Jacksonville handout

advertisement

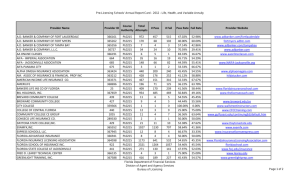

Revised January 2014 LICENSES AND PERMITS New Business Tax Receipts Most counties and cities require businesses to have an occupational license. Rules vary depending on the city and county. Before a County Occupational License can be obtained, a business must meet all conditions required by city, county, state or federal agency regulations that apply to that business or occupation. All businesses will be subject to zoning codes. Duval County/Jacksonville – only a single city/county license is needed with the exception of Jacksonville Beach, Atlantic Beach, Neptune Beach and Baldwin, where the City Clerk’s Office issues a city license prior to application for the county license. Clay County – no county license is necessary. A city occupational license must be acquired from the respective town hall if the business is located within the city limits. Those operating a home based business in Clay County must apply for a County Home Occupational License. St. Johns, Nassau and Putnam Counties – Businesses operating within the city limits must apply for a city occupational license prior to applying for a county license. Occupational License fees vary depending on the nature of the business. The number of employees, equipment and seating capacity are a few variables that factor into the cost. In Duval and St Johns County, occupational licenses are renewed annually. The license is valid through September 30th of the following year. New licenses are issued any time during the year. After April 1st, half-year fees apply. Duval County Tax Collector 231 E. Forsyth Street Room 130 Jacksonville, FL 32202 Phone: (904) 630-1916 www.coj.net/tc St Johns County Tax Collector 4030 Lewis Speedway St. Augustine, FL 32095 Phone: (904) 209-2250 www.sjctax.us Clay County (County Home Occupational Permit only) Board of County Commission Zoning P.O. Box 7 Green Cove Springs, FL 32043 Phone: (904) 284-6310 www.claycountygov.com Nassau County None Required Zoning Permits A zoning permit allows operation of a certain type of business at a certain location. Zoning Approval must be approved before prior to receiving an occupational license. If you are considering doing business from your home, a special permit or zoning exception or variance may be necessary. For addresses within city limits, city-zoning approval must be obtained. For addresses outside city limits, county zoning approval must be obtained (expect Clay County). Businesses located in Jacksonville Beach, Atlantic Beach, Neptune Beach, or Baldwin must seek city zoning rather than county zoning. Duval County St Johns County Clay County Nassau County Zoning Inspection Division 214 N Hogan St, 2nd flr Jacksonville, FL 32202 Phone: (904) 255-8312 www.coj.net Jacksonville Beach - City Clerk 11 N Third St Jacksonville Beach, FL 32233 Phone: (904) 247-6100 www.jacksonvillebeach.org Zoning Department 4020 Lewis Speedway St. Augustine, FL 32095 Phone (904) 209-0675 www.co.st-johns.fl.us St. Augustine City Hall 75 King Street St. Augustine, FL 32084 Phone: (904) 825-1065 www.staugustinegovernment.com St. Augustine Beach City Manager’s Office 2200 A1A South. St. Augustine Beach, FL 32080 Phone: (904) 471-2122 www.staugbch.com Hastings – Town Hall 6195 S. Main Street Hastings, FL 32145 Phone: (904) 692-1420 (no county license required) Zoning and Building 76347 Veteran’s Way, Yulee FL 32097 Phone: (904) 548-4600 Green Cove Springs City Hall 321 Walnut Street Green Cove springs, FL 32043 Phone: (904) 297-7500 Fernandina Beach City Hall 204 Ash Street Fernandina Beach, FL 32034 Phone (904) 310-3100 Keystone Heights City clerk 555 S. Lawrence Blvd. Keystone Heights, FL 32656 Phone: (904) 473-4807 Hilliard Town Hall 15859 West C. R. 108 Hilliard, FL 32046 Phone: (904) 845-3555 Atlantic Beach - City Clerk 800 Seminole Road Atlantic Beach, FL 32233 Phone: (904) 247-5800 Neptune Beach - City Hall 116 First St. Neptune Beach, FL 32266 Phone (904) 270-2400 Baldwin - City Hall 10 US 90W Baldwin, FL 32234 Phone: (904) 266-9211 Callahan – Town Hall 542300 US Hwy 1 Callahan, FL 32011 Phone: (904) 879-3801 www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 1 Revised January 2014 Professional Licenses Investment Advisors Broker / Dealers Division of Professions Division of Regulation Architecture and Interior Design Asbestos Contractors and Consultants Athlete Agents Auctioneers Barbers Boxing, Kick Boxing and Mixed Martial Arts Building Code Administrators and Inspectors Certified Public Accounting Child Labor Community Association Managers and Firms Construction Industry Continuing Education and Examination Services Cosmetology Electrical Contractors Engineers Employee Leasing Companies Farm Labor Florida Building Codes and Standards Geologists Harbor Pilots Home Inspectors Labor Organizations Landscape Architecture Mold-Related Services Real Estate Talent Agencies Veterinary Medicine Business Licenses and Permits Financial Institutions Securities Offerings Alcoholic Beverages and Tobacco Condominiums and Cooperatives Drugs, Devices and Cosmetics Hotels and Restaurants Mobile Homes Pari-Mutuel Wagering Timeshares Yacht and Ships For more information on obtaining a license go to www.myfloridalicense.com Florida Department of Business and Professional Regulation 1940 N. Monroe Street Tallahassee, FL 32399 Phone: (850) 487-1395 www.state.fl.us/dbpr www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 2 Revised January 2014 LICENSES AND PERMITS (Continued) Beverage Licenses Any business selling alcoholic beverages must apply for a state license. If you only want to sell beer and wine you can purchase a consumption-on-premise license. If you want to sell liquor you must get a quota license either by buying