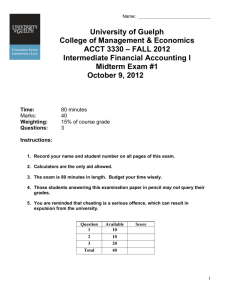

Test 1, Spring 2010

advertisement

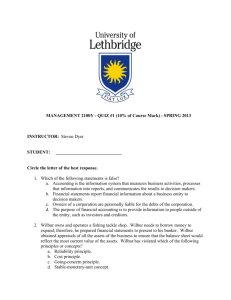

1 Accounting 303 Exam 1, Chapters 1 – 3 Spring 2010 I. Name _______________________ Section _______ Row _______ Multiple Choice Questions. (2 points each, 40 points in total) Read each question carefully and indicate your answer by circling the letter preceding the one best answer. 1. Which of the following is not a current or previous policy-making body given the authority to establish financial accounting standards in the USA? a. Accounting Principles Board b. Financial Standards Board c. Committee on Accounting Procedures d. Financial Accounting Standards Board e. International Financial Reporting Standards Board 2. Which organization has the most legal authority to establish financial accounting standards? a. Accounting Standards Executive Committee b. Cost Accounting Standards Board c. Financial Accounting Standards Board d. Governmental Accounting Standards Board e. Securities and Exchange Commission 3. A firm's comprehensive income a. is the same as its net income. b. is greater than its net income c. is less than its net income d. could be greater than, less than, or equal to net income. 4. Of the following measurement bases, which one is usually the most verifiable? a. current replacement cost b. fair market value c. historical cost d. net realizable value e. present value of future cash flows 5. Which of the following financial statements is prepared as of a given point in time? a. balance sheet b. cash flow statement c. income statement d. statement of retained earnings 2 6. The FASB Conceptual Framework concluded that the primary objective of financial reporting is to a. provide information useful in the decisions of external users. b. meet the needs of internal users. c. provide information about an entity's earnings. d. provide information about an entity's cash flows. 7. A state legislature is currently debating a bill which, if passed, would require the Rom Services Company to go out of business. Which of the following principles or assumptions related to the preparation of Rom Services' financial statements is most directly affected by this impending vote of the legislature? a. economic entity b. going concern c. monetary unit d. periodicity e realization 8. Which of the following groups of accounts are all increased with credits? a. rent expense, cost of goods sold, unearned revenue, and prepaid rent b. sales revenue, capital stock, accounts payable, and patents c. accumulated depreciation, accounts receivable, cost of goods sold, and rent expense d. retained earnings, notes payable, unearned revenue, and allowance for bad debts 9. Which of the following is a contra account? a. depreciation expense b. retained earnings c. sales revenue d. unearned revenue e. accumulated depreciation 10. On June 1, Royal Corp. began operating a service company with an initial cash investment by shareholders of $2,000,000. The company provided $6,400,000 of services in June and received full payment in July. Royal also incurred expenses of $3,000,000 in June that were paid in August. During June, Royal paid its shareholders cash dividends of $1,000,000. What was the company's income before income taxes for the two months ended July 31 under the following methods of accounting? a. b. c. d. e. Cash Basis Accrual Basis $3,400,000 $3,400,000 $5,400,000 $2,400,000 $6,400,000 $3,400,000 $6,400,000 $2,400,000 none of the above are correct 3 11. Which of the following entries could not be a correct adjusting entry? a. b. c. d. Prepaid Rent Rent Expense xxx Accounts Receivable Unearned Revenue xxx Bad Debt Expense Allowance for Uncollectible Accounts xxx Interest Expense Interest Payable xxx xxx xxx xxx xxx 12. Which of the following errors could be detected by a trial balance? a. recording a complete $100 transaction as $200 b. posting a credit to accounts payable as a debit to accounts receivable c. not recording a complete sales transaction d. recording a complete purchases transaction twice 13. When a company accrues federal income taxes at the end of the accounting period a. its acid-test ratio increases. b. its current ratio increases. c. working capital is unchanged. d. its debt to equity ratio increases. 