NEW College Preparatory Academy, Inc.

Secrets

Parents

Need to

Know

About

M.O.N.E.Y.

For College

NEW Opportunities in College Readiness

NEW College Preparatory Academy, Inc.1

5000 Eldorado Parkway

Suite 150

Frisco, Texas 75033

Phone: 866-429-5951

FAX: 214-292-9379

www.NEWCollegePrep.com

DocBeasley@NEWCollegePrep.com

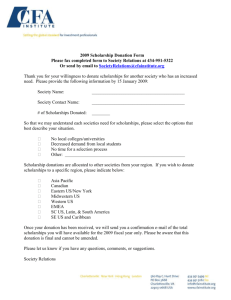

This document is a publication of NEW College Preparatory Academy, Inc., (NCPA). Your use of this document implies your compliance

with the following terms of service. Please read the following before using this document.

Warranty

The information in document is strictly for information purposes only. The document is not intended for use as a substitute for consultation

or advice given by a qualified professional. NCPA makes no representations, and specifically disclaims all warranties, express, implied, or

statutory, regarding the accuracy, timeliness, completeness, merchantability, or fitness for any particular purpose of any material contained

in this document.

The material included in the document is provided for personal, educational and informational purposes only and does not constitute a recommendation or endorsement with respect to any other company, organization, or entity.

Disclaimer

NCPA disclaims any responsibility for any independent actions taken as a result of the information displayed on any pages of this document.

This document is designed to provide interested persons with ideas and information about potential college funding opportunities. This

document shall in no way be construed as being stand-alone specific educational advice.

Your use of this document and all information, products and services made available through this document is at your own risk. You agree

that NCPA, its assigns, affiliates, contractors, employees, members, and/or associates will not be liable for any special, indirect, incidental,

consequential or punitive damages or any other damages whatsoever arising out of your use or inability to use this document or any information, products or services of NCPA, whether based on contractual, statutory, tort or other grounds.

Copyright

This document is copyrighted © 2012 Kuni Michael Beasley, LLC and NEW College Preparatory Academy, Inc. (NCPA), and all rights

are reserved. All logos, trademarks, trade names, and materials comprising this document are owned by NCPA or by third parties who

license NCPA. This NEW College Preparatory Academy, Inc, document is confidential, containing information proprietary to the company.

Your use of the document implies your agreement and compliance of maintaining business confidentiality of the information contained

herein and to use it for information purposes only. No part of this information may be captured and reproduced in any form or by any

means for the purpose of distributing the information to other parties without permission in writing from NCPA.

SATTM and PSATTM are trademarks of the College Board and ACTTM is a trademark of American College Testing, and are used for informational purposes only in the document. The information in this document is not endorsed by College Board or American College Testing.

The opinions expressed in the document represent the personal views of its writer. If you have any questions, please contact:

DocBeasley@NEWCollegePrep.com

Thank you.

Kuni Michael Beasley, Ph. D.

President

NEW College Preparatory Academy, Inc.

Electronic copies of this document in pdf format are available on request.

Printed March 23, 2012

1

NEW College Preparatory Academy, Inc. (NCPA) is a dba of NEW American School, Inc. (NAS).

© 2012 Kuni Michael Beasley, LLC all rights reserved

2

M.O.N.E.Y. for College

Dr. Kuni Michael Beasley

BS, MBA, D. Min., Ph. D.

Dean, NEW College Preparatory Academy, Inc.

Director, REAL College Solutions

Greetings,

Welcome to your next step towards College Success!

I am Dr. Kuni Beasley, Dean of the NEW College Preparatory Academy 1 and Director of

REAL College Scholarships. 2

On the following pages is important information to get you started towards better College Funding for your student. This is part of our College Bound Program used by students at our satellite schools, our homeschool academy students, and it is now available

to public, private, and homeschool students everywhere. We are making a deliberate

effort to make our programs available to the greatest number of students.

I believe we have the best college preparation resources available and we have a 17year track record of preparing, packaging, and positioning students for college success.

Please go through the information in this document thoroughly. Please pay special attention to the material in the Information Boxes and Graphs. They contain critical supplemental information that you don’t want to miss.

I hope these will be helpful to you in pursuing your college goals. When you are ready

to move to the next step in your path to success, please contact me to get the next

step in College Success.

Thanks,

Dr. Beasley

DocBeasley@NEWCollegePrep.com

1

2

www.NEWCollegePrep.com

www.REALCollegeScholarships.com

© 2012 Kuni Michael Beasley, LLC all rights reserved

3

M.O.N.E.Y. for College

Secrets Parents Need to Know About MONEY for College

Our Mission:

Prepare, Package, and Position Students for College Success

Provide Students the Greatest Range of College Options, Opportunities, & Choices

Facilitate Student Progress through College Selection, Application, Funding, and Enrollment

Contents

Secret

4 Types of M.O.N.E.Y. for College

4 Types of MERIT Money

Academic Scholarships

Athletic Scholarships

Arts Scholarships

Activity Scholarships

Types of OPPORTUNITY Money

Private Scholarships

National and State Scholarships

Scholarships by Subject

Scholarships by Type, Miscellaneous, and Weird

Little Known Scholarships

Military Opportunities

Other Programs

Free Colleges and Work Colleges

College with Cost Containment Programs

Types of NEED-BASED Money

Obamacare and College Funding

Types of ENTITLEMENT Money

Are You a Resident? Are You Entitled?

Veterans Entitlements

Types of YOUR OWN Money

2+ Strategies

Saving Money in College

Taxes and Savings

Who We Are and What We Do

NCPA College Readiness Resources

Pg

5

6

6

8

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

24

25

26

26

27

28

29

30

Disclaimer: The content of this document is for your general information and use only. It is subject to change without notice. Neither the author nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness, or suitability of the information and materials found or offered

in this document for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude

liability for any such inaccuracies or errors to the fullest extent permitted by law. Your use of any information or materials in this document is entirely at your own

risk, for which the author shall not be liable. It shall be your own responsibility to ensure that any products, services or information available through this document meet your specific requirements. Links in this document are provided for your convenience to provide further information. They do not signify that we endorse the website(s). We have no responsibility for the content of the linked website(s). This document was published in Collin County, Texas, and subject to the

jurisdiction therein.

© 2012 Kuni Michael Beasley, LLC all rights reserved

4

M.O.N.E.Y. for College

4 Types of M.O.N.E.Y. for College

M

O

N

E

Y

1

Merit Money

This is what many think of as “scholarships.” Our definition of Merit Money is financial aid

awarded by the institution based on student ability and achievement. These include Academic, Athletic, Artistic, and Activity awards. In most cases, no actual “money” changes

hands, though some colleges actually provide direct cash payments to students for expenses. 1 These are awarded as institutional “grants-in-aid,” essentially a “discount” the

college doesn’t charge the student all or part of the regular cost of attendance.

Opportunity Money

These are sources of funding where the student may be required to participate in activities, perform services, or complete specific tasks, or obligate themselves to do so, in return

for assistance in paying for college. These include private scholarships, Work-Study,

ROTC, internships, and a variety of activities.

Need-Based Money

Probably the most used method of meeting college costs, Need-Based Money is determined by calculating the family’s ability to pay against the cost of attendance of the college

producing a figure known as “need.” The primary method is through the Federal government, which provides a range of grants and loans. Some institutions use an additional

method through the College Scholarship Service (CSS) to determine “need” for their particular institution.

Entitlement Money

Certain students are eligible for funds, discounts, or exemptions for college. These range

from the GI Bill to tuition exemptions for disabilities to the difference between resident and

non-resident tuition rates. All US citizens and legal residents are “entitled” to some

amount of Federal aid, mostly in the form of low interest student loans.

Your Own Money

Parents will have to spend “something” even if it filling the gas tank to send the student off

to school. The key is to develop strategies to minimize the out-of-pocket expenses.

There are a number of colleges that make direct cash payments to students as part of their Merit award. Most colleges simply waive the regular charges.

