FN452 Financial Derivatives

advertisement

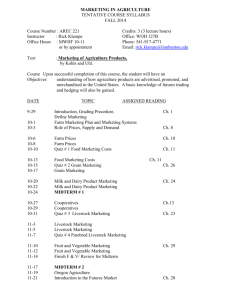

BBA International Program Thammasat Business School 1. Course Title: 2. Course Credits: 3. Prerequisite: 4. Course Description: 5. Course Objectives: FN452-BBA-2-2014 TQF3 Course Specification BBA International Program Thammasat Business School Thammasat University TQF3 Course Specification (Curriculum 2009) FN 452 Financial Derivatives (Curriculum 2013) FN 452 Financial Derivatives Analysis 3 Credits (3-0-6) (Curriculum 2009) FN 312 (Curriculum 2013) Have earned credits o FN 312 (Curriculum 2009) The course covers fundamental knowledge of Futures and Forward contracts, Options, Warrants, and Swaps. Discussion includes derivatives pricing models and selection of appropriate strategies for speculating or hedging. (Curriculum 2013) Fundamental principles of derivatives, including futures, forward contracts, options, warrants, and swaps, derivatives pricing models, strategies for speculating or hedging. Derivatives have become a popular investment tool over the last three decades. The notional amount of derivative contracts traded on the OTC market alone has exceeded $600 trillion in the year 2012. Many companies routinely use derivatives to hedge risks and to compensate employees. Moreover, since many financial transactions and investment decisions today contain some derivative-like features, the materials covered in this course should be useful to students planning a career in asset management, corporate finance, investment banking, sales and trading, financial consulting or any other fields that involve financial decision making. This course is designed to achieve two main objectives. The first objective is to provide students with a framework to understand the fundamental concepts and to develop the necessary skills used in valuing derivative contracts. This will include emphasis on the key concept of “No Arbitrage Principle”, and on the two work horses of the binomial model and the BlackSholes-Merton model. The second objective is to apply the framework to understand a wide variety of issues related to risk management. 6. Date of Latest Course Revision: 7. Purposes of Course Revision: 8. Semester/ Academic Year: 9. Date & Time & Venue: 10. Instructor: 11. Course Co-ordinator 1|P a g e December 24, 2012 The course is revised regularly to ensure the relevance of the courses to the business world. The contents are updated so that it is of the benefits of the students in their future studies or future careers. 2/2014 Date: Time: Venue: Name: Office: Email: Office Hours: Name: Email: Thursday 9.00 a.m.– 12.00 noon. 208 Dr. Sutee Mokkhavesa TBA drsutee@gmail.com 1 hour after class. TBA TBA BBA International Program Thammasat Business School 12. Teaching Assistant: 13. Hours Employed per Semester: 14. Main Texts: 15. Recommended Texts & Materials: 16. Learning Outcomes: 1. Morality and Ethics: 2|P a g e Name: Email: Lecture TBA TBA Supplemental Classes FN452-BBA-2-2014 TQF3 Course Specification Laboratory/ Self-Study Field Work/ Internship 45 hours 0 hours 0 hours 90 hours th Hull, J. Options, Futures, and Other Derivatives(9 Edition) ISBN-10: 0133456315, ISBN-13: 978-0133456318 ©2014 - Prentice Hall - Published 25/01/2014 nd 1. Neftci, S. Principles of Financial Engineering (2 Edition) 2. Wilmott, P. Derivatives; The Theory and Practice of Financial Engineering John Wiley & Sons. 1998 3. Das, S. Traders, Guns and Money FT Printice Hall. 2006 Useful links are provided below www.wilmott.com www.quantnet.com The five learning outcomes are stated below: Expected outcomes on morality and ethics: 1.1 Possess honesty, sacrifice, self-, social-, and environmental responsibility. N/A 1.2 Value “sufficiency” theory and adapt it in life path by adhering to adequacy, rationale, and immunity development. 1.3 Value disciplines, respect, and comply with the rules and regulations of the institution and society at large. 1.4 Acquire knowledge related to business morality and ethics, and be able to handle ethical dilemma with integrity. Teaching methods: Discussion on the misuses of financial derivatives and its catastrophic consequences. Evaluation methods: Assignments based on the case studies of financial losses caused by financial derivatives due to misuses, fraud, and erroneous models. BBA International Program Thammasat Business School 2. Knowledge: 3. Intellectual Development: 3|P a g e FN452-BBA-2-2014 TQF3 Course Specification Expected outcomes on knowledge: N/A 2.1 Acquire knowledge on and understand the important concepts in business management. 2.2 Acquire knowledge on and understand the important social and science concepts related to business management. 2.3 Acquire knowledge on and understand the important concepts related to business processes, planning, corporate structures, operations, control, performance evaluation and contingency plan to suit the circumstances. 