Recent Developments in the Theory of Monetary Policy

advertisement

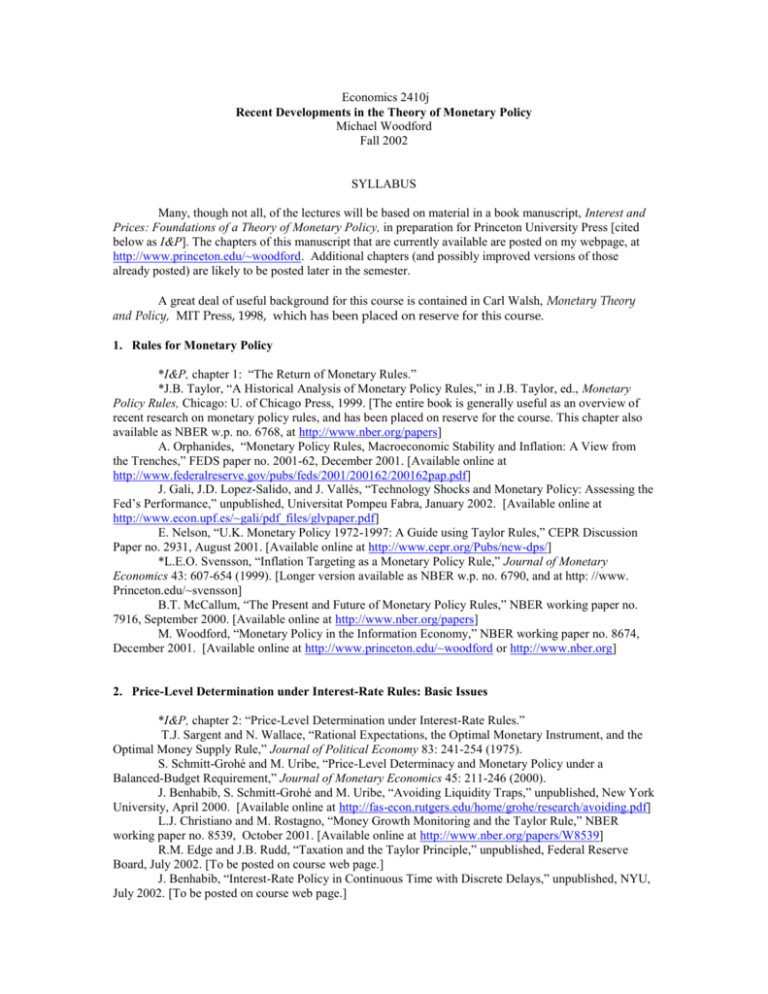

Economics 2410j Recent Developments in the Theory of Monetary Policy Michael Woodford Fall 2002 SYLLABUS Many, though not all, of the lectures will be based on material in a book manuscript, Interest and Prices: Foundations of a Theory of Monetary Policy, in preparation for Princeton University Press [cited below as I&P]. The chapters of this manuscript that are currently available are posted on my webpage, at http://www.princeton.edu/~woodford. Additional chapters (and possibly improved versions of those already posted) are likely to be posted later in the semester. A great deal of useful background for this course is contained in Carl Walsh, Monetary Theory and Policy, MIT Press, 1998, which has been placed on reserve for this course. 1. Rules for Monetary Policy *I&P, chapter 1: “The Return of Monetary Rules.” *J.B. Taylor, “A Historical Analysis of Monetary Policy Rules,” in J.B. Taylor, ed., Monetary Policy Rules, Chicago: U. of Chicago Press, 1999. [The entire book is generally useful as an overview of recent research on monetary policy rules, and has been placed on reserve for the course. This chapter also available as NBER w.p. no. 6768, at http://www.nber.org/papers] A. Orphanides, “Monetary Policy Rules, Macroeconomic Stability and Inflation: A View from the Trenches,” FEDS paper no. 2001-62, December 2001. [Available online at http://www.federalreserve.gov/pubs/feds/2001/200162/200162pap.pdf] J. Gali, J.D. Lopez-Salido, and J. Vallés, “Technology Shocks and Monetary Policy: Assessing the Fed’s Performance,” unpublished, Universitat Pompeu Fabra, January 2002. [Available online at http://www.econ.upf.es/~gali/pdf_files/glvpaper.pdf] E. Nelson, “U.K. Monetary Policy 1972-1997: A Guide using Taylor Rules,” CEPR Discussion Paper no. 2931, August 2001. [Available online at http://www.cepr.org/Pubs/new-dps/] *L.E.O. Svensson, “Inflation Targeting as a Monetary Policy Rule,” Journal of Monetary Economics 43: 607-654 (1999). [Longer version available as NBER w.p. no. 6790, and at http: //www. Princeton.edu/~svensson] B.T. McCallum, “The Present and Future of Monetary Policy Rules,” NBER working paper no. 7916, September 2000. [Available online at http://www.nber.org/papers] M. Woodford, “Monetary Policy in the Information Economy,” NBER working paper no. 8674, December 2001. [Available online at http://www.princeton.edu/~woodford or http://www.nber.org] 2. Price-Level Determination under Interest-Rate Rules: Basic Issues *I&P, chapter 2: “Price-Level Determination under Interest-Rate Rules.” T.J. Sargent and N. Wallace, “Rational Expectations, the Optimal Monetary Instrument, and the Optimal Money Supply Rule,” Journal of Political Economy 83: 241-254 (1975). S. Schmitt-Grohé and M. Uribe, “Price-Level Determinacy and Monetary Policy under a Balanced-Budget Requirement,” Journal of Monetary Economics 45: 211-246 (2000). J. Benhabib, S. Schmitt-Grohé and M. Uribe, “Avoiding Liquidity Traps,” unpublished, New York University, April 2000. [Available online at http://fas-econ.rutgers.edu/home/grohe/research/avoiding.pdf] L.J. Christiano and M. Rostagno, “Money Growth Monitoring and the Taylor Rule,” NBER working paper no. 8539, October 2001. [Available online at http://www.nber.org/papers/W8539] R.M. Edge