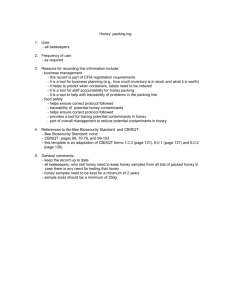

ANALYSIS OF THE MERCHANDISE MIX OF THE BRAND – HONEY

advertisement