© 2012 Kuni Michael Beasley, LLC all rights reserved

5

M.O.N.E.Y. for College

4 Types of MERIT Money

Academic Scholarships

Institutions award academic “scholarships” to

students they wish to attract to their institution.

These are awarded to students who meet specific requirements, usually a combination of GPA,

SAT/ACT scores, and Class Rank. There are two

basic forms of Academic Scholarships: Qualification Scholarships and Competitive Scholarships.

Qualification Scholarships

Students who meet certain criteria are awarded

scholarships without reference to relative competitiveness. Students who meet the criteria are

usually awarded the scholarship on a first come,

first served basis. Institutions often use information on the application as the criteria for selection. In some cases, the student will need to

submit a separate application.

Here is an example of a Qualification Scholarship:

Louisiana Tech Presidential Scholarship

Must be an admitted incoming freshmen (all majors).

Requires: GPA: overall 3.0 (on unweighted 4.0 scale), and ACT: 32 or SAT: 1400 (CR+M)

Unlimited awards which pay Tuition, fees, and on-campus regular dorm and meals for four years.

Student must remain full-time and maintain a cumulative GPA of 3.0. 1

“Automatic” Qualification Scholarships

Many institutions provide “automatic” scholarships for persons who meet specific criteria upon admission. Many colleges simply post scholarship criteria on their websites

(often linked to SAT/ACT scores and GPA) and award students scholarships based on

standard criteria. Here are some examples:

•

•

•

•

Ohio University Gateway Award provides up to full in-state tuition based on a sliding scale of GPA and SAT/ACT scores.

University of Alabama awards Out-of-State scholarships based on SAT/ACT & GPA.

University of Indiana actually posts “Automatic Scholarships” on its website.

Hiram College (OH) awards automatic scholarships to children and grandchildren of

alumni, members of the Disciples of Christ, and siblings of enrolled students.

NOTE: No two institutions are the same. Each institution has its own rules and requirements. No one

set of rules will fit all colleges. I have had students rejected from University of North Carolina only to

receive Presidential Scholarships from Duke and Wake Forest right down the road. Go figure…. Dr. B.

The LA Tech Scholarship is an incredible opportunity. Any above-average student willing to Pay Attention, Follow Instructions, and Do the Work could earn this

scholarship! – Dr. B.

1

© 2012 Kuni Michael Beasley, LLC all rights reserved

6

M.O.N.E.Y. for College

Supplemental Qualification Scholarships

Colleges often provide additional scholarships to supplement scholarships students already received. Here is an example of a Department Supplemental Scholarship:

•

University of Alabama College of Engineering offers scholarships on top of regular

university scholarships based on a SAT/ACT scores and GPA.

National Merit and National Achievement Scholarships themselves are not very much

money. However, winners attract additional scholarships from a number of colleges.

Here are some examples:

•

•

•

•

University of Oklahoma boasts that it has the highest number of National Merit Scholars, primarily

because they “give them the farm.” Scholars are

provided full tuition, cash stipends to offset fees,

room, and board, cash stipend for a laptop, and

cash for study abroad.

University of Alabama offers full tuition, campus

housing, cash stipend, and an iPad.

Baylor University offers full tuition.

University of Southern California offers half-tuition.

Oklahoma University National Merit Students

Competitive Scholarships

This is what most people think about when discussing scholarships. Generally, students

apply separately to a committee who selects the awardees among the applicants. Each

institution has its own scholarships and its own process of competition. Check the institution’s website or contact them to find out about Competitive Scholarships. Here is an

example of a Competitive Scholarship:

University of Alabama Academic Elite Scholarships

There are typically eight to ten of these scholarships offered each year. The

pool of eligible applicants ranges from 900 to 1,000 students. Academic Elite

Scholarship recipients typically receive: $8,500 per year for 4 years, the value of

tuition in-state or out-of-state for 4 years, 4 years of on-campus housing at regular room rate, and an iPad.

Direct Competition Scholarships

Most Competitive Scholarships gather applications and

select the recipients from the top applicants. Sometimes the competition includes an interview or an essay as part of the competition. Here are examples:

•

•

•

Campus at George Fox University

George Fox University has a “Scholarship Competition Day.”

Southern Illinois University awards competitive scholarships on a combination of academic achievement and need.

Texas Tech University offers competitive scholarships to transfer students.

NOTE: No two institutions are the same. Check with the institution for its rules and requirements. Dr. B.

© 2012 Kuni Michael Beasley, LLC all rights reserved

7

M.O.N.E.Y. for College

Athletic Scholarships

Western Washington University winning the NCAA Division II Rowing Championship

Thousands of athletic scholarships are awarded each year, and not just to Pro-level athletes. There are

thousands of opportunities for above-average athletes. The college athletic universe is divided into four

major domains: NCAA, NAIA, NJCAA, and NCCAA.

NCAA – National Collegiate Athletic Association

The NCAA is the most well-known and most visible because its members

are some of the largest institutions and the games dominate college broadcasts. Additional information is available at the NCAA Eligibility Center. The

NCAA is divided into three Divisions:

NCAA Division I Institutions – Most of the larger colleges compete in Division I (known as D-I; pronounced dee-one). Click for the list of D-I FBS

and D-I FCS for football.

NCAA Division II Institutions – Award full and partial scholarships. Exceptions are the Ivy League colleges which do not have athletic scholarships.

NCAA Division III institutions do not award athletic scholarships.

NAIA – National Association of Intercollegiate Athletics

The NAIA supports smaller colleges and has two divisions. Most institutions

offer full and partial scholarships. Additional information is available at the

List of NAIA Colleges, NAIA Eligibility Center, and Differences NCAA/NAIA.

NJCAA – National Junior College Athletic Association

The NJCAA supports two-year colleges. Most provide full and partial scholarships. Additional information is available at Junior College Recruiting, the

List of NJCAA Colleges, and the NJCAA Eligibility Center.

“Dee-One” Football

For football, D-I is sub-divided

into the Football Bowl Subdivision (FBS) which includes major

institutions like University of

Michigan, Ohio State, UCLA,

University of Texas, Notre

Dame, and LSU; and the Football Championship Subdivision

(FCS) which includes smaller institutions like the Ivy League

(Harvard, Yale, etc.), Appalachian State, Sam Houston

State, and Bucknell. Beyond

the size of the institution, the

major difference between the

FBS and the FCS is that the FBS

institutions play in the major

bowls games and the National

Champion decided though the

Bowl Championship Series

(BCS) and the FCS institutions

have a playoff to determine

their National Champion. There

is also a difference in the number of scholarships with 85 to

FBS institutions and 63 to FCS

institutions.

NCCAA – National Christian College Athletic Association

There are about 100 NCCAA members in two divisions: D-I for four-year Christian liberal arts universities

and colleges, and D-II for smaller Christian colleges and Bible colleges. Several have cross memberships

with the NCAA and NAIA. Many provide full and partial scholarships. Additional information at List of

NCCAA Colleges and NCCAA Eligibility Information.

A little known factoid is that many NCAA D-I Institutions have “club football.” Indeed, many sports are “club” level at some institutions and varsity level at others like badminton, crew, fencing, and lacrosse. The institution may provide some support in facilities and some funding. I was on the TCU Judo Team 1973-75, a club sport. Dr. B.

© 2012 Kuni Michael Beasley, LLC all rights reserved

8

M.O.N.E.Y. for College

Variety of Athletic Opportunities

Archery

Badminton

Baseball

Basketball

Bowling

Cheerleading

Climbing

Cross-Country

Cycling

Dance

Equestrian

Fencing

Links to institutions that have these programs

Field Hockey

Figure Skating

Flag Football

Football

Golf

Gymnastics

Handball

Hockey

Judo

Lacrosse

Quidditch

Racquetball

Riflery

Rodeo

Rowing

Rugby

Sailing

Skeet & Trap

Skiing

Snowboarding

Soaring

Soccer

Softball

Squash

Surfing

Swimming

Tennis

Track & Field

Ultimate Frisbee

Volleyball

Water Polo

Water Skiing

Weight Lifting

Whiffle Ball

Wrestling

Other Sports Lists

Grandview University (IA) NAIA Track

From http://www.insidecollege.com/reno/home.do

Additional Information Links

AthleticScholarships.net

AthleticScholarships.com

CollegeScholarships.org

Baseballweb.com

Athletic-Scholarships.net

Small College Sports

Don’t write off small college athletic scholarships. My eldest daughter received a half

scholarship for volleyball at Texas Wesleyan University. We had the other half covered

with a music scholarship.

