COST ANALYSIS

advertisement

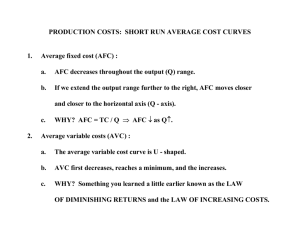

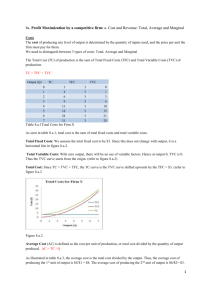

COST ANALYSIS o OBJECTIVES o INTRODUCTION o MEANING o DEFINITIONS o TYPES OF COSTS MONETARY COSTS REAL COSTS OPPORTUNITY COSTS ECONOMIC COSTS ACCOUNTING COSTS INCREMENTAL COSTS SUNK COSTS FUTURE COSTS PRIVATE, EXTERNAL AND SOCIAL COSTS FIXED / SUPPLEMENTARY / OVERHEAD COSTS VARIABLE / PRIME COSTS REPLACEMENT COSTS PRODUCTION COSTS SELLING COSTS CONTROLLABLE COSTS DIRECT COSTS INDIRECT COSTS o SHORT RUN COSTS CURVES o LONG RUN COSTS CURVES OBJECTIVES o To understand the meaning of cost. o To discuss different types of costs. o To describe in detail the short run and long run costs. o To understand the importance of cost in managerial decision-making. INTRODUCTION To decide about the quality and quantity of a product depends upon the cost of the cost of the product. In producing a product / service a firm has in incur various costs in form of wages, interest and price of raw – material etc. Hence, from a firm point of view, to estimate correct cost is important for decision-making. An incorrect estimation or a misunderstanding of the costs may have a negative effect on the profit and growth of an organization. MEANING OF COST In simple words the payments rent, wage, interest and profit which are made to factors of production (land, labour, capital and entrepreneur) for their services. It means cost includes the value of the factors of production employed. The term costs mean sacrifice (interms of money or comforts) which are made to produce goods and services. Cost function depends on various factors such as output, technology and price of input, productivity of inputs. C = f (Q, T, PI, ProI, S) C = Cost, O = Output, PI = Price of Input, S = Size of Plant, T = Technology, Pro I = Productivity of Input The most important determinant of cost is output. Generally cost of production increases with the increase in Output. Technology also has effect on the cost of production. If technology is modern, then cost of production will low and vice-versa. Due to rise in the price of input, the cost of production will also rise productivity of input also determines the cost. If productivity of input is high then cost of production will low and vice-versa. Size of plant – As the size of plant increases, costs of production decreases and viceversa. DEFINITION TYPES OF COSTS 1. Money Cost : Money cost is that cost, in which cost is incurred in terms of money. In simple words, money cost refers to the amount of money which is incurred to produce a good or services. For example – to produce 10 shirts, a producer has to pay Rs.1,000. Hence the money cost is Rs.1000 to produce 10 shirts. Rent, wages, interest, depreciation, packing charges, transport cost, normal profits cost of raw material, selling costs are included in money costs. J. L. Hanson, “The money cost of producing a certain output of a commodity is the sum of all the payments to the factors of production engaged in the production of that commodity.” Money cost is of two types – a) Explicit Costs : Explicit costs are those costs, which are paid to the others for their services and goods. According to Leftwitch, Explicit costs are those cash payments which firms make to outsiders for their services and goods.” These costs are also known as out of packets costs or accounting costs. Explicit costs includes, following items of a firm’s expenditure i. Cost of raw material ii. Transportation cost iii. Packing cost iv. Power changes v. Taxes vi. Rent vii. Wages viii. Interest b) Implicit Costs : Implicit costs are those costs, which are paid by an entrepreneur to his own resources or factors of production (own land, own labour, own capital and own building etc.). Implicit costs are costs of self – owned and self-employed resources.” Implicit cost does not involve a physical cash payment, because it uses the factors which a firm does not buy or hire but already owns. Implicitly money costs are as follows : i. Wages of his own labour ii. Rent of his own land iii. Interest on his own capital iv. Profits for his own entrepreneurial functions. Total Money Cost = Explicit Costs + Implicit Costs 2. Real Costs : Real Costs are non quantifiable in money terms. These costs are psychological in nature. Real costs refers to the payments which are paid to factors of production for their efforts, rain, discomforts, execution and sacrifice, in producing the different products. According to Marshall, “The production of a commodity generally requires many different kinds of labour and the use of capital in many forms. The exertions of all the different kinds of labour that are directly or indirectly involves in making it together with the abstinences or rather the waiting required for saving the capital used in making it – all these efforts and sacrifices together will be called the real cost of production of commodity.” Real costs involves – Compensation package given to employees for the troubles in producing a product. 