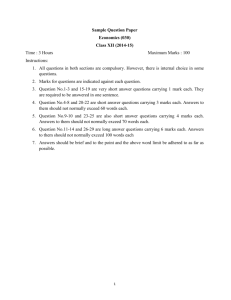

Question Bank

advertisement