Complaint - Republic Report

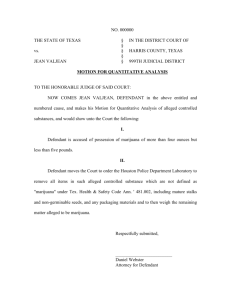

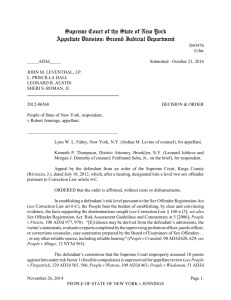

advertisement