and J.B. Rudd, “Taxation and the Taylor Principle,” unpublished, Federal Reserve Board, July 2002. [To be posted on course web page.] J. Benhabib, “Interest-Rate Policy in Continuous Time with Discrete Delays,” unpublished, NYU, July 2002. [To be posted on course web page.] 3. The Monetary Transmission Mechanism: Real Effects of Nominal Instability a. Optimizing Models with Nominal Rigidities *I&P, chapter 3: “Optimizing Models with Nominal Rigidities.” *V.V. Chari, L.J. Christiano, and P.J. Kehoe, “Sticky-Price Models of the Business Cycle: Can the Contract Multiplier Solve the Persistence Problem?” Econometrica 68: 1151-1180 (2000). P.R. Bergin and R.C. Feenstra, “Staggered Price Setting, Translog Preferences and Endogenous Persistence,” Journal of Monetary Economics 45: 657-680 (2000). *M. Dotsey and R.G. King, “Pricing, Production and Persistence,” NBER working paper no. 8407, August 2001. . [Available online at http://www.nber.org/papers/W8407] R.M. Edge, “The Equivalence of Wage and Price Staggering in Monetary Business Cycle Models,” International Finance Discussion Paper no. 2000-672, Federal Reserve Board, July 2000. [Available online at http://www.federalreserve.gov/pubs/ifdp/2000/672/ifdp672.pdf] J.-P. Danthine and A. Kurmann, “Fair Wages in a New Keynesian Model of the Business Cycle,” CEPR discussion paper no. 3423, June 2002. [Available online at http://www.cepr.org] H. Bakshi et al., “Endogenous Price Stickiness, Trend Inflation, and the New Keynesian Phillips Curve,” unpublished, Bank of England, August 2002. [To be posted on course web page.] M. Dotsey, R.G. King, and A.L. Wolman, “State-Dependent Pricing and the General Equilibrium Dynamics of Money and Output,” Quarterly Journal of Economics 114: 655-690 (1999). b. Empirical Evaluation of Sticky-Price Models A. Estrella and J.C. Fuhrer, “Dynamic Inconsistencies: Counterfactual Implications of a Class of Rational Expectations Models,” Working Paper no. 98-5, Federal Reserve Bank of Boston working paper no. 98-5, December 1998. [Available online at http://www.bos.frb.org/economic/wp/wp1998/wp98_5.pdf] *A.M. Sbordone, “Prices and Unit Labor Costs: A New Test of Price Stickiness,” Journal of Monetary Economics 49: 265-292 (2002). *J. Gali and M. Gertler, “Inflation Dynamics: A Structural Econometric Analysis,” Journal of Monetary Economics 44: 195-222 (1999). J. Gali, M. Gertler, and J.David Lopez-Salido, “European Inflation Dynamics,” European Economic Review 45: 1237-1270 (2001). [Available at http://www.elsevier.com/inca/publications/store/ 5/0/5/5/4/1/] K.S. Neiss and E. Nelson, “Inflation Dynamics, Marginal Cost, and the Output Gap: Evidence from Three Countries,” unpublished, Bank of England, June 2002. [Available online at http://www.nber.org/~confer/2002/isom02/] L. Guerrieri, “Inflation Dynamics,” International Finance Discussion Paper no. 715, Federal Reserve Board, December 2001. [Available online at http://www.federalreserve.gov/pubs/ifdp] E. Jondeau and H. LeBihan, “Testing for a Forward-Looking Phillips Curve: Additional Evidence from European and U.S. Data,” Notes d’Etudes et de Recherche no. 86, Bank of France, December 2001. [Available online at http://www.banque-france.fr/gb/publi/main.htm] J. Linde, “Estimating New-Keynesian Phillips Curves: A Full Information Maximum Likelihood Approach,” Working Paper no. 129, Bank of