14. Liquidity refers to a. the amount of cash on hand at a given time. b. the readiness of an asset to be converted to cash. c. the period of time until cash is used and refinancing becomes necessary. d. financial leverage. 15. The principal concern with accounting for related party transactions is a. the size of the transaction. b. differences between economic substance and legal form. c. the absence of legally binding contracts. d. the lack of accurate data to record transactions. 16. Cash equivalents do not include a. cash sinking funds for future plant expansion. b. money market funds. c. U.S. treasury bills. d. bank drafts. 4 17. Which of the following statements is false? a. The accounts shown on a balance sheet represent the basic accounting equation for a particular business. b. The retained earnings balance shown on the balance sheet must agree with the ending retained earnings balance shown on the statement of retained earnings. c. The balance sheet reports the changes in specific account balances over a period of time. d. The balance sheet reports the amount of assets, liabilities, and stockholders' equity of an accounting entity at a point in time. Use the following information for questions 18-20. Prut, Inc. Balance Sheet December 31, 2010 Assets Cash Accounts Receivable Inventory Land, Buildings, and Equipment (net) Intangible Assets 25,000 60,000 95,000 90,000 5,000 275,000 Liabilities and Equity Accounts Payable Salaries Payable Notes Payable (due 1/1/2012) Capital Stock Retained Earnings 18. What is Prut's current ratio at December 31, 2010? a. 1.24 b. 4.00 c. 6.11 d. 1.90 e. some other amount 19. What is Prut's debt to equity ratio at December 31, 2010? a. 16.4% b. 45.5% c. 52.7% d. 111.50% e. some other amount 20. What is Prut's working capital at December 31, 2010? a. $ 35,000 b. $ 40,000 c. $130,000 d. $135,000 e. some other amount 40,000 5,000 100,000 60,000 90,000 275,000 5 II. Problems – (60 points in total) 1. (9 points) Answer each of the following questions with the appropriate word or phrase. You do not need to write complete sentences. Just supply the word or short phrase. a. The FASB Conceptual Framework indicates that the primary qualitative characteristics of useful accounting information are relevance and reliability. According to the Conceptual Framework, what are the three characteristics that make information relevant? (1) (2) (3) b. According to the Conceptual Framework, what are the three characteristics that make information reliable? (1) (2) (3) 6 2. (9 points) Below is a list of basic accounting principles. Following the list is a series of descriptive statements that illustrate the violation of a basic accounting principle. In the space provided, indicate the principle being violated by writing the appropriate letter. NOTE: Each letter may be used once, more than once, or not at all. A. B. C. D. Economic entity assumption Going concern assumption Monetary unit assumption Periodicity assumption E. Realization principle F. G. H. I. Full-disclosure principle Historical cost principle Matching principle Materiality principle _______ a. Andrei Corporation’s accountant increased the book value of a patent from its original cost of $1 million to its recently appraised value of $6 million. _______ b. Corina Corporation paid for the personal travel of its chief financial officer and charged the amount to travel expense. _______ c. Near the end of 2009, Luca, Inc. received an order from a customer for $60,000. The merchandise will ship early in 2010. Because the sale was made to a long-time customer that makes frequent purchases and the invoice was paid in 2009, the controller recorded the sale in 2009. _______ d. In the middle of its 2009 fiscal year, Mihai Company paid $12,000 to its insurance company for a one-year comprehensive insurance coverage. Mihai Company recorded the entire expenditure as an expense of 2009. _______ e. The Radu Pharmaceutical Company omitted any mention in its financial statements about a pending lawsuit against the company because it might put the company in a negative light. _______ f. The Rodica Corporation, a company whose securities are publicly traded, decided to increase its accounting year to 13 months so as to report a larger net income. 