership Foundation AZ 4 Education AZ Christian School Tuition Org AAA Scholarships TOPS for Kids AZ Scholarships School Choice AZ AZ School Choice Trust Northern AZ Christian Scholarship Org Arizona Tuition Connection AZ Ed & Scholar Opportunity Prog. www.ibescholarships.org www.apesf.org School#01259 www.azto.org www.arizonaleader.org www.az4education.org www.acsto.org www.aaascholarships.org www.topsforkids.com www.azscholarships.org www.schoolchoicearizona.org www.asct.org www.nacssf.org www.arizonatuitionconnection.com www.aesopkids.org 520-512-5438 602-318-7477 602-295-3033 928-231-2122 480-478-0624 480-852-0403 888-707-2465 480-414-8677 480-497-4564 480-722-7502 623-414-3429 928-649-6030 480-409-4106 Family income requirements for 2014-15 school year to qualify for corporate funds Household Size 1 2 3 4 5 6 7 8 Each additional Annual Gross Income $39,942 $53,837 $67,732 $81,628 $95,523 $109,418 $123,314 $137,219 $13,895 3 Individual Tax Credit Scholarship Those who pay income tax to the state of Arizona are eligible to participate in targeted tax credit programs. One of these is the private school tuition tax credit. The taxpayer can choose to donate to a Scholarship Tuition Organization (STO) and receive a dollar-for-dollar tax credit. For current dollar amounts see Appendix A Info Sheet. The maximum is “indexed,” meaning it will go up a bit each year. Your Arizona income tax liability will be reduced by the amount of your donation (before your withholdings are applied). An example of where an AZ taxpayer will find the amount of their liability that could be redirected as a tax credit can be found in the Appendix AZ140 Tax Form. This is money the taxpayer is going to pay regardless; they have the power to direct these funds toward a private school scholarship fund rather than the state government. They will also award scholarship funds to private school students who have applied and been approved through the STO. The STO will send the donor the paperwork needed to document the tax credit on their AZ tax return. Here are some helpful tax credit examples: State Tax Information The Brown’s The Smith’s Ms. Jones Mr. Johnson Married Married Single Single Status (-$1100) ($900) ($825) ($825) State Tax Liability $1250 $900 $825 $0 Withholdings Paid $150 $0 $0 ($825) Net Tax Liability $1000 $500 $500 Tax Credit Contribution $1000 $1150 $900 $500 $0 Refund from AZ $0 $0 $0 ($325) Taxes Due to AZ $0 $100 $0 $0 Carry Forward Scenario 1 – The Brown’s The Brown’s are a married couple who have a tax liability of $1,100. They have withheld $1,250 from their paychecks during the year so they should already be receiving a $150 tax refund. If they make a $1000 tax credit contribution, they have now paid in a total of $2,250 ($1,250 to AZ, $1000 to APESF), therefore they will receive a $1,150 tax refund when the file their taxes the following year. Scenario 2 – The Smith’s The Smith’s are a married couple with a tax liability of $900. They have withheld exactly $900 from their paychecks so they have fulfilled their tax obligation for the year. If they make a $1000 tax credit contribution to APESF (the maximum allowed for married taxpayers), they will only receive a $900 refund and they can carry forward $100 to the next tax year. Scenario 3 – Ms. Jones Ms. Jones is a single taxpayer who has a tax liability of $825. She has withheld exactly $825 from her paycheck therefore she has fulfilled her tax obligation for the year. If she makes a $500 tax credit contribution, she will receive a $500 refund. Scenario 4 – Mr. Johnson 4 Mr. Johnson is a single taxpayer who has a tax liability of $825. He has paid nothing to the state during the year. If he makes a $500 tax credit contribution to APESF his tax liability will be $325 at the end of the year. For this and all other matters affecting your tax planning, please contact your tax advisor for more information. Donors can recommend the funds go to a particular school and even recommend a specific student. Since these are not-for-profit organizations, these recommendations cannot be for your own child (since you would profit by the donation). You can, and are certainly encouraged, to recommend your donation go to FCCS without recommending a specific student. FCCS can then have these funds to help new families and others who need the assistance. In addition, please recognize that these are only recommended, not designated, funds. The STO does have the ultimate authority to decide who will receive the scholarship funds. The legislation specifies that donors cannot do what is called “swapping,” or trading donations for each other’s children. It stems from the violation of not-for-profit issue stated above, and some families have tried to circumvent this by trading tax credit donations with other school parents (i.e., Smith family donates to Jones family and Jones to Smith). This is now strictly prohibited. We would strongly recommend any parents simply donate to FCCS and not to a specific student at FCCS to avoid the appearance of “swapping.” Donors may make their contributions at any time during the year, but it is common for the donation to come near the end of the tax year. Donors have the option of contributing up to April 15 for credit toward the previous calendar year. If the donation is made between January 1 and April 15 the donor will choose which tax return to apply the credit towards. Recipients of this scholarship need only to be enrolled in a private school in the state of Arizona. There are no state-imposed income requirements, but applicants need to submit income verification in order to be awarded a scholarship. There are also no limits to how much each individual student may be