an existing license or enter the quota drawing to win the right to apply for a license. The fee for a new license is $10,750. Retailers and wholesalers of beer, wine or liquor are subject to the federal special occupational tax. Additional information is at: www.state.fl.us/dbpr/abt State licensing Federal Special Occupational Tax Information Florida Department of Business and Professional Regulation Division of Alcoholic Beverages and Tobacco 760 Arlington Expressway, Suite 600 Jacksonville, FL 32211 Department of Treasury; Bureau of Alcohol, Tobacco and Firearms 550 N. Reo Street, Suite 303 Tampa, FL 33609 Phone: (813) 288-1252 www.atf.treas.gov Fee State fees are based on the types of beverages sold or served. The license is renewed annually by September 30 th. The Federal Tax is $250 for retailers, $500 for wholesalers, due each year on or before July 1 st. Health Permits Owners of restaurants, motels, hotels and catering and food service businesses need to contact the Division of Hotels and Restaurants. www.myfloridalicense.com/dbpr/hr Owners of convenience stores, grocery stores, bakeries, mobile food vendors and food processing businesses are licensed through the Florida Department of Agriculture www.freshfromflorida.com Owners of bars, taverns, schools, nursing homes, trailer perks, childcare centers, businesses involving animals should contact the County Health Department www.doh.state.fl.us Local Office of: Florida Department of Business Regulation Division of Hotels and Restaurants 4161 Carmichael Ave 3300 Bldg, 2nd floor, Suite 2548 Jacksonville, FL 32207 Phone (904) 727-5540 (First contact: Jacksonville City Health Department for approval, Second contact: Florida Department of Business Regulation, Division of Hotels and Restaurants Third contact: Local Occupational License Office.) Florida Department of Agriculture, Food Inspection Division of Food Safety (850) 245-5595 Email: foodsafe@freshfromflorida.com Local Health Departments Offices Duval County St. Johns County 900 University Boulevard N. Suite 300 Jacksonville, FL 32211 Phone: (904) 253-1000 1955 US 1 South St. Augustine, FL 32086 Phone: (904) 825-5055 Clay County Nassau County 1305 Idlewild Ave Green Cove Springs, FL 32043 Phone: (904) 529-2800 30 S 4th St Fernandina Beach, FL 32034 Phone: (904) 548-1800 Fees are prorated by size and type of establishment. For Hotels, Motels and Restaurants, the fee depends on the number of rental units or on the seating capacity and services provided. Licenses are renewed annually. www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 3 Revised January 2014 Other Regulatory Agencies Federal Wage and Hour Law Any new business that has $500,000 or more in gross sales per year and has any involvement in interstate commerce, with few exceptions, must comply with the wage and hour law. The Federal wage and hour law covers the minimum wage scale, overtime, equal pay, child labor, age discrimination, employment record keeping and wage garnishment laws. Employers have the responsibility to determine if the law applies to their business. U. S. Department of Labor 3728 Phillips Highway, Suite 219 Jacksonville, FL 32207 Phone: (904) 232-2489 Toll free (866) 487-2365 www.dol.gov Occupational Safety and Health Act of 1970 (OSHA) If you own or manage a business, there are legal safety regulations that are your responsibility. All employers are urged to achieve an in-compliance status voluntarily and prior to ant inspections performed pursuant to the act. Fines and penalties can be levied for non-compliance. Occupational Safety & Health Administration, U. S. Department of Labor Ribault Building, Suite 227 1851 Executive Center Drive, Suite 227 Jacksonville, FL 32207 Phone: (904) 232-2895 www.osha.gov Employment Eligibility Verification Every employer with one of more employees is responsible for verifying that employee’s identity and right to work at time of hiring. An employer must complete an I-9 form on each employee within three days of hiring. On this form the employer must attest that he or she has seen certain documents verifying the employee’s employment eligibility. Immigration and Naturalization Service, U.S. Department of Justice 4121 Southpoint Blvd Jacksonville, FL 32216 Phone: (904) 232-2624 For forms: (800) 870-3676 www.ins.gov Florida New Hire Reporting Office In addition to the Federal Requirements listed above (Employment Eligibility Verification) employers need to comply with the Personal Responsibility and Work Opportunity Act of 1996 which seeks to locate “deadbeat “ parents for child support. Contact the Florida New Hire Reporting Office at: (888) 854-4791 www.myflorida.com/dor Equal Opportunity Laws Some EEOC-enforced laws that apply to small businesses: Title VII of the Civil Rights Act of 1964: This law prohibits discrimination on the basis of race, color, religion, sex and national origin. Title VII applies to employers with 15 or more employees. The Florida Civil rights Act of 1992 adds age, disability and marital status to the protected classes. Age discrimination in Employment Act of 1967 (ADEA): This law bars employers with 20 or more employees from discriminating against individuals aged 40 and older. Equal Pay Act of 1963 (EPA): The EPA prohibits wage discrimination between men and women. The law applies to all employers who are covered by the Federal Wage and Hour Law. For additional information call (800) 669-4000 or visit www.eeoc.gov www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 4 Revised January 2014 Other Regulatory Agencies (Continued) Patents, Trademarks and Copyrights A patent is an exclusive property right to an invention. A trademark is a name or symbol used by a business to identify its goods or services and distinguish them from others. Trademarks