I had one student some years ago approach me about playing football in college. He said

he had a few more years of football left in him and he didn’t want to “walk-on” to a D-I

school just to hold blocking dummies for four years. He found a home and scholarship at

Southern Nazarene University in Oklahoma. He played four years, became a “Little AllAmerican,” and played a few years in the Arena League. Dr. B.

Cumberland University (TN) NAIA Football

San Jacinto College (TX) NJCAA Basketball

Bridgewater State (MA) NCAA DIII Swimming

West Point NCAA Club Judo Team

Geneva College (PA) NCCAA Football

Texas Christian University NCAA DI Football Stadium

© 2012 Kuni Michael Beasley, LLC all rights reserved

Mercyhurst (PA) NCAA DII Lacrosse

9

M.O.N.E.Y. for College

Arts Scholarships

Calvin College (MI) Music Scholarship

There are numerous arts scholarships available from institutions. Finding these required a lot of research

and digging, in addition to practicing for competitive scholarships. I have listed some of the major areas

with institution and private scholarship links. Check directly with the institutions for specific information.

Dance

College Dance organizations vary from ballet and modern dance to dance troupes that perform with the

marching band. Some colleges have elevated Dance to a varsity sport.

College Dance Team Info

Scholarships.com Dance Scholarships

Still More Colleges with Excellent Dance Programs

Colleges with Dance Teams

College Dance Scholarships

College Dance Majors

Music Performance

College Music Programs

College Music Business Departments

Colleges for Specialized Music

Colleges with Music Departments

Resources for Music Students

Colleges with Musical Theater Programs

Colleges with Voice Programs

Edgewood College (WI) Varsity Dance Team

Art

Bachelors of Fine Arts

Colleges with Visual/Studio Art

Art Colleges, Art Schools, and Universities

Theatre & Drama

Colleges with Theater Programs

Experts Choice for Aspiring Actors

Colleges with Drama Programs

Photography

Colleges with Photography Programs

Community College Photography Scholarships

Graphic Design Colleges

Photography Scholarships

Hiram College (OH) Scholarship Audition

© 2012 Kuni Michael Beasley, LLC all rights reserved

10

M.O.N.E.Y. for College

Activity Scholarships

The World Famous Kilgore Rangerettes, Kilgore College (TX) Kilgore Rangerette Scholarships

Colleges have many activities and several of them are excellent scholarship sources. I have listed specific

sources and resources for several activities. Always check with the college for specific information.

Band

There are thousands of college marching bands and a significant

number offer some form of scholarship or grant. Here are links to

resources and a sampling of college bands.

College Marching Bands

Best Marching Bands

LSU Band Scholarship

Auburn Band Scholarship

University of Virginia Band Scholarship

USC Trojan Band

Cheerleading

Almost every college has cheerleaders and many of them offer

cheerleading scholarships.

Top Cheers Scholarships

Cheerleading Scholarships

IHigh Cheerleading Scholarships

Angelfire Cheerleading Scholarships

College of Southern Idaho

American Association of Cheerleading Coaches and Administrators

National Council for Spirit Safety and Education

Speech & Debate

National Forensic League

5 Best Speech and Debate Scholarships

Concordia College

Whitman College

College of Southern Idaho

Bethel University (TN) Cheerleaders

Journalism

JournalismScholarships.us

College Scholarships.org

Journalism Schools

School Newspaper Scholarships

© 2012 Kuni Michael Beasley, LLC all rights reserved

BYU Daily Universe Newspaper

11

M.O.N.E.Y. for College

Types of OPPORTUNITY Money

These are sources of funding where the student may be required to participate in activities, submit applications, write essays, perform services, or obligate themselves to do

something, in return for assistance in paying for college. These include Work-Study,

private scholarships, ROTC, internships, and a variety of opportunities.

Federal Work Study

Alabama A&M

Internships

Northern Illinois Univ.

Part-Time Job

Lord Fairfax CC (VA)

Employer Assistance

Federal Work-Study (FWS) provides part-time jobs for

undergraduate and graduate students with financial need,

allowing them to earn money to help pay education

expenses. The program encourages community service work

and work related to the recipient's course of study. Here

are links to more information:

SallieMae

Federal Work-Study

WTAMU Info

Internships are a great way to gain experience while

completing college. 1 Most offered are during the summer,

but some are available during the school year. Here are

some links:

College Board

Summer Internships.com

Monster College.com

Internships.com

Internsushi.com

Magazine Internships

Intern Queen

List of Internships Links

Get a job… the old fashioned way. Most college students

hold some type of job to help fund college. Nothing beats

working through college on a resume. Here are some links:

Snagajob

College Helpers

USAJobs

Boston College

Indeed

A smart way to pay for college is to get your employer to

pay for it. If you are looking for a job, find and employer

who offers tuition assistance. Here are some links:

Fastweb

Finaid

Classes and Careers

Companies that Offer Tuition Assistance

Smucker’s has great educational benefits

1

My daughter did a summer internship with JPMorgan/Chase and was offered a job when she graduated.

© 2012 Kuni Michael Beasley, LLC all rights reserved

12

M.O.N.E.Y. for College

Private Scholarships

Math Majors Graduating – St. Mary’s College (MD)

There is a huge reservoir of Private Scholarships. Many of these are targeted to a specific population, most require an essay or documentation, and several are quite substantial. It would be impossible to address the range and variety of private scholarship.

However, I hope to provide a compact synthesis of links for easy access.

We’ll start with a very comprehensive list of scholarships from Scholarships4school.com. Do not try to

digest this list. Take a quick glance so you know it exists. Scan this Starter List to see if you find anything interesting. Below is a list of free scholarship search engines. It is here so you know you have it.

Scholarship Scams

Scholarship Scams are a $2 billion industry

with people getting bilked every day about

some dream scholarship. Many of these

scams charge you for an “exclusive” or “personal” scholarship search. Most of those

scams use one of these data bases on the

right that they get for free.

Daunting Task

It is an enormous task to navigate private

scholarships. What I have tried to do here is

synthesize the data so it is easier to handle.

Even so, it looks daunting, but worth it if you

get an extra thousand or ten-thousand for

sending in applications.

Free Scholarship Search Engines

AIE Scholarship Search

IFEA

Cancer for College

Mach25

College Answer Scholarship Search My Free Degree

College Board

Peterson’s College Quest

College Financial Aid Advice

Sallie Mae

College Prowler

Scholarship Experts

College Scholarships.com

Scholarship Monkey

College Scholarships.org

Students w/ Health Conditions

College Toolkit Scholarship Search

Scholarships.com

EducationPlanner.org

Scholarships4school

FastWeb

School Soup

FinAid

SRN Express

Financial Aid Finder

The Princeton Review

Financial Aid Tips

U.S. Dept of Ed.

Free-4U

Zinch

Hispanic College Fund

Beware!

There is a lot of data here. Don’t try to absorb all of it. There is a series of strategies to go through

these and apply to the optimum number for the best potential benefit. On the same token, don’t give

up because there seems to be a lot. Behind these links are millions of dollars of college money – Dr. B

“A good place to start is to spend time looking into available information on the scholarship. Your best

chance of success will follow from finding out the requirements from the start and then determining if

you qualify. Before you even begin, be aware of the reason for involvement of the scholarship and their

goals for the Scholarship. If you are qualified, verify that you have the possibility to obtain the scholarship. After figuring out that you have a decent shot of going on to be one of the winners of the Scholarship, then it is useful to put forth the effort to apply.” From Scholarships4Schools.com

© 2012 Kuni Michael Beasley, LLC all rights reserved

13

M.O.N.E.Y. for College

National and State Scholarships

The Flag of the United States of America representing the nation, its heritage, and each individual state

There are number of National Scholarships plus each state has specific scholarships and grants available

to its residents. This list below contains private, state-supported, and institutional scholarships.