awarded per year. It is important to remember that these scholarship funds can only be used to pay tuition and not any fees related to the student’s education. PLUS/Switcher/Overflow Tax Credit Scholarship This tax credit went into effect in the summer of 2012. Donors may give to this program only after they have given the maximum allowed in the Individual Tax Credit program. Students eligible to receive PLUS scholarship need to meet one of the following requirements: (1) dependent of active duty military members on orders in Arizona; (2) student was in public school for at least 90 days of the prior academic year switched to a private school; (3) children entering kindergarten; (4) student is in a qualified private preschool or kindergarten program that offers services to students with disabilities; (5) student has a disability (IEP or 504), attended a public or private pre-school that offers services for disabilities, and attended for at least 90 days of the prior academic year; (6) student received a scholarship from either the Corporate tax credit program or the Disabled/Displaced tax credit program; or (7) student previously received a scholarship from the PLUS program. Helpful Strategies: Getting Others to Give Recommended Scholarships for Your Family Since the Individual Tax Credit program allows donated money to be recommended for a specific student, parents can use this tax credit to help pay their child’s tuition. One simple, time-tested idea that has worked for many parents is to send a personal letter and an IBE brochure out to everyone on their contact list. In this letter, tell a bit about how the program works, share stories of how Christian education has impacted your children’s lives, and ask them to participate in the Individual Tax Credit program 5 through IBE using the enclosed informational brochure. We recommend this approach to requesting donations, and these are strategies you can utilize to increase the responses. For sample Donation Letters see Appendix. Be Informed Remember that most people you speak to will not know about this program and will have questions regarding it. Be informed and yet do not be afraid to say, “I don’t know, but I’ll find out for you.” You can contact the school or a specific STO for answers. When you explain the program make sure that you are factual. Do not exaggerate it. When it is explained properly then it is win-win for all involved. Once someone learns about this program, they will probably think it’s a great idea, but will need to be reminded again and again and again... Don’t be shy about reminders to people to whom you have sent the information. You will need to make every part of the process as simple as possible for those you are asking to give. This removes any obstacle or excuse they may formulate for not participating. Give them enough time to make an informed decision, but be pleasantly persistent in encouraging them to participate. It is not uncommon for people to wait to donate until the very last moment. Don’t be discouraged if you experience a low percentage of people actually participating in this tax credit program. Typically about 10% of those contacted will respond. Make sure to ask many more than you want to respond. Just remember that others may not be able to donate the money to the scholarship fund, or (sadly) may have just forgotten about it. Cover everything in prayer! Let God orchestrate this for you and He will make sure this information gets into the right hands. What to mail to potential donors Many parents have mailed a small packet to those they are requesting donations from. If you choose to do this, we suggest that you include 3 things: an IBE brochure; a personal letter explaining the program; and an addressed stamped envelope to mail the form and check to IBE. Here are a few strategies to follow: Make sure to include your child’s name on the brochure’s form so IBE knows who the money is recommended to. The stamped, addressed envelope will remove all doubt as to where to send the check. The letter should really share your heart about Christian education as well as explain the process. You can even include pictures of your children. Make sure to include any contact numbers they should call for more information. We have included examples of this letter in the Appendix. More parents are utilizing email to request donations. This can be done in conjunction with a packet in the mail- an idea we would highly recommend! Make sure to include the letter that shares your heart about Christian education, explain the donation process, and include the web address of IBE (www.ibescholarships.org). Who you should ask This is a question only you and God can answer, but any taxpayer in the state of Arizona can participate in this program. Some parents only feel comfortable requesting help from family and close friends and others have given this to a great many of co-workers, acquaintances, and professionals. We 6 would recommend you “cast a wide net” and ask as many people as you can. Some ideas for people to request help from are: Co-workers Doctor, dentist, chiropractor, pharmacist, etc. Insurance agent Members of church Members of any organization you belong to (MOPS, Chamber of Commerce, Kiwanis, etc.) Any person you meet in the store or at the bank, etc. (No kidding- one parent kept these in her purse and when someone commented on how nice her family was, she would pull it out and ask them to help pay for their school!) Timing the Requests You can send these out anytime, but the vast majority of people will only send in the money at the last possible moment. Taxpayers can donate up to April 15 of the following year. Any taxpayer who donates between