can be registered at the federal level by the commissioner of Patents and Trademarks or at the state level by the Secretary of State. A copyright is a form of protection given to an author. U.S. Patent and Trademark Office (800) 786-9199 www.uspto.gov U.S. Copyright Office (202) 707-3000 www.loc.gov/copyright Fictitious Names A Fictitious Name is any name other than an individual’s legal name. Registration of that name is required if it is used in business so as to inform the public of who is actually conducting business. Any corporation doing business under a name other than corporate name must register the other name. Jacksonville Circuit Court, Index Department 330 East Bay Street, Room 103 Jacksonville, FL 32202 Phone (904) 630-2047 Florida Department of State, Division of Corporations P.O. Box 6327 Tallahassee, FL 32314 (850) 245-6058 www.sunbiz.org The registration fee is $50. Registration must be renewed every five years. Name must be registered again if ownership changes. Registration does not reserve a fictitious name against use by other business owners. Following is the procedure for registering a fictitious name: 1. Visit the web site listed above or write for application and instructions from address listed above. 2. Run one advertisement in a local newspaper of general circulation 3. Complete application on line or mail with fee to address above. Child Care Center Licensing The child care licensing program is a component of the services provided by the Florida Department of Children and Families. The program is accountable for the statewide licensure of Florida's child care facilities, specialized child care facilities for the care of mildly ill children, large family child care homes and licensure or registration of family day care homes. The purpose of the program is to ensure a healthy and safe environment for the children in child care settings and to improve the quality of their care through regulation and consultation. Local Offices: Florida Health & Human Services 5920 Arlington Expressway Jacksonville, FL 32211 Phone: (904) 723-2000 www.myflfamilies.com Americans with Disabilities Act (ADA) The ADA of 1990 prohibits discrimination against people with disabilities. Title I of the ADA: This title prohibits employment discrimination against qualified individuals with disabilities. It applies to employers with 15 or more employees. Title III: This part of the law covers public accommodations. It applies to all businesses that provide goods and services to the public. U.S. Department of Justice, Civil rights Division Coordination and Review Section P.O. Box 66118 Phone: (800) 514-0301 Washington, DC 20035-6118 www.ada.gov www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 5 Revised January 2014 Business Structures Sole Proprietorship Business owned and operated by one person. Business profit is taxed as personal income on owner’ Schedule C Advantages: Simple and inexpensive (low start up costs); maximum control Disadvantages: Personal legal liability; limited ability to raise capital; succession issues. Partnerships A partnership is the association of two of more persons as co-owners of a business. Florida recognizes several forms of partnerships: Partnerships, General Partnerships, Limited Partnerships, Foreign Limited Partnerships Limited Liability Partnerships or Limited Liability Limited Partnership. Basic information required to file a: Partnership Registration Statement : The name of the partnership; The state or country of formation; The Federal Employer Identification Number; The street address of the chief executive office; The street address of the principal office in Florida, if applicable; The typed or printed names of two partners and their signatures, attesting under penalties of perjury that the facts listed in the document are true. This document must be dated. For more information and fees: Florida Department of State, Division of Corporations P.O. Box 6327 Tallahassee, FL 32314 (850) 245-6051 www.sunbiz.org Incorporation Information Corporations Any entity that transacts business in Florida as a corporation is required by Florida Statutes to file documents of incorporation or authorization with the Division and pay the filing fee. A Corporation is a likely choice for businesses with employees or bank financing. A Corporation is owned by shareholders that elect a board of directors who are ultimately responsible for management of the business. There are two forms of for-profit corporations (see below). Advantages: Personal assets are protected if the business fails or is sued. Disadvantages: Taxes on profits are potentially higher than with sole proprietorships. S Corporation: So called because it is under subchapter S of the IRS Code; known as Sub S. Advantages: Most appropriate for start-ups; limits personal liability; eliminates double taxation. Disadvantages: Taxes on many fringe benefits; limits on retirement benefits; restricts number of stockholders to 100. C Corporation: So called because it is taxed under regular corporation income tax rules. Advantages: Limited liability; access to capital (can raise money through sale of stock); perpetual life (unlike sole proprietorship); ownership can be transferred. Disadvantages: Profits are subject to double taxation (corporate income is taxed, and then dividends paid to stockholders are taxed as part of the individual’s income); regulation and paper work; start-up costs, including legal and filing fees. For more information and fees: Florida Department of State, Division of Corporations, Corporate Filings P.O. Box 6327 Tallahassee, FL 32314 (850) 245-6052 www.sunbiz.org Limited Liability Companies A Limited Liability Company (LLC) is a hybrid form of business entity combining some of the attributes