Sweden, April 2002. [http://www.riksbank.com/upload/6286/ wp_129.pdf] A.M. Sbordone, “An Optimizing Model of U.S. Wage and Price Dynamics,” unpublished, Rutgers University, December 2001. [Available at http://econweb.rutgers.edu/sbordone/Papers/wpdec01.pdf] P.N. Ireland, “Sticky-Price Models of the Business Cycle: Specification and Stability,” NBER Working Paper no. 7511, January 2000. [Available online at http://papers.nber.org/papers/W7511] c. Explaining Inflation Persistence J.C. Fuhrer and G.R. Moore, “Inflation Persistence,” Quarterly Journal of Economics 110: 127159 (1995). G. Calvo, O. Celasun and M. Kumhof, “A Theory of Rational Inflationary Inertia,” unpublished, University of Maryland, June 2001. [Available online at http://www.stanford.edu/~kumhof/ratinfinert.pdf] *M.B. Devereux and J. Yetman, “Predetermined Prices and the Persistent Effects of Money on Output,” Journal of Money, Credit and Banking, forthcoming. [Available online at http://www.econ.hku.hk/%7Ejyetman/PDFfiles/PredeterminedPrices.pdf] J. Yetman, “Contracting Costs versus Menu Costs and Inflation Persistence,” unpublished, U. of Hong Kong, July 2002. [Available online at http://www.econ.hku.hk/%7Ejyetman/PDFfiles/ Persistence.pdf] A. Burstein, “Inflation and Output Decisions with a State-Dependent Pricing Decision,” unpublished, Northwestern University, January 2002. [Available online at http://pubweb.acns.nwu.edu/ ~atb288/index_files/statedepjan23.pdf] *C.J. Erceg and A.T. Levin, “Imperfect Credibility and Inflation Persistence,” Federal Reserve Board, FEDS paper no. 2001-45, June 2001. [Available online at http://www.federalreserve.gov/pubs/ Feds/2001/200145/200145pap.pdf] d. Information Imperfections and the Effects of Monetary Policy *N.G. Mankiw and R. Reis, “Sticky Information versus Sticky Prices: A Proposal to Replace the New Keynesian Phillips Curve,” NBER working paper no. 8290, May 2001. [Available online at http://www.nber.org/papers/W8290] N. G. Mankiw and R. Reis, “Sticky Information: A Model of Monetary Non-Neutrality and Structural Slumps,” NBER working paper no. 8614, December 2001. [Available online at http://www.nber.org/papers/W8614] *M. Woodford, “Imperfect Common Knowledge and the Effects of Monetary Policy,” NBER working paper no. 8673, December 2001. [Available online at http://www.nber.org/papers/W8673 or http://www.princeton.edu/~woodford] C.D. Carroll, “The Epidemiology of Macroeconomic Expectations,” NBER working paper no. 8695, December 2001. [Available online at http://www.nber.org/papers/W8695] *C.A. Sims, “Implications of Rational Inattention,” unpublished, June 2001. [Available online at http://www.princeton.edu/~sims] 4. The Monetary Transmission Mechanism: General-Equilibrium Models with an Interest-Rate Channel *I&P, chapter 4: “A Neo-Wicksellian Framework for the Analysis of Monetary Policy.” M. Goodfriend and R.G. King, “The New Neoclassical Synthesis and the Role of Monetary Policy,” NBER Macroeconomics Annual 12: 493-530 (1997). J. Gali, “New Perspectives on Monetary Policy, Inflation and the Business Cycle,” unpublished, Universitat Pompeu Fabra, Barcelona, January 2001. [Available at http://www.econ.upf.es/~gali/pdf_files/ wcpaper.pdf] *J.J. Rotemberg and M. Woodford, “An Optimization-Based Econometric Framework for the Evaluation of Monetary Policy,” NBER Macroeconomics Annual 12: 297-346 (1997). [Expanded version circulated as NBER technical working paper no. 233, May 1998. Available online at http://www.princeton. edu/~woodford] J.D. Amato and T. Laubach “Estimation and Control of an Optimization-Based Model with Sticky Wages and Prices,” Journal of Economic Dynamics and Control, forthcoming. [To be posted on course web page.] *L.J. Christiano, M.S. Eichenbaum, and C.L. Evans, “Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy,” NBER working paper no. 8403, July 2001. [Available online at http://www.nber.org/papers/W8403] P.N. Ireland, “Money’s Role in the Monetary Business Cycle,” Working Paper no. 458, Department of Economics, Boston College, April 2000. [Available online at http://fmwww.bc.edu/ecp/wp458.pdf] M.B. Canzoneri, R.E. Cumby, and B.T. Diba, “Euler Equations and Money Market Interest Rates: A Challenge for Monetary Policy Models,” unpublished, Georgetown University, May 2002. [To be posted on course web page.] *J.C. Fuhrer, “Habit Formation in Consumption and Its Implications for Monetary-Policy Models,” American Economic Review 90: 367-390 (2000). R.M. Edge, “Time to Build, Time to Plan, Habit Persistence, and the Liquidity Effect,” International Finance Discussion Paper no. 2000-673, Federal Reserve Board, July 2000. [Available online at http://www.federalreserve.gov/pubs/ifdp/2000/673/ifdp673.pdf] F. Smets and R. Wouters, “Monetary Policy in an Estimated Stochastic Dynamic General Equilibrium Model of the Euro Area,” unpublished, European Central Bank, May 2002. [Available online at http://www.nber.org/~confer/2002/isom02/smets.pdf] 5. Policy Rules and Self-Fulfilling Expectations a. The Problem of Indeterminacy of Equilibrium *R.Clarida, J. Gali, and M. Gertler, “Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory,”Quarterly Journal of Economics 115: 147-180 (2000). C.T. Carlstrom and T.S. Fuerst, “Forward-Looking versus Backward-Looking Taylor Rules,” Working Paper no. 00-09, Federal Reserve Bank of Cleveland, August 2000. [Available online at http://www.clev.frb.org/research/workpaper/ 2000/Wp0009.pdf] J. Benhabib, S. Schmitt-Grohe, and Martin Uribe, “Designing Monetary Policy: BackwardLooking Interest-Rate Rules and Interest Rate Smoothing,” unpublished, New York University, November 2002. [Available online at http://www.clev.frb.org/Research/conf2002/november/index.htm] C.T. Carlstrom, T.S. Fuerst, and F. Ghironi, “Does it Matter (for Equilibrium Determinacy) What Price Index the Central Bank Targets?” Working Paper no. 02-02, Federal Reserve Bank of Cleveland, April 2002. [Available online at http://www.clev.frb.org/research/workpaper/ 2002/Wp0202.pdf] N. Batini and J. Pearlman, “Too Much Too Soon: Instability and Indeterminacy with ForwardLooking Rules,” unpublished, Bank of England, July 2002. [To be posted on course web page.] L.J. Christiano and C.J. Gust, “The Expectations Trap Hypothesis,” NBER working paper no. 7809, July 2000. [Available online at http://www.nber.org/papers/W7809] b. Stability under Learning Dynamics *G.W. Evans and S. Honkapohja, Learning and Expectations in Macroeconomics, Princeton: Princeton University Press, 2001. [Essential background on the methods used in the next several paper. See especially chaps. 