THE INTRACORPORATE CONSPIRACY TRAP

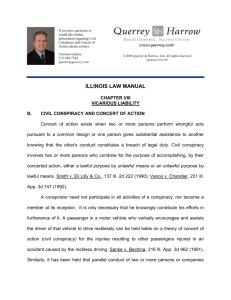

advertisement