3. Compensation for sound effects of pollution caused by factory smoke. Opportunity Costs : Opportunity cost is also known as alternative cost. The concept of opportunity cost was introduced by D.I. Green in 1894, but Prof. Knight made it popular. Factors of production or resources, in an economy are limited and have alternative uses. To produce a particular good the resources has to be withdrawn / sacrificed from the production of other goods. The cost of sacrifice or foregone for the next best use of resource is known as opportunity cost. Ferguson, “The opportunity cost of producing one unit of ‘X’-commodity is the amount of ‘Y’-commodity that must be sacrificed.” Leftwitch -, “Opportunity Cost of a particular product is the value of foregone alternative products that resources used in its production, could have produced.” For example, in an economy two goods X and Y are produced. The quantity of X good is OX and Y good is OY. If the quantity Y Figure - increase from OY to YY’, then the quantity of X commodity has increased Y-Commodity of Y commodity has to Y1 Y from OX to OX’. O 1 4. Economic Costs: X X X X-Commodity Economic costs includes the payments such as rent, wages, interest and profit, which are paid to factors of production – land, labour, capital and entrepreneur for their services. Hence, economic costs include normal profits which are paid to an entrepreneur for his managerial and entrepreneurial skills. It means economic costs refer to the payment costs which are paid to factors of production. (outside resources) for their services as well as payments for owned factors. In simple words, economic costs include explicit and implicit costs. Economic Costs = Explicit Costs + Implicit Costs Or Economic Costs = Accounting Costs + Implicit Costs 5. Accounting Costs: - An accountant’s view is differed from an economists view on cost. Accounting costs refer to only cash payments which are made to factors of production for their services. Hence, an accountant will include only explicit costs. It means accounting costs include rent, wage and interest but not the profits. Accounting Costs = Explicit Costs Or Accounting Costs = Rent + Wage + Interest 6. Incremental Costs: - Incremental costs refer to the additional cost that a firm has to incur as a result of implementing a major managerial decision. Examples of incremental costs are purchasing new company, hiring new staff. 7. Sunk Costs: - Sunck costs are the historical costs which are made in past. These costs are irrelevant while making decisions. 8. Future Costs: Future costs are also known as planned or budgeted costs. These costs are incurred in the future for making financial, managerial, business decisions. 9. Private, External and Social Costs: - Private costs are the costs which are incurred by a firm for the production of a commodity. Whereas social costs are the costs which are incurred by the society as a whole. The cost which is incurred by others in society is known as external cost. Social Cost = Private Cost + External Cost 10. Fixed Cost / Supplementary / Overhead Costs:– Fixed / Supplementary/ Overhead costs are those costs which do not change with the change in level of output. It means if the output of firm is zero, even than a producer has to pay it and this cost remain fixed with the increase in the level of output. Examples payments of rent for a building, insurance premium, interest on capita etc. 11. Output Fixed Cost 0 10 1 10 2 10 3 10 4 10 5 10 Variable / Prime Costs: - Variable / Prime costs are the costs which change with the change in level of output when output is zero, the variable cost also zero. It will increase with the increase in level of output. Examples are expenses on raw material, electricity changes, telephone charges. Output Fixed Cost 0 0 1 5 12. 2 12 3 14 4 15 5 20 Replacement Costs: - Replacement cost is also known as depreciation cost. With the continue utilization of fixed assets such as tools, equipments and machinery, they depreciated. Hence, there is need to replace these assets. The cost at which these assets are replaced is known as replacement cost. 13. Production Costs: - Production costs are the costs which are incurred to increase the level of output of a firm. The payments which are made to factors of production are known as product costs. 14. Selling Costs: - Selling costs are incurred t increase the sale of available products. Examples are commission paid to salesman, advertisement of different products. 15. Controllable Costs: - Controllable Costs are controlled by the management of a firm. For example cost of quality control, fringes benefits to employees. 16. Uncontrollable Costs: - These types of costs are beyond the control of the management of a firm. For example – price of raw material. 17. Direct Costs: - Direct costs refers to those costs which can be attributed to any particular activity. 