1-2.] *J. Bullard and K. Mitra, “Learning about Monetary Policy Rules,” Journal of Monetary Economics 49: 1105-1129 (2002). Also available as Working Paper no. 2000-001E, Federal Reserve Bank of St. Louis, revised January 2002. [Available at http://www.stls.frb.org/ docs/ research/wp/2000-001.pdf] J. Bullard and K. Mitra, “Determinacy, Learnability, and Monetary Policy Inertia,” Working Paper no. 200-030A, Federal Reserve Bank of St. Louis, November 2000. [Available online at http://www.stls. frb.org/docs/research/wp/2000-030.pdf] C.T. Carlstrom and T.S. Fuerst, “Learning and the Central Bank,” unpublished, Federal Reserve Bank of Cleveland, August 2001. [Available online at http://www.clev.frb.org/research/workpaper/2001/ wp0117.pdf] S. Honkapohja and K. Mitra, “Performance of Monetary Policy with Internal Central-Bank Forecasting,” unpublished, University of Helsinki, October 2001. [Available online at http://www.valt.helsinki.fi/raka/heteroforecast.pdf] *B. Preston, “Learning about Monetary Policy Rules when Long-Horizon Forecasts Matter,” unpublished, Princeton University, August 2002. [To be posted on course web page.] J. Bullard and I.-K. Cho, “Escapist Policy Rules,” Working Paper no. 2002-002A, January 2002. [Available online at http://www.stls.frb.org/docs/research/wp/2002-002.pdf] 6. Welfare Effects of Inflation Stabilization *I&P, chapter 6: “Inflation Stabilization and Welfare.” M. Goodfriend and R.G. King, “The Case for Price Stability,” NBER working paper no. 8423, August 2001. [Available online at http://www.nber.org/papers/W8423] *A. Khan, R.G. King, and A.L. Wolman, “Optimal Monetary Policy,” Working Paper no. 00-10, Federal Reserve Bank of Richmond, October 2000. [Available online at http://www.rich.frb.org/pubs/ wpapers/pdfs/wp00-10.pdf] *C.J. Erceg, D.W. Henderson, and A.T. Levin, “Optimal Monetary Policy with Staggered Wage and Price Contracts,” Journal of Monetary Economics 46: 281-313 (2000). K. Aoki, “Optimal Monetary Policy Responses to Relative Price Changes,'' Journal of Monetary Economics 48: 55-80 (2001). P. Benigno, “Optimal Monetary Policy in a Currency Area,” CEPR discussion paper no. 2755, April 2001. [Available online at http://www.cepr.org] J. Steinsson, “Optimal Monetary Policy in an Economy with Inflation Persistence,” unpublished, Harvard University, May 2002. J.D. Amato and T. Laubach, “Implications of Habit Formation for Optimal Monetary Policy,” FEDS paper no. 2001-58, Federal Reserve Board, May 2001. [Available online at http://www.federalreserve.gov/pubs/feds/2001/200158/200158pap.pdf] B. Dupor, “Nominal Price versus Asset Price Stabilization,” unpublished, Wharton School, August 2002. [Available online at http://finance.wharton.upenn.edu/~dupor/research.html] *A. Sutherland, “A Simple Second-Order Solution Method for Dynamic General Equilibrium Models,” unpublished, University of St. Andrews, July 2002. [Available online at http://www.st-and.ac.uk/ ~ajs10/secord2.pdf] 7. Implementing Optimal Policy a. Advantages of Rules over Discretionary Policy *I&P, chapter 7: “The Importance of Commitment to a Policy Rule.” F.E. Kydland and E.C. Prescott, “Rules Rather than Discretion: The Inconsistency of Optimal Plans,” Journal of Political Economy 85: 473-491 (1977). B.T. McCallum and E. Nelson, “Timeless Perspectives vs. Discretionary Monetary Policy in Forward-Looking Models,” NBER Working Paper no. 7915, September 2000. [Available online at http://papers.nber.org/ papers/W7915] R. Dennis, “Precommitment, the