Major National Scholarships

From FinancialAidTips.org

Coca-Cola Scholars

National Merit Scholarship

Fulbright Scholarships

Florida Bright Futures

Walmart Scholarships

Rhodes Scholarship

Bill Gates Scholarships

Gates Millennium Scholarships

Georgia HOPE Scholarship

Tylenol Scholarships

Horatio Alger Scholarships

Truman Scholarships

Marshall Scholarships

Morehead-Cain Scholarship

State Scholarships

From Free-4u.com

Alabama Scholarships

Alaska Residents Scholarships

Arkansas Resident Scholarships

Arizona Scholarships

California Scholarships

Connecticut Scholarships

Colorado Scholarships

District of Columbia

Delaware Scholarships

Florida Resident Scholarships

Georgia Scholarships

Hawaii Scholarships

Idaho Resident Scholarships

Illinois Scholarships

Indiana Scholarships

Iowa State Resident Scholarships

Kansas Scholarships

© 2012 Kuni Michael Beasley, LLC all rights reserved

State Scholarships

From Free-4u.com

Kentucky Resident Scholarships

Louisiana Resident Scholarships

Maine Scholarships

Maryland Scholarships

Massachusetts Scholarships

Michigan Scholarships

Minnesota Scholarships

Mississippi Resident Scholarships

Missouri Resident Scholarships

Montana Scholarships

Nebraska Scholarships

Nevada State Scholarships

New Hampshire Scholarships

New Jersey Scholarships

New Mexico Scholarships

New York Scholarships

North Carolina Scholarships

North Dakota Scholarships

Ohio Resident Scholarships

Oklahoma State Scholarships

Oregon Scholarships

Pennsylvania Scholarships

Rhode Island Scholarships

South Carolina Scholarships

South Dakota Scholarships

Tennessee Scholarships

Texas Resident Scholarships

West Virginia State Scholarships

Wyoming State Scholarships

Vermont State Scholarships

Virginia Scholarships

Wisconsin Resident Scholarships

Washington Resident Scholarships

Vermont State Scholarships

14

The Horatio Alger Foundation awards 104

$20,000 scholarships nationally and 25 $5,000

scholarships in each state.

The Gates Millennium Scholarship is awarded

to 1,000 minority students

Coca-Cola Scholar-Athletes in Atlanta

M.O.N.E.Y. for College

Scholarships by Subject

Lew Alcindor (Kareem Abdul-Jabbar) towers above his UCLA classmates at the 1969 graduation

Many organizations list their scholarships by Subject. Here a list of links of different Subject opportunities

Scholarships by SUBJECT

From College Prowler.com

Scholarships by SUBJECT

From College Prowler.com

Academia

Math

Accounting & Finance

Media

Advertising & PR

Medicine

Agriculture

Metal Work

Archeology

Military

Architecture & Design

Music

Art

Non-Profits

Astronomy

Nuclear Engineering

Automotive

Nursing

Aviation

Personal Services

Biology

Pharmacy

Biomedical Sciences

Photography

Business and Management

Physical Therapy

Chemistry

Physics

Computer Hardware Engineering

Police & Fire

Computer Programming

Public Transportation

Construction

Science

Culinary Arts

Social Services

Dentistry

Sports

Education

Sports Medicine

Engineering

Transportation

Environmental Science

Writing

Forestry & Fishing

Details

Geology

If you are otherwise qualified, most scholarships are a

Government

function of dotting the I’s and crossing the T’s. – Dr. B

Graphic Design

Hospitality & Travel

“An important detail in the process of trying for the

Information Technology

Scholarship is filling out the application correctly. AppliInterior Design

cations can sometimes be drawn-out, but you should

Journalism

not underestimate how important it is that your work

Landscape Architecture

was done precisely and completely. Use caution to inLaw

sure that you will not be bumped because of carelessLibrary Science

ness.” From Scholarships4Schools.com

Manufacturing

Marketing

© 2012 Kuni Michael Beasley, LLC all rights reserved

15

The Clay Lacy Foundation provides a

$12,500 scholarship for students who want to

become a professional pilot (1968 photo)

Microsoft offers full tuition and summer internship scholarships.

CIA Scholarship

From their website: “Once selected, you

will be given an annual salary; a benefits

package that includes health insurance, life

insurance, and retirement; and up to

$18,000 per calendar year for tuition, mandatory fees, books and supplies. You'll be

required to work at an Agency facility during summer breaks and to maintain fulltime college status during the school year

with a minimum cumulative 3.0/4.0 GPA.

We will pay the cost of transportation between school and the Washington, DC area each summer and provide a housing allowance.”

M.O.N.E.Y. for College

Scholarships by Type, Miscellaneous, and Weird

Graduation at the University of Minnesota

Scholarships by TYPE

From Scholarships4School.com

Academic Scholarships

African American Scholarships

Athletic Scholarships

Community Service Scholarships

Students with Disabilities

Essay Scholarships

Extracurricular Scholarships

Financial Need Scholarships

GPA Based Scholarships

Hispanic Scholarships

Jewish Scholarships

Leadership Scholarships

Military Scholarships

Minority Scholarships

Native American Scholarships

Union-Sponsored Scholarships

Veteran Scholarships

Scholarships for Women

Miscellaneous from My List

American Culinary Federation

The Culinary Trust

Culinary Institute of America

Culinary Arts

Wine and Food

Women Chefs

National Federation for the Blind

Jewish Guild for the Blind

Financial Aid Finder Blind

Financial Aid Finder Hearing

Cancer Survivor

SuperSibs

Learning Disabilities

Veterans

Strange and Weird

32 Weird Scholarships

Unusual Scholarships

Weird Scholarships

45 Weird Scholarships

Overwhelmed?

No doubt that all this data is overwhelming. There is a series of

strategies to approach all these scholarships, but it still requires

work and diligence. – Dr. B

“Once the application is sent off, it's important to know when the

Scholarship chooses a winner and distributes any funds so you'll be

aware of whether or not you will be able to count on the scholarship

to provide additional support for your financial needs and how it will

help you out, since there might be constraints on how you can use

the Scholarship. You might find it challenging to find ways to take

care of the expenses associated with school, and having the additional resources of the Scholarship to defray some of the costs can

be a huge help. If you are not fortunate to receive the Scholarship,

keep at it, you can find different scholarships that you can hopefully

get.” From Scholarships4Schools.com

© 2012 Kuni Michael Beasley, LLC all rights reserved

Anthem Scholarship up to $1,000

for an essay on the book by Ayn Rand

16

$500 Kor Memorial Scholarship from the

Klingon Language Institute

David Letterman Scholarship

In Telecommunications at Ball State

M.O.N.E.Y. for College

Little Known Scholarships

Washington Crossing Foundation Student Scholarship

Many of these are open to high school students:

"Free Will and Personal Responsibility" Essay Contest

"If I Were President..." Competition

"My Turn" Essay Competition

AAA Travel High School Challenge

AAU Youth Excel Award Program

ABC's "The Scholar" - Reality TV Show Scholarship

Accepting The Challenge of Excellence Award

Achievement Award in Writing

Afl-Cio Skilled Trades Exploring Scholarships

AFSA National Scholarship Essay Contest

Afscme Family Scholarship Program

Ag Day Essay Contest

America Loves Math Scholarship Contest

American Spirit Publishing Scholarship

Angel Soft Angels in Action Award

Annual Signet Classic Scholarship Essay Contest

Arrid Total Women of Today Scholarship

CarDonors.com Scholarship

City Year - Volunteer for America

CollegeProwler Essay Competition

Dale E. Fridell Memorial Scholarship

Digital Dorm Room of the Future Essay Contest

Discover Card Tribute Award Scholarship Program

Do Something BRICK Awards

Dyzco Distance Learning Essay Contest

ExploraVision Science Competition

Federal Junior Duck Stamp Art Competition

Frank O'Neill Memorial Scholarship

Free Speech and Democracy Film Contest

George S. & Stella M. Knight Essay Contest

Holocaust Remembrance Project Essay Contest

Idea of America Essay Contest

Imation Computer Arts Scholarship

Interdependence Day 2004 Essay Contest

Ivysport Excellence in Life Scholarship Video Contest

Jane Austen Society Essay Contest

Lemonade Series Writing Scholarship

Most Valuable Student Competition

NAPF Swackhamer Peace Essay Contest

National D-Day Museum Online Essay Contest

Paul Zindel First Novel Award

Sam Walton Community Scholarship

Shakespeare Fellowship Essay Competition

ShopKo Scholarship

SPAACSE George R. Faenza Scholarship

TDS National Essay Contest

Teenage Vision for America Essay Contest

US Foreign Service National High School Essay Contest

Young Epidemiology Scholars Competition

Young Naturalist Award

Youth Foundation Grant

These are assembled by a Texas organization, so there are a lot of Texas based links.

4-H Opportunity Scholarships

Abe and Annie Seibel Foundation

AFSA/CMSAF/AMF Scholarship Program

Air Force Aid Society Education Grants

Air Line Pilots Association Scholarship Program

Alexander Graham Bell Association for the Deaf

American Chemical Society Scholars Program

American Legion Auxiliary (Texas) Scholarships

American Legion Oratorical Contest

APS Scholarship for Minority Undergraduate Physics Majors

Charles, Lela and Mary Slough Foundation Scholarship

Chopin Piano Competition

CHRISTUS US Family Health Plan Nursing Scholarship

© 2012 Kuni Michael Beasley, LLC all rights reserved

Clara Stewart Watson Foundation Scholarship Fund

Coast Guard Mutual Assistance Education Program

Coca-Cola Scholars Foundation, Inc.

Colburn-Pledge Music Scholarship Foundation

Conrad and Marcel Schlumberger Scholarship Program

DECA Scholarship Awards

Disciples of Christ Student Scholarship Fund

Educational Trust Fund

ESA Foundation

Evalee C. Schwarz Charitable Trust for Education

Family, Career & Community Leaders of America

Washington Crossing Foundation Scholarship Award

17

M.O.N.E.Y. for College

Military Opportunities

The United States Merchant Marine Academy class of 2010 marches in for their graduation ceremony, Kings Point, NY.

The military is the single largest provider of college funding in the country with five Military Academies,

three ROTC Programs, and the educational benefits on active duty, reserves, veterans, and their families.

Service Academies

There are five Service Academies that provide full scholarships, meals and

housing, and salaries for those who attend. These academies look for well

rounded students with leadership potential. Graduates leave with a college diploma, a commission in one of the services, and a service obligation.

United States Military Academy, West Point, NY

United States Naval Academy, Annapolis, MD

United States Air Force Academy, Colorado Springs, CO

United States Coast Guard Academy, New London, CT

United States Merchant Marine Academy, Kings Point, NY

List of Military and Maritime Colleges

Reserve Officers Training Corps (ROTC)

ROTC Scholarships cover tuition, books, fees, and provide monthly stipend for

living expenses.

Army ROTC 1

Air Force ROTC

Navy ROTC

The Frederick C. Branch Scholarship is a special Naval ROTC Scholarship offered for students who

attend Historically Black Colleges.

MIT Navy ROTC guidon aboard the Space

Shuttle. MIT, Harvard, and Tufts are part of

the same Navy ROTC unit.

Army ROTC at Embry-Riddle

Reserve Components

Army Reserve , Navy Reserve, Air Force Reserve, and Marine Corps Reserve offers the GI Bill, loan repayment, and tuition assistance. List of Benefits

National Guard

Army and Air National Guard receive Federal Educational Benefits similar to the

Reserves, plus many states offer significant educational aid to Guard members.

States like Indiana will cover 100% of tuition.

Veteran Benefits

Certain Veterans can transfer GI Bill benefits to spouses and children. More detail on Veterans Benefits is in the Entitlements Section of this document.

1

President Bush at the Air Force Academy

Note: I received an Army ROTC Scholarship that covered my degree at TCU – Dr. B.

© 2012 Kuni Michael Beasley, LLC all rights reserved

18

M.O.N.E.Y. for College

Other Programs

Peace Corps Volunteers

There are many Federal, State, and Local programs that help fund education, provide employment, and

forgive or repay loans. Need to dig to find many of these. Here are basics of Student Loan Forgiveness

and Repayment Programs:

Federal Programs

Student Educational Employment Program employs students while they are in college

Americorps has a program to help fund college or repay loans.

Public Service Loan Forgiveness allows those who work in public service jobs to have their loans forgiven.

Teacher Loan Forgiveness for those who serve low income families.

Nursing Loan Repayment Program to encourage people to enter the nursing field.

Peace Corps will repay certain school loans.

Several Federal Agencies use Loan Repayment as a recruiting and retention incentive.

Additional Information on Loan Forgiveness and Repayment.

Other Programs

Police Cadet programs in places like New York and Los Angeles offer tuition assistance and pay.

Many employers will assist in loan repayments.

UPromise helps earn extra money for education through rebates, coupons, and discounts.

From the Left: NYC Police Cadet, Teaching in a low income school, Nurse at a VA hospital, Americorps Volunteer in Michigan

© 2012 Kuni Michael Beasley, LLC all rights reserved

19

M.O.N.E.Y. for College

Free Colleges & Work Colleges

Deep Springs College, Mojave Desert

FREE Colleges

Alice Lloyd College 1

Barclay College

Berea College

College of the Ozarks

Cooper Union

Curtis Institute of Music

Deep Springs College

Saint Louis Christian College

Webb Institute

William E. Macaulay Honors College at CUNY

Temporarily FREE: Antioch College

Students admitted in 2012, 2013, and 2014 will receive a full-tuition, fouryear scholarship.

Campus Dairy Farm – College of the Ozarks

Almost FREE: Moody Bible Institute

Provides full tuition through Federal grants and Institutional grants. Student

pay for room, board, fees, and expenses.

Half FREE: Franklin W. Olin College of Engineering

Used to be completely free, but now offers half-tuition

Work:

Work Colleges Consortium

Member colleges allow student to work off all or part of their tuition.

Blackburn College

Ecclesia College

Sterling College

Warren Wilson College

Cooper Union

Alice Lloyd, Berea, and College of the Ozarks are also WCC members.

Work-Learning-Service – Sterling College

1 Noted alumni – Carl D. Perkins, who served in the U.S. House of Representatives from 1949 until his death in 1984. Perkins's legacy lives on in the form of the

Perkins Loan, a need-based Federal student loan.

© 2012 Kuni Michael Beasley, LLC all rights reserved

20

M.O.N.E.Y. for College

Colleges with Cost Containment Programs

A view from Warren Wilson College in the Swannanoa Valley of the Blue Ridge Mountains (NC)

These colleges reduce cost by replacing loans with grants, providing full tuition to families below a certain

level, capping loans, eliminating family contribution, and finding ways to reduce cost of attendance.

