Table of Contents - Continuing Legal Education

advertisement

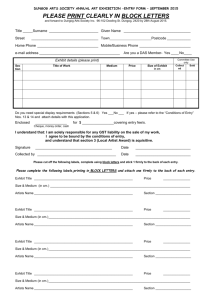

Table of Contents About This Book How To Use This Book Foreword Acknowledgments Preface vii ix xi xiii xv Chapter 1 Initial Client Engagement Topical Index 1.01 Nature of Federal Tax Law 1.02 Role of the Internal Revenue Service 1.02(a) Specific Functions of the Internal Revenue Service 1.03 Organization of the Internal Revenue Service 1.03(a) Examination Process 1.03(b) Collection Process 1.03(c) The Criminal Investigation Division (CID) 1.03(d) Appeals Branch 1.03(e) Area Counsel 1.04 Where Do Tax Clients Come From? 1.05 The Initial Consultation 1.06 Beginning the Engagement—Form 2848 1.07 Rules of Practice 1 1 5 7 7 11 12 14 17 18 18 19 20 23 25 Practice Points 28 Exhibit 1-1 IRS Organization Structure Exhibit 1-2 Pre-Payment Appeal Process Examination Exhibit 1-3 Post-Payment Appeal Process Examination/Claims Exhibit 1-4 The Collection Process Exhibit 1-5 The Criminal Process Exhibit 1-6 Filing Form 2848 Exhibit 1-7 Practitioner Hotlines Exhibit 1-8 IRS E Services Exhibit 1-9 Initial Client Engagement Checklist Exhibit 1-10 Ten Ways To Identifying The Problem Client Exhibit 1-11 Initial Client Representation Letter Exhibit 1-12 Retainer Agreement Exhibit 1-13 Conflict Advisory to Client Exhibit 1-14 Letter to IRS Advising of Representation Exhibit 1-15 Representation Memorandum To File Exhibit 1-16 Enforcement Activity by IRS Office of Professional Responsibility Exhibit 1-17 IRS Employees Exhibit 1-18 Circular 230 Procedure 10 13 15 16 17 25 34 35 36 37 38 38 40 41 41 On CD-ROM Only: xvii 43 44 44 Circular 230 Form 56 Notice Concerning Fiduciary Relationship Form 2848, Power of Attorney and Declaration of Representative Form 4506 Request for Copy of Tax Return Form 4506-T Request for Transcript of Tax Return Form 8821 Tax Information Authorization Publication 1 Your Rights as a Taxpayer Chapter 2 Examination of Returns Topical Index 2.01 Audit Basics 2.02 Pre-Audit Action by Practitioner 2.03 Conducting the Audit Examination 2.04 Closing the Audit Examination 2.04(a) Statute of Limitations Extension Issues 2.05 Jeopardy and Termination Assessments 2.06 Coordinated Examination Program (CEP) 2.07 Partnership Audit Problems 47 47 51 60 63 68 71 73 74 75 Practice Points 77 Exhibit 2-1 Methods of IRS Audit Selection Exhibit 2-2 Chance of Audit by Taxpayer Category Exhibit 2-3 Typical DIF Factors Used in Return Selection Exhibit 2-4 Examination of Returns Checklist Exhibit 2-5 Types of IRS Agents Exhibit 2-6 How To Recognize an Eggshell Audit Exhibit 2-7 Initial Examination Conference Checklist Exhibit 2-8 IRS Settlement Forms Exhibit 2-9 Ten Negotiating Techniques that Work and Ten that Don’t Exhibit 2-10 Settling Cases at the Examination Stage Exhibit 2-11 Closing the Examination Checklist Exhibit 2-12 IRS Audit Notice—Corporation Exhibit 2-13 IRS Audit Notice—Individual Exhibit 2-14 Thirty-Day Notice Exhibit 2-15 Letter 3164—Notice of Third-Party Contact Exhibit 2-16 IRS Market Segment Papers Exhibit 2-17 IRS Industry Specialization Papers Exhibit 2-18 Notice of Tax Due on Federal Tax Return—Individual Exhibit 2-19 Notice of Tax Due on Federal Tax Return—Business 55 56 59 61 61 62 64 68 69 69 71 81 82 84 87 87 89 92 92 On CD-ROM Only Audit Technique Guides (ATGs) Automated Under Reporter Inventory Strategy Database (AUR-ISD) Form 870 Waiver of Restrictions on Assessment and