of a corporation with the status of a partnership. Any entity that transacts business in Florida as a limited liability corporation is required by Florida Statutes to file documents of incorporation or authorization with the Division and pay the filing fee. Advantages: Liability protection; no “member” restrictions; no double taxation: (LLC’s are not subject to Florida Corporate Income Tax); easier access to capital (compared with partnership). Disadvantages: Annual reporting to Florida Division; start-up and annual corporate fees to Division of Corporations. For more information and fees: Florida Department of State, Division of Corporations P.O. Box 6327 Tallahassee, FL 32314 (850) 245-6051 www.sunbiz.org www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 6 Revised January 2014 Taxes Federal Taxes Federal Corporation Income Tax C-corporations pay income tax using federal form 1120 or 1120A. A Limited Liability company classified as a corporation for federal tax purposes must file a federal corporate income tax form. An S-Corporation generally is not liable for federal income tax, but must file a federal form 1120S annually and pay tax on certain investment income and capital gains. Returns are due by the 15th day of the third month after the close of the corporation’s fiscal year. Federal Unemployment Tax. Floridians are required to report wages and pay taxes to the federal Unemployment Compensation program is they paid $1,500 in wages within a calendar quarter or have employed one person for any portion of a day in 20 different weeks during the calendar year. Social Security and Medicare Taxes Employers are required to collect Social Security and Medicare taxes from employees. Useful small business IRS resources: “Tax Guide for Small Businesses” (Publication 334), “Circular E. Employer’s Tax Guide” (Publication 15) and “Starting a Small Business and Keeping Records” (Publication 583). All are available on the IRS internet site. U.S. Internal Revenue Service (800) 829-1040 General Information (800) 829-3676 (forms and publications) www.irs.gov/smallbiz/index.htm Local IRS Office: Internal Revenue Service Taxpayer Assistance Office Federal Office Building, Room 163 400 W. Bay Street Jacksonville, FL 32202 Phone: (904) 665-1040 www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 7 Revised January 2014 Taxes Florida State Taxes Florida Corporate Income Tax Corporations doing business in Florida are subject to the 5.5% tax that is due on April 1st. For local Florida Corporate Income Tax information: Florida Department of Revenue 921 N. Davis Street, Suite A-215 Jacksonville, FL 32209 Phone: (904) 359-6070 Florida State Tax Information: Florida Department of Revenue (800) 352-3671 www.myflorida.com/dor www.myflorida.com/dor/froms/efile.html (e-registration e-filing and e-pay) Florida Reemployment Tax Floridians are required to report wages and pay taxes to the Unemployment Compensation program if they paid $1,500 in wages within a calendar quarter or have employed one person for any portion of a day in 20 different weeks during the calendar year, or are liable for federal unemployment tax (FUTA) because of employment in another state. This tax is due on: 1/31, 4/30,7/31 and 10/31. Florida Sales and Use Tax Florida businesses must collect sales tax for many products and services. Check with the Florida Department of Revenue to determine what’s taxable. If your business will involve taxable transactions, you must register as a, sales and use tax dealer (form DR-1). Most businesses pay monthly, with returns and payments due on the first day of the next month after the tax was collected. Tangible Tax All businesses with tangible personal property are subject. This tax does not apply to inventory or vehicles. Applicable tax returns must be filled annually on form DR-405 by April 1st in every county in which a company has tangible property. The county will assess the tax based on fair market value each year at current rate. There is a 25% penalty for failure to file. Real Estate Tax All businesses with real estate must pay this tax. The fee is assessed according to the value of land, the value of any improvements and the current tax rate. Duval County Personal Property Tax Agency 231 E. Forsyth Street, Room 330 Jacksonville, FL 32202 Phone: (904) 630-2014 www.coj.net Clay County Tax Collector Administration Building 477 Houston Street Green Cove Springs, FL 32043 Phone: (904) 269-6320 www.claycountytax/com St. Johns County Tax Collector 4030 Lewis Speedway St. Augustine, FL 32095 Phone: (904) 209-2250 www.sjctax.us Nassau County Tax Collector 86130 License Rd Fernandina Beach, FL 32034 Phone: (904) 491-7400 www.nassautaxes.com www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 8 Revised January 2014 Business Plan Outline See Business Plan templates at www.score.org under Resources Like accounting, there are generally accepted and recognized methods for writing an effective business plan. Use this standardized format while still telling your unique story. The key is to write the plan yourself. Nobody knows your business better than you! We recommend the following outline: Cover Table of Contents Mission Executive Summary Management and Organization Product or Service Plan Marketing Plan Operating and Control System Growth Plan Financial Plan Appendix Cover: Tells the reader who you are and how you can be reached. Many people include a picture of their product or service and feature their logo as well. Some people forget to put a cover on their plans! Table of Contents Most people will not read your entire plan. An accountant wants to see the numbers; a sales consultant wants to see your marketing plan. They are likely to appreciate the fact that you told them where everything is in