Download: Note 7.1

advertisement

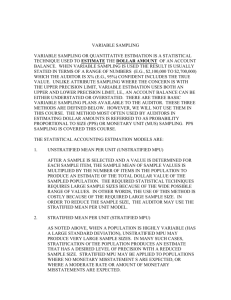

Risk Based Audit Approach Monetary Unit Sampling Session Overview This session is the last of the sessions on audit sampling. Session 5.1 was on the basic concepts of sampling and Session 6.1 on the application of attribute sampling for control procedures. This session will cover the basics of another type of sampling, the Monetary Unit Sampling and its application for substantive test of details. Actually, Monetary Unit Sampling (MUS) is used widely both for Test of Controls Account Balance In this session, we will discuss MUS for Substantive Test of Details covering the following important points: • • • Monetary Unit Sampling (MUS), advantages and limitations of MUS and it’s application to substantive test of details Determining the sample size for substantive test of details; and Evaluation of results of substantive test of details. . Learning Objectives At the end of the session, you would be able to apply MUS for substantive test of details, to the extent that, the steps are followed correctly and keeping in mind the advantages and limitations of MUS. The session is expected to provide only a broad overview of MUS and is not meant to impart expertise on MUS. Participants may read additional study material suggested in the bibliography for further knowledge. Note 7.1 Session 7.1 Basic Concepts Some of the new concepts that would be discussed in this session are explained below: (a) Monetary Unit Sampling: Monetary Unit Sampling (MUS) is a sampling method in which the sampling unit is not an invoice or any other physical unit, but an individual rupee. However, when the individual rupee is selected, the auditor does not verify just that particular rupee, but the rupee acts as a hook and drags the whole invoice with it. For example, if as a result of sample selection, Rs.365 is selected for testing and if that rupee falls in voucher number 14, then that voucher will be audited and its quality assigned to the sampling unit. Let us assume that there are 6 items out of which 2 items are to be selected. The value of the 6 items are 100, 200, 300, 400, 500 and 1000. If attribute sampling is used to select the 2 items, then all the items have equal chance of selection, as the sampling unit would be individual item. On the other hand, if MUS is used, then the total value of 6 items works out to Rs.2500, i.e., there are 2500 sampling units. As 2 items are to be selected, the sampling interval would be 2500/2 (Rs.1250). This means that one rupee out of every 1250 rupees would be selected. In such a case, the chances of 1000 rupee item getting picked up is 10 times more than the 100 rupee item getting picked up. Thus MUS has a bias towards high value items. (b) Most Likely Error: Most Likely Error (MLE) is an estimation of the error in the population. Initially MLE will be estimated based on past experience and used for determining the sample size. After carrying out substantive test of details, the MLE will be projected based on actual sample results and used for drawing audit conclusions. 1 Risk Based Audit Approach (c) Basic Precision: Basic Precision (BP) is the allowance for errors which exist but no evidence of that is found in the sample. It is dependent on the confidence level and the size of the sample and is present even where no errors have been found in the sample. (d) Precision Gap Widening: Precision Gap Widening (PGW) is the additional allowance that must be made in the Precision as a result of errors in the sample. (e) Planned Precision: Planned Precision (PP) is the difference between Upper Error Limit and the Most Likely Error, i.e., Planned Precision = Materiality - Most Likely Error = Basic Precision + Precision Gap Widening. (f) High value and key items: The Auditor may decide that all items/ transactions above a particular monetary value are to be audited 100%. These items are called high value items. For e.g., the auditor may decide that all items above Rs.100,000 are to be audited fully. Similarly the auditor using his judgement may decide that some items due to their nature are prone to error. Such items are called key items. For e.g., if there is a complete breakdown of controls in a particular division in one account area, he may treat all items relating to that account area from that division as key items and check all these items. It is to remembered that all high and key items are to be deducted from population to arrive at representative population for sampling. (g) Maximum Possible Misstatements or Upper Error Limit: The Upper Error Limit (UEL) is the maximum possible error estimated in the population as a result of the substantive test of samples. If the Upper Error Limit is above the materiality limit, then the auditor will either perform further substantive tests Note 7.1 Session 7.1 to check whether there is a material error or conclude that there is a material error. (h) Tainting: Tainting is the percentage of error found in monetary terms in a sample item. For e.g., if the accounts receivable balance of ‘x’ as per financial statement is Rs.10,000 and its value as per auditor’s findings is Rs.8,000 then the tainting would be (Rs.10,0008,000)/10,000 = 20%. MUS – Advantages, Limitations and Relevance to Substantive Tests As described previously, substantive tests are those tests of transactions and balances that seek to provide evidence as to the completeness, accuracy and validity of information in the financial statements. The objective of substantive testing is to obtain reasonable assurance that financial statement