January 1 and April 15 will have the option of which tax year to apply the credit to, previous or present. We have seen the two most successful times at October/November and January- send it out in October, remind them over the next few months with phone calls and postcards. Remember, many people think it’s a great idea, but are forgetful and don’t do it unless you lovingly- and persistentlyencourage them to participate. Common Questions, Concerns, and Misunderstandings There are a few questions and concerns that frequently come up in regard to the Individual tax credit program, including: “But I get money back from the state. Since I don’t owe the state, I can’t help you.” This response often indicates a misunderstanding of how payroll withholdings work. Their withholdings are more than they owe the state. They do owe something in state income tax- line 19 on form AZ140 specifies the amount they owe in tax. This ought to be the amount they donate, if it doesn’t exceed the maximum for donors. “I already give my tax credit to the public schools, so I can’t help you.” There is a tax credit available for extracurricular activities in the public schools, but it is separate from the Scholarship tax credit program. If they like, they can take advantage of both programs. “Unfortunately, I do not have $1000 to donate, so I can’t help you.” This can be addressed in a number of ways. First, they can make multiple smaller donations over the course of the year. Second, if their employer is willing, they can set up a payroll deduction directly from their paycheck. Third, if they file their federal tax return early in order to get any tax return funds, they can use those recourses to make the donation before April 15. Please remember: in regard to Arizona income taxes, this is not a tax deduction. It is a dollar-fordollar tax credit where the donor’s taxes are credited- lowered- by every dollar they donate to this program. Essentially, they can pay the state or they can give a scholarship for a student at a Christian school. 7 Individual Tax Credit Scholarship Checklist October: Gather your address book of Arizona friends, family, co-workers, church members to donate Prepare a personal letter that you will send to potential donors IBE Brochures, these can be picked up from the FCCS office. Include your child/family name December - March: Keep asking individuals and remind those you already contacted. The deadline for current tax year is April 15. Corporate Tax Credit Scholarship Corporate entities that pay Arizona income tax- typically “C” corporations- are eligible to participate in the corporate tax credit scholarship program. There is no limit to the amount of money a single corporation can give, but there is a state aggregate limit. Donors to this program can recommend a school but not a specific student. There are some very specific requirements for donors in this program, so contact FCCS or IBE for more information. Recipients of this scholarship do have to meet enrollment requirements as well as income requirements. To qualify, students must be either a new Kindergarten student, transferring from a public/charter school (minimum of 100 days previously enrolled in a public/charter school), or received a corporate scholarship the previous year. They also have to have an income below 185% of the Federal Lunch Program requirements. See Appendix for current AZ Corporate Scholarship Income Limits. Corporate Tax Credit Scholarship Checklist February: Complete personal taxes as early as possible so you are able to apply early for scholarships. March-July: Obtain a list of all STO’s with application deadlines to stay on top of it. Have ready a copy of the first 2 pages of your Federal 1040 tax form and Schedule C if you are self-employed. If there is a financial situation that is not reflected on your 1040, a written letter of explanation may also be included. A narrative for each of your children. This is a letter that can include some of the following: your child’s activities (in and out of school), leadership, goals, academic achievements, child’s character, perseverance, citizenship, community involvement, why you are requesting funds and what FCCS means to you. An example of a narrative is in the Appendix. Possible Pastor/Community Leader recommendation letter, a short paragraph from about your child and/or family. Disabled/Displaced Tax Credit Scholarship Corporations have the option of allowing any portion of their donation be used for the Disabled/Displaced Tax Credit program, also referred to as Lexie’s Law. Recipients of these funds are students who have a state approved disability (usually identified through an IEP) or have been a part of the foster care program in the state of Arizona. This scholarship is only available to students in grades 112. The student must have attended the first 100 days of the previous school year at a publically funded school (either public or charter) or have received a Disabled/Displaced scholarship the year before. 