Amherst College

Appalachian State University

Arizona State University

Boston University

Bowdoin College

Brown University

Bryan College (TN)

California Institute of Technology (Caltech)

Carleton College

Claremont McKenna College

Colby College

College of Holy Cross (Worcester, MA)

College of William and Mary

Colorado State University-Pueblo

Columbia University

Connecticut College

Cornell University

Dartmouth College

Davidson College (North Carolina)

Duke University

Emory University

Fairfield University

Georgia Institute of Technology

Grinnell College

Harvard University

Haverford College

Indiana University Bloomington

Kenyon College

Lafayette College

Lamar University

Lehigh University

Massachusetts Institute of Technology

Miami University (Ohio)

Michigan State University

North Carolina State University

Northern Illinois University

Northwestern University

Oberlin College

Pomona College

Princeton University

Rice University

Sacred Heart University

South Texas University

Stanford University

Swarthmore College

Texas A&M University

Texas State University - San Marcos

Tufts University

University of Arizona

University of California at Berkeley

University of California System

University of Chicago

University of Florida

University of Illinois at Urbana-Champaign

University of Louisville

University of Maryland, College Park

University of Michigan at Ann Arbor

University of Minnesota System

University of North Carolina at Chapel Hill

University of Pennsylvania

University of Tennessee

University of Toledo

University of Vermont

University of Virginia

University of Washington

Vanderbilt University

Vassar College

Washington and Lee

Washington University in St. Louis

Wellesley College

Wesleyan University

Williams College

Yale University

Check with the institution for specific information

© 2012 Kuni Michael Beasley, LLC all rights reserved

21

M.O.N.E.Y. for College

Types of NEED-BASED Money

All Need-Based Aid starts with the Free Application for Federal Student Aid or FAFSA.

The FAFSA is used to determine how much and what kind of aid a student can receive.

Most Need-Based Aid comes from the Federal Government with States and institutions

contributing. It is important that parents and students understand how this aid works.

NEED does not mean NEEDY! “Need” is the difference between what a college costs and what you are

expected to pay according to the FAFSA results. If the college costs $20,000 and it is determined you

can pay $12,000, the NEED is $8,000. You would qualify for $8,000 in Need-Based Aid.

Some Soap Box Here

Federal Aid

Most Federal Aid is in the form of grants and scholarships.

Grants

Grants do not have to be repaid. To be eligible for government

grants, you must submit a FAFSA. The Federal grants are:

Federal Pell Grant

Federal Supplemental Educational Opportunity Grant (FSEOG)

Academic Competitiveness Grant (ACG)

National SMART Grant

TEACH Grant

Loans

Loans have to be paid back. The Federal loan programs are:

Perkins

Direct Stafford

Direct PLUS (graduate and professional degree student borrowers)

Direct PLUS (parent borrowers)

Direct Loan Consolidation

State Aid

The State Higher Education Agencies will have specific information of their programs.

Institutional

Comments by Dr. Beasley

Saving. The financial aid system favors

the unprepared. This means that if you

have diligently saved for your student’s

college, it will be counted against you in

calculating aid. Indeed, because you

have saved, it will likely cost you more

overall for college than if you simply used

the money for a trip to Europe. Keep this

in mind when you do college planning.

Loans. The financial aid system will let

you borrow yourself into oblivion:

College debt exceeds credit card debt.

Colleges raise tuition easily, up at twice

the rate of inflation, because… they can!

College debt is “cheap credit on easy

terms [that] increases the amount of

money chasing the product (in this case

a diploma) allowing schools to increase

prices. This inflation makes it harder for

middle-class families to afford paying

their own tuitions” (Fox News).

Many Institutions have done away with or capped the loan

amounts for students. Princeton University started this in 2001

and many institutions have followed. Other institutions use additional methods to determine funding packages for students.

The CSS/Financial Aid Profile is administered by the College Board

and used by institutions to determine how much institutional aid

the student may receive. The CSS looks at more things than the

FAFSA. For example, home equity is not considered in the Federal aid, but may be considered in institutional aid.

Private Sources

Many private sources factor in need when awarding scholarships.

I want to go on record stating that I do not recommend any form of student debt! A well advised family with a properly guided

student can avoid all debt. Anything to the contrary – except in very rare situations – is bad advice and bad guidance! – Dr. B.

© 2012 Kuni Michael Beasley, LLC all rights reserved

22

M.O.N.E.Y. for College

Obamacare and College Funding

President Obama at the Notre Dame Graduation

Comments by Dr. Beasley

You are probably wondering “What Obamacare has to do with College

Funding?” The short answer is “A lot… probably more than a lot. Possibly

everything!”

My best friend, Howard Berg – the World’s Fastest Reader – was invited by

Neil Cavuto of Fox News to read the Obamacare bill live on TV. He did this

three times in three broadcasts, reading the House version, the Senate

version, and what is called the Reconcilement version, where they work

out differences between the bills and hammer out one version and vote on

it. During the reconcilement process, the Student Loan Program was

slipped into the bill. Nobody seemed to notice this until Howard read it on

the air. It was Howard who asked on live TV “I don’t understand why they

inserted the Student Loan Program into this bill.” That was the first national disclosure that this had been done. Within minutes, Rahm Emanuel,

White House Chief of Staff, had a call into Fox complaining about the disclosure. Quite frankly, student loans were slipped in and I bet nobody but

a select few knew it – yet it passed both Houses, and was signed into law.

What does this mean? All federally insured private lending ended. Now all

loans are made by the government. It means that the interest will be paid

to the government, ostensively, to help pay for Obamacare. It also means

that the government can bring more power to bear to collect loans with

the world’s largest collection agency, the IRS. This could easily go a step

further to see colleges and students held hostage by the government because of the Golden Rule… “He who has all the gold makes all the rules.” 1

Avoiding Debt

There are very simple solutions to

paying for college and they have

been around for a long time:

Simple Solution 1:

Better Grades + Higher Test Scores =

More Scholarship Opportunities

As you have seen in the previous

pages, many colleges provide

significant scholarships to good

students.

What does it take to be a good

student? That hasn’t changed

since Socrates.

•

•

•

Pay Attention

Follow Instructions

Do the Work

Simple Solution 2:

Get Sound Advice

Don’t Try This Alone

There was a big ideological debate on Student Loans as a separate bill, so it was never passed because it required a 60% vote

to pass the Senate. As a Reconcilement amendment, it only requires a majority vote, so it was easily slipped in among the 2000

pages of the Obamacare bill. Former Education Secretary Lamar Alexander equates this to a “Soviet style takeover.” Others

see this as something that will actually increase the Federal debt. Online articles include A Guide to Obama’s Student Loan Plan,

Student Loan Overhaul Plan, or SLOP, and College Lending Hidden in Obamacare. I guess we’ll wait and see. – Dr. B.

[OPINION] Please don’t get me wrong. Like many people, I believe there needs to be some form of universal health coverage. However, as a former Political

Science professor who has a Ph.D. in Urban and Public Administration, I don’t believe Obamacare is the solution. It places medical decisions into the hands of

government bureaucrats. With the Student Loan Program slipped in, decisions on who gets funding and possibly even what majors are available are in the

hands of a government bureaucrat, who may have only a GED.

1

© 2012 Kuni Michael Beasley, LLC all rights reserved

23

M.O.N.E.Y. for College

Types of ENTITLEMENT Money

Entitlement money comes in the form of grants, direct payments, discounts, waivers,

fee reductions, or some other means that reduce your out of pocket expenses.

Are you a RESIDENT? Are you ENTITLED?

The single largest entitlement benefit is residency. Just because you live in a particular location, you are

usually entitled to reduced tuition to publicly supported institutions within that jurisdiction. As you look at

public institutions, you will see cost difference between “In State” and “Out of State” students. This “fee

reduction” is because public money (often a tax) is used to help support the institution, and as a member

of that particular tax base, you get the benefit of that tax. Jurisdictions can also include county/parish,

city, school district, or any other tax entity that uses funds to support colleges.

There can be huge differences between “In State” and “Out of State” costs, often as much as double the

for “Out of State,” so some students have simply moved to the state or district to claim residency status.

Institutions have become smart to this and have placed specific “residency requirements” that require the

student to have lived in the jurisdiction a minimum amount of time (and be able to prove it) before they

can receive the reduced residency rate. Ethically, the reduced rate is a benefit for those who have been

contributing to the tax base, not to student “carpetbaggers” who move in just to receive the benefit of

those whose taxes have paid for the reduction.

