Product Bundling in Finance Services a Perspective

advertisement

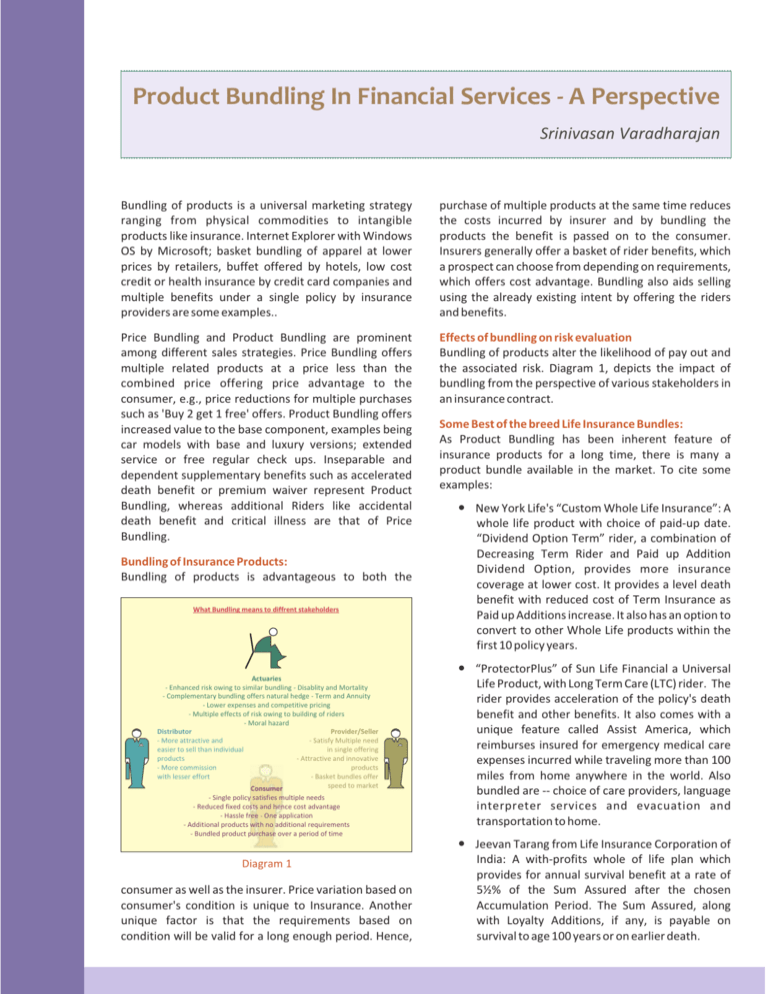

Product Bundling In Financial Services - A Perspective Srinivasan Varadharajan Bundling of products is a universal marketing strategy ranging from physical commodities to intangible products like insurance. Internet Explorer with Windows OS by Microsoft; basket bundling of apparel at lower prices by retailers, buffet offered by hotels, low cost credit or health insurance by credit card companies and multiple benefits under a single policy by insurance providers are some examples.. purchase of multiple products at the same time reduces the costs incurred by insurer and by bundling the products the benefit is passed on to the consumer. Insurers generally offer a basket of rider benefits, which a prospect can choose from depending on requirements, which offers cost advantage. Bundling also aids selling using the already existing intent by offering the riders and benefits. Price Bundling and Product Bundling are prominent among different sales strategies. Price Bundling offers multiple related products at a price less than the combined price offering price advantage to the consumer, e.g., price reductions for multiple purchases such as 'Buy 2 get 1 free' offers. Product Bundling offers increased value to the base component, examples being car models with base and luxury versions; extended service or free regular check ups. Inseparable and dependent supplementary benefits such as accelerated death benefit or premium waiver represent Product Bundling, whereas additional Riders like accidental death benefit and critical illness are that of Price Bundling. Effects of bundling on risk evaluation Bundling of products alter the likelihood of pay out and the associated risk. Diagram 1, depicts the impact of bundling from the perspective of various stakeholders in an insurance contract. Bundling of Insurance Products: Bundling of products is advantageous to both the What Bundling means to diffrent stakeholders Actuaries - Enhanced risk owing to similar bundling - Disablity and Mortality - Complementary bundling offers natural hedge - Term and Annuity - Lower expenses and competitive pricing - Multiple effects of risk owing to building of riders - Moral hazard Distributor Provider/Seller - More attractive and - Satisfy Multiple need easier to sell than individual in single offering products - Attractive and innovative - More commission products with lesser effort - Basket bundles offer speed to market Consumer - Single policy satisfies multiple needs - Reduced fixed costs and hence cost advantage - Hassle free - One application - Additional products with no additional requirements - Bundled product purchase over a period of time Diagram 1 consumer as well as the insurer. Price variation based on consumer's condition is unique to Insurance. Another unique factor is that the requirements based on condition will be valid for a long enough period. Hence, Some Best of the breed Life Insurance Bundles: As Product Bundling has been inherent feature of insurance products for a long time, there is many a product bundle available in the market. To cite some examples: New York Life's “Custom Whole Life Insurance”: A whole life product with choice of paid-up date. “Dividend Option Term” rider, a combination of Decreasing Term Rider and Paid up Addition Dividend Option, provides more insurance coverage at lower cost. It provides a level death benefit with reduced cost of Term Insurance as Paid up Additions increase. It also has an option to convert to other Whole Life products within the first 10 policy years. “ProtectorPlus” of Sun Life Financial a Universal Life Product, with Long Term Care (LTC) rider. The rider provides acceleration of the policy's death benefit and other benefits. It also comes with a unique feature called Assist America, which reimburses insured for emergency medical care expenses incurred while traveling more than 100 miles from home anywhere in the world. Also bundled are -- choice of care providers, language interpreter services and evacuation and transportation to home. Jeevan Tarang from Life Insurance Corporation of India: A with-profits whole of life plan which provides for annual survival benefit at a rate of 5½% of the Sum Assured after the chosen Accumulation Period. The Sum Assured, along with Loyalty Additions, if any, is payable on survival to age 100 years or on earlier death. Product bundling vis-à-vis Product mix Product bundling is where the bundled products are sold at a price less than that of the sum of individual prices. Product mix is where products meeting a particular need are supplied together but the fact they are sold together doesn't necessarily reduce the price. Best example for this is deposits, insurance, loans and mutual funds offered under one umbrella to satisfy completely and fulfil the financial needs of a person. Initially bundling does not enable product mix, as customer was required to go to different providers to satisfy his different financial needs. With increase in customer focus, the trend now is to provide all that the customer wants as a single package rather than what the seller has. Hence product mix is all about product bundling now. some of them: Externalizing rules provides flexibility Build once and reuse infinitely Rules and rates can be built once and reused a number of times to achieve 'Speed to Market' Other Finance