8 How to Apply for a Scholarship Parents will apply directly to the STOs for scholarship funds. See Appendix for current listing of Student Tuition Organizations (STOs). Each STO will have a different application and process. Personal information you should have available is your current 1040 federal tax return, student narrative, and recommendation letters. There are also a number of deadlines for each STO. We want you to be informed, so please check with these organizations regularly to make sure you do not miss any application deadlines. These application deadlines are important and can make a significant difference in what- if any- award you may receive. We highly recommend you apply to all organizations and programs that you qualify for. This may seem to be quite a bit of work, but it is well worth the effort! Remember that there are more than 55 different STOs in the state of Arizona. If you would like, you can apply to any that you choose. We list these organizations due to the fact that FCCS already has a professional relationship with them. For more information and a complete listing, you may visit the website created by the state of Arizona to share information about these programs as well as all the educational choices available in the state: http://www.arizonaschoolchoice.com. Empowerment Scholarship Accounts Another new option offered by the state of Arizona is titled Empowerment Scholarship Accounts (ESAs). This is not another tax credit scholarship, but rather a whole new option of school choice in Arizona. These are available to students with an identified disability or need, defined in an Individualized Educational Plan (IEP) or a 504 or have attended a “failing public school” the year previous. To be eligible, a student has to have an IEP or 504 in place and have attended a publicly funded school (such as a public or charter school) for the first 100 days of the previous academic year. The deadline to apply for this program is in the spring, usually before the beginning of May. Once the application is approved, the state will place 90% of the annual educational funds it would have spent on your child in to an account that the parents can utilize for educational purposes. This would include private school tuition, books, specialists, and other services related to your child’s needs. Please contact the school for more information. 9 Examples of Parent Donor Request Letters PLEASE NOTE: Please use this as an example for wording but the donation amounts may not be correct. You could also add a personal note from your student and/or pictures. Letter #1 Dear Friends and Family, This has been a fruitful year for our family with the addition of new grandkids. That makes 10 grands now! Aden is 10 and in fourth grade this year at Flagstaff community Christian School (FCCS). He continues to be a bundle of energy that threatens to keep us young. Aden’s favorite part of school is recess, but he is excelling academically and loves to read. We are thankful for the gift of Aden too. It’s that time of year, once again, to remind you about the DOLLAR FOR DOLLAR Arizona State Income Tax Credit Program. Please consider the opportunity to redirect some of your state tax dollars to organizations that provide grants and scholarships to students attending qualified private schools. Thanks to you, we have received some scholarship money again this year as a result of this program. It’s a simple process. Just fill out the Institute for Better Education (IBE) form, and mail it with your donation before April 15. Donations made between December 31 and April 15 can be claimed as part of the previous year’s tax commitment or the present. Remember, the entire amount you donate will be returned to you from the state, in the form of a tax credit or credited toward what you owe to the state of AZ. This year the state of AZ has increased the amount you can give, so you are able to give a maximum of $1003 (individual) or $2006 (married, filing jointly), which is exciting! When you donate, you will receive the equal amount tax credit, so it costs you nothing. IBE will send you a receipt for your donation, along with a form to file with you 2012 state income tax return. In addition, you may also be eligible for a Federal Tax Deduction if you itemize on your 1040 form, which could result in a refund of more than you actually donated. Since FCCs has been a real benefit in our lives, and Aden is thriving in this private school, we hope you will consider supporting us through this program. Please call us if you have any questions. Letter #2 To Our Closest Friends and Family, We want to thank you on behalf of Flagstaff Community Christian School (FCCS), for your generous support! Next year, Trace will begin 12th grade, Ben 10th grade, Cooper 3rd grade, and Carly will be a 1st grader! Will you consider the tax credit program again this year? It will cost you nothing but would help us out tremendously, as we will once again have two kids attending FCCS! As you may already know, in 1997 the Arizona Legislature approved a program in which residents can donate funds to private schools and receive a DOLLAR FOR DOLLAR Arizona State income tax credit. You can re-direct some of your state taxes to organizations that provide grants and scholarships to students attending qualified private schools. This year, Arizona law allows you to receive up to $2006 maximum in state tax credit for married taxpayers who file jointly or $1003 for single taxpayers or heads of households (assuming your tax liability is at least that much). The process is really simple. You fill out and return the enclosed Institute for Better Education form, (IBE) with your donation. (Or, new this year, make your donation by credit card online at www.ibescholarships.org) Then IBE will send you a receipt documenting your donation, along with a form that you file with your state income tax return. The entire amount you donate will be returned to you 10 from the state in the form of a tax credit. If you donate $1000, you receive $1000 tax credit, so it truly costs you nothing but is a huge benefit for the school and our children. We feel strongly about the value of education. We believe FCCS has already had a huge impact on our children and the community by reinforcing the values and morals taught at home, as well as embracing our American heritage and celebrating traditional