Generally, the minimum residency requirement for “In State” rates is one year. Often, students will move

to the state, get a job for a year or attend a community college where residency requirements are less

stringent. Often, you only have to prove you live in the district. A water bill or some other documentation that links the student to an address within the district is usually sufficient. After a year, they apply to

the state school with “In State” rates. Considering you have just cut your tuition costs in half, this might

not be a bad strategy.

You need to do some research. You might find you are entitled to a lot more than you think. – Dr. B.

Tuition Equalization Grants

States like Texas, Georgia, and Oklahoma, provide Tuition Equalization Grants to resident students who

attend private colleges in the state because it is more cost effective, in some cases, to pay a student to

go to a private college verses the state’s cost for a public college.

Reciprocity

Many states provide Reciprocity with other states, where students from one state can receive In State or

reduced tuition to attend a college in another state and vice-versa.

New England Board of Higher Education has a reciprocity agreement among Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont.

Academic Common Market is a reciprocity agreement among 16 southern states: Alabama, Arkansas,

Delaware, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South

Carolina, Tennessee, Texas, Virginia, and West Virginia.

Midwest Student Exchange Program is a consortium of six midwestern states: Kansas, Michigan, Minnesota, Missouri, Nebraska, and North Dakota.

Western Undergraduate Exchange covers institutions in Alaska, Arizona, California, Colorado, Hawaii,

Idaho, Montana, Nevada, New Mexico, North Dakota, Oregon, South Dakota, Utah, Washington, and Wyoming.

Indeed, some states have reciprocity agreements with colleges in Canada.

© 2012 Kuni Michael Beasley, LLC all rights reserved

24

M.O.N.E.Y. for College

Veterans Entitlements

President Franklin Delano Roosevelt signs the first GI Bill into law, June 22, 1944

Not only is the military is the largest provider of college funding, it is also the largest provider of entitlement payments to those who are serving, have served, and their families. Military Opportunities

listed earlier were separated because going to West Point is an opportunity, not an entitlement. Listed

here are entitlements service members and their families receive as a result of serving. 1

Federal Veterans Benefits

Department of Veteran Affairs

Military Tuition Assistance

Scholarships

Federal Loans and Grants - Federal Student Aid

Active Duty Education Benefits User's Guide

Reserve Education Benefits User's Guide

National Guard Education Benefits User's Guide

Veterans Education Benefits User's Guide

Spouse and Family Benefits Programs

State Veteran Benefits

State Tuition Assistance, Fee Reductions, or Waivers

State Veteran's Benefits Directory

Veterans Advantage

GI Bill Entitlements

The GI Bill was specifically designed as a post-service

entitlement for service members who returned to civilian

life. Although some GI Bill benefits can be used while on

active duty, it is the entitlements after service that is the

focus of the Department of Veteran Affairs.

Montgomery GI Bill

Vocational Rehabilitation

Veterans Educational Assistance Program.

Post-9/11 GI Bill and Yellow Ribbon Program

Fry Scholarship

Dependents Educational Assistance

Transfer of Post-9/11 GI-Bill Benefits to Dependents (TEB)

Reserve GI Bill

Reserve Educational Assistance program

Additional info on the GI Bill and Department of Education.

There are several versions of the GI Bill with different benefits

The GI Bill paid for my MBA while I was on active duty and my Ph.D. after I left service. All my college education except for my Seminary doctorate was paid for

through Military Opportunities and Veterans Entitlements. – Dr. B.

1

© 2012 Kuni Michael Beasley, LLC all rights reserved

25

M.O.N.E.Y. for College

Types of YOUR OWN Money

College is now the biggest investment a family will make – exceeding the average cost of a house – if

you have to pay for all or part of it “out of pocket.” There are two types of savings: 1) Money you put

away, and 2) Money you don’t have to spend. Here are some thoughts and information on saving money

before, during, and after you send your student to college.

No College Worth That Much Money

Comments by Dr. Beasley

Colleges (and the government) will let you go into debt up to your eyeballs for some perceived value of a

particular college, but it is all fluff! I recommend you watch this video on Why college costs so much.

Indeed, I will go on record stating:

There is no college in the country worth more than $15,000 out of pocket per year – period!

I challenge anyone to prove quantitatively and qualitatively that there is that much of a difference that

would justify paying more, and that there is correlation between cost of college and success in life.

And there’s always that guy in the back of the room who quips, “What about Harvard?” Well, what about

Harvard?

Harvard will meet 100% of demonstrated need. Students whose families make less than $60,000 pay

nothing! Costs are scaled up to $150,000, where the cost is 10% of that amount. Hence, the maximum

someone would pay with a $150,000 income is $15,000 – which makes my point. Harvard is actually one

of best college values and one of the most affordable if you get in.

“2 PLUS” Strategies – I have TWO “2 PLUS” strategies to save money and time:

2+2 – Students go to a junior or community college for two years then transfer to a four-year college to

complete the last two years of their degree. This is a relatively straight-forward strategy with a little

twist. Community colleges are the best educational value in America. Most community college professors are better paid than their counterparts in four-year colleges and they are more focused on teaching.

In addition, it is easy to compare community college with its smaller classes to a large state college lecture halls filled with 500 students whose papers are graded by Teaching Assistants. Also, if students

maintain a 3.5 or higher, they qualify for Phi Theta Kappa, the Junior College Honor Society, which puts

them on the radar of four-year colleges and transfer scholarships! 1 When they graduate from the fouryear college, there is no asterisk at the bottom of the diploma that says, “Only went here two years.”

2+2+2 – For ambitious students only! This is a strategy to complete high school AND college in six

years. Here, the ambitious student completed the freshman and sophomore year (with significant college

prep), then takes dual credit courses at the local community college or even a four-year college which

count for both high school and college credit. Students then transfer to a four-year college to finish the

last two years of their degree. The same transfer scholarships are available. 2

Dual Credit

Do not try to do this alone. This requires a very solid plan and strong commitment from the student.

Get sound counsel, because doing this wrong can cost you a lot of misspent money and even forfeit opportunities.

1 My wife graduated from a community college and transferred to Harvard on the Phi Theta Kappa Scholarship which paid for her first semester. She maintained

her GPA and continued on scholarship the next year.

2 We have had a number of students do the 2+2+2, in some cases completing their Associates Degree BEFORE they graduated from high school! Many received transfer scholarships, completed their Bachelors Degree, and several went on to Law and Medical school as young as 19!

© 2012 Kuni Michael Beasley, LLC all rights reserved

26

M.O.N.E.Y. for College

Saving Money in College

Commencement at Excelsior College (NY) where almost all the credit required for graduation can be earned through testing. 1

Credit by Examination

There are ways to accumulate college credit easily and

cheaply. A convenient way is to take tests for credit.

College Level Examination Program (CLEP) 90 minute exams that cover most of the courses the first two years of

college. Exams cost $77 plus test administration fee. 2

DANTES Exams – Similar to CLEP, developed for the military, but available to the general public. DANTES cost

about $80, a lot cheaper than a class.

Transfer Credits – You may be able to take courses at

another college where they are cheaper and transfer them

in. Transferable courses can reduce up to a full year’s tuition cost. Check with the college on transfer policies.

College Budget Strategies – Here’s a List of Cost Reductions, ideas to Reduce College Costs, and Reduce Expenses, and Student Budget Worksheet.

Textbooks – Textbooks are expensive. Buy used textbooks. 3 Cheap Textbooks.com, Buy Used Textbooks.net,

Rent Textbooks, Campus Books, and Cheapest Textbooks.

Vanity Colleges

There is a prevailing belief that where you go to college somehow determines your success in life, prepositions you for medical or law school, or has some

sort of mystical effect on job opportunities. I will just

ask some simple questions to bring us down to reality:

1 – Do you have a family doctor?

2 – Do you have family lawyer?

3 – Did you pick them based on where they went to

college?

In the two most important professions where college

education is the most important credential, the vast

majority of people don’t even consider where these

people went to college. Quite frankly, if it is not important when you choose your doctor, how important

should it be to your student?