assertions individually and together correspond to established criteria within limits not exceeding materiality. Thus, substantive tests are intended to determine the monetary effect of errors in the financial statements. For example, the aim of substantive tests of accounts receivable could be to check the extent to which the balance is overstated. For substantive test of details (audit of individual transactions), we must use sampling to select individual items for examination. In MUS, as explained earlier, each rupee is treated as a sampling unit and acts as a hook for the physical unit in which it occurs; conclusions on the physical unit in monetary terms can be reached. The results from the tests of sample are then used to project the most likely error and the upper error limit in the population. As MUS helps in arriving at audit conclusions in monetary terms with quantification of the degree of confidence in the result, it is the preferred method of sampling for substantive test of details. 2 Risk Based Audit Approach Advantages of MUS The important advantages of MUS are: (i) It normally produces smaller sample sizes than other substantive sampling plans. (ii) There is no difficulty in expressing a conclusion in monetary terms. (iii) The application of rupee unit sampling is not contingent on knowledge of the population size. This permits sample selection to be started before the total value of the final population is known. As will be explained later in the session, the average sampling interval can be worked out without details of population size. (iv) No rupee stratification is necessary, as this will be accomplished automatically, thus avoiding problems of determining optimum strata boundaries and allocation of sample size among strata. (v) It is relatively easy to apply compared to other sampling plans. (vi) The problem of detecting the large but infrequent errors is solved, since all items greater than the sampling interval will be selected. Disadvantages of MUS The main disadvantages of MUS are the following: (i) Accounts/items with nil balances will have no chance of selection. (ii) The more an item is understated; the less likely the item has a chance of selection. Hence, MUS is less useful for finding understatements. (iii) A large percentage error in a small transaction can significantly increase the computed error limit. (iv) It is very difficult to use MUS in a non-computerized environment as totaling the sample items in the population for the purpose of finding Note 7.1 Session 7.1 out the particular item in which the dollar falls, is an onerous task. (v) MUS is more time consuming than other sampling plans, as the number of sampling units (rupee) is higher than in attribute sampling (physical unit like voucher, cheque). Steps involved in MUS The stages in MUS are: (a) determining the sample size; (b) selecting the sample for performing substantive test of details; and (c) evaluation of sample test results. Steps involved in performing these stages are explained below: (a) Determining the Sample Size The steps involved in determining the sample size are as follows: (i) Set Upper Error Limit (UEL) (mostly equal to materiality). (ii) Subtract the estimated Most Likely Error (MLE) (usually based on prior knowledge, i.e. the results of last year’s audit; in the absence of sound prior knowledge approximately 15-20 percent of materiality is a good rule of thumb) (iii) Subtract Precision Gap Widening (PGW) (approximately 1/2 materiality is a good rule of thumb, but can vary depending upon the number and magnitude of errors anticipated and the assurance level). (iv) Obtain Basic Precision (BP): BP = UEL -MLE- PGW. (v) For the given assurance level, use the Assurance table to determine the basic precision factor. (vi) Calculate the sampling interval by using the formula: Average Sampling Interval (ASI) = BP/BP factor. (vii) Deduct the high value and key value items from the total population to arrive at the estimated representative population. 3 Risk Based Audit Approach (vii) Session 7.1 Calculate the sample size by using the formula: Sample size = representative population/ average sampling interval. 3. Average sampling interval (1/3) Rs.261,000(B) Calculation of Sample Size Example 7.1.1 An auditor is performing substantive tests on the valuation of buses in the company. The total value of the fleet is Rs.25,000,000. The materiality limit established for the audit is Rs.1,000,000. The auditor anticipates an error of Rs.250,000 (based on past experience). The auditor estimates the precision gap widening of Rs.150,000. The auditor wants 90 percent assurance from the substantive tests. The auditor has identified high-value items of Rs.1,000,000 and key-value items of Rs.500,000 in the population. Using the table of basic precision and precision gap widening factors (Appendix - I), the basic precision, average sampling interval and representative sample size are calculated as explained below: Calculation of Basic Precision 1. Upper Error Limit (equal to materiality) Rs.1,000,000 2. Less: anticipated most likely errors Rs.250,000 3. Estimated precision available (1-2) Rs.750,000 4. Less: estimated precision gap widening Rs.150,000 5. Basic precision (3-4) Rs.600,000 (A) Calculation of Average Sampling Interval 1. Basic precision for audit 2. Assurance level expected 3. Basic precision factor (from table for 90%) Note 7.1 Rs.600,000 90% 2.3 1. Average sampling interval Rs.261,000(B) as above 2. Total population Rs.25,000,000 3. Less: High-value items Rs.1,000,000 4. Less: Key-value items Rs.1,000,000 5. Representative