The Los Angeles Area Fashion Industry Profile and 2014 Outlook

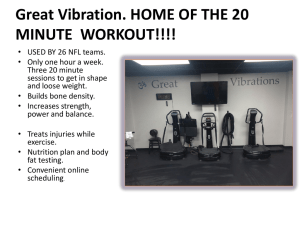

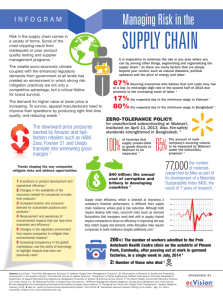

advertisement