Virtually every college in the country will provide your

student an academically sound undergraduate education. You need to understand this and so does

your student. – Dr. B.

Moby Dick – Most Classic Literature is available online, so you don’t need to buy Moby Dick at the book

store. Try these: U Penn, Books Online, Bartelby, Page by Page, Project Gutenberg, Classic Reader, 446

Places for Free Books Online, and Links to Libraries Online

1 Excelsior College celebrated its 40th anniversary in 2011. It has been a leader in extended, distance, and non-traditional education. Formerly the University of

the State of New York, it is operated under the New York State Board of Regents, is fully accredited, and offers Associates, Bachelors, and Masters Degrees.

2 CLEP Exams are written by the College Board, which also writes AP and SAT Subject Exams. There is about an 85% crossover in content, so students who

prepare for AP Exams could easily take the CLEPs for the same subjects. We have a complete strategy on CLEPs, AP, and SAT Subject Exams.

3 You want to talk about a SCAM; textbooks are a $500 - $1,000 expense per year. Just about every year, publishers put out a “new edition” of last year’s textbooks to thwart the used textbook industry. Usually they incorporate a few minor changes and reorder things so the page numbers are changed so they won’t

line up with last year’s books. When the professor publishes a new syllabus, the references are to the newer book.

© 2012 Kuni Michael Beasley, LLC all rights reserved

27

M.O.N.E.Y. for College

Taxes and Savings

Tax Benefits – Federal Education Tax Benefits allow people to deduct

the costs of college. Lifetime Learning Credit, American Opportunity

Tax Credit, Tuition and Fees Deduction, Student Loan Interest Deduction, and Education Savings Accounts provide for tax-free savings, interest, and withdrawal. Here’s a quick explanation of these from Smart

Money.

529 Plans – 529 plans came out to provide a tax-free savings for college. Here’s info on SEC 529 Plans, 529 Plans by State, How 529 Plans

Work, 529 Plan Statistics, and IRS Qualified Tuition Programs.

529 Reasons NOT to do a 529

I am NOT a big proponent of 529s. In the market down-turn in 2008,

529s took huge losses. There are many better and more prudent ways

to save for college. Although I have an MBA and am pretty smart on

this stuff, I, too must turn to those smarter than me. My financial advisor is Richard Beidl, Impact College Planning, who has his MBA from

MIT in Financial Engineering and several years of Wall Street experience. He provided me with some articles to share: Misguided Promise

of 529 Plans and Oregon Sues Over Risks Taken In Its '529' Fund. I’ve

also dug up a few that might be interesting: Seven Things You Didn't

Know About 529 Plans, How Safe is Your College Savings Account?, and

Market Slide Snags Alabama Tuition Program. – Dr. B.

There are significant Tax breaks on tuition

NO Debt! NOT worth it!

Final Thoughts on YOUR MONEY

I addressed Scholarship Scams earlier. The newest Scam is actually legal, but highly unethical – the

Mortgage Scam. So called “College Planners,” actually insurance salesmen who often never went to

college, put together a college funding plan that includes refinancing your house. You refinance, put the

money in an annuity or whole life policy, and borrow against it to pay for college. Sound simple enough,

right? However, you end up paying retail for college, owe more on your house with a bigger mortgage

payment, and owe your insurance policy the money. If you had $100K of equity and put it in an insurance policy, they just made $10,000 off of you and they probably charged you $3,000 for the privilege!

There are times when refinancing your house is a wise decision. But if they push you to do it, be wary!

Contact me DocBeasley@NEWcollegePrep.com BEFORE you shoot yourself in the foot!

One more thing. NEVER, EVER, EVER use your retirement for your kid’s college. There are so many other ways to get a degree without you forfeiting your future. – Dr. B.

© 2012 Kuni Michael Beasley, LLC all rights reserved

28

M.O.N.E.Y. for College

Partial list of where our

students have been admitted and received

scholarships*:

Air Force Academy*

Alabama*

Alvernia*

Arizona State*

Arizona*

Arkansas State*

Arkansas*

Arkansas-Little Rock*

Baylor Medical

Baylor*

Brigham Young*

Colorado*

Concordia (TX)*

Dallas Baptist*

Denver*

Duke*

Embry-Riddle*

Florida Tech*

Florida*

Georgetown Law*

Georgia Tech*

Georgia*

Harvard*

Houston*

Leeds (UK)

Lehigh*

LeTourneau*

Louisiana Tech*

Morehouse*

Naval Academy*

New York Maritime*

North Texas*

Northwood*

Notre Dame*

Oklahoma State*

Oklahoma*

Oral Roberts*

Oregon State*

Patrick Henry*

Pepperdine*

San Diego

Savannah College of Art*

Schreiner*

Southern California

Southern Methodist*

Stanford*

Texas-Arlington*

Texas-Austin*

Texas-Dallas*

Texas-San Antonio*

Texas A&M Galveston*

Texas A&M*

Texas Christian*

Texas Medical Branch

Texas Tech*

Trinity (TX)*

Vanderbilt Law*

Virginia Tech*

Virginia*

Wake Forest*

West Point*

Who We Are

We are NEW College Preparatory Academy. We operate 15 small college preparatory academies across

the country and the National Homeschool Academy

where we provide complete homeschool programs.

We have been in the College Readiness Business for

over 20 years.

What We Do

We provide Complete College Readiness Programs

that include:

College Readiness

• PSAT/ACT/SAT Training

• College Advisory and Planning

• College Selection-Application-Funding-Enrollment

Learning Strategies

• Read-Study-Test-Write Techniques

• Accelerated Learning Applications

• Critical College Skills

Michelle Preston

Full Scholarship

Harvard Univ.

Stephen Terry

Graduated

Univ. TX-Arl at 16

Masters at 19

Ph.D. Student

Stanford

Sean Gent

Selected to ALL 3

Service Academies

Chose Air Force

Academic Curriculum

• Complete College Prep Curriculum

• Dual Credit and College Credit Programs

• Supplemental and Enrichment Programs

Success Strategies

• Planning and Goal Setting

• Tracking and Accountability

• Time Management

Support Teams

• Coaching, Counseling, and Advising

• Mentoring, Monitoring, and Tracking

• College Concierge Services

Contact us for more information

www.NEWCollegePrep.com

Info@NEWCollegePrep.com

© 2012 Kuni Michael Beasley, LLC all rights reserved

29

Kyla Harris

Magic Carpet Ride

Univ. TX-Dallas

Full Scholarship

Plus Housing

Plus $4,000 Cash

Stipend/Yr

Jonathan

Niemirowski

Magic Carpet Ride

Louisiana Tech

Full Scholarship

Plus Dorm & Meals

Daniel Ting

Nat’l Merit Scholar

Full Scholarship

Univ. Oklahoma

M.O.N.E.Y. for College

NCPA College Readiness Resources

PSAT-ACT-SAT Resources

Preview & Review Resources

Secrets to PSAT-ACT-SAT Success

Video version of this document

SAT Crash Course

Quick SAT preview prior to the test date

ACT Crash Course

Quick ACT preview prior to the test date

PSAT Crash Course

Quick PSAT preview prior to the test date

Preparation Resources

Module 1: PSAT-ACT-SAT Orientation

Introduction & Overview of the tests & Preparation Strategies

Module 2: Test-Taking-Techniques

Specific techniques to answer every type of question on each test.

Module 3: Critique Process

Our unique method to learn how to understand the test

Module 4: ACT & SAT Essay

Our special template method to write a timed essay

SAT Solutions

SAT Math Solutions

Each Math question is solved using the Test-Taking-Techniques

SAT Reading Solutions

Each Reading question is solved using the Test-Taking-Techniques

SAT Writing Solutions

Each Writing question is solved using the Test-Taking-Techniques

Learning Dynamics

Ultimate Reading – Speed Reading & Accelerated Learning Strategies

Study Dynamics – Systematic Study Strategies & Note-Taking Methods

Testing Dynamics – Academic Test Preparation Strategies & Testing Methods