the document. Mission This is where you put into words how you see your company and how you envision its future. It serves as the key statement on which your business plan will be based. Executive Summary Arguably the most important part of your plan, precisely because it is the only part almost everyone reads! This is your best chance to get across what you want to do, and create interest. The summary should include elements of all the other business plan sections, yet be no longer than two pages. Think of it as a two page business plan. It should address all of the elements of your proposal including: How much money you want, how the funds will be utilized, and how they will be repaid. If you can not get capture attention here, it is unlikely anyone will read any further. Management and Organization This section lets you list the primary job duties, what those responsibilities are, and who does them. This is where you establish credibility by discussing the background, experience and aptitude of your personnel. Those who will be reading and evaluating your business plan will be looking for evidence of a cohesive Management Team. Investors would rather back a second rate idea with a great management team, than a first rate idea with a poor management team. Product and/or Service Plan You must convey to the reader exactly what you are doing or making. You need to ensure potential investors that all the details have been considered and that you have no problems with your products. Remember not to www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 9 Revised January 2014 get too technical. Your audience is much more interested in what you product does and what its potential is, rather than how it works. Marketing Plan Frequently used on its own to convey your marketing approach, the marketing section is of vital importance if people are to become aware of your company and purchase your product. Typically, the marketing plan has four parts: A profile of your industry, a look at your competition, how you are going to market your product/service (and to whom), and how it will be priced. This is often a poorly written section, as a good marketing plan requires investigation, research and analysis. Many businesspeople are god at selling, but not effective market planners. Don’t just say you are going to advertise in the Yellow pages or Florida Times-Union. Tell people why you are choosing those advertising venues and how they reach your customer. Operating and Control Systems This is where you demonstrate that you have implemented a system to make your business run effectively. Potential investors want to see that you have a schedule and that you recognize that there are sequences of events from the time and order is received through fulfillment. Growth Plan What will your company need in the future? What are your long-term expansion plans? Investors want to know that you are not a “flash in the pan” and are looking at the big picture. Try to make assumptions based on solid information. Don’t just increase your sales by the same percentage every year. Most growth plans look three years into the future. Financial Plan This is a very important component of your plan, and it is appropriate that it is shown last. The previous sections show how you led up to this meaningful financial information. This is where you analyze what dollars will be needed to implement the business plan. You need to show a budget that accurately reflects all of the areas in which you are spending funds. Some areas are projected based on assumptions. The assumptions you make will show how the budget figures were derived. You will have to defend your assumptions by having a good reason for your financial decisions. Projections show the reader how much cash is flowing through the business and reflect you monthly pre-tax income. It is not surprising that investors are very interested in these figures. Your income statement shows how well the business has been doing over a stated period of time. The balance sheet looks at a specific time, and ratios look at the business at various points of time. This in itself is why business plans have to be updated often. Financial information must be as recent as possible in order to be credible. The executive summary and financial plan are your most read sections of a plan, so put the appropriate amount of time into both. Appendix This is where you put other salient information you want your reader to have. Typical components found in the appendix of a business plan are resumes of key personnel, news articles about the company, contracts, patents, photographs of the product, and letters of reference. This can be a valuable section if done correctly. Avoid clutter and meaningless information. Strive to place the information in order consistent with the other sections of the plan. You can cite appendix information as you write the other sections of your plan, but do so sparingly. While any plan is better than no plan at all, a well conceived, well written business plan can make all the difference between investor interest and investor apathy. Smart companies have great business plans. Do you think your competition wants you to have a plan? www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 10 Revised January 2014 Business Insurance Like home insurance, business insurance protects the contents of your business against fire, theft and other losses. Contact your insurance agent or broker. It is prudent for any business to purchase a number of basic types of insurance. Some types of coverage are required by law, other simply make good business sense. The types of insurance listed below are among the most commonly used and are merely a starting point for evaluating the needs of your