Collection of Deficiency in Tax and Acceptance of Overassessment Form 1902-B Report of Individual Income Tax xviii Form 4089 Notice of Deficiency Waiver Form 4549 Income Tax Examination Changes Form 4549-CG Income Tax Examination Changes Form 4549-E Income Tax Discrepancy Adjustments Form 4564 Information Document Request Form 5564 Notice of Deficiency IRS Telephone Assistance Letter 915 Cover Letter for Examination Report Letter 937 Cover Letter Response to Power of Attorney Letter 2205-A Notice of Return Selected for Examination Letter 3254 (DO) Confirmation of Appointment to Begin Examination Process Publication 3498 The Examination Process Chapter 3 Statute of Limitations 95 Topical Index 95 3.01 The Statutes of Limitations in Tax Matters 99 3.02 Statute of Limitations on Assessment 102 3.02(a) Extensions of the Statute of Limitations on Assessment 104 3.03 Statute of Limitations on Collection 106 3.03(a) Effect of Offers in Compromise, Installment Agreements, and Miscellaneous Actions 107 3.04 Statute of Limitations on Claims for Refund 109 3.05 Statute of Limitations on Assessment of Trust Fund Liability: §6672 112 3.06 Special Rules for Suspension of the Statute of Limitations—Mitigation 113 3.07 Transferee Liability 114 3.08 Limitations Period for Criminal Prosecution 116 Practice Points 116 Exhibit 3-1 Exhibit 3-2 Exhibit 3-3 Exhibit 3-4 100 123 124 Major Statutes of Limitation Statute of Limitations Checklist Suspension of Statute of Limitation Due To Client Action Letter to Client To Extend Assessment Statute in Criminal Case Exhibit 3-5 Letter to Client Regarding Trust Fund Penalty Extension Exhibit 3-6 Letter to Client To Extend Assessment Statute in Civil Case Exhibit 3-7 Letter to Client Confirming No Extension of the Assessment Statute Exhibit 3-8 Circumstances That Evidence Fraudulent Transfer Exhibit 3-9 Things That Affect the Assessment Statute of Limitations Exhibit 3-10 How To Determine the Collection Statute of Limitations Expiration Date (CSED) On CD-ROM Only Form 843 Claim for Refund and Request for Abatement xix 125 126 127 127 128 128 129 Form 872 Consent To Extend the Time To Assess Tax Form 872-A Special Consent To Extend the Time to Assess Tax Form 872-T Notice of Termination of Special Consent To Extend the Time To Assess Tax Form 900 Tax Collection Waiver Form 1040X Amended U.S. Individual Income Tax Return Form 2750 Waiver Extending Statutory Period for Assessment of Trust Fund Recovery Penalty Letter 907(DO) IRS Request for Extension Publication 1035—Extending the Tax Assessment Period Chapter 4 Administrative Summons Topical Index 4.01 Nature of Summons 4.02 Summons Enforcement 4.03 Compliance Considerations 4.04 Defenses to Summons and Right To Quash 131 131 133 136 141 143 Practice Points 146 Exhibit 4-1 Exhibit 4-2 Exhibit 4-3 Exhibit 4-4 149 150 151 152 Administrative Summons Checklist Practitioner Objections to Summons Request for Third-Party Contacts Petition to Quash Summons On CD-ROM Only Employee Plans Continuing Professional Education (CPE) Technical Instruction Program for Fiscal Year 2003 Ch 12(c)—Summons Procedures Form 2039 Client Summons—Examination Division Form 2039 Criminal Division Summons Form 2039 Summons for Handwriting Exemplar Form 4564 Information Document Request Form 6540 Handwriting Exemplars Form 6637 Summons Collection Information Statement Form 6638 Summons for Income Form 6639 Financial Records Summons Form 6863 