CHAPTERS 3 AND 9—ADJUSTING ENTRIES AND ACCOUNTING

advertisement

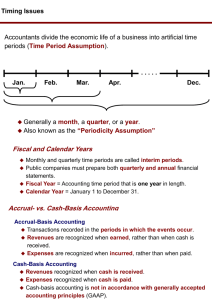

CHAPTER 3—THE BASICS OF ADJUSTING ENTRIES Study Objectives—after studying the chapter, you should be able to: 1. 2. 3. 4. 5. 6. 7. 8. Explain the time period assumption. Explain the accrual basis of accounting. Explain why adjusting entries are needed. Identify the major types of adjusting entries. Prepare adjusting entries for deferrals (prepayments). Prepare adjusting entries for accruals. Describe the nature and purpose of an adjusted trial balance. Prepare adjusting entries for the alternative treatment of prepayments. INTRODUCTION: Take the following Quiz on Adjusting Entries and then check the answers on the last page of the lecture notes after you have studied this chapter: 1. T or F: Adjusting entries are made to apply the matching principle. 2. T or F: The Cash account is found in some adjusting entries. 3. T or F: All adjustments affect both the Balance Sheet and the Income Statement. Matching from types of Adjusting Entries: (1) Accrued expense; (2) Accrued revenue; (3) Deferred expense; and (4) Deferred revenue: 4. ____ Unpaid salaries 5. ____ Rent received in advance 6. ____ Prepaid insurance 7. ____ Interest earned but not received 8. ____ Rent paid in advance 9. ____ Subscriptions received in advance 10. ____ Rent due to us 11. ____ Unpaid interest I. Definitions and Key Concepts—the Accrual Basis Accounting applies these principles: A. Define the cash basis and the accrual basis of accounting: Cash basis—an accounting method in which an expense is recorded when cash is paid and revenue is recorded when cash is received. Cash-basis accounting is NOT in accordance with GAAP. 2. Accrual basis—an accounting method in which an expense is recorded when it is incurred and revenue is recorded when it is earned. It is the basis of accounting in which transactions that change a company’s financial statements are recorded in the periods in which the events occur. 1. B. Define the matching principle. 1 Matching principle—the accounting principle that states that revenue earned during an accounting period should be offset by the expenses that were incurred in earning that revenue. The principle that efforts (expenses) be matched with accomplishments (revenues). 2. How to apply the matching principle—at the end of the accounting period expenses and revenues must be examined to find out what amounts belong to the period regardless of when the related cash payments and receipts occur which means you will need to adjust both expenses and revenues in order to apply the matching principle. 3. To determine Accrual Net Income: All Recognized Revenues All Matched Expenses Recognized Revenues - Matched Expenses = Accurate net income for the period 1. C. Define the time period assumption: An assumption that the economic life of a business can be divided into artificial time periods. 2. Owners and managers as well as other users need timely results of operations of a business: a) Management usually wants monthly financial statements. b) Internal Revenue Service (IRS) requires all businesses to file annual tax returns. 1. D. Fiscal and Calendar Years: Accounting time periods are generally a month, a quarter, or a year. Monthly and quarterly time periods are called interim periods—less than one year. 2. Fiscal year—an accounting period that is one year in length. A fiscal year usually begins on the first day of a month and ends twelve months later on the last day of a month. 3. Calendar year—an accounting period that extends from January 1 to December 31. 1. E. Define the revenue recognition principle: The principle that revenue be recognized in the accounting period in which it is earned. 2. In a service enterprise, revenue is considered to be earned at the time the service is performed. F. Define accruals and deferrals. 1. Accruals—Expenses incurred and revenue earned in the current accounting period but not recorded as of the end of the period. To accrue means to build up or to accumulate. Thus, an accrual is a buildup or accumulation of revenue or an expense that has not been recorded by a routine journal entry. 2. Deferrals—Expenses and revenues that have been recorded in the current accounting period but are not incurred or earned until a future period. To defer means to put off or to postpone. Thus a deferral is a putting off or a 1. 2 postponement of revenue or an expense that has been recorded by a routine journal entry but belongs to the future. G. Define the Going Concern Concept—financial reports of a business are prepared with the expectation that the business will remain in operation indefinitely. Since this concept assumes that a business will continue indefinitely into the future, by accruing expenses and revenues, it is understood that the business has a future. H. The Basics of Adjusting Entries: Adjusting entries are entries made at the end of an accounting period to ensure that the revenue recognition and matching principles are followed. 2. Adjusting entries are required every time financial statements are prepared and are dated as of the balance sheet date. 3. Adjusting entries are needed because: a) Some events are not journalized daily because it is inexpedient to do so. Examples are the consumption of supplies and the earning of wages by employees. b) Some costs are not journalized during the accounting period because they expire with the passage of time rather than through recurring daily transactions. Examples are equipment deterioration, and rent and insurance expiring. c) Some items may be unrecorded. An example of a utility bill that will not be received and/or paid until the next accounting period. I. Types of Adjusting Entries: 1. 