18. Indirect Costs: - These types of costs can not be attributed to a particular activity. Figure 10.1 Costs According to Time Period Short Run Cost Curve Total Cost (TC) Total Fixed Costs (TFC) Total Variable Costs (TVC) Average Cost (AC) Average Fixed Costs (AFC) Long Run Cost Curve Marginal Cost (MC) Average Variable Costs (AVC) Long Run Total Costs (LTC) [TC =TFC+TVC] Long Run Average Costs (LAC) Long Run Marginal Costs (LMC) [AC = AFC+AVC] MC = TCn – TCn-1 Or MC = ΔTC ΔQ According to ‘Time Period’ Cost is of two types : a) Short Run Cost b) Long Run Cost a) Short Run Cost : In short run, some factors remain fixed and other are variable. In short run, costs are of three types: i) Total Costs ii) Average Costs iii) Marginal Costs i) Total Costs : - Total cost is the aggregate of money, which is spend by a firm in the production of a commodity. For example, if a firm is spending Rs.1000 on the production of 500 units. Then total cost is Rs.1000. In other words total cost is the sum of the fixed and variable cost. TC = TFC + TVC Or TC = FC + VC TC = Total Costs TFC = Total Fixed Costs TVC = Total Variable Costs FC = Fixed Costs VC = Variable Costs Dooley, “Total cost of production is the sum of all production is the sum of all expenditure incurred in producing a given volume of output. Total costs are of two types: a) Total Fixed or Supplementary Costs : - Total Fixed Cost is the cost of fixed factors which are used to produce goods in short time period. Firm spends on plant, fittings, equipments etc. even starting the production. It means fixed costs do not change with the change in output. If the production is zero, even than a firm has to pay fixed cost. As the quantity of output increases, the fixed costs do not change. Fixed Costs are also known as, supplementary cost, indirect costs overall costs or plant costs. 1. Anatol Murod, “Fixed costs are cost which do not change with changes in the quantity of output.” 2. Benham, “The fixed costs are those costs that do not vary with the size of its output. Rent, depreciation, normal profit, license fee, insurance premium are the expenses included in fixed costs. indicates 2 fixed costs remain fixed whatever the level of output. Fixed cost is parallel to OX 1210- 6- that fixed cost 4- remain 2- same either output is zero or 10. It costs F C 8- axis. It reveals means Figure -2 Fixed Costs Y that Fixed Costs (Rs.) Figure O | 1 | 2 | 3 | 4 fixed | 5 | 6 | 7 | 8 | 9 | 10 X Output remain same irrespective of the volume of output. b) Total Variable or Prime or Special Costs : - Total variable or prime or special costs refer to those costs which change with the change in volume of level of production. Dooley, “Variable costs is one which varies as the level of output varies.” If output increases, variable costs also increase and as the output decreases, Costs also decrease. When output zero, these costs are also zero. The short run variable costs are – Prices of raw material, wages of temporary labour, excise duties and sales tax, wear and tear expenses, transport costs etc. Table 2, shows that costs increase with the increase in level of output, When output is zero, total variable costs are also zero. When Output is 1 unit, cost is Rs.12 and when it reaches 10 units the variable costs are Rs.74. Table 10.2 Total Variable Costs Figure 3, Output Total Variable 0 0 1 12 2 20 3 26 4 30 5 32 6 32 7 40 8 48 9 58 10 70 shows that the shape of Y 100- total variable costs cost is determined by the Law of Returns. Initially factors employed variable when 80- Total Variable Costs variable 70D.R. 6050- C.R. 4030- are 20- then 10O factor VC 90- is inverse S shape. The shape of total Figure -3 Total Variable Costs I.R. | | | | | | | | | | 1 2 3 4 5 6 7 8 9 10 Output X brings in more than proportionate returns, hence cost increases at diminishing rate. At the point of optimum capacity, the returns of variable factors remain constant, hence cost is also constant. At last, after optimum point every additional unit of variable factor yields only less than proportionate return, hence cost increase. Variable cost curve is sloping upwards at diminishing, constant and increasing rate. IR = Increasing Returns CR = Constant Returns DR = Decreasing Returns Relationship between Total, Fixed and Variable Cost In short time period, total costs is the aggregate of total fixed costs and total variable costs. 1) TC = TFC + TVC OR TC = FC + VC 2) VC = TC – FC 3) FC = TC – VC TC = Total Costs VC = Variable Costs FC = Fixed Costs TFC = Total Fixed Costs TVC = Total Variable Costs Table 10.3 Total Costs Output Fixed Costs Variable Costs Total Costs (Rs.) (Rs.) (Rs.) 0 10 0 10 1 10 12 22 2 10 20 30 3 10 26 36 4 10 30 40 5 10 32 42 6 10 34 44 7 10 40 50 8 10 48 58 9 10 58 68 10 10 72 82 Table 3, shows that when output is zero, fixed cost is rs.10 and variable cost is Rs. Zero, while total cost is [FC(10+VC(0) = Rs. 10]. It reveals that total costs are the sum of fixed and variable costs. When output increases to 8 units total costs go up Rs. 58 (Rs.10+Rs.48). Figure 4 shows the relationship between total costs, fixed costs and variable costs. Total costs are the sum total of fixed and variable costs. 