business. Liability Insurance -- Businesses may incur various forms of liability in conducting their normal activities. One of the most common types is product liability, which may be incurred when a customer suffers harm from using the business product. There are many other types of liability, which are frequently related to specific industries. Liability law is constantly changing. An analysis of your liability insurance needs by a competent professional is vital in determining an adequate and appropriate level of protection for your business. Property -- There are many different types of property insurance and levels of coverage available. It is important to determine the property you need to insure for the continuation of your business and the level of insurance you need to replace or rebuild. You must also understand the terms of the insurance, including any limitations or waivers of coverage. Business Interruption -- While property insurance may pay enough to replace damaged or destroyed equipment or buildings, how will you pay costs such as taxes, utilities and other continuing expenses during the period between when the damage occurs and when the property is replaced? Business Interruption (or "business income") insurance can provide sufficient funds to pay your fixed expenses during a period of time when your business is not operational. "Key Man" -- If you (and/or any other individual) are so critical to the operation of your business that it cannot continue in the event of your illness or death, you should consider "key man" insurance. This type of policy is frequently required by banks or government loan programs. It also can be used to provide continuity in operations during a period of ownership transition caused by the death or incapacitation of an owner or other "key" employee. Automobile -- It is obvious that a vehicle owned by your business should be insured for both liability and replacement purposes. What is less obvious is that you may need special insurance (called "nonowned automobile coverage") if you use your personal vehicle on company business. This policy covers the business' liability for any damage which may result for such usage. Office and Director -- Under some circumstances, officers and directors of a corporation may become personally liable for their actions on behalf of the company. This type of policy covers this liability. Home Office -- If you are establishing an office in your home, it is a good idea to contact your homeowners' insurance company to update your policy to include coverage for office equipment. This coverage is not automatically included in a standard homeowner's policy. www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 11 Revised January 2014 Financing Your Business A start-up or early-stage business has virtually no chance of getting a significant bank loan. Unless you have a proven track record, lenders are not willing to put their money on the line. Where does the money come from? Here are a few suggestions: Stick close to home: Home equity loan Friends and Family Profit-sharing funds from your previous job If you need more than these sources can provide, consider: Personal Savings Business credit card Store credit Bank loan Limited Partnership Private/Stock offering Seek Venture Capital only if your business has the potential to achieve multimillion-dollar sales within five years. For additional information: National Venture Capital Association (703) 524-2549 or www.nvca.org National Association of Small Business Investment Companies at (202) 628-5055 or www.nasbic.org Do not get bogged down hunting for funds: if you encounter problems raising money, try to start your business on a smaller scale. Be sure you know your current credit rating and history – For both you (personal credit rating) and your business. Try to find out which credit reporting service your prospective lender uses and request a report from that company. The three major credit reporting companies are : Equifax (800)997-2493 www.equifax.com Experian (888) 397-3742 www.experian,com Trans Union (800) 888-4213 www.transunion.com When reviewing a loan request, the lender is primarily concerned with repayment. Loan officers judge loan applications based on what is commonly referred to as the “Five C’s of Credit”: 1. Character: Lenders will order a copy of your credit report and look at debit repayment trends. They want to simply know if you pay your bills and if you pay them on time. If there are blemishes on your report, explain them. 2. Cash Flow: Lenders will look at historical and projected cash flow statements to determine whether you will be able to repay the loan and still have money to adequately run the business. Include written justification for your projections in your loan proposal. 3. Collateral: Collateral is an asset (something you own) which a lender may claim to satisfy a loan in the event the loan is not repaid according to the required terms. Often the items purchased with the loan may serve as collateral. If the business does not have enough collateral, the bank will look to personal assets. 