Timeless Perspective, and Policymaking from Behind a Veil of Ignorance,” Federal Reserve Bank of San Francisco working paper 01-19, October 2001. [Available online at http://www.frbsf.org/publications/economics/papers/2001/wp01-19bk.pdf] *S. Albanesi, V.V. Chari and L.J. Christiano, “How Big is the Time Inconsistency Problem in Monetary Policy?” NBER working paper no. 8139, February 2001. [Available online at http://www.nber.org/papers/W8139] *A. Khan, R.G. King and A.L. Wolman, “The Pitfalls of Monetary Discretion,” Federal Reserve Bank of Richmond working paper no. 01-08, October 2001. [Available online at http://www.rich.frb.org] P.N. Ireland, “Expectations, Credibility and Time-Consistent Monetary Policy,” Macroeconomic Dynamics 4: 448-466 (2000). I.-K. Cho, T.J. Sargent, and N. Williams, “Escaping Nash Inflation,” unpublished, University of Illinois, May 2001. [Available online at ftp://zia.stanford.edu/pub/sargent/webdocs/research/csw19.pdf] b. The History-Dependence of Optimal Policy *M. Woodford, “Optimal Monetary Policy Inertia,” NBER Working Paper no. 7261, July 1999. [Available at http://www.nber.org/papers/ or at http://www.princeton.edu/~woodford] D. Vestin, “Price-Level Targeting versus Inflation Targeting in a Forward-Looking Model,” Bank of Sweden working paper no. 106, May 2000. [Available online at http://www.riksbank.com/upload/4086/ WP_106.pdf] C. Walsh, “Speed Limit Policies: The Output Gap and Optimal Monetary Policy,” unpublished, U.C. Santa Cruz, October 2001. [Available at http://econ.ucsc.edu/~walshc/Walsh_Speed_Limit_1.pdf] c. Optimal Interest-Rate Rules *R. Clarida, J. Gali, and M. Gertler, “The Science of Monetary Policy: A New Keynesian Perspective,” Journal of Economic Literature 37: 1661-1707 (1999). *M.P. Giannoni and M. Woodford, “Optimal Interest-Rate Rules,” unpublished, Princeton University, November 2001. [Available online at http://www.princeton.edu/~woodford] J.J. Rotemberg and M. Woodford, “Interest-Rate Rules in an Estimated Sticky-Price Model,” in J.B. Taylor, ed., Monetary Policy Rules, Chicago: U. of Chicago Press, 1999. [Also available as NBER w.p. no. 6618, at http://www.nber.org/papers] M.P. Giannoni, “Optimal Interest-Rate Rules in a Forward-Looking Model, and Inflation Stabilization versus Price-Level Stabilization,” unpublished, Federal Reserve Bank of New York, October 2000. [Available online at http://www.newyorkfed.org/rmaghome/economist/giannoni/papers.html] A. Levin, V. Wieland, and J.C. Williams, “The Performance of Forecast-Based Monetary Policy Rules under Model Uncertainty,” Federal Reserve Board, FEDS paper no. 2001-39, August 2001. [Available online at http://www.federalreserve.gov/pubs/feds/2001/200139/200139pap.pdf] 8. Special Topics a. Policymaking under Uncertainty *L.E.O. Svensson and M. Woodford, “Indicator Variables for Optimal Policy,” NBER working paper no. 7953, November 2000. [Available online at http://www.nber.org] *L.E.O. Svensson and M. Woodford, “Indicator Variables for Optimal Policy under Asymmetric Information,” NBER working paper no. 8255, April 2001. [Available online at http://www.nber.org] K. Aoki, “Optimal Commitment Policy under Noisy Information,” CEPR Discussion Paper no. 3370, May 2002. [Available online at http://www.cepr.org/Pubs/new-dps/] J. Gali, “The Conduct of Monetary Policy in the Face of Technological Change: Theory and Postwar U.S. Evidence,” unpublished, Universitat Pompeu Fabra, October 2000. [Available online at http://www.econ.upf.es/~gali/pdf_files/bmexpaper.pdf] L.P. Hansen and T.J. Sargent, “Robust Control and Filtering of Forward-Looking Models,” unpublished, University of Chicago, October 2000. [Available online at ftp://zia.stanford.edu/pub/sargent/webdocs/research/king1.pdf] M.P. Giannoni, “Does Model Uncertainty Justify Caution? Robust Optimal Monetary Policy in a Forward-Looking Model,” unpublished, Federal Reserve Bank of New York, September 2000. [Available online at http://www.newyorkfed.org/rmaghome/economist/giannoni/papers.html] A. Orphanides and J.C. Williams, “Imperfect Knowledge, Inflation Expectations, and Monetary Policy,” FEDS paper no. 2002-27, Federal Reserve Board, June 2002. [Available online at http://www.federalreserve.gov/pubs/feds/2002/] R.J. Tetlow and P. von zur Muehlen, “Avoiding Nash Inflation: Bayesian and Robust Responses to Model Uncertainty,” FEDS paper no. 2002-9, Federal Reserve Board, January 2002. [Available online at http://www.federalreserve.gov/pubs/feds/2002/] b. Inflation Forecast-Targeting Procedures K. Leitemo, “Targeting Inflation by Constant-Interest-Rate Forecasts,” unpublished, University of Oslo, November 2000. [Available online at http://home.c2i.net/kai_leitemo/tar.pdf] C.A.E. Goodhart, “Monetary Transmission Lags and the Formulation of the Policy Decision on Interest Rates,” Federal Reserve Bank of St. Louis Review, July/August 2001, pp. 1-18. [Available online at http://www.stls.frb.org/docs/publications/review/01/05/165-182Goodhart.qxd.pdf] L.E.O. Svensson, “The Inflation Forecast and the Loss Function,” unpublished, Princeton University, December 2001. [Available online at http://www.princeton.edu/~svensson] *L.E.O. Svensson and M. Woodford, “Implementing Optimal Policy through Inflation Forecast Targeting,” unpublished, Princeton University, November 1999. [Available online at http://www.princeton. edu/~woodford] *G.W. Evans and S. Honkapohja, “Monetary Policy, Expectations and Commitment,” CEPR discussion paper no. 3434, June 2002. [Available online at http://www.cepr.org] G.W. Evans and S. Honkapohja, “Adaptive Learning and Monetary Policy Design,” unpublished, Univ. of Oregon, October 2002. [Available online at http://www.clev.frb.org/Research/conf2002/ November/index.htm] *B. Preston, “Adaptive Learning and the Use of Forecasts in Monetary Policy,” unpublished, Princeton University, December 2002. [Available online at http://www.princeton.edu/~bpreston/preston_jmp1.pdf] c. Monetary Policy for an Open Economy R.H. Clarida, J. Gali, and M. Gertler, “Optimal Monetary Policy in Closed versus Open Economies: An Integrated Approach,” American Economic Review 91(2): 248-252 (2001). [Also available as NBER w.p. no. 8604, November 2001, at http://www.nber.org] J. Gali and T. Monacelli, “Monetary Policy and Exchange Rate Volatility in a Small Open Economy,” NBER working paper no. 8905, April 2002. [Available online at http://www.nber.org] *C. Engel, “Expenditure Switching and Exchange-Rate Policy,” NBER w.p. no. 9016, June 2002. [Available online at http://www.nber.org/papers/w9016.pdf] *A. Sutherland, “Incomplete Pass-Through and the Welfare Effects of Exchange-Rate Variability,” unpublished, University of St. Andrews, June 2002. [Available online at