1. Prepayments: Prepaid Expenses—expenses paid in cash and recorded as assets (or expenses as shown in the chapter appendix—alternative treatment of prepaid expenses) before they are used or consumed. Depreciation of plant assets falls into this category. b) Unearned Revenues—cash received and recorded as liabilities (or revenues as shown in the chapter appendix—alternative treatment of unearned revenues) before revenue is earned. a) 2. Accruals: Accrued Revenues—revenues earned but not yet received in cash or recorded. b) Accrued Expenses—expenses incurred but not yet paid in cash or recorded. a) II. Accounting for Accrued Expenses—ADJUSTING ENTRIES FOR ACCRUALS. The accrual of expenses creates liabilities. Expenses that have been incurred but not yet recorded at the end of an accounting period require an adjusting entry to recognize both the proper amount of expense for the period on the income statement and the proper amount of liabilities on the balance sheet. Accrued Expenses are also called Accrued Liabilities because accrued expenses have not been paid as of the end of the period and thus represent a liability of the firm. Helpful hint to remember what is done with Accruals: The “A” in Accrual means 3 add to expense or revenue as the adjusting entry will be adding to expenses or to revenues. A. Explain ACCRUED SALARIES and the adjustment needed: 1. How accrued salaries occur—accrued salaries occur only when the last day of the payroll period and the last day of the accounting period are different days. 2. Steps to accrue salaries: a. Determine the days to accrue: BE CAREFUL determining the number of days to accrue salaries. Best way to determine the number of days to accrue is to set up a calendar of the week and notate what day the year ends. YOU ARE ACCRUING THE EXPENSE FOR THE CURRENT YEAR (2014) NOT THE FOLLOWING YEAR (2015). If $20,000 is the weekly payroll, the daily amount for a five-day work week would be $4,000: 2014 2015 Dec. 29 30 31 Jan. 1 2 Monday Tuesday Wednesday Thursday Friday Total $4,000 $4,000 $4,000 $4,000 $4,000 $20,000 $12,000 is Accrued $8,000 is NOT Accrued b. Determine the amount to accrue: $20,000 is total payroll ÷ 5 days = $4,000 per day x 3 days (Dec. 29 – Dec. 31) = $12,000. c. Prepare the adjusting entry: General Journal Page 1 Date Account Title P.R. Debit Credit 2014 Adjusting Entries Dec. 31 Salaries Expense 12,000.00 Salaries Payable 12,000.00 3. An adjusting entry, such as one for an accrued expense, affects both the income statement and the balance sheet) as it results in an increase (debit) to an expense account and an increase (credit) to a liability account. In the case of an accrued expense such as accrued salaries, the income statement is affected because an expense account (Salaries Expense) is debited; a balance sheet account is affected because a liability account (Salaries Payable) is credited. 4. Affect if the adjusting entry for accrued expenses is OMITTED: a. Expenses are understated as did not accrue the additional expense of Salaries Expense. Set up the accounting equation with simple balances in the accounts if fail to do the adjustment: A = L + OE + R – E or 200 = 100 + 50 +100 -50. Expenses are showing a balance of $50 but the balance SHOULD BE (S/B) $60 as an additional expense of $10 should have been 4 accrued. Therefore expenses are understated by $10 if the adjusting entry is omitted. b. Liabilities are understated as did not accrue the additional liability owed of Salaries Payable. The example of 200 = 100 + 50 +100 -50 is showing the balances in the accounts if fail to do the adjustment. Liabilities are showing a balance of $100 but the balance SHOULD BE (S/B) $110 as an additional liability of $10 should have been accrued. Therefore liabilities are understated by $10 if the adjusting entry is omitted. c. Net income is overstated as did not accrue the additional expense of Salaries Expense which would reduce the amount of net income as expenses decrease income and owner’s equity. The accounting equation is showing a net income of $50 ($100 Revenues - $50 Expenses) if fail to do the adjustment. When the accrued expense is made the net income is $40 ($100 Revenues - $60 Expenses). Therefore net income is overstated by $10 if the adjusting entry is omitted. 5. TYPICAL STUDENT MISCONCEPTION: Students often want to use the Cash account when making an adjusting entry for an accrual. This point needs to be emphasized—Cash is NEVER involved in ANY adjusting entry. The reason is that the Cash account should already be reconciled BEFORE adjusting entries are made. If an adjusting entry is made to the Cash account, the account WILL NO LONGER BE RECONCILED to the balance per the bank statement. B. Explain accrued interest and the adjustment needed. Helpful hint to remember what is done with Accruals: The “A” in Accrual means add to expense or revenue as the adjusting entry will be adding to expenses or to revenues. Thus with accrued interest, additional interest will be added to the interest expense account. 