Request for Expenses Incident to Summons Form 6882 IDRS-Master File Information Request Letter 3164: IRS Third Party Contact Letter Chapter 5 Appeals Branch Topical Index 5.01 Nature of Appeals Branch 5.02 Protest Filing 5.03 The Appeals Hearing 5.04 Settlement of Cases in Appeals 155 155 157 162 165 168 xx 5.04(a) 5.04(b) Alternative Dispute Resolution Collection Due Process Hearings 169 172 Practice Points 176 Exhibit 5-1 Exhibit 5-2 Exhibit 5-3 Exhibit 5-4 Exhibit 5-5 Exhibit 5-6 Exhibit 5-7 Exhibit 5-8 159 160 165 182 183 184 185 188 Cases Handled By Appeals Office Advantages/Disadvantages of Appeals Hearing When Not To File a Protest to Appeals ADR in Appeals Appeals Branch Checklist Protest: Income Tax Protest: §6672 Trust Fund Recovery Penalty Appeals Protest Transmittal Letter On CD-ROM Only Appeals Acknowledgment and Notice of Appeals Hearing Appeals Office Notification to Taxpayer Form 870-AD Offer of Waiver of Restrictions on Assessment and Collection of Deficiency in Tax and Acceptance of Overassessment Form 906 Closing Agreement on Final Determination Covering Specific Matters Form 906-c Closing Agreement on Final Determination Covering Specific Matters Form 9423 Collection Appeal Request Form 12153: Request for Post-Lien/Pre-Levy Collection Due Process Hearing Form 12203 Request for Appeals Review Form 12257-c Summary Notice of Determination, Waiver of Right to Judicial Review of a Collection Due Process Determination, and Waiver of Suspension of Levy IRS Letter 913 (RO): Appeals Approval of Settlement IRS Response to Collection Due Process Hearing Request IRS Thirty Day Letter Letter to Client re Collection Due Process Hearing Model Arbitration Agreement Notice of Determination Concerning Collection Action(s) Under Section 6320 and-or 6330 Publication 5 Your Appeal Rights Publication 4167 Introduction to Alternative Dispute Resolution Request for Collection Due Process Hearing Chapter 6 Collection Branch Topical Index 6.01 Nature of Collection 6.02 Service Center Collection Activity 6.03 ACS 6.04 District Office 6.05 Notices and Forms Filing 6.06 Tax Liens 6.07 Tax Levies 189 189 195 197 199 200 204 207 212 xxi 6.08 6.09 6.10 6.11 6.12 6.13 6.14 6.15 6.16 6.17 The Taxpayer’s Advocate Service Offers in Compromise 6.09(a) Effect of Offer 6.09(b) Acceptance or Rejection of the Offer 6.09(c) How Much To Offer? 6.09(d) So, Should You File? 6.09(e) Collateral Agreements and Post Submission Procedures Bankruptcy Principal Residence Re-Audits Installment Agreements Actions To Enjoin IRS Employment Tax Assessments Innocent Spouse—Section 6915 Judicial Review of Collection Action 217 218 222 225 226 227 230 231 237 238 238 241 241 243 254 Practice Points 258 Exhibit 6-1 Getting the Offer in Compromise Accepted Checklist Exhibit 6-2 Applying for Innocent Spouse Relief Checklist Exhibit 6-3 Collection Due Process Hearing Requests Exhibit 6-4 Collection Branch Checklist Exhibit 6-5 The Collection Process Exhibit 6-6 FAQs for New Offer in Compromise Rules Exhibit 6-7 Offer in Compromise—Response from IRS Exhibit 6-8 Application for Certificate of Subordination Exhibit 6-9 Application for Certificate of Discharge Exhibit 6-10 Installment Agreements Available Exhibit 6-11 FAQs for Married Taxpayers Exhibit 6-12 How To Pay Taxes Electronically 228 245 254 270 271 272 276 277 279 281 282 282 On CD-ROM Only Form CVL PEN Overpaid Taxes Applied to Other Taxes You