6050- hence total costs is 40- also Total 30- Cost and variable 20- cost 10O Rs.10. parallel other. 2) Rs.10, 70- Costs cost curves to are each VC 80- zero and variable fixed TC 90- At point O, output is cost is also zero but Figure - 4 Total Costs Y 100- FC | | | | | | | | | | 1 2 3 4 5 6 7 8 9 10 Output Average Costs : - Average cost is the per unit cost of a commodity. Dolley, “The average cost of production is the total cost per unit of output.” Ferguson -, “Average cost is total cost divided by output.” X Hence AC can be calculated as following AC = AC = TC Q Average Cost TC = Total Cost Q = Quantity The other method to calculate average cost is AC = AFC + AVC AC = Average Cost AFC = Average Fixed Cost AVC = Average Variable Cost AFC = AC – AVC AVC = AC – AFC Table 10.4 Average Cost Output Total Cost Average Cost (Rs.) (Rs.) 0 10 ∞ 1 22 22 2 30 15 3 36 12 4 40 10 5 42 8.4 6 44 7.3 7 50 7.1 8 58 7.2 9 68 7.5 10 82 8.2 Table 10.4 depicts that average cost can be calculated by dividing total costs with output. In the beginning average cost is high and then it diminishing. At unit 7, AC is minimum, after this point as the level of output increases, AC also increasing. Figure 5, shows the 90- shape of AC is ‘u’ In beginning, level of 80- the as the output 70- Costs shaped. Figure - 5 Average Cost Y 100- 60- AC 50- increases, AC 40- diminishes and 30- reach at ‘M’ point 20- which 10O shows minimum cost. After M | | | | | | | | | | 1 2 3 4 5 6 7 8 9 10 point ‘M’ average X Output cost again rises. a) Average Fixed Cost : - Average Fixed Cost, can be calculated by dividing total fixed cost with the level of output. As the level of output increases, the average fixed cost decreases. AFC = AFC = TFC Q Average Fixed Cost TFC = Total Fixed Cost Q = Quantity Table 10.5 Average Fixed Costs Output Total Fixed Cost Average Fixed Cost (Rs.) (Rs.) 0 10 ∞ 1 10 10 2 10 5 3 10 3.3 4 10 2.5 5 10 2 6 10 1.7 7 10 1.4 8 10 1.2 9 10 1.1 10 10 1 Table 5 conveys that as level of output is increasing the Average Fixed Cost diminishing. Figure 6, shows that the slope of average fixed cost is downward 90- sloping, it means as the 80- level output 70- increases the average 60- fixed costs diminish. 50- Average Cost 40- curve is a rectangular 30- of Fixed hyperbola, because the total area under the curve at different Figure - 6 Average Fixed Costs Y 100- 2010O AFC | | | | | | | | | | 1 2 3 4 5 6 7 8 9 10 points will be the same. X Quantity b) Average Variable Costs : - Average Variable Cost is the per unit cost of the variable factors of production. It can be calculated dividing total variable cost by output. AVC = AVC = TVC Q Average Variable Cost TVC = Total Variable Cost Q = Output Table 10.6 Average Variable Costs Output Total Fixed Cost Average Fixed Cost (Rs.) (Rs.) 0 0 0 1 12 12 2 20 10 3 26 8.6 4 30 7.5 5 32 6.4 6 34 5.6 7 40 5.7 8 48 6 9 58 6.4 10 72 7.2 Table 6, conveys that if output is zero, total variable cost is also zero, hence average 8070- Upto 6 units of output, 60- average variable cost is 50- falling, but it begins to 40- increase the 30- seventh units. This is 20- happened because of 10O implication of law of variable proportion. AVC 90- variable cost is also. from Figure - 7 Average Variable Costs Y 100- | | | | | | | | | | 1 2 3 4 5 6 7 8 9 10 Quantity X In Figure 7, Output is shown on OX-axis and costs is shown on OY axis. The shape of AVC is ‘U’ shaped. It shows that upto 6 units of output, AVC is falling because as the output is increasing, AVC is diminishing. From 7 units onward, AVC begins to increase, which implies that AVC is increasing with increase in output. Relation between AC, AFC and AVC : AC is the aggregate of AFC and AVC. AC = AFC + AVC AC = TC/Q AFC = TFC/Q AVC = TVC/Q AFC = AC – AVC AVC = AC - AFC Table 10.7 Relation between AC, AFC & AVC Output AFC (Rs.) AVC (Rs.) AC = AFC+AVC (Rs.) 0 ∞ 0 ∞ 1 10 12 22 2 5 10 15 3 3.3 8.6 12 4 2.5 7.5 10 5 2 6.4 8.4 6 1.7 5.6 7.3 7 1.4 5.7 7.1 8 1.2 6 7.2 9 1.1 6.4 7.5 10 1 7.2 8.2 Table 7 shows that at zero output AFC is ∞ and AVC is zero, hence AC is equal to ∞. Then at 7 units AFC is Rs.1.4 and AVC is Rs.5.7, hence AC is Rs.7.1, here AC is at minimum. After 7 units AC is increasing. Figure 8 reveals that Y AC Figure - 8 Relation b/w AC, AFC & AVC is AC obtained AC by adding of Costs and AVC. A AFC B AC curve tends F to AC come close to O AVC but it Q Q1 Quantity never touches the latter. On point ‘A’ AC is falling. Hence a firms AC is minimum because it making full use of its available resources and output is maximum, i.e. OQ1. After A point there is only rise is cost but not in production. AVC minimum point is ‘B’, when level of output is less i.e. OQ as compare to OQ1. The combination of AFC and AVC at point F gives U shape and exactly above this point AC curve is showing in U shape. It reveals that AC is ‘U’ shaped but also is the combination of AFC and AVC. Causes of AC is ‘U’ shaped. AC is ‘U’ shaped like English alphabet ‘U’. It shows that initially average cost falls with the rise in production, after then it reaches at its