1. How to calculate the due date of a note: Determine Due Dates of Notes (a) 90 days from May 8: Begin with last day of month that the note was dated Subtract the date of the note May May 31 -8 Days in the first month Add the total days in the following month Add the total days in the following month May June July 23 30 31 Days needed in the next month for a total of 90 days Aug Total days of note 2. 6 84 days Due Date of Note 90 How to calculate interest: Interest (I): The cost of borrowing money that accumulates with the pages of time or the charge for credit; calculated as principal (P) x rate (R) x time (T). Bankers’ interest uses a 360-day year 5 if the note is by days but if notes are by months, then the denominator will use 12 for months in a year. 3. Accrued interest arises when the accounting period ends BEFORE THE NOTE REACHES ITS MATURITY DATE. The interest from day of note to the end of the accounting period is an expense and a liability and must be recorded with an adjusting entry. 4. Steps to make an adjusting entry for accrued interest: a. Determine the days from the date of the note to the end of the accounting period. Refer to the example: Assume that on November 1, 20--, Bluff City Supply Company borrowed $12,000 on a 90-day, 14% note (the day after the note is signed is the first day when counting days). Begin with last day of month that the note was dated Subtract the date of the note Nov. Nov. 30 -1 Days in November Add the total days in December Total days from the date of the note to end of period Nov. Dec. 29 31 60 b. Calculate the interest from the date of the note to the end of the accounting period. Principal x Rate x Time = Interest $12,000 X 14% X 60/360 = $280 c. Make the adjusting entry: General Journal Page 1 Date Account Title P.R. Debit Credit 20-Adjusting Entries Dec. 31 Interest Expense 280.00 Interest Payable 280.00 d. Post to the General Ledger: Assets = Liabilities + Owner's + Rev. Equity Cash Expenses Interest Payable Interest Expense Dec.31 Adj. Dec. 31 Adj. 280 280 5. Affect if the adjusting entry for accrued expenses is OMITTED: a. Expenses are understated as did not accrue the additional expense of Interest Expense. Set up the accounting equation with simple balances in the accounts if fail to do the adjustment: A = L + OE + R – E or 200 = 100 + 50 +100 -50. Expenses are showing a balance of $50 but the balance SHOULD BE (S/B) $60 as an additional expense of $10 should have been accrued. Therefore expenses are understated by $10 if the adjusting entry is omitted. b. Liabilities are understated as did not accrue the additional liability owed of Interest Payable. Liabilities are showing a balance of $100 but the balance SHOULD BE (S/B) $110 as an additional liability of $10 should 6 have been accrued. Therefore liabilities are understated by $10 if the adjusting entry is omitted. c. Net income is overstated as did not accrue the additional expense of Interest Expense which would reduce the amount of net income as expenses decrease income and owner’s equity. The accounting equation is showing a net income of $50 ($100 Revenues - $50 Expenses) if fail to do the adjustment. When the accrued expense is made the net income is $40 ($100 Revenues - $60 Expenses). Therefore net income is overstated by $10 if the adjusting entry is omitted. C. Describe other types of accrued expenses—the adjusting entry always involves a debit to an expense and a credit to a liability. 1. To accrue rent that is owed but unpaid at the end of the accounting period—debit Rent Expense and credit Rent Payable. 2. To accrue taxes that are owed but unpaid at the end of the accounting period—debit Taxes Expense and credit Taxes Payable. 3. To accrue utilities that are owed but unpaid at the end of the accounting period—debit Utilities Expense and credit Utilities or Accounts Payable. III. Accounting for Accrued Revenue . The accrual of revenue creates assets. Accrued revenue has been earned in the current accounting period but the cash will NOT BE RECEIVED until the next period. Accrued revenue is also called an Accrued Asset as the debit will be to a Receivable (an asset) account when accrued revenue is credited). Helpful hint to remember what is done with Accruals: The “A” in Accrual means add to expense or revenue as the adjusting entry will be adding to expenses or to revenues in this case. Remember that the goal is to adhere to the revenue recognition principle—a business earns (realizes) revenue when goods or services are sold to customers, even though cash may not be collected until sometime in the future. Therefore, to make sure that the correct amount of revenue is shown that is earned each fiscal year for the accrual basis of accounting, some revenue may need to be accrued that has been earned but not yet recorded. Adjusting entries to accrue revenue will affect both an income statement (credit to a revenue) and a balance sheet (debit to a receivable) account ALL adjusting entries effect one Income Statement account and one Balance Sheet account. A. Explain accrued rent revenue and the adjustment needed. 1. Accrued rent revenue—revenue earned but not yet received. 