4. Capitalization: Capitalization refers to the basic resources of the business including; owner’s equity, retained earnings, and fixed assets. You do not have to be fully capitalized to qualify for a loan. 5. Conditions: Factors that affect the success of the company yet are external to the business will also be considered by the lender. Examples include; government regulation, competition and industry trends. www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 12 Revised January 2014 S–T–A–R–T–U–P Select the Idea What type of business would you like to start? Start from scratch, existing, franchise? Do you know the business, its customers and competitors? Consider working in the business before investing. Are you fit to be an entrepreneur? The new business is 24/7. Test the Market Learn everything possible about the business itself, the industry, and the target market. Know thy competitor! What are his strengths and weaknesses? Who will buy your product? At what price? Develop marketing strategy. Acquire Capital Determine capital needs. Don’t under estimate. Include funds for you to live on. Sources of funds include personal savings, family and friends, second mortgage, bank loan, credit cards, etc. A substantial portion of funds must come from owner. Know your personal credit history; prepare financial statements and business plan before you seek outside help. wRite a Business Plan The Plan will prove to you, and potential investors or lenders that the business idea is feasible. Clear focused description of the business concept (what you are selling), a market assessment (who will buy it, who are the competitors), a financial assessment (what will they pay, will I make a profit), and a self assessment (do I have what it takes). Turning for Help Obtain a professional team; attorney, accountant, insurance broker, and banker. SCORE, Small Business Center (SBC), UNF Small Business Development Center; Use SBC workshops on Startup, Marketing, Understanding Financials, and Business Plan Understand Legal Requirements Select the legal structure; sole proprietorship, partnership, or corporation (S Corp, C Corp, or LLC). Register the name of the business; obtain proper licensing and permits from city, county, and state Know what types of insurance are required; unemployment, workers compensation, etc. File the proper tax forms; federal and state, sales tax, etc. Intellectual property – trademarks, copy write, patent issues? Project the Cash Flow Know how much money you will need to start up the business. Know your monthly fixed expenses after startup. Find your cash flow breakeven point. Use the cash flow forecast to evaluate changes in business assumptions. As a minimum, project monthly cash flow for year 1 and quarterly for years 2 and 3. www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 13 Revised January 2014 Sources for Research (Just a few to get you started) SCORE o SCORE Jacksonville (www.jacksonville.score.org) o SCORE National (www.score.org) Jacksonville Specific o Chambers of Commerce (www.myjaxchamber.com) o Small Business Center (www.jaxsbc.com) o UNF Small Business Resource Network (www.sbrn.org) o Jacksonville City (http://www.coj.net/I+am/a+business/default.htm) Florida o Florida Information (www.myflorida.com) o Florida Corporations/Fictitious Name (www.sunbiz.org) o Florida Trend (www.floridasmallbusiness.com) Federal Government o Small Business Administration - SBA (www.sba.gov) o IRS Small Business and Self Employed One Stop Resource (http://www.irs.gov/businesses/small/index.html) Small Business Publications o Wall Street Journal Startup (http://www.startupjournal.com/) o Wall Street Journal Startup Guides (http://guides.wsj.com/small-business/) o Business Week Small Business (http://www.businessweek.com/smallbiz/) o Fortune Magazine (http://money.cnn.com/smbusiness/index.html) o Inc.com 9 (www.inc.com) Business Plans o SCORE JAX Workshop (http://www.scorejax.org/wssoftware.html) o Bank of America Small Business Resources (www.bankofamerica.com/smallbusiness/resourcecenter/) o Intuit Small Business Resources (www.jumpup.com) Other Sources o Business Statistics (www.bizstats.com) o Thomas Register of American Manufacturers – (www.thomasregister.com) o Public Library or the BIC Annual Statement Studies, RMA – www.rmahq.com Trade Associations – Encyclopedia of Associations o Compensation: www.salary.com o Market Research Firms o Competition o Suppliers o Customers www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 14 Revised January 2014 Achieve Your Dream Workshop Content Session 1: Foundations for Your Business Discover the fundamentals for small business success Start up, Business Structures, Customer Profile, Defining Your Product or Service A proper foundation is important for the success of your small business. Examined are the different types of business structures (Sole Proprietor, LLC etc) and the professionals needed to help you start or grow your business. Discover who makes your business successful – your customer (target market) and how to determine who is best suited to utilize your product or service. Look forward to in class interactive exercises including developing your unique customer profile and creating your business identity. Session 2: Business and Finance Basics Determine if your business will make money Naming your Company, Logo, Tagline, Competition, Financial Basics, Business Networking Learn how to create a memorable business name, and why a logo and tagline are important. Next discover why it is important to analyze your competition so you can create a thriving business. Then interact with us to create your basic financial picture to help answer the questions: “How much money do I need to start or grow my business?” “Am I charging enough for my product or service?” “Will my business make money?” The session ends with how business networking is critical to promoting and impacting your bottom line. Interactive class exercises include creating your tagline and predicting through financial calculations what it will cost to start or maintain your business. Session 3: Marketing Strategies Learn successful, inexpensive ways to market your product or service Buying Decisions, Building a Website, Low Cost Marketing Methods and Tools, Social Media We let out the big secret: Who buys most products and services? – The answer may surprise you! Learn how to create a marketing message that maximizes its appeal