2.4 Acquire the knowledge on academic advancement and professional development in business management including the understanding of the situational adaptability and its impacts on business. Teaching methods: Discussion on the various ways in which derivatives are used by financial institutions. Lecture on different types of derivatives. Lecture on the pricing of these derivatives and the concept of no-arbitrage. Evaluation methods: Take quiz on the application of financial derivatives. Take exam on the pricing of financial derivatives. Expected outcomes on intellectual development: 3.1 Be able to search and process information and utilize various concepts appropriately in a given circumstance. 3.2 Be able to think systematically and rationally and to integrate knowledge from other disciplines to solve the problems in business and other settings. 3.3 Be able to collectively propose solutions to problems at hand and analyze the impacts of the proposed solutions and be able to choose the solution that is appropriate to a given situation to ensure business competitive advantages. Teaching methods: Describe the scientific method in solving financial problems Derivative pricing can be quite challenging to the students since it requires a significant amount of technical know-how. The students must first learn the underlying concept and the mathematical tools before they can be used to derive the B-S-M partial differential equation. Evaluation methods: Examination on Black-Scholes-Merton model. BBA International Program Thammasat Business School 4. Interpersonal Skills and Responsibilities: 5. Quantitative Analysis, Communication and Information Technology: 4|P a g e FN452-BBA-2-2014 TQF3 Course Specification Expected outcomes on Interpersonal Skills and Responsibilities: 4.1 Be able to work in team, possess interpersonal skills and leadership skills, and be professionally adaptive to a given situation. N/A 4.2 Be creative and constructively criticize to solve problem of the team. N/A 4.3 Be responsible for self-learning and professional development. Teaching methods: Group Assignments are used to improve interpersonal skills and encourage self-learning. Evaluation methods: Class presentations Expected outcomes on Quantitative Analysis, Communication and Information Technology: 5.1 Be able to apply mathematics, statistics, quantitative analysis in analyzing and making decisions in business and daily life. N/A 5.2 Be able to efficiently communicate in Thai and foreign languages that are relevant in doing business. N/A 5.3 Be able to explain the issues and make the issues clear in verbal or writing, and be able to choose the appropriate pattern of communication for different groups of audience both in business context and in other contexts. N/A 5.4 Be able to utilize the information technologies or others to support the business operations. Teaching methods: The technical nature of this course will imbue the importance of mathematical analysis to this field of finance. Evaluation methods: Quizzes and Examination BBA International Program Thammasat Business School 17. Evaluation Plan: FN452-BBA-2-2014 TQF3 Course Specification The evaluation plan for this course is stated as follows: Expected Methods/Activities Week Outcomes Evaluated 1.1, 2.2, 2.4, 5.1 Midterm 8 1.3, 2.2, 2.4, 5.1 Final 16 1.1, 2.2, 2.4, 5.1 Quiz All 1.3, 3.1, Project 13 3.2,3.3,4.1, 5.1 Weights Assigned 35% 45% 10% 10% 100% 18. Course Schedule: Session/Date & Time #1: 09:00-12:00 15.01.15 #2: 09:00-12:00 22.01.15 #3: 09:00-12:00 29.01.15 #4: 09:00-12:00 05.02.15 #5: 09:00-12:00 12.02.15* #6: 09:00-12:00 19.02.15 #7: 09:00-12:00 26.02.15 5|P a g e The course schedule for this course is stated as follows: Topics Activities/ Text&Materials/ Media Overview of Financial Engineering Lecture Derivatives Market Discussion Mechanics of Futures Lecture Specification of futures contract Discussion Practice Price convergence Forwards vs Futures Futures Hedging Quiz Lecture Basic Principles Discussion Argument for hedging Practice Cross hedging Stock index futures Interest Rates Types of rates Zero rates Bond Pricing Forward rates FRA Duration and Convexity Forwards and Futures Prices Investment vs Consumption assets Short selling Forward price for an investment asset Valuing forward contract Futures prices of stock indices The cost of carry Interest Rate Futures Day count and quotation conventions Treasury bond futures Duration-based hedging strategies Swaps Mechanics of swaps Comparative-advantage argument Valuation of interest rate swaps Credit risk Quiz Lecture Discussion Practice Quiz Lecture Discussion Practice Quiz Lecture Discussion Practice Quiz Lecture Discussion Practice BBA International Program Thammasat Business School #8: 09:00-12:00 12.03.15 #9: 09:00-12:00 19.03.15 #10: 09:00-12:00 26.03.15 #11: 09:00-12:00 02.04.15 #12: 09:00-12:00 09.04.15 #13: 09:00-12:00 23.04.15 #14: 09:00-12:00 30.04.15 #15: 09:00-12:00 07.05.15 6|P a g e Mechanics of Option Prices Types of options Options positions Underlying asset Specification Trading OTC markets Trading Strategies Single option and stock strategies Spreads Combinations Other payoffs Properties of Option Prices Factors affecting prices Assumptions Put-Call parity Early Exercise issue Wiener Process and Ito’s Lemma Markov Property Continuous time stochastic process Process of stock price Ito’s lemma The Lognormal property Black Scholes Merton Model The main idea Derivation of B-S-M Model Solution to the Partial Differential Equation Greek Letters Naked and covered position Stop-loss strategy Delta Hedging Theta Gamma Vega Rho The realities of hedging Exotic Options Packages Chooser option Barrier option Binary option Lookback option Shout option Asian option Derivatives Mishaps Lessons for all users of derivatives FN452-BBA-2-2014 TQF3 Course Specification Quiz Lecture Discussion Practice Quiz Lecture Discussion Practice Quiz Lecture Discussion Practice Quiz Lecture Discussion Quiz Lecture Discussion Practice Quiz Lecture Discussion Practice Quiz Lecture Discussion Quiz Lecture Discussion BBA International Program Thammasat Business School 19.1 Details on Assignment 19. 