Holidays. We hope that with your support, we can give our kids the best education possible. Thank you for your consideration. Please feel free to call us if you have any questions. Sincerely, Letter #3 Dear John: I hope this finds you well! This is just a quick note to ask you to consider participating in the Private School Tax Credit Program. Since 1998, Arizona has given a dollar-for-dollar tax credit (as of 2012 up to $1003 for single filers and $2006 for married filing jointly) when a tax payer contributes on behalf of a child attending private school. The donation must go through a School Tuition Organization (STO), like the Institute for Better Education (IBE), and contributions must be post-marked by April 15th. Your Arizona income tax liability will be reduced by the amount of your donation. Also, if you claim the donation on your Federal taxes, you will need to donate by December 31st of the tax year in which you claim the contribution. Check with your tax preparer to see if this is to your advantage. I have enclosed a donation envelope with our children’s names already filled in for you, or you can go to IBE’s website (ibescholarships.org) and contribute online. In either case, it is pretty quick and makes a big impact on our ability to have the kids attend a great school. Everyone really does win! Tax payers save money they would have had to pay (up to $9500 per student) for each child in public school; more children are enabled to attend the school that best meets their needs; and the community benefits through the many civic and volunteer programs that private schools provide (nearly twice the number as public schools). If you have any questions please call me. You can also speak with the very helpful staff at IBE (520-512-5438). We appreciate your kind consideration, John. Thanks Sincerely, PS: If you contribute more than your tax liability…not to worry. You will only get the dollar-for-dollar credit for wheat you actual liability for this year – but he rest will carry over for a credit for next your (up to 5 years!). 11 Sample Narrative Letter For Older Student for Scholarships Abigail is a young woman of excellence and integrity. In and out of school she is a leader among her peers and a delight with adults. In academics Abigail has been a straight A student since Kindergarten. She is in advance placement in math and spelling. Diligence and quality are cornerstones in her work ethic. Abigail placed 1st place in this year’s science fair and also received the school’s 1st place overall award. She received a superior rating on her speech at this year’s speech meet. She is called upon to help mentor and tutor those who may need extra help. Abigail was elected to represent her class in student council this year. She was selected as Student of the Week by the faculty. She was part of the yearbook staff. Abigail played a major role in this year’s school drama production. She has participated in numerous service projects, such as Adopt-A-Hwy and orphanage clean-up. Outside of the school setting Abigail plays soccer, basketball and piano. She is a great example of sportsmanship. Reading and hiking are just some of the pastimes she enjoys. She is a junior helper in children’s church and serves in her church nursery. Abigail is a leader on the kid’s prayer team and is often called upon to pray in the adult prayer times. She has recently begun babysitting and does a wonderful job. The Christian school environment has been so vital in Abigail’s foundation and maturing. She is able to strengthen in her convictions and focus on her dreams of being an obstetrician or government leader. The funds that you provide are so appreciated. It assists us as parents to continue to partner with God’s call on her life of a Christian education. Sample Narrative Letter For Younger Student for Scholarships 2012-2013 will be Elizabeth’s 3rd year at Flagstaff Community Christian School. She attended both her Kindergarten and 1st grade year, and she will be a second grader next year. We are amazed about how much Beth has progressed during these years. We initially chose FCCS because of the small class sizes, academic excellence, biblical truths that are instilled, and tremendous teachers. We keep her at FCCS for all these reasons and more. We love how her school and teachers encourage her to be involved in the community. She is an advocate for cleaning up her town, she detests litter and picks up all of her surroundings in order to care for the land we live in. She is bold enough to stand up for litter pick-up as well. She has contributed to the Crises Pregnancy Center Diaper Drive, Numerous Canned Food Drives, and an Orphanage Clean-up. Beth is shy little girl that has found a love of Rock Climbing this year. She is willing to try all sorts of athletics, but has settled in on gymnastics and rock climbing. While she has not excelled at soccer, basketball, or other team sports she is always willing to try. She has a positive attitude while doing so, and sticks with her season she committed. I admire her commitment at her young age. This is a quality her dad and I have instilled in her. Additionally, she joined the girl scouts this spring, and has received her first pin! FCCS is a stable, positive, loving, and fun environment. We feel it is necessary to her continued growth as a young woman of God. It has enhanced her prayer life – (she is our prayer warrior), and instilled so much biblical knowledge at her young age. We love the positive social atmosphere, and the friendships that she has made are positive and encourage her to be her best. Thank-you for considering Elizabeth Craven for a scholarship for the 2012-2013 School Year! 12 13