http://www.stand.ac.uk/~ajs10/ ipt3.pdf] A. Kara and E. Nelson, “The Exchange Rate and Inflation in the U.K.,” unpublished, Bank of England, September 2002. . [Available online at http://www.econ.cam.ac.uk/dae/people/chadha/ conference/karanelson_camsep04.pdf] G. Benigno, “Price Stability with Imperfect Financial Integration,” unpublished, New York University, December 2001. [Available online at http://homepages.nyu.edu/~pb50/welincom17.pdf] [For more on this general topic, see the website “Monetary Policy Rules in Open Economies,” at http://www.geocities.com/monetaryrules/mpoe.htm] d. Monetary Policy in a “Liquidity Trap” *Krugman, Paul, “It’s Baaack: Japan’s Slump and the Return of the Liquidity Trap,” Brookings Papers on Economic Activity 1999(2), pp. 137-205. Svensson, Lars E.O., “The Zero Bound in an Open Economy: A Foolproof Way of Escaping from a Liquidity Trap,” NBER working paper no. 7957, October 2000. Available online at http://papers.nber.org/papers/] Clouse, James, et al., “Monetary Policy when the Nominal Short-Term Interest Rate is Zero,” Finance and Economics Discussion Series no. 2000-51, November 2000. [Available online at http://www.federalreserve.gov/pubs/ feds/2000/index.html] B.T. McCallum, “Theoretical Analysis Regarding a Zero Lower Bound on Nominal Interest Rates,” Journal of Money, Credit and Banking 32 (conf. supp.): 870-904 (2000). A.L. Wolman, “Staggered Price Setting and the Zero Bound on Nominal Interest Rates,” Economic Quarterly, Federal Reserve Bank of Richmond, 84: 1-24 (1998). *T. Jung, Y. Teranishi, and T. Watanabe, “Zero Bound on Nominal Interest Rates and Optimal Monetary Policy,” unpublished, Hitotsubashi University, Tokyo, February 2001. [To be posted on course web page.] 9. Optimal Coordination of Monetary and Fiscal Policy *V.V. Chari and P.J. Kehoe, “Optimal Fiscal and Monetary Policy,” in J.B. Taylor and M. Woodford, eds., Handbook of Macroeconomics, vol, 1C, Amsterdam: North Holland, 1999. [Also available as NBER working paper no. 6891, January 1999. Available online at http://www.nber.org] C.A. Sims, “Fiscal Consequences for Mexico of Adopting the Dollar,” unpublished, Princeton University, July 1999. [Available online at http://www.princeton.edu/~sims] B. Adao, I. Correia, and P. Teles, “Gaps and Triangles,” CEPR discussion paper no. 2668, February 2001. [Available online at http://www.cepr.org] *I. Correia, J.P. Nicolini, and P. Teles, “Optimal Fiscal and Monetary Policy: Equivalence Results,” unpublished, Bank of Portugal, April 2001. [Available online at http://www.frbsf.org/economics/ conferences/0106/conf5.pdf] F. DeFiore and P. Teles, “The Optimal Mix of Taxes on Money, Consumption and Income,” CEPR discussion paper no. 3437, June 2002. [Available online at http://www.cepr.org] S. Schmitt-Grohé and M. Uribe, “Optimal Fiscal and Monetary Policy under Sticky Prices,” Rutgers University working paper no. 2001-06, June 2001. [Available at http://econweb.rutgers.edu/grohe/ research/research.htm] *H.E. Siu, “Optimal Fiscal and Monetary Policy with Sticky Prices,” unpublished, Northwestern University, November 2001. [To be posted on course web page.] F. Alvarez, A. Neumeyer and P. Kehoe, “The Time Consistency of the Friedman Rule,” Federal Reserve Bank of Minneapolis working paper no. 616, July 2001. [Available online at http://woodrow.mpls. frb.fed.us/research/wp/]