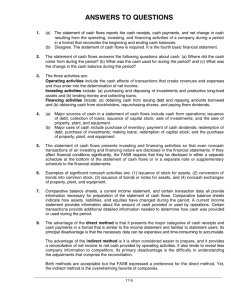

Ch23

advertisement