Owe Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals Form 433-B Collection Information Statement for Businesses Form 433-D Installment Agreement Form 433-F Collection Information Statement (Short Form) Form 656 Offer in Compromise Form 656-L Offer in Compromise (Doubt as to Liability) Form 668(W) Notice of Levy on Wages, Salary, and Other Income Form 668(Y) Notice of Federal Tax Lien Form 668-A(c) Notice of Levy Form 668-D Release of Levy/Release of Property from Levy Form 668-Z Release of Federal Tax Lien Form 669-A Certificate of Discharge of Property xxii Form 669-D Certificate of Subordination of Federal Tax Lien Form 911 Request for Taxpayer Advocate Service Assistance Form 2751 Proposed Assessment of Trust Fund Recovery Penalty Form 4180 IRS Trust Fund Recovery Penalty Interview Form Form 8857 Request for Innocent Spouse Relief Form 8919 Uncollected Social Security and Medicare Tax on Wages Form 12153 Request for a Collection Due Process Hearing Form 12509 Statement of Disagreement Letter 726 Notice of Amount Due on Tax Account Letter 1058 Final Notice of Intent To Levy and Notice of Your Right to a Hearing Letter 1058 Notice of Intent to Levy and Right to a Hearing Letter 1153 (DO) Notice of Proposed Trust Fund Recovery Penalty Letter 2850 Approval of Request To Pay Taxes in Installments Letter 3172 Notice of Tax Lien Filing and Your Right to Hearing Letter 3283(DO) IRS Innocent Spouse Determination Letter Letter—Notice of Determination Concerning Collection Actions Letter—Taxpayer Advocate Service Acknowledgment Letter National Standards Food, Clothing and Other Items Notice 746 Information About Your Notice, Penalty and Interest Notice CP 89 Annual Installment Agreement Statement Notice CP 91 Final Notice Before Levy on Social Security Benefits Notice CP-504 Urgent Collection Notice Notice CP-523 Notice of Intent To Levy Notice of Collection Appeals Program Online Payment Agreement Option (OPA) Private Debt Collection Program Publication 594 The IRS Collection Process Publication 783 How To Apply for Certificate of Discharge of Property from Tax Lien Publication 784 How To Prepare Application for Certificate of Subordination of Federal Tax Lien Publication 1450 How To Request Certificate of Release of Federal Tax Lien Publication 1660 Collection Appeal Rights Publication 1854 How To Prepare a Collection Information Statement (433-A) Publication 4165 Introduction to Collection Due Process Hearings Chapter 7 Criminal Tax Topical Index 7.01 Nature of Criminal Investigation Division 7.01(a) Voluntary Disclosure 7.02 Specific Procedure 7.03 Grand Jury Investigations—Alternative IRS Investigation 7.04 Dealing with Special Agents 7.05 Crimes Investigated by the IRS 7.06 Negotiating the Plea Agreement 7.07 Hearings in District Court for Criminal Violation—Plea Hearing 7.08 Sentencing Hearing xxiii 283 283 287 289 291 293 294 297 300 303 304 7.09 7.10 Defenses to Criminal Violations SEP 306 307 Practice Points 307 Exhibit 7-1 Voluntary Disclosure Checklist 290 Exhibit 7-2 The Criminal Process 291 Exhibit 7-3 Ten Badges of Criminal Tax Fraud 296 Exhibit 7-4 Title 26 Criminal Penalties and Fines 300 Exhibit 7-5 Sentencing Options by Zone 305 Exhibit 7-6 Criminal Tax Checklist 317 Exhibit 7-7 Criminal Tax Appeals Checklist 318 Exhibit 7-8 Rule 11 Plea Hearing Checklist 319 Exhibit 7-9 Sentencing Hearing Checklist 319 Exhibit 7-10 Kovel-CPA Agreement 320 Exhibit 7-11 Federal Sentencing