minimize point due to X maximum production and after this it begins to rise upward due to fall in production. There are following causes of ‘U’ shape of AC : i) Basis of Internal Economies : - In short run when a firm increase its level of production then due to indivisibles of fixed factors firm gets its internal economies such as market economies, managerial economies, technical economies etc. Hence with the increase in production level its cost per unit fall. ii) Basis of Diseconomies : - In short run due to various diseconomies such as poor division of labour, inefficient management, poor or updated technology, unskilled labour with the rise level of production, cost per unit increases. iii) Basis of Law of Variable Proportions : - Law of variable proportion is applicable in short run in which only one factor i.e. labour is variable ad all factors are fixed. Here are three stages of law of variable proportion – (a) Law of Increasing Returns to Factors : – When this law is applicable with the rise in level of production, the cost decreases. (b) Law of Constant Returns to Factors : – It means at this point the production is maximum due to optimum utilization of factors, hence cost is minimum. (c) Law of Decreasing Returns to Factors : - According to this law as the number of variable factor increases, the production beings to diminish, which means cost per unit of production increase. Hence these are the causes of AC is ‘U’ shaped. 3) Marginal Cost :- Marginal Cost is an addition made to total cost by the production of one more unit of output. In other words marginal cost is the change in total cost with the one unit change in output. It measure the increase in total cost as increase in one unit. It is also known as extra unit cost or incremental cost. MC = ∆TC ∆Q MC = Marginal Cost ∆TC = Change in Total Cost ∆Q = Change in Output OR MC = TCn – TCn-1 MC = Marginal Cost TCn = Total Cost of ‘n’ units TCn-1 = Total Cost of ‘n-1’ units If the total cost of production of 7 units of a commodity is Rs.100. When 8 units are produced, change in total cost is Rs.120. Thus the marginal cost is i) MC = TCn – TCn-1 MC = 120 – 100 MC = Rs.20/- Samuelson, “Marginal Cost at any output level is the extra cost producing one extra unit more or less.” ii) Ferguson, “Marginal Cost is the addition to total cost due to the addition of one unit of output.” Table 10.8 Marginal Cost Output TC (Rs.) MC (Rs.) 0 10 - 1 22 12 2 30 8 3 36 6 4 40 4 5 42 2 6 44 2 7 50 6 8 58 8 9 68 10 10 82 4 It is clear from table 8, that marginal cost initially falls with the rise in the level of output. After then constant and ultimately rises with the rise in level of output. Figure 9, reveals that the shape of is ‘U’ shaped. In starting MC falls with the rise in level of 16- 12108- ‘M’ is 6- and 4- after ‘M’ point 2- minimum MC rises with MC 14- output. At point MC Figure -9 Marginal Cost 18- Costs MC Y 20- O M | | | | | | | | | | 1 2 3 4 5 6 7 8 9 10 the rise in the X Output level of output. Relationship between Average Cost and Marginal Cost :i) Both AC & MC are calculated from TC. Both AC and MC are calculated from TC. i) Formula to calculate AC. ii) AC = TC Q Formula to calculate MC MC = TCn – TCn-1 ii) When AC falls MC also falls. Figure 10, shows that when AC falls MC also fall more than AC. It means MC curve is below than AC. iii) When AC rises, Y MC also rises – Figure 10 Relation between AC and MC Figure 10 shows that after M AC MC Costs point when AC runs, MC also rises more than M AC. iv) M MC cuts AC at its 1 minimum point M from O Q1 below. v) X Q Quantity Attraction between AC and MC – Figure 11 Y Figure 11 Attraction between AC and MC shows that MC When MC>AC :- It pulls AC upwards. Costs AC MC When MC = AC :- Then Ac MC is constant. When MC < O Output AC:- Then MC pushes AC downward. Estimation of Cost Function Cost function expresses the relationship between cost and output. TC = f (Q) TC = Total Cost Q = Output X Costs function is of three types i) Linear Cost Function : - A linear cost function in short run is as under:TC = a + bQ a = is intercept (represent Total Fixed Cost) bQ = slope coefficient (represent Total Variable Cost) AFC = AVC = ATC = MC = TFC Q TVC Q = = TC = a + bQ Q Q ∆TC = b ∆Q a b bQ Q = b = a+b Q Figure 12 shows linear relationship TC, AC & MC. Figure 12 Linear Cost Function Costs Y AC=MC O ii) TC Output X Quadratic Cost Function :- Quadratic Cost function is as following : - TC a BQ CQ 2 a AC b CQ Q MC b 2CQ Quadratic Cost function shows law of diminishing returns only. Figure 13 Figure 13 Quadratic Cost Function conveys that Y MC and AC are MC AC rising but MC is than Costs rising more AC, hence law of diminishing returns is applying. X Output Cubic Cost Function : - Cubic Cost function is as following :TC a BQ CQ 2 dQ 3 AC a b CQ dQ 2 Q MC b 2CQ 3dQ 2 Figure 14 Y shows Figure 14 Cubic Cost Function Cubic relations MC AC hip between AC & Costs iii) O M MC. MC cuts AC from below at O its minimum points ‘M’. Output Q X Long Run Cost Curves : In short run except few