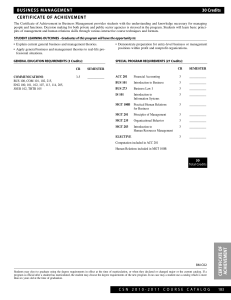

Barney School of Business

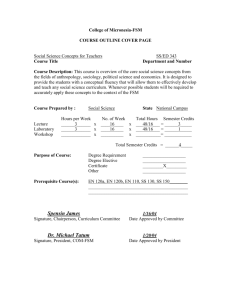

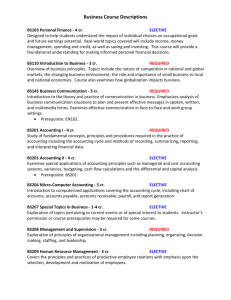

advertisement