2. Steps to prepare the adjusting entry: a. Calculate the amount of rent earned. b. Prepare the adjusting entry—an adjusting entry for accrued revenues results in an increase (debit) to an asset account and an increase (credit) to a revenue: General Journal Page 1 Date Account Title P.R. Debit Credit 20-Adjusting Entries Dec. 31 Rent Receivable 1,200.00 Rent Income 1,200.00 7 c. Post to the General Ledger where the Rent Receivable will be shown under the current asset section on the Balance Sheet and Rent Income account will be closed and its balance listed as nonoperating revenue on the income statement: Owner's = Liabilities + + - Expenses Assets Revenues Equity Cash Rent Income Dec.31 Adj. 1,200 Rent Receivable Dec.31 Adj. 1,200 3. A good way to understand the concept of accrued revenue is the mirror image concept—accrued revenue is the mirror image of accrued expenses. A rent accrual can be shown as follows: a. From the Lessor perspective, the entry would be: Debit—Rent Receivable 1,200 Credit—Rent Income 1,200 b. From the Lessee perspective, the entry would be: Debit—Rent Expense 1,200 Credit—Rent Payable 1,200 4. Affect if the adjusting entry for accrued revenues is OMITTED: a. Revenues are understated as did not accrue the additional revenue of Rent Income. Set up the accounting equation with simple balances in the accounts if fail to do the adjustment: A = L + OE + R – E or 200 = 100 + 50 +100 -50.. Revenues are showing a balance of $100 but the balance SHOULD BE (S/B) $110 as an additional revenue of $10 should have been accrued. Therefore revenues are understated by $10 if the adjusting entry is omitted. b. Assets are understated as did not accrue the additional receivable owed to the company of Rent Receivable. The accounting equation is showing the balances in the accounts if fail to do the adjustment. Assets are showing a balance of $200 but the balance SHOULD BE (S/B) $210 as an additional receivable of $10 should have been accrued. Therefore assets are understated by $10 if the adjusting entry is omitted. c. Net income is understated as did not accrue the additional revenue of Rent Income which would increase the amount of net income as revenues increase income and owner’s equity. The net income shows $50 ($100 Revenues - $50 Expenses) if fail to do the adjustment. When the accrued revenue is made the net income is $60 ($110 Revenues - $50 Expenses). Therefore net income is understated by $10 if the adjusting entry is omitted. B. Describe other types of Accrued Revenue: 1. In Chapter 8 Notes Receivable are covered and should be considered as the mirror image of Notes Payable. Calculations of due date and interest are 8 identical for notes payable and notes receivable and where one company’s interest expense is another company’s interest income. To accrue interest income: a. Calculate interest earned from the date of the note until the end of the accounting period—P x R x T. b. Record the adjusting entry: Debit—Interest Receivable Credit—Interest Income 2. Any unbilled revenues such as fees earned or sales made but where the cash has not yet been received needs to be accrued to accounts receivable. Normally the name of the receivable account will match the name of the revenue account as shown in the above examples (i.e. Rent Receivable/Rent Income; Interest Receivable/Interest Income, etc.) unless the revenue is for the regular income for the business. The example of fees earned, but not yet recorded example: Debit—Accounts Receivable Credit—Fees Earned IV. Summary of Accruals: A. Accruals ALWAYS Add—the “A” in accrual means Add. You always Add to expense or Add to revenue (bringing in something not yet recorded into the present) and you ALWAYS Add to the Balance Sheet (liabilities or assets and Add to the Income Statement (expenses or revenues). B. The adjustment for accruals usually (unless you are accruing the service or sales revenue for the normal operations of the business in which case accounts receivable is the account) ALWAYS creates a balance sheet account. C. Accruals can ALWAYS be reversed. This point is a key one before going on to deferrals, which can only SOMETIMES BE REVERSED. The RULE TO MASTER: Whenever an adjusting entry creates a Balance Sheet account (liability or asset) reversal is possible and desirable as well so that the adjusting entry into the created account WILL NOT BE FORGOTTEN. When the salaries are paid the following period, the debit to Salaries Payable must be made along with the amount for Salaries Expense. But the amount in Salaries Payable is often FORGOTTEN and the entire amount of $4,000 in this example is debited to Salaries Expense. V. Accounting for Prepayments: Prepaid (Deferred) Expenses. Deferred expenses are also called prepaid expenses or deferred charges. A key letter, “D” and a key word, “Deduct,” to remember with Deferrals as amounts are deducted from deferrals during the adjusting process to record correct expenses incurred and revenues earned. With deferred expenses and deferred revenues, not all adjusting entries can be reversed as can be done with accrued expenses and accrued revenues. 9 A. Explain the entries needed when deferred expenses are first recorded as assets. 1. Define deferred expense—advance payment for goods or services that benefit more than one accounting period. Deferred expenses are actually Prepaid expenses (supplies, prepaid insurance, prepaid rent, prepaid advertising, etc.). Deferred expenses have already been paid, but will benefit future periods. To match (Matching principle) revenue and expenses properly, a part of the deferred expense must be “put off” into the future (part that has future benefit) and part must be recognized in the current period (part that has been used or expired). Be Careful with the word, “Expense,” as many students get confused thinking that the account must be an Expense account but the usual transaction is to record the amounts paid for expenses paid in advance as an asset NOT AN EXPENSE. If the prepayment will become an expense in one year or less, then the prepaid expense account is listed under the “Current Asset” section of the Balance Sheet. If the prepayment will become an expense longer than one year, it is shown in the “Other Asset” section (long-term section) of the Balance Sheet as a Deferred charge. 