factors of production, all factors of production consumed to be constant. Whereas in long run all factors of production are changeable. In long run a firm can increase its capacity, equipment, machinery, land, employee, etc. in order increase output. Hence, there is no difference between fixed and variable costs. All costs are variable costs. Koutsoyiannis, “The long run is the period in which all factors are variable. Figure 15 Long Run Costs Curve Long Run Total Cost Long Run Marginal Costs Long – Run Total Cost :- Long run total cost is always equal or less than to short run total cost, but it is never more than long run total cost (LTC) i.e. LTC≤ STC. In long run when output is zero and all costs being variable Y Figure 16 (A) Long Run Total Costs LTC costs, hence, total cost is also equal to zero. Hence, it starts from origin. Long run total costs, is of three types:- Costs i) Long Run Average Cost Figure 16(A), shows that LTC Curve is based on an assumption O Output X that as output is increased cost in starting rises at diminishing rate and later at increasing rate. Figure 16(B) shows that increase in output, followed by increase in cost at constant rate. Y Figure 16 (B) Long Run Total Costs Costs LTC O X Output Figure 16(C) shows that as output is increased, cost rises at diminishing rate. The Final Shape of LRTC is Y Figure 16 (C) Long Run Total Cost OQ point shows that when returns scale are increasing at increasing rate, total cost increases Costs to LTC at diminishing rate. OQ1 point shows that returns to scale are constant hence total cost is also constant. O Output X Beyond Q1 point in figure 17 shows that returns to scale are decreasing, hence total cost is increasing at Figure -17 Long Run Total Cost Y faster rate. LRTC Costs D.R. C.R . I.R . O ii) Q Q1 X Long Run Average Cost : - Long run average cost is also known as ‘Envelope Curve’ or ‘Planning Curve’. Long Run average cost refers to the minimum cost of producing different quantities. Definition :a) J. S. Bain, “The long run average cost curve shows for each possible output, the lower cost of producing that output in the long run.” b) Robert Awh, “The LAC shows the lowest AC of producing output when all inputs can be varied freely.” Long run average cost involves various short run average cost plan. It helps a producer to choose. In long run each firm has various plants and each plant has its short run average cost (SAC), which helps to estimate about LAC. Plants help a producer to choose that plant whose average cost is minimum. Let a firm has three types of plants – Small plant operates with cost SAC1, the medium plant operates with the cost SAC2 and large plant operates with the cost SAC3. If firm wants to produces OQ1 quantity of output, then it will select the small plant. If it wants to produce OQ3 quantity of output it will go for large plant. Figure 18, reveals that small plant produces at minimum cost upto OU quantity of output. After this point cost will begin to rise. If demand is likely to exceed OB in future then firm will start medium sized plant because its quantity is more and cost is less as compare to small size plant i.e. OQ2 and OC2. If firm excepts that the demand for its product will exceed OC units, then it will install large size plant. LAC is also known as envelope curve because it is the envelope of a group of SAC. LAC Curve is like a planning device, because it helps a producer to choose optimum scale of plant. SAC1 Figure 18 Long Run Average Cost SAC2 Y SAC3 C1 C2 Cost C3 O u Q1 Q2 v Quantity Q3 w3 X Figure 19 shows LAC is the tangent to each short average cost curves. The figure shows that optimum scale of plant for a producer is at M point. At this point long run average cost and short run average cost are equal to each other (LAC = SAC). Figure 19 Envelope Or Planning Curve Y SAC1 SAC5 SAC2 SAC4 LAC Cost SAC3 M O X Quantity Economies of Scale and the LAC The shape of LAC Curve is less U-shaped or rather dish or source shaped. The LAC Curve is the mirror image of the returns to the scale in the long run. The returns to scale are based on Y Figure 20 Economies and Diseconomies and LAC economies and diseconomies of scale. LAC In figure 20, Costs A (IRTS ) Economies the point from increasing B returns to scale which firm means is (DRTS) Diseconomies (CRTS) A to B shows O Economies = Diseconomies Quantity D C X enjoying various economies the points B and shows constant returns to scale which indicates that economies and diseconomies are equal to each other. After C point there is decreasing returns to scale which means diseconomies are arising. Long Run Marginal Cost : - Long run marginal cost is the change in long run total cost due to the production of one more unit. LMC LTC Q The shape of LMC curve has a flatter Y U-shape. Figure - 21 Long Run Marginal Cost Figure 21, depicts that Long LMC Run SMC Marginal Cost is of flatter shape indicating that due to increasing scale of initially Marginal Cost iii) production, output expands but after certain point tends to