New York State - Division of Housing and Community Renewal

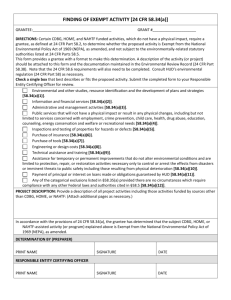

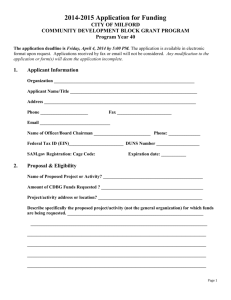

advertisement