2 Details on Project 20. Notes to Students: FN452-BBA-2-2014 TQF3 Course Specification The details for the assignment are stated as follows: Assignments will be giving out in class. Late submissions will result in an automatic 25% reduction of your score. Video Project (1) Form a group of 7 or less, and assign a Group Manager (GM). (2) The list of eligible topics will be given in the second period. (3) Each group must conduct a detailed analysis of the topic assigned and create a 15 mins video on the topic. (4) Points will be awarded for origination, ease of understanding and level of engagement. To gain the full benefit of this course, it is highly recommended that students spend at least 2 hours to read the relevant material in the required text before lecture. The academic calendar is stated below: 21. Academic Calendar: Academic Schedule of Semester 2/2014: (January 12, 2015 - May 26, 2015) Important Dates Semester Begins Period of Withdraw W/O Record Makha Bucha Day* Period of Midterm Examination Period of Withdraw with "W" Chakri Memorial Day* Songkran Festival Day* Last Day of Classes Period of Final Examination Coronation Day* Royal Ploughing Ceremony Day* Note *Public Holiday Schedule January 12, 2015 January 21 - 26, 2015 March 4, 2015 March 1 - 8, 2015 March 16 - 27, 2015 April 6, 2015 April 11 - 17, 2015 May 9, 2015 May 12 - 26, 2015 May 5, 2015 TBA The regulations on the class attendance is stated below: 22. Attendance: Important Notes to Students Regarding Class Attendance Announced by BBA International Program: a. Students who miss more than 13 hours of class but less than 22 hours must seek instructor’s approval for eligibility to take the final exams and approval by the dean. The dean’s decision is considered final. b. Students who miss more than 22 hours of class are NOT eligible to take the final exams and results in course failure. Please note that feigning other student signatures or failure to attend class after signing in results different level of penalty imposed. o Level 1 penalty: First time rule breakers will be considered as “Absent” for that actual class time. And a warning letter issued to first-time rule breakers. o Level 2 penalty: Second time rule breakers receive an “F” for the course and will not be considered for BBA scholarships, exchange student programs and other awards. o Level 3 penalty: Third-time rule breakers are given one semester of class suspension. Cheating in any form of class exam or quiz or plagiarism is subject to the penalties based on Thammasat University’s student compliance act. 7|P a g e BBA International Program Thammasat Business School 23. Course and Teaching Evaluation and Improvement: 8|P a g e FN452-BBA-2-2014 TQF3 Course Specification The Program has set policies related to course and teaching evaluation and improvement as follows: 1. Strategies for course evaluation by students: There will be two evaluations per course: Mid-semester and end-ofsemester course evaluations. The course evaluation will be administered by BBA staff with the instructor absent from the classroom. The instructor will receive feedback from students in the following key areas: Class preparation Teaching capability Appropriateness of activities or assignments Encouragement of Class discussion Opportunity to ask questions Encouragement of independent study and additional practices Benefits of the course Course evaluation will be summarized and returned to the instructor after the grades are sent to the Program. Moreover, the course evaluation of each instructor of every course offered will be reviewed by BBA Operating Committee. 2. Evaluation strategies in teaching methods: The effectiveness of teaching methods will be evaluated from the students’ accomplishments such as participation, assignments, and exams. 3. Improvement of teaching methods: The instructor will use the feedbacks from 2. above to improve the teaching methods. 4. Evaluation of students’ desire learning outcomes: After receiving the feedback from the mid-semester course evaluation and students’ assessments, the instructor revises the teaching methods to ensure that the desired learning outcomes are achieved. 5. Review and improvement for better outcomes: A summary of course evaluation for each course will be supplied to course instructor. The Program will use the feedback to improve the curriculum structure and course content in the regular curriculum revision cycle.