to the markets you intend to serve. Did you know that you can create a website? – for free! We show you how. Costs to promote your business can be expensive – learn 10 different low cost methods and tools. We discuss how to use social media (Facebook etc) to promote and gain new customers. Learn how to price your product or service that satisfies your customer’s needs and your bottom line. Learn from examples, the rights and wrongs of marketing and advertising. www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 15 Revised January 2014 Session 4: Create Your Plan for Your Business Putting it all together to create a practical plan to start or grow your business Create Elevator Speech, Business Plan Basics This is our most interactive workshop. We start by helping you develop your “elevator pitch” – a 30second speech that tells your customer, banker or neighbor quickly and effectively what your business is about. Then we pull together the first 3 sessions to help you begin to write out some of the detailed plans for your business. What is a business plan? – It is a tool that is a proposed course of action that shows how you plan to accomplish your goals. It is a vital document that helps with start up, managing and operating your business. It is a road map for success. Use your business plan to guide you or to obtain financing. The Workshops are scheduled up to four times a year; the schedule can be found on www.jacksonville.score.org www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 16 Revised January 2014 Trade Associations for Florida Business Florida's small businesses often turn to trade associations for industry research, networking and, perhaps most important, lobbying support in Tallahassee. Membership costs and services and interaction with members vary widely from group to group. Accounting Florida Institute of Certified Public Accountants (850) 224-2727 www.ficpa.org Agriculture Florida Farm Bureau Marketing Division (352) 378-8100 www.floridafarmbureau.org Florida Citrus Commission (863) 537-3999 www.fdocgrower.com Florida Fruit and Vegetable Association (321) 214-5200 www.ffva.com Architects Florida Association of the American Institute of Architects (850) 222-7590 www.aiafla.org Attorneys The Florida Bar (850) 561-5600 www.flabar.org Banking and Finance Florida Bankers Association (850) 224-2265 www.floridabankers.com Florida Credit Union League (850) 576-8171 www.fcul.org Florida International Bankers Association (305) 579-0086 www.fiba.net Business and Industry Florida Chamber of Commerce (877) 521-1200 www.flchamber.com Associated Industries of Florida (850) 224-7173 www.aif.com National Federation of Independent Business (800) 634-2669 www.nfib.com Florida United Businesses Association (850) 681-6265 www.fuba.org Florida League of Cities (800) 342-8112 www.flcities.com Florida Economic Development Council (813) 977-3332 www.fedc.net Florida Association of Counties (850) 922-4300 www.fl-counties.com Contractors, Construction Florida Roofing, Sheet Metal & Air Conditioning Contractors Assoc. (407) 671-3772 www.floridaroof.com Asphalt Contractors Association of Florida (850) 222-7300 www.acaf.org Florida Concrete & Products Association (800) 342-0080 www.fcpa.org Florida Associated General Contractors Council (850) 222-2421 www.floridafl.org Florida Association of Electrical Contractors (407) 260-1511 www.faeccf.org Florida Home Builders Association (850) 224-4316 www.fhba.com Education and Training Association of Florida Colleges (850) 222-3222 www.myafchome.org Florida Education Association (850) 201-2800 www.feaweb.org Engineering Florida Engineering Society (850) 224-7121 www.fleng.org Forestry Florida Forestry Association (850) 222-5646 www.floridaforest.org Horticulture Florida Nurserymen and Growers Association (800) 375-3642 www.fnga.org Hospitality Florida Restaurant Association (888) 372-9119 www.frla.com North Florida Hotel & Lodging Association (904) 421-9176 www.northfloridalodging.com Central Florida Hotel & Lodging Association (407) 313-5000 www.cfhla.org Insurance Florida Association of Insurance Agents (850) 893-4155 www.faia.com Labor Florida AFL-CIO (850) 224-6926 www.flaflcio.org www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 17 Revised January 2014 Trade Associations for Florida Business Marine Florida Ports Council (850) 222-8028 www.flaports.org Real Estate Florida Association of Realtors (407) 438-1400 www.floridarealtors.org Medical and Pharmaceutical BioFlorida Inc. (561) 653-3839 www.bioflorida.com Florida CCIM Chapter (800) 621-7027 www.flccim.com Florida Dental Association (850) 681-3629 www.floridadental.org Retail Florida Retail Federation (888) 357-3824 www.frf.org Florida Hospital Association (850) 222-9800 www.fha.org Associated Grocers of Florida (954) 876-3000 www.agfla.com Florida Medical Association (800) 762-0233 www.flmedical.org Florida Pharmacy Association (850) 222-2400 www.pharmview.com Publications And Printing Printing Association of Florida (407) 240-8009 www.pafgraf.org Technology Florida High Tech Corridor Council (407) 708-4630 www.floridahightech.com InternetCoast www.internetcoast.com Transportation, Trucking, Automotive, Aviation Florida Transportation Builders Association (850) 942-1404 www.ftba.com Florida Trucking Association (850) 222-9900 www.fltrucking.org Florida Aviation Business Association (321) 383-9662 (800) 280-9662 http://faba.aero Utilities Florida Municipal Electric Association (850) 224-3314 www.publicpower.com Florida Electric Cooperatives Association (850) 877-6166 www.feca.com www.jacksonville.score.org Southside: 7825 Baymeadows Way, Suite 100B Jacksonville, FL 32256 (904) 443-1900 Downtown: Jacksonville Chamber of Commerce 3 Independent Drive Jacksonville, FL 32202 (904) 366-6618 18