2. To differentiate between Accruals and Deferrals, think of the phrase: “Show me the money!”. a. With Deferrals, money has changed hands where the money has been paid in advance BEFORE an expense has been incurred. With Revenues, money was received BEFORE a revenue has been earned. b. With Accruals, money has NOT changed hands where the expense has not yet been paid by the end of the accounting period but it HAS BEEN INCURRED. For Revenues: revenues HAVE BEEN EARNED but the money has not yet been received at the end of the accounting period. 3. When deferred or prepaid expenses are initially recorded as assets, an adjusting entry is needed to transfer the amount of the asset used or expired from the asset account to an expense account. a. For the initial recording when the cash was paid example: On October 1, an entry for $3,600 for a one-year insurance policy: debit to Prepaid Insurance and a credit to Cash. b. The adjusting entry transfers the amount of expenditure (for insurance in the example) expired or used to an expense account. To calculate the amount expired, divide the amount by 12 (months in a year) and then multiply by the number of months that have expired as follows: $3,600 ÷ 12 = $300/month x 3 months = $900 expired. Debit Insurance Expense and credit Prepaid Insurance. c. The closing entry that closes the balance of the expense account to the income summary which then becomes part of owner’s equity for the net income or net loss of the company. 10 d. Consider the concept of whether a reversing entry will be considered or not (Reversing entries are introduced in the Appendix, chapter 4 of the textbook). NOTE that no reversing entry will be made. Recall the RULE TO MASTER: Whenever an adjusting entry creates a Balance Sheet account (liability or asset) reversal is possible. When a deferred or prepaid expense is initially recorded as an asset, the adjusting process will create an expense account that is closed in the normal closing routine at the end of the fiscal year. Since NO ASSET or LIABILITY account was created during the adjustment, there is no support for a reversing entry. 4. Describe the adjustment for supplies used. The supplies account will contain the amount that was in the account at the beginning of the period plus (+) any supplies purchased during the period Example: purchased advertising supplies costing $2,500 on October 5. A debit (increase) was made to the asset Advertising Supplies. This account shows a balance of $2,500 on the October 31 trial balance (T.B.). The adjustment will be the amount of supplies that have been USED. At October 31st, an inventory of supplies is taken and it is determined that $1,000 of supplies is still on hand. In order to determine the amount of supplies used, you must SUBTRACT. THIS STEP IS OFTEN FORGOTTEN and should be done as follows: Balance of account on T.B. 2,500.00 1,000.00 - Inventory count (amount on hand) 1,500.00 = Amount USED (the adjustment) Assets Expenses = Liabilities + Owner’s Equity + Revenues Adver. Supplies 2,500 1,500 Adver. Supplies Exp. USED 1,500 1,000 Note that after the adjusting entry, the balance of the Advertising Supplies account, $1,000 reflects the amount shown in the inventory count or the amount of the supplies still on hand. Every adjusting entry affects both the balance sheet and the income statement. For example, the adjustment for supplies used, the debit is to Supplies Expense (an income statement account) and the credit is to supplies (a balance sheet account). This will always hold true. 5. Illustrate the adjustment needed for depreciation of assets. a. Define depreciation—an allocation process in which the cost of a longterm asset (except land as land is considered permanent and is assumed to last forever, so depreciation is not allowed) is divided over the periods in which the asset is used (useful life) in the production of the business’s revenue in a rational and systematic manner. The objective of depreciation accounting is to spread the cost of a long-term asset over the assets’ useful life, rather than treating the cost of an asset as an expense in the year of purchase. TYPICAL STUDENT MISCONCEPTION: in accounting for depreciation, students often think of depreciation in the economic sense. That is, they view it as a 11 valuation process used to record the decline in the value of an asset. In accounting, depreciation has nothing to do with value. It refers only to the allocation of an asset’s cost over its estimated useful life. As time passes, the usefulness of assets will decline, and eventually they will no longer serve their original purpose so the accounting system, must, therefore, reflect the fact that the equipment and furniture will gradually wear out or become obsolete and will have to be replaced. b. Describe the straight-line method of computing depreciation—a popular method of calculating depreciation that yields the same amount of depreciation for each full period an asset is used. When