Guidelines—Offenses Involving Taxation 321 Exhibit 7-12 Request for Conference at U.S. Department of Justice 322 Exhibit 7-13 Memo to Client Regarding Rule 11 Proceeding 323 Exhibit 7-14 Memorandum to Client Regarding Sentencing Hearing 326 Exhibit 7-15 Defense Memorandum 327 Exhibit 7-16 Request for Conference at U.S. Attorney’s Office 330 Exhibit 7-17 Contents of Special Agent’s Report 331 Exhibit 7-18 Request for Conference at District Counsel 332 Exhibit 7-19 Application for Permission To Enter Plea of Guilty 332 Exhibit 7-20 Indications of Consideration of a Criminal Record 339 Exhibit 7-21 Criminal Division Focus 340 On CD-ROM Only AUSA Letter to Judge Regarding Allocution Questions District Court Order of Release District Court Standing Order District Court Waiver of Indictment Explanation of the Pre-Sentence Report Federal Criminal Guidelines Sentencing Table Federal Criminal Guidelines Worksheets Form 211 Application for Award for Original Information Form 3949A Information Referral Plea Agreement Probation Report and Presentence Investigation Report Referral Report for Potential Criminal Fraud Cases Chapter 8 Tax Court Practice Topical Index 8.01 Nature of Tax Court 8.02 Admission to Practice 8.03 Petition Filing 341 341 345 349 350 xxiv 8.04 8.05 8.06 8.07 8.08 8.09 8.10 Trial Practice Small Case Procedure Motion Practice Other Areas of Tax Court Jurisdiction Burden of Proof Claims for Litigation and Administrative Costs Appeals 353 359 361 362 366 368 371 Practice Points 371 Exhibit 8-1 Advantages/Disadvantages of U.S. Tax Court Exhibit 8-2 Cases Only Exhibit 8-3 Emergency Petition—U.S. Tax Court Exhibit 8-4 Format for Briefs—Tax Court (Rule 151) Exhibit 8-5 Tax Forum Comparison Exhibit 8-6 Selecting the Best Tax Forum Exhibit 8-7 U.S. Tax Court Checklist Exhibit 8-8 Entry of Appearance Exhibit 8-9 Tax Court Petition Exhibit 8-10 Settlement Agreement and Related Documents Exhibit 8-11 Request for Production of Documents Exhibit 8-12 Tax Court Cities Exhibit 8-13 Answer of Respondent Exhibit 8-14 Notice Setting Case for Trial Exhibit 8-15 Standing Pre-Trial Order Exhibit 8-15 Trial Memorandum 347 349 351 357 377 378 379 380 380 382 386 387 388 390 391 393 On CD-ROM Only Form 5601 Statutory Notice Letter 3219 (SC-CG) Notice of Deficiency Notice of Receipt of Petition Notice Setting Case for Trial Tax Court Application for Order to Take Depositions Form 15 Tax Court Attorney Admission Form 18 Tax Court Decision Document Tax Court Entry of Appearance Form 7 Tax Court Petition for Administrative Costs—Sample Tax Court Petition Kit Tax Court Request for Place of Trial Tax Court Rule 23 Form and Style of Papers Filed in Court Tax Court Subpoena Form 14 Trial Memorandum Sample United States Tax Court Fees and Charges United States Tax Court Telephone Numbers xxv Chapter 9 Claims Practice Topical Index 9.01 Claims Basics 9.02 Statute of Limitations 9.03 The Full/Divisible Payment Rules 9.04 IRS Claims Procedure 9.05 Resort to Courts 9.06 Choice of Judicial Forum 9.07 Claim Look-Alikes 9.08 Tax Payments 395 395 399 383 404 404 406 407 409 410 Practice Points 410 Exhibit 9-1 Claims Procedure Exhibit 9-2 Suspension of Claims Statute of Limitations for Disability Under Section 6511(h) Checklist Exhibit 9-3 Claim Elements Under the Informal Claims Doctrine Exhibit 9-4 Claims Checklist Exhibit 9-5 Thirty Day Notice Exhibit 9-6 Memorandum in Support of Claim for Refund Exhibit 9-7 Notice