test population Rs.23,500,000 6. Representative sample size (5/1) 90 Thus the representative sample size for substantive test of details will be 90. (b) Selecting the Sample Out of the four samples selection methods is described in Session 5.1 Basic concepts of statistical sampling, the two methods that are used in MUS are systematic selection and cell selection. In systematic selection, one or two items are selected randomly and the average sampling interval is added to arrive at the other items to be selected. In cell selection, the population is divided into various cells and one item is selected from each cell. Systematic selection ensures that all items whose value is higher than the average sampling interval are automatically selected. In Cell selection all items whose value is twice more than the sampling interval are selected automatically. Thus, chances of highvalue but infrequent error escaping audit scrutiny are avoided. After selecting the sample refer to Handout 7.1.3 go through it before we discuss it in detail. (c) Evaluating Results of Substantive Test of Details 4 Risk Based Audit Approach The steps involved in evaluating the results of substantive test of details are: (i) Calculate the percentage of tainting for individual items. (ii) Add the individual tainting percentages to arrive at net tainting percentage. (iii) Calculate the Most Likely Error (MLE) for the representative sample by using the formula: MLE = Net tainting percentage * Average Sampling Interval (ASI) (iv) Add the errors in the high-value and key-value items to the MLE to arrive at total most likely errors as follows: Total most likely error = MLE + error in high value items + error in key value items (v) Arrange the tainting according to the percentage of tainting, in descending order, for overstatement and understatement separately. Only tainting found out from the representative sample are to be used for this purpose and tainting in highand key-value items is to be excluded. (vi) Calculate the tainting adjusted PGW factor for each tainting sorted as at (v). Tainting adjusted PGW factor = Tainting percentage * PGW factor. (vii) Total the tainting adjusted PGW factors for overstatement and understatement separately. (viii) Calculate overstatements and understatements PGW of separately: PGW = sum of tainting adjusted PGW factors * ASI. (ix) Calculate UELs for overstatement and understatement separately: UEL(overstatement) = MLE + BP + PGW UEL(understatement) = MLE - BP – PGW Example 7.1.2 Note 7.1 Session 7.1 In the example 7.1.1 discussed earlier, assume that the auditor has identified the following errors: Item . No. Book value Representative sample: 14 Rs.5,000 24 Rs.7,500 16 Rs.4,000 High value: 28 Rs.30,000 Audited value Rs.3,000 Rs.1,500 Rs.6,000 Rs.21,000 Using the basic precision and precision gap widening factors table (Appendix 7.1-A), the total most likely error, the upper error limits for overstatement and understatement and audit conclusion can be arrived at as explained below: Calculation of Total Most Likely Error 1. Net sample error tainting will be: Item Book number value Audit value Error Tainting 14 Rs.5,000 Rs.3,000 Rs.2,000 40% 24 Rs.7,500 Rs.1,500 Rs.6,000 80% 16 Rs.4,000 Rs.6,000(Rs.2,000) (50%) Net tainting 70% 2. Net most likely error for representative sample will be: Sum of net tainting percentage % x Average sampling interval We know that average sampling interval is Rs. 261,000 (B) in Example 7.1.1. 70% X Rs.261,000 = Rs.182,700 3. Error in high-value item= Rs.30,000Rs.21,000=Rs.9,000 5 Risk Based Audit Approach Session 7.1 4. Total most likely error 2+3 =Rs.191,700(X) Upper Error Limits Calculation of Upper Error Limits Audit Conclusions The most likely error in the population is Rs.191,700 overstatement. The UELs at 90 percent confidence are that the overstatement is at most Rs.958,740 and the understatement at the most is Rs.485,295. As the UELs are less than the materiality limit the auditor can conclude that there is no material error. If the UEL is more than the materiality, then the Auditor will have to conclude either that there is a material misstatement in the accounts or increase the quantum of substantive test of details. 1. Tainting adjusted Precision Gap Widening factors (a) Overstatements Taintings Ranked PGW by size factors (from table) Tainting adjusted PGW factors 40% 2nd 0.43 40%X0.43=0.172 80 1st 0.59 80%X0.59=0.472 (b) Understatements 50% 1st 0.59 50%X0.59=0.295 2. Precision Gap Widening PGW = Sum of tainting adjusted PGW factors x Average sampling interval (a) Overstatements = 0.644 X 261,000=Rs.167,040 (Y) (b) Understatements =0.295 X 261,000=Rs.76,995 (Z) 3. Upper Error Limits Basic Precision is Rs.600,000 as worked out at (A) in Example 7.1.1 Overstatements Understatements Rs. Rs. Basic Precision 600,000 PGW 167,040 (Y) as above (485,295) Thus MUS is used, both at the stage of planning the sample size and subsequently at the stage of evaluation of sample results of substantive test of details. We will now discuss Handout 7.1.3 performing substantive test of details Summary The key points that were discussed in the session are: • Monetary Unit Sampling (MUS) – Advantages, limitations and relevance of MUS for substantive test of details • Steps involved in MUS • Determining the sample size for substantive test of details • Selecting the sample for performing substantive test of details and • Evaluation of results of substantive test of details. (600,000) (76,995) (Z) as above Total Precision 767,040 (676,995) Add total most likely error (X) as above 191,700 191,700 Note 7.1 958,740 6