Medical Reimbursement Plan

advertisement

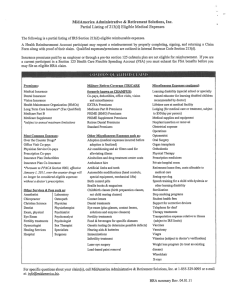

P.O. Box 1392 Addison, TX 75001-1392 (888) 483-1392 • Fax (888) 211-1392 • www.ntalifebsg.com Section 125 Flexible Benefit Program Cafeteria Plan Administration Common Remitter Billing Benefits Consultation and Plan Design Health Savings Account Administration Quick Access to Flexible Spending Accounts Online Billing and Enrollment On Site Enrollment Assistance Everything is FSA Eligible! Access the FSAStore through our website www.ntalifebsg.com under the FSA Shopping tab! 90-213 (10.13) Bryan YOUR CAFETERIA PLAN PROGRAM (An Overview for Employees…..Doing the Math) Your Cafeteria Plan Program allows you to take advantage of paying for selected items on a pre-tax basis such as Group Health, Health Expenses (Medical Flexible Spending Accounts (FSAs)), Dependent Care Expenses (DCAs), and Supplemental Health (Cancer and Heart products). The cost of the items you select is then deducted from your paycheck prior to paying your taxes. By using pre-tax dollars to pay for these programs, you save on federal, state (if applicable), as well as FICA, Medicare and other payroll taxes. Alternatively, you would be paying for these programs with your after-tax dollars. By using pre-tax dollars, your take-home income increases as approximated below: Annual Income Pre-Tax Expenses (For example, group medical premiums, medical and dependent care flexible accounts to be reimbursed, and supplementary health premiums). Taxable Income Estimated Taxes @ 25% Rate FICA and Medicare @ 7.65% Rate After-Tax Expenses (For example, group medical premiums, medical & dependent flexible accounts to be reimbursed, and supplementary health premiums). Net Take-Home Pay Take-Home Pay Annual Increase Group Health Premiums The expenses which can be paid pre-tax from this component include your payroll-deducted premiums for health, dental, or vision insurance. Without a Cafeteria Plan With a Cafeteria Plan $40,000 $0 $40,000 $4,000 $40,000 ($10,000) ($3,060) ($4,000) $36,000 ($9,000) ($2,754) $0 $22,940 $0 $24,246 $1,306 All figures are annual (or over $100 per month) Supplementary Health Premiums The expenses which can be paid pre-tax from this component include your payroll-deducted premiums for the Cancer and Heart NTA Life programs. FLEXIBLE SPENDING ACCOUNT ELIGIBLE EXPENSES Healthcare FSA Eligible Expenses: Dental Dental X-rays Dentures and Bridges Exams and teeth cleaning Extractions and fillings Gum treatment Oral surgery Orthodontia and braces Vision Eyeglasses and contact lenses Laser eye surgeries Prescription sunglasses Radial keratotomy/LASIK Hearing Hearing devices and batteries Hearing examinations Lab Exams/Tests Blood tests and metabolism tests Body scans Cardiographs Laboratory fees X-rays Medical Equipment/Supplies Crutches and wheel chairs Hospital beds Medic alert bracelet or necklace Nebulizers Prosthesis Syringes Wigs* Medical Procedures/Services Acupuncture Ambulance Hospital services Infertility treatment Physical exams Service animals Vaccinations and immunizations Dependent Care FSA Eligible Expenses: Household services (including a maid or cook) provided they are directly related to the care of the “qualified dependent” Medication Insulin Prescription drugs Weight loss drugs* Actual physical care of the “qualified dependent” Obstetrics OB/GYN exams OB/GYN prepaid maternity fees (Reimbursable after date of birth) Pre and postnatal treatments A dependent care center, if they provide care for 7 or more individuals (day care only), and comply with all applicable laws and regulations Nursing home for an invalid parent, for day care only If the employee is married, dependent childcare is generally reimbursed as long as the spouse is either employed, a fulltime student, or is incapable of caring for himself or herself or the dependent. Practitioners Allergist Chiropractor Dermatologist Homeopath or naturopath* Osteopath Physician Psychiatrist or psychologist Important Note: Therapy Alcohol and drug addiction Counseling (not marital, financial or career) Massage* Occupational Physical Speech Weight loss programs* As of January 1, 2011 OTC medications and drugs without a doctor’s prescription are not reimbursable through the healthcare FSA. The prescription requirement only applies to OTC items that contain a medicine or drug (i.e., cold medicines, aspirins, acid controllers, allergy and sinus drugs, etc.). Healthcare FSA Ineligible Expenses: Contact lens or eyeglass insurance or discount programs Cosmetic surgery/procedures Diaper service Personal trainer Insurance premiums and interest Long-term care premiums Marriage counseling Please note: Expenses marked with an asterisk (*) are “potentially eligible expenses” that require a Letter of Medical Necessity from your healthcare provider to qualify for reimbursement. This is not a complete listing. For more information, please visit www.irs.gov. Maternity clothes Teeth bleaching or whitening Vitamins or nutritional supplements* IMPORTANT INFORMATION ABOUT YOUR PREPAID BENEFITS CARD Ten Important Things Our Team Thought You Should Know RECEIPTS & SUBSTANTIATION (SAVE YOUR RECEIPTS) REQUESTS FOR RECEIPTS OR OTHER DOCUMENTATION 1. The IRS has established specific guidelines that require all FSA transactions-even those made using a healthcare debit card (i.e. your Benny card)-to be substantiated. Substantiation simply means that a purchase must be verified as an eligible medical expense. The good news is that a majority of eligible expenses made by a healthcare debit card will be autosubstantiated at the point of sale through verification by the third-party merchant. 6. If substantiation is required we will mail you a receipt or other documentation request. The first two (2) receipt requests are sent by email, if we have an email address on file. If not, a hard copy letter is sent through the mail. The final request letter is sent 120 days after the transaction date and at that time the card could be temporarily suspended until the proper documentation is received and adjudicated. 2. Auto-substantiation may also occur through recurring claims that exactly match the provider and dollar amount for a previously approved and substantiated transaction and through co-pay matching for charges that exactly match the dollar amount or a multiple of such co-pay amount. 3. If your transactions do not qualify for autosubstantiation through one of the methods listed above, then they must be manually substantiated with receipts or other documentation submitted for review to us. SAVE YOUR RECEIPTS! 4. MOST DENTAL/VISION PROVIDER VISITS WILL REQUIRE RECEIPTS. This is because the dollar amount of the transaction is not an even dollar amount or equal to a multiple of your co-pay, is not recurring, and cannot be auto-substantiated. Therefore, the only way to substantiate your transaction is manually. SAVE YOUR RECEIPTS! 5. Recurring claims must be set up as a recurring claim each new calendar year. ACCOUNT INFORMATION 7. To check your balance and transaction history please register your account at www.mybenny.com. 8. Please inform us of an address or e-mail change to ensure correspondence is being delivered properly. Also if you are set up on ACH (direct deposit) for your claims, please notify us of any banking changes. Direct deposit forms are located on our website www.ntalifebsg.com. CARDS 9. New Benny cards are automatically re-issued by Evolution Benefits two (2) weeks prior to the expiration date. 10. There is a $5.00 replacement fee to replace a lost Benny card. The cards are issued in increments of 2 in the employee’s name only, but your spouse or child may use the cards. The re-issue usually takes 7-10 business days from the request date.