decrease. it O Quantity X Case of Economies of Scale and Cost Minimization A well known, car manufacturing firm in India that is Maruti Udyog Limited, has revealed the importance of economies of scale in business decision making. Due to these economies the firm could achieved three fold rise in its net profit earnings in the year 2003-04. The firm has reduced its average fixed cost by increasing its output and sales volume by 30 percent. Source : MUL Gains from Cost-Saving Measures, Sify India, 18 May, 2004. Modern approach of cost curves: The concept of modern approach of cost curve was propounded by Sargent, Andrews, Stigler, Florence and Friedmen etc. According to traditional theory of costs, Cost curves are of ‘U’ shape. But according to modern theory cost curves are of ‘L’ shaped. Like traditional theory, modern theory is based on two time periods i.e. (i) Short Run and (ii) Long Run. Average Fixed Cost, Average Variable Cost, Average Cost and Marginal Cost Curves are explained in Short Run time period is as following – Short Run Average Fixed Cost: - Average Fixed cost includes cost such as depreciation of machinery, salaries of permanent staff members, salaries and other expenses of administrative staff etc. In short run a firm has limited capacity to increase the level of output but in long run it has largest capacity units, which is indicated in figure 22, by boundary line N. The firm has also Y limited Figure - 22 Short-Run Average Fixed Cost as per Modern Theory L boundary N line L which is shown in figure. In case of N boundary Cost (i) c line a firm d a can expand b AFC its short run output upto N by paying O Quantity X overtime to labour for longer working hours. In this case AFC is ab line. A firm can also increase it output by purchasing additional machinery. In this case, the AFC shifts upwards and starts falling again, as shown by the dotted line cd. Average Variable Cost: - As per modern theory, the shape of short run average variable costs curve is saucer – shaped, that is it has a flat stretch over a range of output. Flat stretch represents the built in reserve capacity of the plant. There are various reasons to have some reserve capacity for a firm – (a) to meet seasonal and cyclical fluctuations in demand, (b) it gives a freedom to an entrepreneur to increase output upto to desire level, (c) due to change in technology etc. Figure 23, shows that the Figure 23 Short Run Average Variable Cost Y falling portion (AB) of SAVC shows reduction in cost whereas the SAVC D A Costs (ii) rising portion (CD) B of the SAVC shows increase C the in cost. The BC O Quantity portion shows that SAVC is equal to the marginal cost. X (iii) Short Run Average Cost Curve: - According to modern theory AC curve is continuously falling Figure - 24 Shirt Run Average Cost Y upto a given level of output. Thereafter AC SAC upward. Cost Curve is rising It means AC will rise if output is increased beyond reserved O capacity (figure X Quantity 24). Short – Run Figure - 25 Short Run Marginal Cost Y Marginal Cost Curve: - Figure 25 shows that in MC AVC initial MC is below to AVC. From AVC Cost (iv) MC M N point M to N marginal cost is horizontal which mean O AVC=MC. After point N, MC rises above to AVC. Quantity X Long Run Cost Curves According to Modern theory long run average cost curve and long run marginal cost curve are not ‘U’ shaped but ‘L’ – shaped. i) Long Run Average Cost Curve:- There are two main causes of L – shape of LAC – (a) Technological Progress and (b) Learning by doing. According to modern Figure - 26 L-Shape of Long Run Average Cost Y theory, a firm normally makes use of 2/3 of its Cost plant’s production capacity. On the basis of short run average cost relating to LAC O Quantity X 2/3rd utilization of plant capacity the shape of LAC is L-shaped, which is shown in figure-26. Long Run marginal Cost Curve:- shape of depends MC upon relation Figure – 27 (A) Shape of LMC The is the between LAC and LMC Curve Cost ii) Y is shown in figure 10.27(A) and LAC 10.27(B) LMC respectively. O Quantity X Figure 10.27(A) shows that when L-shaped LAC curve is falling then LMC Curve will also be falling. LMC falling portion will be below the falling portion of LAC Curve. Figure 10.27(B) shows that when LAC is inverted shaped of LAC Jthen Cost Curve Figure – 27(B) Shape of LMC Y LMC is below than LAC Curve. When LAC is constant, LMC also LAC = LMC LM C O Quantity X become constant. Case Study 10.1: Estimate of Short-Run and Long-Run Cost Functions: The results of 16 empirical studies on short run and long run cost functions, as well as on the method of estimation, reported by A.A. Walters in 1963. The questionnaire’s method is based on managers’ answers to questions asked by the researcher on the firm’s production costs. Most studies found that in the short run. MC is constant in the observed range of outputs. Most studies also indicate the presence of economies of scale at all observed levels of output. Firms, however, seen to avoid expanding into the range of decreasing returns