calculating the amount of the adjustment for straight-line depreciation, you should always calculate a yearly amount first, then a monthly amount. See example on page 99 of the textbook. c. Describe the contra-account Accumulated Depreciation. The depreciation adjustment is not reflected directly in the asset account. Accumulated Depreciation is a contra asset account—an account whose balance is opposite (offset against) the asset to which it relates. Since asset accounts have debit balances, contra asset accounts (the opposite of assets) have credit balances. Contra means opposite or against like in the words contradiction, contraband, and contrary (similar to what drawing and expenses do to owner’s equity). Depreciation is recorded in the Accumulated Depreciation account , rather than directly in the asset account, so as to maintain both the asset account showing the original (or historical) cost of the asset and the Accumulated Depreciation account showing how much the asset has depreciated (the total cost that has expired to date). This is especially needed when the asset is sold to determine any gain or loss on the sale of the asset. The questions that must be answered on the tax return are: 1. What was the original cost of the asset? (the amount is found in the asset account) 2. What is the total depreciation that has been taken on the asset? (the amount is found in the accumulated depreciation account) 3. How much was the asset sold for? 4. What is the gain or loss on sale? The use of a contra account provides disclosure of both the original cost of the equipment and the total cost that has expired to date. The following example illustrates the process of allocating expired (deferred) prepayments to expenses: Assets Expenses = Liabilities + Owner’s Equity + Revenues Office Supplies 125 45 Office Supplies Exp. USED 150 275 230 12 45 Prepaid Insur. 240 20 Insurance Expense USED (EXPIRED) 20 220 Office Equip. 3,000 Acc.Dep-Off Eq USED (ALLOCATED) 50 Depr.Exp.-Off. Eq. 50 Office Furn. 2,000 Acc.Dep-Off Furn USED (ALLOCATED) Depr.Exp.-Off.Furn. 30 30 d. Every adjusting entry affects both the balance sheet and the income statement. For example, the adjustment for depreciation, the debit is to Depreciation Expense (an income statement account) and the credit is to accumulated depreciation (a balance sheet account). e. Book Value of an asset. Refer to Illustration 3-8 on page 100 of the text showing the partial balance sheet. Note how the balance sheet discloses the book value of each asset—the difference between an asset’s cost and its accumulated depreciation. The book value of an asset and its market value are not the same. The book value is just the value that is being shown “on the books,” also sometimes referred to as carrying value or unexpired cost. Book value is cost minus (-) accumulated depreciation; market value is what the asset would sell for. A question that often comes up is: Can a business continue to use an asset if it has been fully depreciated (book value is equal to zero). The answer is, YES, because the purpose of depreciation accounting is to spread the cost of an asset over its useful life. An asset may last longer than its “estimated” useful life 6. Affect if the adjusting entry for deferred expenses, initially recorded as assets, is OMITTED: a. Expenses are understated as did not accrue the additional expense of Insurance or Supplies Expense. Set up the accounting equation with simple balances in the accounts if fail to do the adjustment: A = L + OE + R – E or 200 = 100 + 50 +100 -50.. Expenses are showing a balance of $50 but the balance SHOULD BE (S/B) $60 as an additional expense of $10 should have recorded. Therefore expenses are understated by $10 if the adjusting entry is omitted. b. Assets are overstated as did not adjust the asset for the portion used or expired. The accounting equation shows the balances in the accounts if fail to do the adjustment. Assets are showing a balance of $200 but the balance SHOULD BE (S/B) $190 as an asset should have been reduced by $10 for the portion used or expired. Therefore assets are overstated by $10 if the adjusting entry is omitted. 13 c. Net income is overstated as did not record the additional expense of Insurance or Supplies Expense which would reduce the amount of net income as expenses decrease income and owner’s equity. The accounting equation shows a net income of $50 ($100 Revenues - $50 Expenses) if fail to do the adjustment. When the additional expense is recorded the net income is $40 ($100 Revenues - $60 Expenses). Therefore net income is overstated by $10 if the adjusting entry is omitted. 