of Claim Disallowance 398 401 403 415 416 418 420 On CD-ROM Only Form 1040X Amended US Individual Tax Return Form 843 Claim for Refund and Request for Abatement Form 870-AD Offer to Waive Restrictions on Assessment and Collection of Tax Deficiency Form 1045 Application for Tentative Refund Form 1120-X Amended US Corporate Income Tax Return Form 1139 Corporation Application for Tentative Refund Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer Form 2297 Waiver of Statutory Notification of Claim Disallowance Chapter 10 Obtaining Information and Assistance from the IRS Topical Index 10.01 Obtaining Background Information 10.02 Filing FOIA Requests 10.03 Obtaining IRS Information Online 10.04 Resolving Taxpayer Problems with the IRS 10.05 IRS Publications 10.06 Local IRS Offices 10.07 Obtaining Private Letter Rulings and Determination Letters 10.08 Tax and Legal Websites 423 423 425 430 432 433 434 435 435 439 Practice Points 440 xxvi Exhibit 10-1 Exhibit 10-2 Exhibit 10-3 Exhibit 10-4 Exhibit 10-5 Exhibit 10-6 Relative Importance of IRS Tax Authorities Applying for IRS Rulings Obtaining Information and Assistance from IRS Checklist IRS Transaction Codes Used To Interpret IRS Transcripts Schedule of Typical User Fees Freedom of Information Act Request to District Disclosure Officer 426 436 444 444 448 449 On CD-ROM Only Form 4506 Request for Copy of Tax Return Form 4505-T Request for Transcript of Tax Return Form 8717 User Fee for Employee Plan Determination, Opinion, and Advisory Letter Sample Format For a Letter Ruling Request Chapter 11 Penalties and Interest Topical Index 11.01 Accuracy-Related Penalty—Negligence Penalty 11.02 Civil Fraud Penalty 11.03 Innocent Spouse Defense to Penalties 11.04 Substantial Understatement of Tax—Section 6662(b)(2) 11.05 Substantial Valuation Misstatements 11.06 Substantial Estate or Gift Tax Valuation Understatement 11.07 Failure To File Returns 11.08 Failure To Pay Tax 11.09 Estimated Tax Penalty 11.10 Failure To Timely Deposit 11.11 Trust Fund Recovery Penalty 11.12 Defense of Reasonable Cause 11.13 The Penalty Appeal Procedure 11.14 Third Party Penalties 11.15 Interest 11.16 Abatement of Interest 11.17 Miscellaneous 451 451 457 460 462 464 465 466 466 467 469 470 471 477 482 483 487 489 490 Practice Points 493 Exhibit 11-1 Exhibit 11-2 Exhibit 11-3 Exhibit 11-4 Exhibit 11-5 458 463 474 478 Most Often Assessed Penalties Obtaining Equitable Innocent Spouse Relief §6015(f) Trust Fund Recovery Penalty Checklist Does Reasonable Cause Exist? Penalty Appeal Procedure Checklist (Post Assessment Prepayment of Penalties) Exhibit 11-6 Interest Abatement Procedure Checklist xxvii 483 492 Exhibit 11-7 Memorandum In Support Of Penalty Appeal Form 843 Exhibit 11-8 Penalties Assessed by IRS Exhibit 11-9 Important Do’s and Don’ts of Circular 230 507 510 510 On CD-ROM Only Appeals Denial of Request for Abatement of Penalties FAQs Related to Tax Return Perparer Penalty Notices Form 843 Claim for Refund and Request for Abatement Form 843 Claim for Refund and Request for Abatement—Sample Form 8275 Disclosure Statement Form 8275-R Regulation Disclosure Statement How To Apply for Zero Interest Netting Letter 1153 (DO) Trust Fund Penalty Assessment Notice Letter 1277 IRS Penalty Appeal Determination Letter Notice 746 Information About Your Notice, Penalty and Interest Procedures for Taxpayers To Make Remittances To Stop Running of Interest on Deficiencies xxviii