to scale in the long run. Another empirical study on the extent of economies of scale in specific U.S. industries over the 1967-1970 periods by William G. Shepherd found economies of scale to be slight in steel, fabric, weaving, shoes, paints, cement, automobile, batteries and petroleum refining, slight to moderate in beer and refrigerators. Another study of 29 industries in India by V. K. Gupta in 1968 found that 18 industries had L-shaped LAC Curves, 6 industries had horizontal or nearly horizontal LAC curves and the remaining 5 industries had U-shaped LAC Curves. Source : Marginal Economies: Principles and Worldwide Applications by Salvatore, Dominick. Case Study 10.2:Cost Analysis of Bajaj Auto Limited – In India Bajaj Auto Limited has been the most dominant two wheeler manufacturer. The goal of the company is to provide the best value for his money to its customer. Till 1996, Bajaj Auto India had an overall 49 percent share in the market. Bajaj Scooter, Bajaj Moped and Bajaj three Wheeler had 69 percent, 12 percent and 90 percent share in the market. The company claims to be the lowest cost producer of scooters in the world and its nearest competitor that LML charges a price 50percent higher. In spite of having the most illustrious market profile, the company’s overall performance has taken a beating. Its profit margin has fallen from 20.24 percent in 1995-96 to 19 percent in 1996-97. It competitors such as TVS Suzuki, Kinetic Honda etc have slowly been eating into its 44 percent share in two wheelers, bringing it down to 41.6 percent in 1996-97 alone. The scooter has dipped to a 6.6 percent share in the market, the moped share down by 2 percent to 10 percent and three wheeler share down by 5 percent to 85 percent share of the market. The present plant near Pune and Indore are running to their full capacity manufacturing one million scooters per year making Bajaj the only company to the have achieved the feet outside Japan. The new plant coming at Chakan near Pune and the expansion of capacity at 1999. Bajaj Auto is a legendary story of optimizing cost to maximize value for the customer. In its quest to minimize costs it has shown tremendous amount of professionalism in beating competition not only through cutting down heavily on manufacturing costs, but also on other indirect farm a part of overheads results which show that Bajaj being an Indian company has successfully prevented foreign giants to invade the Indian markets and capture large market shares. Source : Managerial Economics by Atmanand OBJECTIVE QUESTIONS:Q1. Define Cost? Q2. What is Monetary Cost? Q3. Describe Opportunity Cost? Q4. Write down the difference between economic and accounting costs? Q5. Distinguish between production and selling cost? Q6. Write down the different names of Fixed Costs? Q7. Distinguish between Sunk and Future Costs? Q8. Distinguish between controllable and uncontrollable costs? Q9. What is the shape of AFC? Q10. Write down the formula to calculate Marginal Cost? Q11. What is Variable Cost? Q12. Distinguish between Explicit and Implicit Costs? Q13. What is the shape of AVC? Q14. What is the shape of AVC in the long run as per modern theory? Q15. Draw the different shapes of LRTC? Q16. Which curve is known as Envelope Curve? Q17. Write down Quadratic Cost Function? Q18. What is the shape of LMC as per modern theory? Q19. Explain the relationship between AC and MC? DESCRIPTIVE QUESTIONS: Q1. Define Cost? Explain in detail different types of costs in general? Q2. Explain the traditional theory of cost with tables and diagrams? Q3. Can cost function be derived graphically from production functions? Q4. Explain AC, AFC and AVC in detail. Also draw schedules and diagrams? Q5. Why AVC Curve ‘U’ shaped? Q6. Describe why AVC curve is known as planning curve? Q7. Discuss the relationship between TC, Ac and MC? Q8. Explain modern theory of costs in detail? Q9. Explain the relationship between LAC and LMC according to modern theory of cost curves? Q10. Calculate – TFC, TVC, AC, AFC AVC and MC from the following table: Output 0 1 2 3 4 5 6 Total Cost 40 100 120 130 150 190 210 ASSIGNMENTS: 1. Collect the data regarding Total Fixed Cost, Total Variable Cost, Average Fixed Cost, then from this data calculate: a) Total Cost b) Average variable Cost c) Average Cost d) Marginal Cost Also draw diagrams of all these costs. 2. Collect the Long Run Average Cost of different firms and study the shape the LRAC either it is ‘U’ shaped or L-shaped? SUGGESTED READINGS:1. Raj Kumar and Kuldip Gupta (2007), “Business Economics”, UDH Publishers and Distributors (P) Ltd, New Delhi, pp.338-362. 2. Mithani, D.M.(2010), Marginal Economics: Theory and Applications, Himalaya Publishing House, New Delhi, Mumbai, pp.271-302. 3. Geetika, Piyali, Ghosh and Purba Roy Choudhary, (2008), “Managerial Economics, “Tata McGraw Hill, pp.215-230. 4. Jain, T.R.(1996), Micro Economics, V.K. Publishing House, Delhi, pp.188-218. 5. Atmanand (2005), “Managerial Economics, Published by Anurag Jain, New Delhi, pp.125-166.