7. Explain the entries needed when deferred expenses are first recorded as expenses. a. There are two ways to initially record deferred or prepaid expenses (1) as assets or (2) as expenses. Both methods yield the identical results on the income statement and the balance sheet. A question usually arises at this point as to WHY would this entry be initially recorded as an EXPENSE and believe it or not, from an auditor’s perspective, this is the METHOD that I have observed is the MORE COMMON method done in practice. Some of the reasons are: i. The entry was made by an inexperienced or not properly educated bookkeeper who believes that any time an expenditure is made; IT MUST BE AN EXPENSE because money has been spent and anytime money is spent, it is an expense with that thinking. ii. There is actually a conceptual reason for recording this type of expenditure initially as an expense especially dealing with the expenditure for supplies. If it is believed that all of the supplies would be used by the end of the accounting period, then it would be wise to initially record the amount as an expense because then it would not be necessary to make an adjusting entry at the end of the accounting period. This reasoning does not make sense, though, when paying for an insurance policy because you would know at the time of the payment if the policy would totally expire or not by the end of the accounting period. But if most of the policy will be expired, then it could be initially recorded as an expense. b. The adjusting entry that transfers the amount of the expenditure that is unexpired (insurance in the example) to an asset account. c. The closing entry that closes the balance of the expense account to the income summary which then becomes part of owner’s equity for the net income or net loss of the company. d. Consider the concept of whether a reversing entry will be considered or not. . Recall the RULE TO MASTER: Whenever an adjusting entry creates a Balance Sheet account (liability or asset) reversal is possible and desirable as well so that the adjusting entry into the created account WILL NOT BE FORGOTTEN. Since an 14 asset account had been created in the adjusting process (prepaid insurance in the example), a reversing entry is needed to return the prepayment to an expense in the next accounting period. VI. Accounting for Prepayments: Unearned (Deferred) Revenues. Deferred revenue can also be called unearned revenue or deferred credits. Endof-the-year adjustments are different for the two methods. A key letter, “D” and a key word, “Deduct,” to remember with Deferrals as amounts are deducted from deferrals during the adjusting process to record correct expenses incurred and revenues earned. With deferred expenses and deferred revenues, not all adjusting entries can be reversed as can be done with accrued expenses and accrued revenues. Another liability called unearned (deferred) revenue that does not have the word, "payable," with the name of the account but it is a liability (a debt owed by the company) as it originates from receiving cash in advance before a revenue (income earned from carrying out the activities of a firm) is performed. The reason that this account is a liability is that a service or sale must be made requiring a performance in the future (a liability as a debt of performance is owed) or the money must be refunded (a liability as a debt owed) if the job is not done. A. Explain the entries needed when deferred revenue is first recorded as a liability: 1. The initial recording when the cash was received: Debit Cash and credit Unearned Subscriptions. 2. The adjusting entry that transfers the amount of money received (for subscriptions in the example) in advance that has been earned to a revenue account: Debit Unearned Subscriptions and credit Subscriptions or Subscription Income, etc. 3. The closing entry that closes the balance of the revenue account to the income summary which then becomes part of owner’s equity for the net income or net loss of the company. (Closing entries are covered in chapter 4 of the textbook). 4. Decide whether a reversing entry will be considered or not. NOTE that no reversing entry will be made. Recall the RULE TO MASTER: Whenever an adjusting entry creates a Balance Sheet account (liability or asset) reversal is possible. When deferred or unearned revenue is initially recorded as a liability, the adjusting process will create or increase a revenue account that is closed in the normal closing routine at the end of the fiscal year. Since NO ASSET or LIABILITY account was created during the adjustment, there is no support for a reversing entry. 5. Affect if the adjusting entry for deferred expenses, initially recorded as assets, is OMITTED: 15 a. Revenues are understated as did not record the additional revenue earned. Set up the accounting equation with simple balances in the accounts if fail to do the adjustment: A = L + OE + R – E or 200 = 100 + 50 +100 -50.. Revenues are showing a balance of $100 but the balance SHOULD BE (S/B) $110 as additional revenue of $10 should have been recorded. Therefore revenues are understated by $10 if the adjusting entry is omitted. b. Liabilities are overstated as did not adjust the portion of the unearned revenue that has now been earned and should be transferred to a revenue account. The accounting equation shows the balances in the accounts if fail to do the adjustment. Liabilities are showing a balance of $100 but the balance SHOULD BE (S/B) $90 as a liability should have been reduced by $10 for the portion earned. Therefore liabilities are overstated by $10 if the adjusting entry is omitted. c. Net income is understated as did not record the additional revenue that had been earned where revenues increase income and owner’s equity. A net income shows of $50 ($100 Revenues - $50 Expenses) if fail to do the adjustment. When the additional revenue is recorded the net income is $60 ($110 Revenues - $50 Expenses). Therefore net income is understated by $10 if the adjusting entry in omitted. B. Explain the entries needed when deferred revenue is first recorded as revenue. 