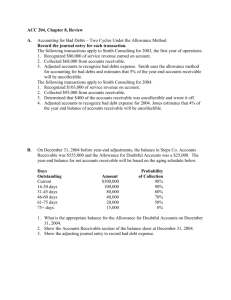

CHAPTER I

advertisement