Provider Life & Annuity Provider P&C Provider Base price of the independent products E- Commerce Portal Distributor 2 Distributor 1 Below table depicts the Products and Needs map: Product\ Need Term Insurance Endowment Whole Life ULIP Variable Life Universal Life VUL Annuities Variable annuities VA Guarantees Accident benefits Disability benefits Premium waiver benefit Long Term Care Reverse mortgages Bank deposits Mutual funds Insurance ? ? ? ? ? ? ? Savings Market based return ? ? ?? ?? ? ?? ? ?? ? ? ? ? Guaranteed Return Commission Agreement 1 Commission Agreement 2 Regular income ? ? ? Base Prices of different products + Commission Base Prices of various products + Commission ? ? ? ? ? ? ? ? ? ? ? ? ?? Business drivers for bundling Some of the business drivers for bundling are: Value maximization through cross sales Value added attractive product delivery Better and innovative products Lesser time to Market Easier sales than individual products Economies of scale through parasitic bundling of complex and less attractive products like Payment Protection Insurance Implications to Life Insurers' systems and how IT could help Bundling changes the way a product is administered. Bundling impacts product features of the bundle, underwriting rules, rates, billing and documentation for varied premium and term of rider. Claims, cash value calculations and other areas need to be revisited to deal with the complexity created by bundling. In a nutshell, insurer needs to re-jig his systems across the product life cycle, with more emphasis on New Business and Claims. IT plays a major role in bundling of financial products like insurance and at times is indispensable, listed below are Customer 1 Customer 2 White Labeling Bundling of products across the companies using industry standards Product Innovation Bundling of products across product lines, varying features Trends in Product Bundling: Bundling need not be restricted to Life Insurance products alone. Bundling can happen across Life and P&C lines and Insurance and non-insurance products. For example, retirement segment of the population can be targeted with Long Term Care products tied up with specific caregivers at a lower rate for the customer. Life insurance combined with Fire and Home Insurance adds value to the customer, reduces costs and risks to a certain extent. Product Bundling Factory-gate pricing: Another possible innovation in Product Bundling is Factory-gate pricing Independent Intermediaries can offer products from providers across the industry by combining base-priced products from various providers and adding up their commission as agreed with the customer. Association of British Insurers (ABI) asserts that such a model is likely to increase demand for financial advice and products. A logical extension of this would be where the customer fulfills his particular needs through product from several providers through an independent intermediary vendor. Technology can enable such a portal where products and services from different providers are brought together to a selling place. Customer is given a choice and is not forced to buy a particular institution's products for all of his needs just because he/she makes the purchase decision at the same moment. Bundling has not remained a choice for the insurer, but is inevitable to survive in the competitive market. Bundling enables an Insurer to: Enhance product offering Stick to core competencies Outsource product value adds Increase and retain customers Increase distribution bandwidth and Reduce overheads Thus, it is necessary for an insurer to continuously revisit their product offering designs and leverage opportunities through innovative bundling. References: 1. Manakkal Kartik, Renuka Sridhar & Shrinivas Susarla (2006), “Provider or Distributor An Insurer's Dilemma”, The Actuary India, October 2006. 2. Stefan Stremersch & Gerard J. Tellis (2002), “Strategic Bundling of Products and Prices: A New Synthesis for Marketing”, Journal of Marketing, January 2002. 3. http://www.newyorklife.com/custom_whole_life_ insurance/ 4. http://www.sunlife-usa.com/spotlight.cfm?page=3 5. https://www.allianzlife.com/ProductsServices/ Annuities/Variable/HighFiveOverview.aspx 6. “The Economic Benefits of Bundling Payment Protection Insurance with Primary Credit Products” by Maarten Janssen1, Nils von Hinten-Reed and Ewa Mendys 7. ABI RESEARCH PAPER 6 “Customer Agreed Remuneration - Research into the market impact of encouraging Customer Agreed Remuneration” January 2008 Source: http://www.abi.org.uk 8. Guidance received from Mr. Biju Simon, Actuary, ING Life Insurance India. Srinivasan Varadharajan is a Life and Pensions Domain Consultant with a combined experience of over 15 years in Life Insurance industry and Information Technology services. He holds FLMI (LOMA, USA) and, AIII (Associate of Insurance Institute of India) Certifications. He has experience in Estimation, Requirement Development, Requirement Management, Gap Analysis and, Quality Control activities apart from Insurance Industry business areas. His work experience spans across India, United States and the United Kingdom. He holds a graduate degree in Mathematics. The opinions expressed and conclusions reached by the authors are their own and do not represent any official position of Wipro Technologies. Unless explicitly stated, the information and views expressed in this article may not be construed as those of Wipro Technologies.