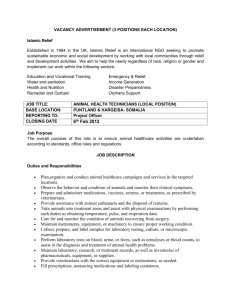

Part 12 - Revenue Commissioners

advertisement