7 3. (14 points) Chişinău Music Corporation is in the process of preparing its year-end financial statements for 2009. Since certain accounts in the trial balance do not reflect all activities that have occurred, prepare the necessary adjusting journal entries for the following items. Make the journal entries in proper general journal entry form and show the work for any calculations you make. a. The Supplies account shows a balance of $540, but a count of supplies reveals only $210 on hand at the end of the year. b. Chişinău Music Corporation initially records the payments of all insurance premiums as expenses. The trial balance shows a balance of $420 in Insurance expense. A review of insurance policies reveals that $125 of insurance is unexpired. c. Chişinău Music Corporation's employees work Monday through Friday, and salaries of $2,400 per week are paid each Friday. Chişinău Music Corporation's year-end falls on Tuesday. d. On December 31, 2009, Chişinău Music Corporation received a utility bill for December electricity usage of $190 that will be paid in early January. e. If Chişinău Music Corporation chose to make reversing entries, which of the above 8 adjustments (a - d) would be reversed? Use the following adjusted, pre-closing December 31, 2009 trial balance for problems 4 and 5. Note that the accounts listed in the trial balance are in alphabetical order. Bran Castle Corporation Trial Balance December 31, 2009 Accounts Payable Accounts Receivable $ 21,000 $ 206,000 Accrued Liabilities $ 5,000 Accum Depreciation-Bldg & Equip $ 121,000 Allowance for Uncollectible Accts $ 25,000 Bad Debts Expense Buildings and Equipment $ 5,000 $ 425,000 Capital Stock $ 200,000 Cash $ 31,000 Cost of Goods Sold $ 310,000 Depreciation Expense $ 27,000 Interest Expense $ 13,000 Inventory $ 45,000 Land $ 140,000 Notes Payable Due 5/1/2014 Prepaid Rent $ 210,000 $ 5,000 Retained Earnings Salaries Expense $ 50,000 $ 185,000 Sales Revenue $ 760,000 Total $ 1,392,000 $ 1,392,000 9 4. (11 points) Using the trial balance for Bran Castle Corporation, prepare December 31, 2009 closing entries. Make the entries in proper general journal entry form. 10 5. (17 points) Using the trial balance for Bran Castle Corporation, prepare a December 31, 2009 classified balance sheet. Bran Castle Corporation Balance Sheet December 31, 2009 11 Answers Question Answer 1 b 2 e 3 d 4 c 5 a 6 a 7 b 8 d 9 e 10 c Question Answer 11 b 12 b 13 d 14 b 15 b 16 a 17 c 18 b 19 e 20 d Problems 1. a. (1) predictive value (2) feedback value (3) timeliness b. (1) verifiability (2) representational faithfulness (3) neutrality 2. Question Answer a G b A c E d H e F f D 3. a. Supplies Expense Supplies 330 330 b. Prepaid Insurance Insurance Expense 125 c. Wages Expense Wages Payable 960 125 960 12 d. Utilities Expense Utilities Payable 190 190 e. b,c,d 4. Sales Revenue Cost of Goods Sold Depreciation Expense Interest Expense Bad Debts Expense Salaries Expense Retained Earnings 760,000 310,000 27,000 13,000 5,000 185,000 220,000 13 5. Bran Castle Corporation Balance Sheet December 31, 2009 Assets Current Cash Accounts Receivable Less: Allow for Uncollectibles Inventory Prepaid Rent Total Current Assets Noncurrent Land Buildings and Equipment Less: Accumulation Depr. Total Noncurrent Assets Total Assets Liabilities Current Accounts Payable Accrued Liabilities Total Current Liabilities Noncurrent Notes Payable Total Liabilities Stockholders' Equity Capital Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $ $ 206,000 25,000 $ 31,000 $ $ $ 181,000 45,000 5,000 $ 262,000 $ $ 425,000 121,000 $ 140,000 $ 304,000 $ 444,000 $ 706,000 $ $ 21,000 5,000 $ 26,000 $ 210,000 $ 236,000 $ $ 200,000 270,000 $ 470,000 $ 706,000