1. The initial recording when the cash was received: Debit Cash and credit a revenue account. There are two ways to initially record deferred or unearned revenues (1) as liabilities or (2) as revenues. Both methods yield the identical results on the income statement and the balance sheet. A question usually arises at this point as to WHY would this entry be initially recorded as an REVENUE and believe it or not, from an auditor’s perspective, this is the METHOD that I have observed is the MORE COMMON method done in practice. Some of the reasons are: a. The entry was made by an inexperienced or not properly educated bookkeeper who believes that any time cash is deposited; IT MUST BE REVENUE because money has been RECEIVED and anytime money is RECEIVED, it is revenue with that thinking. b. There is actually a conceptual reason for recording this type of expenditure initially as revenue. If it is believed that all of the revenue will be earned by the end of the accounting period, then it would be wise to initially record the amount as revenue because then it would not be necessary to make an adjusting entry at the end of the accounting period. This reasoning does not make sense, though, when receiving cash for subscriptions because you would know at the time when the cash is received whether all the subscriptions will be sent or not by the end of the accounting period. But if most of the subscriptions will be sent, then it could be initially recorded as 16 revenue since the interim financial statements would be showing closer to revenue that will be or has been earned. 2. The adjusting entry that transfers the revenues unearned (unearned subscriptions in the example) to a liability account: Debit the revenue account and credit the Unearned Subscriptions. 3. The closing entry that closes the balance of the revenue account to the income summary which then becomes part of owner’s equity for the net income or net loss of the company. (Closing entries are covered in chapter 4 of the textbook). 4. Decide whether a reversing entry will be considered or not. Recall the RULE TO MASTER: Whenever an adjusting entry creates a Balance Sheet account (liability or asset) reversal is possible and desirable as well so that the adjusting entry into the created account WILL NOT BE FORGOTTEN. When a deferred or unearned revenue is initially recorded as revenue, the adjusting process will create or increase a liability account (some unearned revenue account—unearned subscriptions income in the example) and since a liability account had been created or increased in the adjusting process, a reversing entry is needed to return the prepayment to revenue in the next accounting period. VII. Summary of Deferrals. A. Deferrals always result in a DEDUCTION. You will always be reducing what already happened. The final amount of expense or revenue that is shown in the expense or revenue account will always be less than the dollar value that you started to work with. B. There are always two methods to account for deferrals. However, though there are two ways of recording deferrals, there is still just ONE CORRECT RESULT. IX. Accounting Records Formats for Adjusting Entries. A. General Journal showing adjusting entries: 1. The caption, “Adjusting Entries,” is entered on the first line opposite the year of the adjusting entries. This caption helps to inform the readers of the general journal that the entries that are following are the adjusting entries—entries made at the end of an accounting period to insure that the revenue recognition and the matching principles are followed which bring the account balances up-to-date. 2. Explanations are OPTIONAL if you use the caption at the beginning of the adjusting entries, “Adjusting Entries,” as this is all that is needed to inform the readers that the entries following are the adjusting entries at the end of the accounting period. 17 B. General Ledger: 1. The words “Adjusting Entry” are entered into the Explanation column which again alerts the readers of the general ledger that these entries were made at the end of the accounting period to bring the balances of the accounts up-to-date. 2. The date transferred from the general journal shows that the entries were made the last day of the accounting period. C. Preparing the Adjusted Trial Balance: 1. It proves the equality of the total debit balances and the total credit balances in the ledger after all the adjustments have been made. 2. The accounts in the adjusted trial balance contain all the data that are needed for the preparation of the financial statements except for the capital account that may have additional investments in which case that information would show in the general ledger account. D. Preparing Financial Statements: 1. The income statement is the first prepared from the revenue and expense accounts where the numbers are entered from the adjusted trial balance with the adjusted account balances. 2. The statement of retained earnings shows the net income (loss) from the income statement and dividends that have been declared. 3. The balance sheet is then prepared from the asset and liability accounts and the ending retained earnings from the statement of retained earbubgs. Retake opening Quiz and then check your answers as follows: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. True False. The cash account NEVER appears as an adjusting entry. True (1) Accrued expense (4) Deferred revenue (3) Deferred expense (2) Accrued revenue (3) Deferred expense (4) Deferred revenue (2) Accrued revenue (1) Accrued expense 18